US Senior Living Market Size 2025-2029

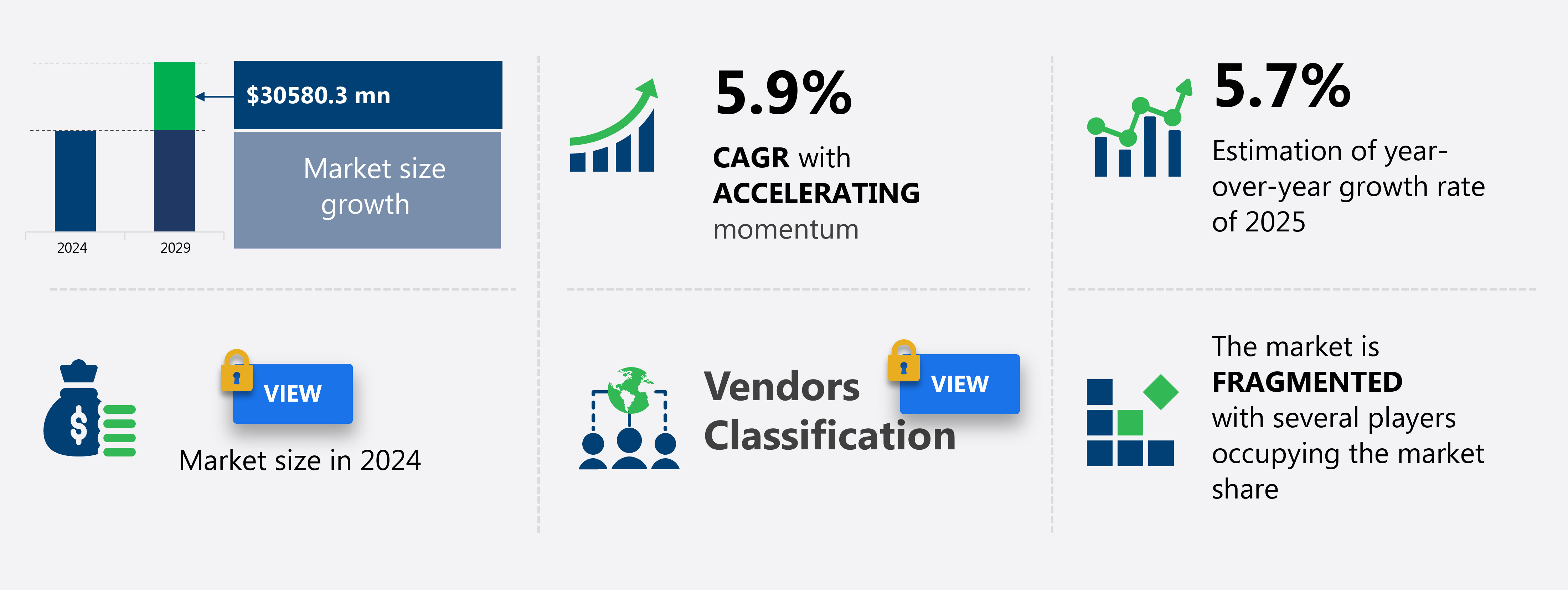

The senior living market in US size is forecast to increase by USD 30.58 billion at a CAGR of 5.9% between 2024 and 2029.

-

The senior living market is experiencing significant growth due to various driving factors. One of the primary factors is the aging population, as the number of seniors continues to increase, the demand for services is also rising. Another key trend is the integration of technology into senior living facilities, which enhances the quality of care and improves the overall living experience for seniors. Innovations in artificial intelligence, data analytics, predictive modeling, and personalized care plans are disrupting traditional care models and improving overall financial sustainability through cost containment and value-based care. However, affordability remains a challenge for many seniors and their families, as the cost of services can be prohibitive. This report provides a comprehensive analysis of these factors and more, offering insights into the current state and future direction of the market.

What will be the Size of the Market During the Forecast Period?

-

The market encompasses a range of services designed to address the unique needs of an aging population, including long-term care, end-of-life care, palliative care, hospice care, respite care, adult day care, home health services, geriatric care, and various forms of cognitive and behavioral health support. This market is driven by demographic trends, with the global population of individuals aged 65 and above projected to reach 1.5 billion by 2050.

-

Key challenges in this market include addressing cognitive decline, social isolation, fall prevention, medication management, nutritional support, mobility assistance, personal care assistance, continence management, and other aspects of daily living. Additionally, there is a growing focus on quality of life, resident satisfaction, staffing ratios, caregiver training, technology adoption, and regulatory compliance. The aging services network is evolving to provide a continuum of care, from independent living to palliative care, with a focus on evidence-based practices, industry best practices, and regulatory compliance.

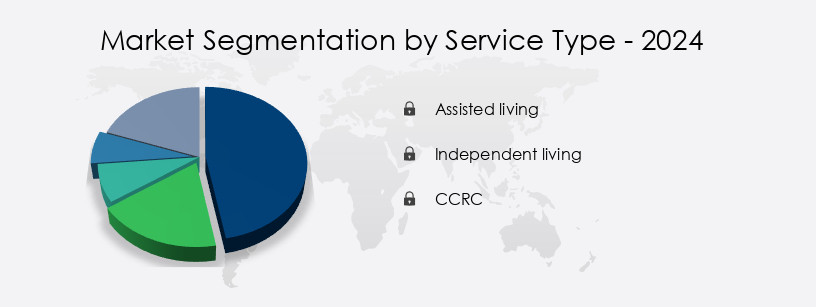

How is this market segmented, and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service Type

- Assisted living

- Independent living

- CCRC

- Age Group

- Age 85 and older

- Age 66-84

- Age 65 and under

- By Type

- Medical Services

- Non-Medical Services

- Distribution Channel

- Direct Sales

- Agency Referrals

- Online Platforms

- End-User

- Baby Boomers

- Silent Generation

- Gen X

- Geography

- US

By Service Type Insights

- The assisted living segment is estimated to witness significant growth during the forecast period. Assisted living communities cater to seniors who require assistance with daily activities but do not necessitate full-time nursing care. These residences offer a combination of personalized care, social engagement, and medical support in a secure and comfortable setting. The market is experiencing growth due to the expanding aging population, rising life expectancy, and a preference for home-like environments over traditional nursing homes. Personalized care services are a defining feature of assisted living. Residents receive aid with activities of daily living, such as bathing, dressing, grooming, medication management, and mobility assistance, based on their individual needs.

- Trained staff members are available 24/7 to ensure the safety and well-being of residents. Memory care communities are a specialized segment within assisted living, designed for seniors with Alzheimer's disease and other forms of dementia. These facilities provide secure environments and specialized care techniques to address the unique needs of these residents. Independent living communities offer seniors the opportunity to live in a social, active environment while maintaining their independence. These communities provide housing solutions with minimal support services, such as meal preparation and housekeeping. Nursing care homes and skilled nursing facilities offer comprehensive care for seniors with chronic health conditions and complex care needs.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of US Senior Living Market?

- An aging population is the key driver of the market. The market in the US is experiencing significant growth due to the increasing aging population. According to World Bank data, individuals aged 65 and above accounted for 17% of the total population in the US in 2023, and this demographic is projected to reach 80 million by 2040. The US Census Bureau anticipates that by 2030, all baby boomers will be older than 65 years, making up approximately one in every five residents. This demographic shift is driving demand for senior housing and care services, including assisted living, memory care, independent living, nursing care, skilled nursing, rehabilitation services, and healthcare services.

-

Wellness programs, remote monitoring, and technology-driven solutions are becoming increasingly popular in the market. These offerings cater to the diverse needs of the aging population, focusing on lifestyle amenities, fitness centers, nutrition programs, mental health services, social activities, and active aging. Comprehensive care, integrated services, and geographic reach are essential factors for facilities, as they aim to provide affordable housing, housing costs, and healthcare expenses for aging residents. Facility design, care techniques, and social engagement are crucial elements of senior care initiatives. Specialized care for chronic health conditions, such as Alzheimer's disease, is a growing trend in the market.

What are the market trends shaping the US Senior Living Market?

- Technology integration is the upcoming trend in the market. The market in the US is undergoing significant transformation through the adoption of technology, catering to the needs of an aging population more efficiently. Artificial intelligence (AI) is at the forefront, with health monitoring and predictive analytics becoming essential. Wearable devices and smart sensors track vital signs, mobility patterns, and sleep cycles, enabling early detection of health issues. AI-powered fall detection systems and emergency response alerts enhance resident safety, reducing hospitalization risks. Telehealth and virtual care services have gained prominence, especially post-COVID-19, offering accessible healthcare services. Facility design is evolving to incorporate technology-driven solutions, such as remote monitoring systems, telemedicine platforms, and sustainable practices.

-

Wellness-focused amenities, including fitness centers and nutrition programs, are integrated into communities. Mental health services, social activities, and active aging initiatives are prioritized to promote emotional well-being. Comprehensive care services, including skilled nursing, rehabilitation, and memory care, are offered in facilities. Specialized care techniques cater to diverse needs, such as Alzheimer's disease and chronic health conditions. Care plans are personalized, focusing on holistic wellness and integrated wellness. Affordable housing solutions, including housing costs, healthcare expenses, social security, personal savings, and disposable incomes, are essential considerations for senior care initiatives. Premium living options, such as luxury facilities and service units, cater to those with higher disposable incomes.

What challenges does the US Senior Living Market face during its growth?

- Affordability issues related to services are a key challenge affecting the market growth. The market in the US is experiencing significant growth due to the increasing aging population and the diverse needs of older adults. Baby boomers are now reaching retirement age, leading to an influx of demand for options. However, affordability remains a major challenge for many seniors and their families. The costs of housing, healthcare, and long-term care continue to rise, making it difficult for seniors on fixed incomes to access services. Retirement communities, assisted living facilities, and nursing homes offer various levels of care, from independent living to skilled nursing and rehabilitation services.

-

These services come with different price points, depending on factors such as location, level of care, amenities, and housing preferences. The high cost of entry fees, monthly rent, and care services often exceed the financial resources available to seniors, leading to affordability challenges. Wellness programs, memory care, and specialized care techniques are becoming increasingly important in facilities. Facility design and care techniques are being tailored to meet the unique needs of aging residents, with a focus on social engagement, recreational amenities, and maintenance-free lifestyles. Healthcare services, such as physical therapy, occupational therapy, and speech therapy, are integrated into communities to provide comprehensive care.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AbsoluteCare - The company offers senior living services through its innovative Beyond Medicine model. This approach integrates primary care, behavioral health, and support for social determinants of health, ensuring personalized care for vulnerable populations.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AbsoluteCare

- Affinity Living Communities

- Atria Senior Living Inc.

- Avila Senior Living

- Belmont Village Senior Living

- Brookdale Senior Living Inc.

- Covenant Living Communities and Services

- Discovery Senior Living

- Erickson Senior Living Management LLC

- Five Star Senior Living

- Genesis Healthcare Inc.

- Golden Heights Personal Care Home

- Lendlease Corp. Ltd.

- Life Care Centers of America Inc.

- Life Care Services

- Merrill Gardens

- ProMedica Health Systems Inc.

- Senior Lifestyle

- Sunrise Senior Living LLC

- Wickshire Senior Living

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The senior living market encompasses a range of facilities and services catering to the unique needs of an aging population. This market includes assisted living, memory care, independent living, nursing care, and skilled nursing facilities, among others. These senior living facilities offer comprehensive care solutions, integrating healthcare services, wellness programs, and recreational amenities. The aging population continues to grow, driven by demographic trends and increasing life expectancy. Baby boomers, a significant demographic cohort, are now entering their retirement years, leading to a swell in demand for senior living options. Active adult communities have emerged as a popular choice for those seeking maintenance-free lifestyles and social engagement.

Senior living facilities prioritize person-centered care models, focusing on the diverse needs of aging residents. Specialized care techniques are employed to address chronic health conditions, such as Alzheimer's disease and other memory impairments. Facility design and care techniques are tailored to ensure safety, comfort, and social engagement. Affordability is a critical factor in the senior living market. Housing costs and healthcare expenses are major concerns for many seniors. Some seek affordable housing solutions, while others rely on Social Security, personal savings, and disposable incomes to fund their retirement. Premium living options, such as luxury facilities, cater to those with higher disposable incomes.

Geographic reach is another essential aspect of the senior living market. Favorable climates and desirable locations attract many retirees. Lifestyle amenities, such as fitness facilities, nutrition programs, mental health services, and social activities, are integral to senior living ecosystems. Technology-driven solutions, including remote monitoring systems and telemedicine platforms, are increasingly integrated into senior care services. Sustainability initiatives, such as energy-efficient designs and eco-friendly amenities, are gaining popularity. The senior care industry is undergoing consolidation activities, with joint ventures and digital infrastructure investments driving operational sophistication. Regulatory compliance and risk management capabilities are essential for ensuring quality care and financial sustainability.

Community engagement programs, staff training, and retention initiatives are crucial for maintaining high-quality care and enhancing the overall senior living experience. Affordable retirement living options, transparent communication, and personalized care plans are key differentiators for senior living facilities. The senior living market is a dynamic and evolving industry, catering to the diverse needs of an aging population. Facilities and services offer comprehensive care solutions, integrating healthcare services, wellness programs, and recreational amenities. Affordability, technology, and sustainability are critical factors shaping the future of senior living.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

152 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2025-2029 |

USD 30.58 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.7 |

|

Key countries |

US |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends, and changes in consumer behaviour

- Growth of the market across the US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch