US Real Estate Property Management Software Market Size 2025-2029

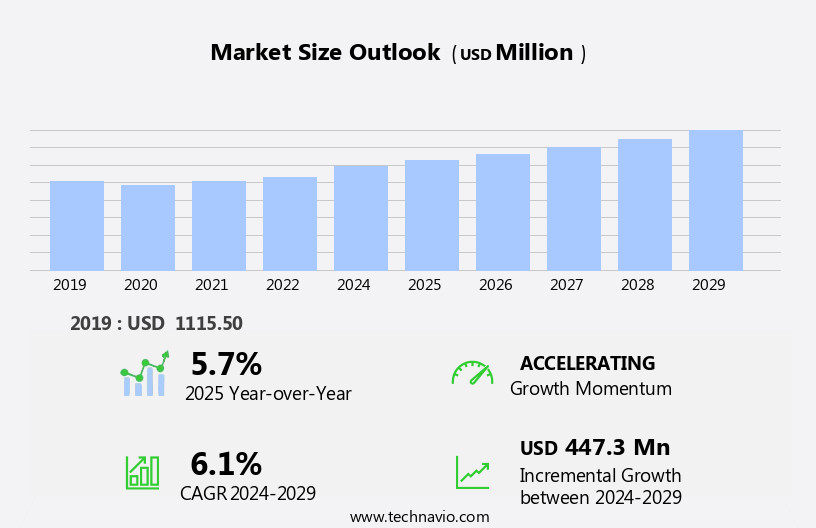

The us real estate property management software market size is forecast to increase by USD 447.3 million, at a CAGR of 6.1% between 2024 and 2029.

- The Real Estate Property Management Software Market in the US is experiencing significant growth, driven by the increasing emphasis on customer-centric business processes. Property management companies are recognizing the value of streamlined operations and enhanced tenant experiences, leading to a surge in demand for advanced software solutions. Moreover, the adoption of big data analytics is transforming the industry, enabling data-driven decision-making and improved operational efficiency. However, the market faces challenges as well. The threat of open-source real estate property management software is growing, with some organizations opting for cost-effective alternatives.

- This trend could put pressure on established players to innovate and differentiate their offerings, ensuring they maintain a competitive edge. To capitalize on opportunities and navigate challenges effectively, companies must focus on delivering superior customer service, leveraging data insights, and continuously improving their technology offerings.

What will be the size of the US Real Estate Property Management Software Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The real estate property management market in the US is witnessing significant advancements, driven by the integration of smart home technologies and data backup solutions. Energy efficiency is a top priority, with regulatory compliance and property insurance companies encouraging the adoption of green building standards and sustainability certifications. Tenant screening services are utilizing background checks, credit history reports, and biometric authentication for thorough vetting processes. Artificial intelligence (AI) and machine learning are revolutionizing property management through predictive analytics, workflow optimization, and eviction prevention. Virtual tours and 3D modeling enable remote property inspections, while data visualization tools provide valuable insights for property investment analysis.

- Cloud security and mobile device management are essential for secure data access and management. Property risk management is a growing concern, with disaster recovery plans and property liability insurance playing crucial roles. Property management training and lease negotiation strategies are also key components in maintaining tenant retention. In summary, the US real estate property management market is undergoing a digital transformation, focusing on energy efficiency, regulatory compliance, tenant screening, and advanced technologies such as AI, data visualization, and predictive analytics. These trends are shaping the future of property management, offering increased efficiency, security, and profitability for businesses.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Integrated software

- Standalone software

- Deployment

- Cloud based

- On premises

- Application

- Residential

- Commercial

- Industrial

- Sector

- Large enterprise

- SMEs

- Individuals

- Geography

- North America

- US

- North America

By Type Insights

The integrated software segment is estimated to witness significant growth during the forecast period.

Real estate property management software in the US integrates various applications to streamline operations for single-family homes, vacation rentals, student housing, and commercial properties. This software includes property marketing automation for tenant communication and listing platforms, occupancy management for rent collection and lease management, property accounting for financial reporting and automated payment processing, and property data analytics for value optimization and market trends. Compliance management ensures legal requirements, while property inspections and maintenance management maintain property conditions. API integration enables tenant screening and property investor collaboration.

Cloud-based platforms offer accessibility and data security. Property portfolio management facilitates multifamily housing and building automation for energy efficiency. Insurance management and access control enhance security systems. Real estate agents and property managers can utilize these integrated features to effectively manage their property businesses.

The Integrated software segment was valued at USD 659.20 million in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the US Real Estate Property Management Software Market drivers leading to the rise in adoption of the Industry?

- The primary catalyst driving market growth is the heightened emphasis on customer-centric business processes. This focus ensures that companies prioritize meeting customer needs and expectations, thereby enhancing overall market performance.

- Real estate property management software plays a crucial role in enhancing the efficiency and productivity of property managers, investors, and developers. This software offers various features that cater to different aspects of property management, from property data analytics for identifying market trends and optimizing property value, to property assessment tools for evaluating potential investments. Property management software also facilitates property listing platforms, enabling easy and convenient property searches based on preference and locality. Moreover, property accounting functionalities enable property managers to track rental income, manage expenses, and generate financial reports. Tenant screening and API integration are other essential features that streamline the property management process.

- By providing a centralized platform for managing property-related tasks, real estate property management software helps property managers save time and resources, ultimately leading to increased profitability and customer satisfaction. Customer centricity is a critical factor in the success of real estate property management software companies. While certain customer services can be provided without the aid of software, services such as SMS or email alerts for payment due dates, document uploads, and utility bill visibility require digital assistance. By offering these services, property management software providers differentiate themselves and add value to their offerings. In conclusion, the adoption of real estate property management software is essential for property managers, investors, and developers seeking to streamline their operations, optimize property value, and enhance customer satisfaction.

What are the US Real Estate Property Management Software Market trends shaping the Industry?

- The use of big data analytics is becoming increasingly prevalent in today's market trends. It is a professional and knowledgeable response to acknowledge the growing importance of big data analytics in the business world.

- Real estate property management software is a valuable tool for businesses in the industry, particularly in the areas of commercial and residential property management. This software utilizes big data analytics to provide valuable business insights, enabling companies to make informed decisions. For instance, data on search patterns and historical pricing trends can help real estate firms understand market dynamics and create accurate property valuation models. These insights are essential for making sound investment decisions. Additionally, property management software offers features such as rent collection, property tax management, insurance management, access control, security systems integration, and property marketing automation. By leveraging a cloud-based platform, real estate agents can access critical information in real-time, ensuring efficient and effective management of mixed-use properties.

- Data security is paramount, and these systems employ robust measures to protect sensitive information. Overall, real estate property management software is an indispensable solution for businesses seeking to optimize their operations and gain a competitive edge.

How does US Real Estate Property Management Software Market faces challenges face during its growth?

- The expansion of open-source real estate property management software poses a significant challenge to the industry's growth. This trend necessitates increased competition and potential cost savings for businesses, necessitating a strategic response from industry players to maintain competitiveness.

- The real estate property management software market in the US is experiencing significant competition from open-source solutions, which are gaining popularity among property owners due to their transparency, cost-effectiveness, and scalability. Open-source software, freely available on the Internet, offers an attractive alternative to paid software solutions for managing multifamily housing properties. Solutions like Innago and Landlord Studio provide functionality for property valuation methods, lease management, property appraisal, work order management, building automation, maintenance management, financial reporting, data encryption, and tenant communication. The adoption of open-source software is particularly beneficial for organizations with limited budgets, as it eliminates the need for substantial upfront investment.

- While open-source software offers numerous advantages, it is essential for property management organizations to ensure robust compliance management and secure data encryption to maintain the integrity of their operations. In conclusion, the increasing preference for open-source real estate property management software presents both opportunities and challenges for market participants, requiring a strategic response to remain competitive.

Exclusive US Real Estate Property Management Software Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accely Group

- Anton Systems Inc.

- AppFolio Inc.

- ARKA Softwares

- Brainvire Infotech Inc.

- Chetu Inc.

- CoreLogic Inc.

- Entrata Inc.

- Fingent

- Infor Inc.

- ManageCasa

- Matellio Inc.

- MRI Software LLC

- Planon Group

- RealPage Inc.

- Rentec Direct

- Salesforce Inc.

- TenantCloud LLC

- Yardi Systems Inc.

- Zillow Group Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Real Estate Property Management Software Market In US

- In February 2023, Yardi Systems, a leading provider of real estate investment management and property management solutions, announced the launch of Yardi Voyager 9.2, an advanced version of its property management software. This release includes new features such as enhanced reporting capabilities, improved accounting functions, and increased integration with Yardi's other offerings (Yardi Systems Press Release, 2023).

- In May 2024, MRI Software, another prominent player in the real estate property management software market, entered into a strategic partnership with CoStar Group, a commercial real estate information and analytics firm. This collaboration aims to integrate CoStar's data and analytics tools into MRI's property management software, providing clients with more comprehensive market insights (MRI Software Press Release, 2024).

- In October 2024, AppFolio, a technology provider for property managers and small businesses, completed a merger with Buildium, a leading property management software company. This merger created a combined entity with an expanded product portfolio and a larger customer base, further solidifying their position in the market (AppFolio Press Release, 2024).

- In January 2025, the RealPage, Inc. Announced a significant investment of USD200 million from Blackstone Growth, a growth equity investment arm of Blackstone, to accelerate the development and expansion of its property management software solutions. This investment will enable RealPage to expand its offerings, enhance its technology, and expand its market presence (RealPage Press Release, 2025).

Research Analyst Overview

The real estate property management software market in the US continues to evolve, catering to the diverse needs of various sectors. From mixed-use properties to single-family homes, this dynamic industry offers solutions for rent collection, legal compliance, property marketing, occupancy management, and tenant satisfaction. Seamless integration of features such as security systems, commercial property management, property tax management, insurance management, access control, real estate agents, and cloud-based platforms enhances operational efficiency. Property valuation, marketing automation, and residential property management are integral components, ensuring optimal property value and tenant engagement. Data security is paramount, with encryption and compliance management safeguarding sensitive information.

API integration, tenant screening, and property portfolio management facilitate streamlined workflows for property investors and owners. Property inspections, student housing, and multifamily housing solutions cater to specific niches, while property development and property data analytics offer valuable insights for strategic decision-making. The ongoing unfolding of market activities reveals evolving patterns, with property market trends and property listing platforms shaping the future of property management software. Building automation, maintenance management, financial reporting, and lease management further enrich the offerings, catering to the ever-changing needs of the real estate industry.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Real Estate Property Management Software Market in US insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.1% |

|

Market growth 2025-2029 |

USD 447.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.7 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch