Welding Equipment Market Size 2024-2028

The welding equipment market size is forecast to increase by USD 4.72 billion at a CAGR of 6.1% between 2023 and 2028.

- The market is driven by several key trends and challenges. The emergence of advanced welding technologies, such as friction stir welding, is gaining significant traction in the automotive sector due to its ability to join base metals without the need for filler rods or heat generation. Another trend is the increasing adoption of automated welding solutions, which help improve productivity and reduce the dependence on skilled labor. Base metals, such as steel, inox steel, and cast iron, are extensively used in construction, pipeline welding, steel erection, and farm equipment repairs. However, the lack of skilled workforce remains a significant challenge for the market. Additionally, the use of electric curre ants, such as AC and DC, in SMAW machines, as well as the application of flux for oxidation prevention, are essential considerations for welding processes. Contamination and carbon dioxide gas usage are critical factors affecting the quality of welds. Overall, the market is expected to witness steady growth due to these trends and challenges.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant growth due to the increasing demand for electric current-powered welding processes in various industries. Electric current plays a crucial role in welding as it facilitates the melting of base metals, enabling the joining process. Welding equipment manufacturers are focusing on developing advanced technologies to cater to the specific requirements of these industries. Filler rods and flux are essential consumables in the welding process.

- Furthermore, it helps in preventing oxidation and contamination during welding. Carbon dioxide gas is commonly used as a shielding gas in welding processes like Shielded Metal Arc Welding (SMAW) machines. SMAW machines operate on AC and DC currents and are widely used for welding large and thick materials. Heat generation is another critical factor in the welding process. Economical welders are being developed to address the need for faster processes and efficient heat generation. These welders are designed to cater to open spaces and outdoor use, making them ideal for pipeline welding and construction projects. MIG welding, also known as Metal Inert Gas welding, is a popular welding process that uses a consumable wire as a filler material.

How is this market segmented and which is the largest segment?

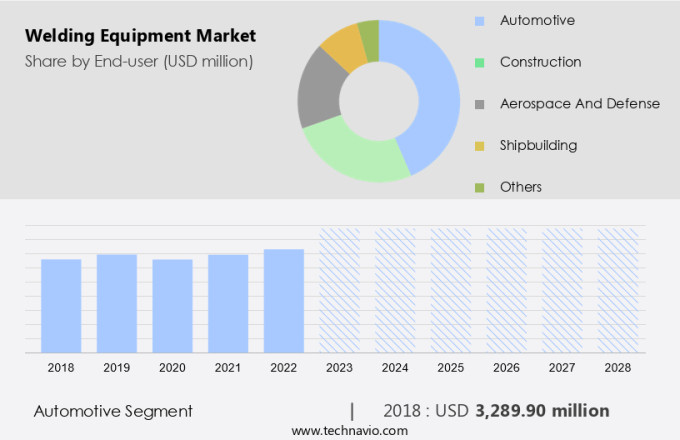

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Automotive

- Construction

- Aerospace and defense

- Shipbuilding

- Others

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By End-user Insights

- The automotive segment is estimated to witness significant growth during the forecast period.

The market experiences substantial growth due to its extensive application in the automotive industry. The industry's stringent demand for superior quality and precision drives the adoption of advanced welding technologies. Robotic welding, for instance, has gained significant traction in automotive manufacturing operations, thanks to its automation capabilities. Electric current, a crucial component of welding, plays a pivotal role in the process. Base metals are melted and joined together using electric current, which generates heat. Filler rods are used to supplement the base metal during the welding process.

Get a glance at the market report of share of various segments Request Free Sample

The automotive segment was valued at USD 3.29 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

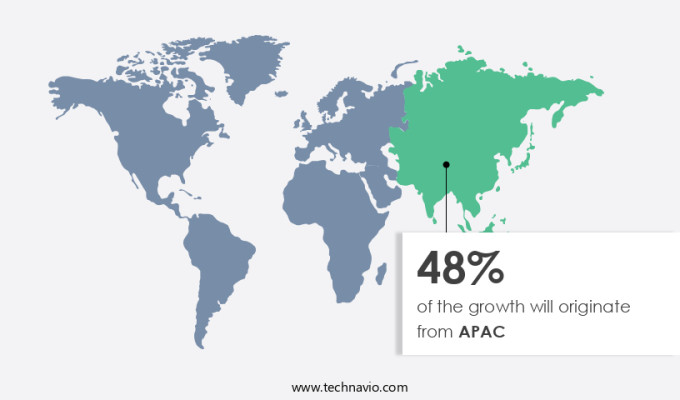

- APAC is estimated to contribute 48% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The increase in infrastructure development projects in Asia Pacific (APAC) has led to a significant increase in the demand for welding equipment in the region. With a focus on large-scale construction of roads, bridges, airports, seaports, and public utilities, the need for efficient welding solutions to join thick materials such as stainless steel, aluminum, and magnesium has become crucial. Consumable wires, electrodes, and filler materials play a vital role in the welding process, ensuring faster production and lower costs. Shielding gases, primarily argon, are essential for protecting the weld zone from atmospheric contamination during the welding process.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Welding Equipment Market ?

Emergence of friction stir welding technology in automotive sector is the key driver of the market.

- The allure of the welding industry is not just limited to the sparks and glamour portrayed in movies, but it is a serious job that requires precision and skill. Friction stir welding (FSW) technology, a modern welding technique, is revolutionizing the industry by joining two metals, typically carbon steel, using frictional heat and controlled forging pressure. This innovative process, which prevents mechanical distortion by maintaining a low operating temperature, results in defect-free products with high integrity. FSW has already made a significant impact in the aerospace industry, but its applications are expanding to the automotive sector.

- In addition, with the increasing demand for lightweight materials like aluminum in the automotive industry due to the quest for improved fuel efficiency, FSW technology is gaining popularity. This technology's ability to create strong, defect-free bonds between metals is crucial in the production of high-performance vehicles. Critics have studied the filming of welding processes for movies, but the real-life applications of FSW technology are far more enriching, driving the growth of The market.

What are the market trends shaping the Welding Equipment Market?

Increasing adoption of automated solutions for welding is the upcoming trend in the market.

- The adoption of automation in the welding industry has seen a notable increase in recent years. companies are increasingly recognizing the benefits of automation in enhancing efficiency, improving quality, and boosting productivity. While initial automation efforts focused on small-scale applications, advancements in robotics technology have led to the integration of robots in welding processes. Robots offer several advantages in welding, including minimizing scrap, reducing heat input, and enabling the use of difficult techniques such as TIG welding with a TIG torch. The versatility of robots allows them to weld various metals, including conventional metals like nickel, as well as aluminum and other materials.

- In addition, advancements in welding gun technology and software have further enhanced the capabilities of robots in welding applications. These advancements enable robots to weld with precision and consistency, resulting in high-quality welds. With the ability to weld various metals sheets, robots have gained popularity among end-users seeking to streamline their welding processes and improve overall production.

What challenges does Welding Equipment Market face during the growth?

Lack of skilled workforce is a key challenge affecting the market growth.

- The market is experiencing a notable skills gap issue, particularly in countries like the US, India, and China, which are known for their large workforces. In the US, the average age of welders is escalating, with many nearing retirement, leading to a significant shortage of skilled labor. This shortage is exacerbated by the fact that the new generation of welders may not possess the same level of expertise as their predecessors. Bare wire, flux core, and both Stick Welding and Arc welding techniques are widely used by DIY enthusiasts and hobby welders.

- However, the high cost of expensive equipment and the complexity of some gas supply systems can deter beginners from entering the industry. To address this challenge, there is a growing demand for more affordable and user-friendly welding equipment. A flow meter is a crucial component in the welding process, ensuring consistent gas supply. However, for beginners, understanding the technicalities of using a flow meter can be daunting. To cater to this need, manufacturers are introducing more accessible welding equipment options, such as those with built-in flow meters and user-friendly interfaces. As the welding industry grapples with the skills gap, it is essential to focus on attracting new talent and providing them with the necessary training.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ador Welding Ltd.

- Amada Co. Ltd.

- Banner Welding Inc.

- Carl Cloos Schweisstechnik GmbH

- Daihen Corp.

- Doncasters Group Ltd.

- Enovis Corp.

- Fronius International GmbH

- Illinois Tool Works Inc.

- Kobe Steel Ltd.

- Kriton Weld Equipments Pvt. Ltd.

- Miller Electric Manufacturing Co.

- Mitco Weld Products Pvt. Ltd.

- Mogora Pvt. Ltd.

- OBARA Group Inc.

- Panasonic Holdings Corp.

- Sonics and Materials Inc.

- Telwin Spa

- The Lincoln Electric Co.

- voestalpine AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for electric currents in various welding processes. Electric currents, including AC and DC, play a crucial role in the fusion of base metals such as steel, inox steel, cast iron, and carbon steel. Filler rods and flux are essential consumables in the welding process, providing oxidation prevention and contamination shielding. Heat generation during welding requires the use of shielding gases like carbon dioxide and argon to prevent contamination. SMAW machines, also known as stick welders, are economical solutions for welding large and thick materials.

Furthermore, MIG welding, using Metal Inert Gas, is a faster process for welding large materials, while TIG welding, using a TIG torch, is suitable for difficult techniques and various metals like stainless steel, aluminum, magnesium, and nickel. Open spaces and outdoor use applications, such as pipeline welding, construction, farm equipment repairs, steel erection, and maintenance, require versatile and strong welding equipment. DIY enthusiasts and hobby welders also contribute to the market growth, despite the expensive equipment required. Bare wire and flux core welding processes cater to beginners and experienced welders alike, with various options available for outdoor use. Adequate gas supply and flow meter regulation are essential for optimal welding performance.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

156 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.1% |

|

Market growth 2024-2028 |

USD 4.72 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.7 |

|

Key countries |

China, US, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch