Vaginal Ring Market Size 2024-2028

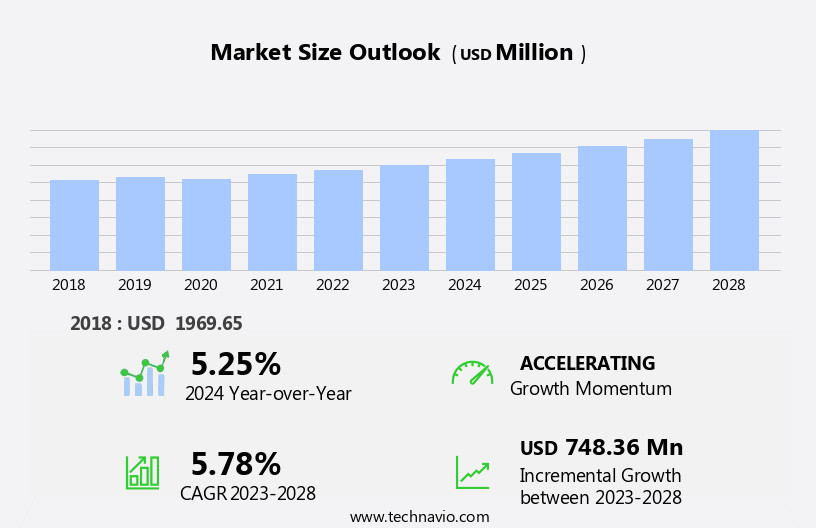

The vaginal ring market size is forecast to increase by USD 748.36 million, at a CAGR of 5.78% between 2023 and 2028.

- The market is driven by the progressive perspective of consumers towards contraceptives, with an increasing preference for discreet and long-acting methods. The high disposable income of consumers in developed regions further fuels the market growth. In the realm of digital health, vaginal rings are gaining popularity as they offer a discreet and convenient method of birth control. Hematology analyzers and reagents play a crucial role In the manufacturing process of vaginal rings, ensuring their quality and efficacy. However, the availability of alternative methods of contraception poses a significant challenge to market players. Consumers' shifting preferences and the presence of competitive options necessitate continuous innovation and differentiation strategies from companies. To capitalize on the market opportunities, players must focus on developing advanced, user-friendly, and cost-effective vaginal ring products.

- Additionally, addressing the concerns and challenges surrounding the safety and side effects of vaginal rings will be crucial for market success. Companies that effectively navigate these dynamics and offer innovative solutions will be well-positioned to capture market share and drive growth in the market.

What will be the Size of the Vaginal Ring Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in biocompatible polymers and innovative drug delivery systems. These technologies enable the development of new contraceptive options, including non-hormonal alternatives, with varying contraceptive failure rates and applications across sectors. Endometrial suppression is a key consideration in the manufacturing process, ensuring the safety profile and user experience are optimized. Barrier methods, such as the vaginal ring, offer women reproductive health benefits beyond contraception, including menstrual cycle regulation. However, patient education is crucial to ensure proper application methods and adherence to storage conditions. Side effects, including potential hormonal imbalances and adverse events, remain a focus of ongoing clinical trials.

Quality control and shelf life are critical aspects of the supply chain, with healthcare providers seeking reliable distribution channels and market access. Regulatory approvals and product labeling are essential components of the regulatory landscape, ensuring the safety and efficacy of vaginal rings as medical devices. Intrauterine devices (IUDs) and hormonal contraception continue to shape the market, with ongoing research into controlled release and hormone levels. Patient compliance and sexual health are key concerns, with ongoing efforts to minimize ovulation inhibition and optimize user experience. Adverse events and blood concentration remain areas of ongoing research, with transdermal absorption a potential area of innovation.

The evolving nature of the market underscores the importance of continuous improvement and collaboration between healthcare providers, manufacturers, and regulatory bodies to ensure the delivery of safe, effective, and accessible contraceptive solutions.

How is this Vaginal Ring Industry segmented?

The vaginal ring industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

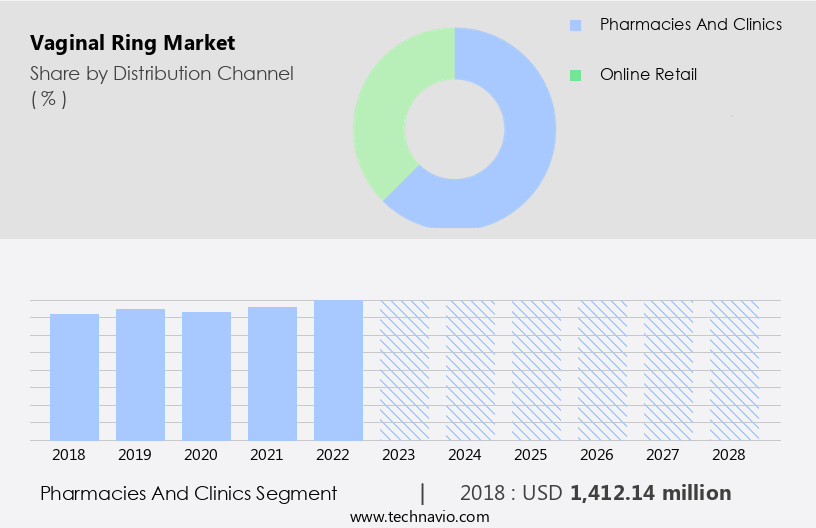

- Distribution Channel

- Pharmacies and clinics

- Online retail

- End-user

- Hospitals

- Gynecology clinics

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The pharmacies and clinics segment is estimated to witness significant growth during the forecast period.

Vaginal rings, a form of reversible contraceptive, have gained popularity due to their convenience and effectiveness. These rings, typically made from biocompatible polymers, release hormones continuously for up to a month, inhibiting ovulation and thickening cervical mucus for sperm prevention. The manufacturing process ensures endometrial suppression, reducing the risk of breakthrough bleeding. Application methods involve inserting the ring into the vagina once a month, with various contraceptive options available, including hormonal and non-hormonal versions. Storage conditions are essential, with rings requiring refrigeration before use and protection from light. Intrauterine devices (IUDs) and controlled release implants are alternative contraceptive methods.

The supply chain includes healthcare providers, pharmacies, and family planning clinics, ensuring accessibility and patient education. Side effects, such as headaches, nausea, and mood changes, are common but generally manageable. Barrier methods, like condoms, can be used in conjunction for added protection. Regulatory approvals, clinical trials, and product labeling are crucial for safety and patient compliance. Hormonal levels and menstrual cycle regulation are essential considerations, with potential adverse events including blood concentration and transdermal absorption. Healthcare providers play a vital role in patient consultations, ensuring the suitability and proper use of vaginal rings. Quality control and shelf life are essential factors in the manufacturing process.

Drug delivery systems are continually evolving, with ongoing research focusing on improving patient experience and safety profile. The market for vaginal rings is expanding, with an increased focus on non-hormonal contraceptives and menstrual cycle regulation. Distribution channels include retail pharmacies, hospital pharmacies, and family planning clinics, ensuring accessibility and affordability. Market access and patient compliance are crucial for continued success, with ongoing efforts to address any potential challenges. In summary, vaginal rings offer a convenient and effective contraceptive solution, with ongoing research and advancements in manufacturing processes, drug delivery systems, and patient education driving market growth.

Healthcare providers play a vital role in ensuring proper use and addressing any concerns, making this a dynamic and evolving market.

The Pharmacies and clinics segment was valued at USD 1412.14 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

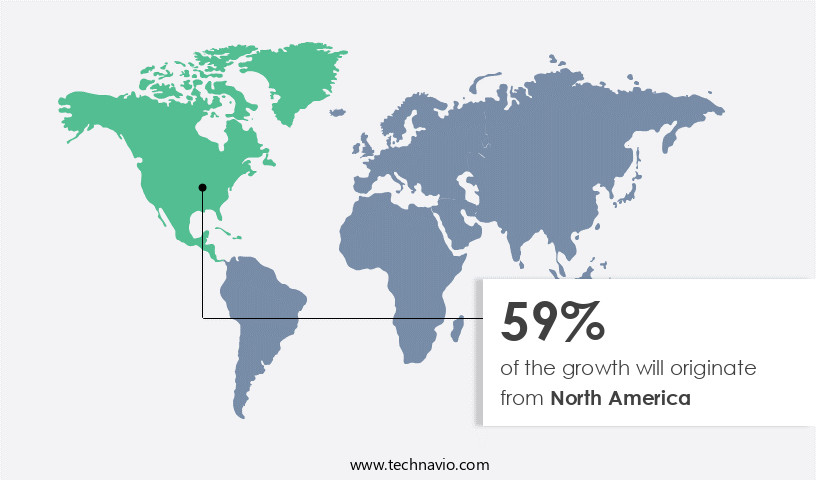

North America is estimated to contribute 59% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing growth due to heightened awareness and accessibility of these contraceptive options. Women's health and family planning are prioritized through public health initiatives and educational campaigns, leading to an increase in demand for effective and convenient contraceptives. The region's substantial healthcare expenditure facilitates investment in research and development, clinical trials, and marketing for vaginal ring products. In 2022, US healthcare spending reached USD 4.5 trillion, or USD 13,493 per person, enabling advancements in this sector. Biocompatible polymers are utilized in the manufacturing process of vaginal rings, ensuring safety and endometrial suppression.

Application methods vary, with some rings requiring removal for menstruation and others providing continuous use. Both hormonal and non-hormonal contraceptive options are available, catering to diverse patient needs. Proper storage conditions are essential to maintain the effectiveness of the rings. Intrauterine devices (IUDs) and controlled release vaginal rings are alternative contraceptive methods gaining popularity. The supply chain is well-established, with healthcare providers offering various application and removal services. Patient education is crucial for proper usage and potential side effects, including hormonal fluctuations, adverse events, and blood concentration changes. Barrier methods, such as condoms, continue to coexist with vaginal rings in the reproductive health landscape.

Safety profiles, user experiences, and quality control are key factors in the market's evolution. Shelf life and drug delivery systems are critical considerations for manufacturers and consumers alike. Regulatory approvals and product labeling ensure transparency and compliance with medical device regulations. Family planning clinics serve as crucial distribution channels, providing easy access to vaginal rings and other contraceptives. Market access and patient compliance are essential for the continued growth of the market in North America. Hormonal levels and ovulation inhibition are primary mechanisms of action for hormonal contraceptive rings. Overall, the market in North America is dynamic, driven by advancements in technology, increasing awareness, and evolving patient preferences.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Vaginal Ring Industry?

- The progressive perspective of consumers towards contraceptives serves as the primary catalyst for market growth.

- The market in the US is witnessing growth due to the increasing acceptance and use of female contraceptives. This shift in societal norms is driven by the evolving perspective towards sexuality and the desire for convenient and effective contraceptive options. Vaginal rings, a type of contraceptive, are made from biocompatible polymers that release hormones continuously for up to a month. They offer a lower contraceptive failure rate compared to other methods and can be easily self-administered. The manufacturing process of vaginal rings involves the use of advanced technology and controlled release mechanisms to ensure consistent hormone delivery. Application methods are user-friendly, allowing for discreet use and minimal interference with daily activities.

- The market offers various contraceptive options, each with different hormone combinations and release rates. Storage conditions for vaginal rings are crucial to maintain their efficacy. Proper handling and storage can prolong the shelf life and ensure optimal performance. While intrauterine devices (IUDs) and other long-term contraceptive methods are available, vaginal rings offer a more flexible alternative for those seeking a reversible and convenient method of birth control. The supply chain for vaginal rings involves various stakeholders, from raw material suppliers to manufacturers, distributors, and retailers. Ensuring a seamless and efficient supply chain is essential to meet the growing demand for these products.

- With the increasing acceptance and use of female contraceptives, the market is expected to continue its growth trajectory in the US.

What are the market trends shaping the Vaginal Ring Industry?

- The current market trend indicates an increasing preference for consumers with high disposable income. This demographic holds significant purchasing power and represents a lucrative market segment for businesses.

- The women's health market, specifically the vaginal ring segment, experiences significant growth due to several factors. Increasing disposable income globally empowers consumers to invest in their reproductive health, driving market expansion. Developing countries, including Malaysia, Indonesia, and Vietnam, exhibit promising potential with rising affluence. Additionally, the workforce participation rate of women, particularly in the US where over 50% of women are employed and 70% of mothers with young children are part of the labor force, contributes to increased household income, enabling purchases of both essentials and luxury items. Patient education plays a crucial role in this market.

- Users demand a thorough understanding of the product's safety profile, side effects, and user experience. Barrier methods, such as vaginal rings, offer convenience and effectiveness in reproductive health management. Quality control and shelf life are essential considerations for manufacturers to ensure product reliability and customer satisfaction. The drug delivery system of vaginal rings is a significant advancement in contraceptive technology, providing consistent hormonal release and improved patient compliance. Side effects and safety concerns are essential aspects of patient education. Transparent communication from manufacturers about potential side effects and addressing them effectively can help build trust and confidence in the product.

- The market prioritizes user experience, focusing on ease of use, comfort, and effectiveness. Market dynamics continue to evolve, with ongoing research and development to enhance the product's safety, efficacy, and patient satisfaction.

What challenges does the Vaginal Ring Industry face during its growth?

- The expansion of the industry is significantly influenced by the accessibility of various contraceptive options, representing a substantial challenge that must be addressed.

- The market faces competition from various non-hormonal contraceptives, including Copper-T implants, sponges, surgical sterilization, oral contraception, IUDs, and female condoms. These alternatives cater to diverse user preferences and budgets. The benefits of non-hormonal contraceptives, such as delaying pregnancy to achieve desired family sizes and health advantages, have led to increasing awareness and acceptance. Clinical trials and regulatory approvals ensure the safety and efficacy of these medical devices. Family planning clinics and distribution channels expand market access, making these options readily available to consumers.

- The affordability of these alternatives, offered in various price ranges, empowers users to make informed decisions based on their financial capabilities. As healthcare providers continue to emphasize the importance of effective family planning, the demand for a range of contraceptive methods is expected to persist.

Exclusive Customer Landscape

The vaginal ring market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the vaginal ring market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, vaginal ring market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AbbVie Inc. - The company specializes in providing vaginal ring solutions, including the FDA-approved Femring for managing moderate to severe symptoms of vaginal atrophy associated with menopause.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AbbVie Inc.

- Allergan

- Bayer AG

- Bos Medicare Surgical

- EUROGINE SL

- Johnson and Johnson

- Mayne Pharma Group Ltd.

- Merck and Co. Inc.

- Mithra Pharmaceuticals SA

- Novo Nordisk AS

- Pfizer Inc.

- Prasco Laboratories

- QPharma Inc.

- Searchlight Pharma Inc.

- SMB Corp. of India

- Teva Pharmaceutical Industries Ltd.

- TherapeuticsMD Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Vaginal Ring Market

- In January 2024, Bayer AG announced the launch of its new vaginal ring product, Evra2, which offers extended hormonal contraception for three months, expanding its contraceptive portfolio (Bayer AG Press Release).

- In March 2024, Merck KGaA and The Female Health Company entered into a strategic partnership to co-develop and commercialize the FemCap vaginal ring for contraception and treatment of bacterial vaginosis (Merck KGaA Press Release).

- In April 2024, The Women's Capital Connection, a venture capital firm, led a USD 20 million Series B funding round for Lyra Women, a women's health startup specializing in the development of a reusable, hormone-free vaginal ring for menstrual cycle control (Business Wire).

- In May 2025, the European Medicines Agency granted marketing authorization to Amgen for its vaginal ring, Myfembree, to treat moderate to severe hot flashes associated with menopause, marking a significant regulatory approval for the company (Amgen Press Release).

Research Analyst Overview

- In the market, health equity plays a significant role as marketing strategies prioritize access to healthcare for diverse populations. Healthcare professionals collaborate with public health initiatives to increase awareness and education on the use of these rings. Patient support programs, brand loyalty schemes, and clinical pharmacology research are essential elements of product lifecycle management. Polymer chemistry, specifically silicone elastomers, drives innovation in ring design and material selection. Customer segmentation and regulatory affairs are crucial in navigating the complex healthcare policy landscape. Post-marketing surveillance, health economics, and sales channels are integral to ensuring product quality and competitive advantage. Environmental impact, intellectual property, and drug formulation are key considerations in the development of new vaginal ring products.

- Consumer behavior and training programs for healthcare providers are vital in risk management and reproductive endocrinology applications. Quality assurance and risk management practices are essential in maintaining product safety and effectiveness throughout the product lifecycle. Global health initiatives and generic competition necessitate continuous product differentiation and regulatory compliance.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Vaginal Ring Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.78% |

|

Market growth 2024-2028 |

USD 748.36 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.25 |

|

Key countries |

US, Canada, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Vaginal Ring Market Research and Growth Report?

- CAGR of the Vaginal Ring industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the vaginal ring market growth of industry companies

We can help! Our analysts can customize this vaginal ring market research report to meet your requirements.