Wind Turbine Monitoring Systems Market Size 2025-2029

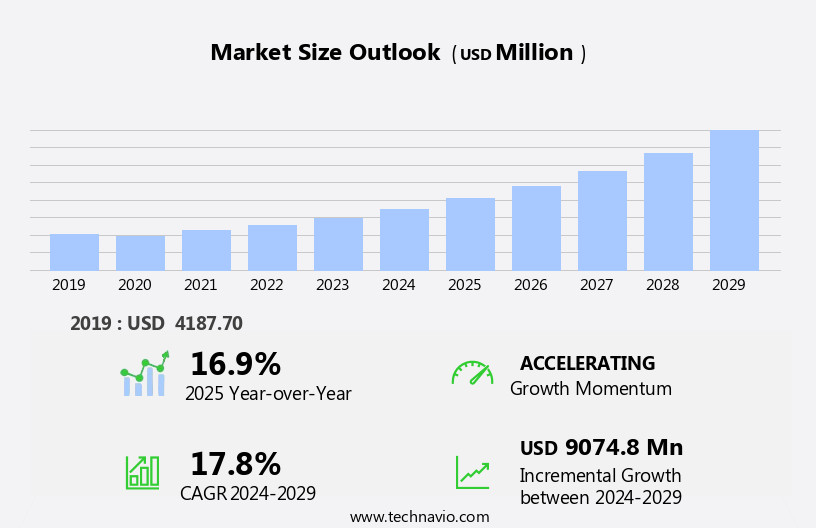

The wind turbine monitoring systems market size is forecast to increase by USD 9.07 billion at a CAGR of 17.8% between 2024 and 2029.

- The market is witnessing significant growth due to the expanding global wind power market and the increasing adoption of offshore wind energy installations. However, the reliability of wind turbine systems is under scrutiny due to the rising number of false alarms, which casts doubts on the performance and longevity of turbine parts. To mitigate these challenges, market participants are focusing on developing advanced monitoring systems that provide real-time data and predictive analytics to enhance the efficiency and productivity of wind turbines.

- Moreover, the integration of IoT and AI technologies in wind turbine monitoring systems is expected to revolutionize the industry by enabling proactive maintenance and reducing downtime. Overall, the market is poised for strong growth in the coming years, driven by these trends and the increasing demand for renewable energy solutions.

What will be the Size of the Wind Turbine Monitoring Systems Market During the Forecast Period?

- The market encompasses a range of hardware and software solutions designed to optimize wind farm performance and ensure the reliable operation of wind turbines. These systems enable real-time monitoring of critical parameters such as wind speeds, rotor blade performance, and stresses on blades, towers, and gearboxes. With the expansion of high-altitude wind projects and the use of tall towers, monitoring systems have become increasingly important for mitigating risks and enhancing energy production. Digitization of processes and the adoption of control strategies have driven the market's growth, with remote monitoring systems and predictive maintenance tools becoming essential subsystems.

- Sensor technologies and hardware platforms form the foundation of these monitoring systems, while software platforms provide the data analysis and visualization capabilities necessary for effective wind farm management. Cybersecurity issues have emerged as a significant concern in the wind energy sector, with strong cybersecurity solutions becoming essential to protect against potential threats. Individual turbine control and troubleshooting capabilities are also critical features, enabling operators to quickly address any issues and minimize downtime. The market spans both onshore and offshore wind applications, with the offshore wind industry presenting unique challenges due to its complex and harsh operating environment.

How is this Wind Turbine Monitoring Systems Industry segmented and which is the largest segment?

The wind turbine monitoring systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Vibration monitoring

- Automated oil-particulate systems

- Acoustic monitors

- Application

- Onshore

- Offshore

- Deployment

- Cloud based

- On-premises

- Product Type

- Hardware

- Software

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- North America

- Canada

- US

- Middle East and Africa

- South America

- APAC

By Type Insights

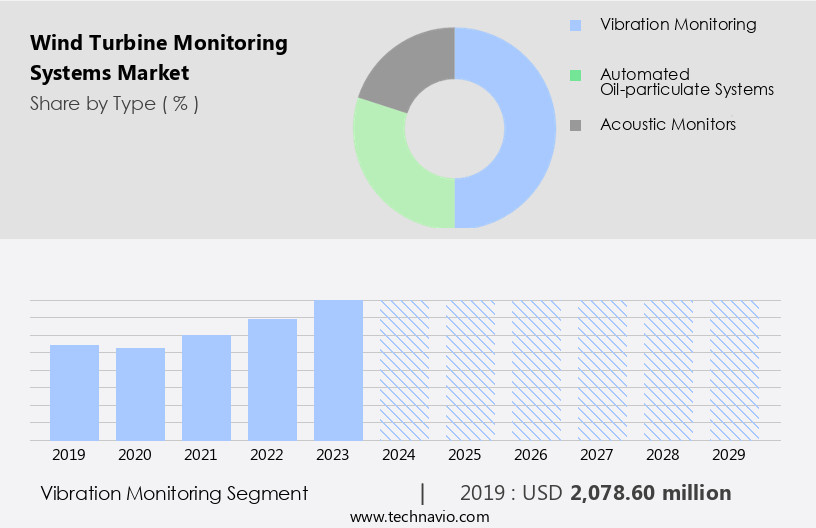

- The vibration monitoring segment is estimated to witness significant growth during the forecast period.

Wind turbine monitoring systems play a crucial role in optimizing wind farm performance and ensuring the reliability of wind energy production. These systems employ various sensors and technologies to collect data on wind speeds, tower vibrations, and stresses. Vibration sensors, with a recommended range of 0.1 to 100 Hz, are used to monitor tower conditions and identify stresses. High altitude wind and harsh weather conditions are effectively managed through tall towers and reliable gearboxes. Digitization of processes and control strategies enable real-time monitoring and predictive maintenance tools, enhancing overall wind farm performance.

Remote monitoring systems facilitate troubleshooting capabilities, reducing the need for onsite visits. Monitoring subsystems such as pitch systems, yaw systems, main control systems, and brake systems is essential for maintaining optimal windmill functionality. Cybersecurity issues are addressed through strong cybersecurity solutions and security services, ensuring the protection of sensitive data. Individual turbine control and energy production data are essential for wind farm operators and investors. Offshore wind farms and onshore applications alike benefit from these advanced monitoring systems. SMEs, startups, OEMs, and turbine manufacturers all contribute to the evolving wind energy landscape. Incorporating

Get a glance at the Wind Turbine Monitoring Systems Industry report of share of various segments Request Free Sample

The vibration monitoring segment was valued at USD 2.08 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

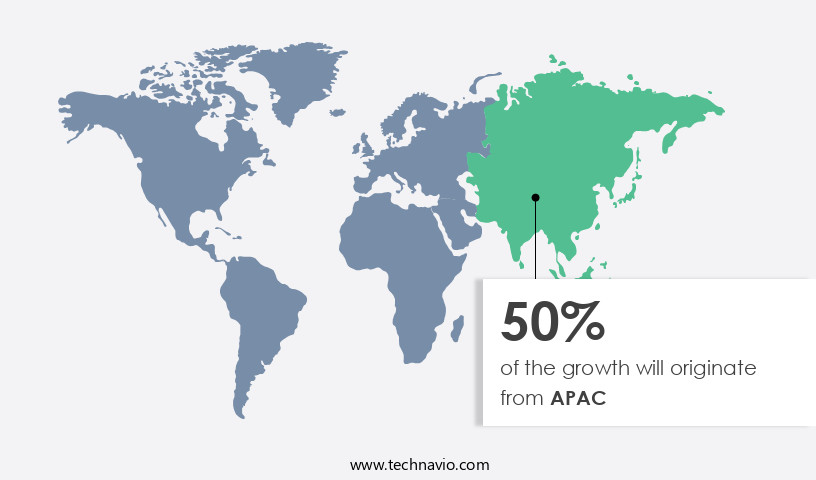

- APAC is estimated to contribute 50% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is driven by the region's increasing energy demand and focus on renewable energy sources, particularly wind energy. China and India are expected to dominate the market due to government initiatives promoting clean energy production. Wind energy is gaining popularity as a cost-effective alternative to non-renewable energy sources. Wind turbines are essential for harnessing wind energy, and monitoring systems play a crucial role in optimizing their performance. These systems enable remote monitoring, predictive maintenance, and individual turbine control. They incorporate sensor technologies, hardware platforms, and software solutions to ensure reliable operation.

In addition, wind turbines are subjected to harsh weather conditions, tall towers, and high altitude wind, necessitating strong cybersecurity solutions and security services. The market comprises SMEs, startups, OEMs, and turbine manufacturers. Key components include rotor blades, stresses, wind speeds, pitch systems, yaw systems, main control systems, and brake systems. Wind farms and windmills benefit from these systems to enhance energy production and troubleshoot issues effectively. The onshore and offshore wind industries are significant markets for wind turbine monitoring systems.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption?

The rapid growth of global wind power market is the key driver of the market.

- The global wind energy sector is experiencing significant growth due to the increasing demand for renewable energy sources, driven by population growth and economic expansion. Europe and China are leading markets for wind turbine monitoring systems, fueled by the expansion of the offshore wind industry. Onshore wind development continues to thrive, with advancements in electronics and efficient planning and management leading to improved reliability and cost reduction. Wind turbine monitoring systems play a crucial role in optimizing wind farm performance by tracking wind speeds, stresses on rotor blades, and the health of subsystems such as pitch systems, yaw systems, main control systems, and brake systems.

- These systems enable predictive maintenance through sensor technologies and remote monitoring, reducing downtime and maintenance costs. As wind projects have longer lifespans, reliable gearboxes and strong cybersecurity solutions are essential to ensure energy production and protect against cybersecurity issues and security services. The market for wind turbine monitoring systems is expected to continue growing, offering opportunities for SMEs, startups, and OEMs to invest in this sector and contribute to the transition to renewable energy sources.

What are the market trends shaping the Industry?

The rise in offshore wind energy installations is the upcoming market trend.

- The market is expanding due to the increasing adoption of offshore wind energy. Offshore wind farms are preferred for their ability to capture stronger and more consistent winds, leading to a rise in their deployment, particularly in regions like Europe, Asia-Pacific, and North America. Advanced systems are essential for the efficient operation and maintenance of wind turbines in offshore wind farms. These systems enable early detection of potential issues, minimize downtime, and optimize wind turbine performance, thereby enhancing the overall reliability and productivity of offshore wind energy projects. Monitoring systems incorporate various subsystems, including rotor blades, stresses, wind speeds, and hardware platforms.

- Sensor technologies play a crucial role in collecting data on these subsystems. Control strategies, such as individual turbine control, troubleshooting capabilities, and pitch and yaw systems, are integrated into monitoring systems to ensure optimal energy production. The digitization of processes in the wind energy sector has led to the development of remote monitoring systems and software platforms. Reliable gearboxes are a critical component of wind turbines, and monitoring their condition is essential for predictive maintenance. Cybersecurity issues are a growing concern in the wind energy sector, necessitating strong cybersecurity solutions to protect against potential threats. The wind energy sector's industrialization and urbanization have increased energy consumption, making it vital to optimize wind farm performance.

What challenges does the Wind Turbine Monitoring Systems Industry face during its growth?

False alarms cast doubts on reliability of turbine parts is a key challenge affecting the industry growth.

- These systems play a crucial role in optimizing wind farm performance by collecting and analyzing data from various turbine subsystems and components. These systems gather information on wind speeds, rotor blades, stresses, and other operational parameters. The data is then used to implement control strategies, ensure reliable gearboxes, and perform predictive maintenance using sensors and hardware platforms. The wind energy sector faces unique challenges, including harsh weather conditions, tall towers, and high altitude wind. Monitoring systems enable individual turbine control, troubleshooting capabilities, and remote monitoring for both onshore and offshore wind farms.

- The digitization of processes in the wind industry has led to the development of advanced software platforms and remote monitoring systems. Cybersecurity issues are a growing concern in the wind energy sector, necessitating strong cybersecurity solutions and security services. Energy production from wind turbines is a significant contributor to renewable energy sources, competing with traditional energy sources such as fossil fuel, solar power, hydro energy, geothermal, and biofuel. SMEs, startups, and OEMs invest in wind turbines and related technologies, requiring spare parts, pitch systems, yaw systems, main control systems, and brake systems. The wind industry's expansion is influenced by industrialization, urbanization, and increasing energy consumption.

Exclusive Customer Landscape

The wind turbine monitoring systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB SKF - The company offers wind turbine monitoring systems, namely Protean, a new diagnostic tool which helps operation and maintenance technicians concentrate on potential real performance issues and thereby reduce the risk of false alarms.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACOEM Group

- Advantech Co. Ltd.

- American Superconductor Corp.

- Ammonit Measurement GmbH

- Avnet Inc.

- Campbell Scientific Inc.

- Dewesoft d.o.o.

- Envision Group

- ESCO Technologies Inc.

- General Electric Co.

- GreenStream Data Ltd.

- Hansford Sensors Ltd.

- Hexagon AB

- Indutrade AB

- James Fisher and Sons Plc

- National Instruments Corp.

- NSK Ltd.

- Siemens AG

- Spectris Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The wind energy sector has witnessed significant growth in recent years, driven by the global push towards renewable energy sources and the increasing demand for sustainable energy production. One of the critical aspects of wind energy generation is ensuring the optimal performance and reliability of wind turbines. This is where wind turbine systems come into play. Wind turbines, with their rotor blades reaching impressive lengths and towering heights, are subjected to various stresses due to wind speeds and harsh weather conditions. The longevity of these structures, known as wind projects, is essential for maximizing energy production and minimizing maintenance costs.

Further, monitoring systems play a pivotal role in maintaining wind farm performance by providing real-time data on wind speeds, blade conditions, and other critical subsystems such as pitch systems, yaw systems, main control systems, and brake systems. These systems enable wind farm operators to implement control strategies that optimize energy production and minimize downtime. The digitization of processes in the wind energy sector has led to the development of advanced monitoring systems. These systems leverage sensor technologies and hardware platforms to collect and analyze data, which is then transmitted to software platforms for analysis and visualization. Remote monitoring capabilities allow operators to troubleshoot issues and perform predictive maintenance, reducing the need for on-site visits and minimizing downtime.

The wind industry, including OEMs (Original Equipment Manufacturers), SMEs (Small and Medium Enterprises), and startups, has seen a rise in innovation in wind turbine monitoring systems. The focus on reliable gearboxes, tall towers for high altitude wind, and strong cybersecurity solutions to address cybersecurity issues and security services has been a priority. The offshore wind industry, with its unique challenges, has also adopted systems to ensure optimal performance and reliability. Offshore wind farms face harsher weather conditions and require specialized maintenance due to their remote locations. Systems enable operators to remotely monitor and troubleshoot issues, reducing the need for costly and time-consuming on-site visits.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 17.8% |

|

Market Growth 2025-2029 |

USD 9.07 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.9 |

|

Key countries |

China, US, France, UK, India, Canada, Japan, Germany, South Korea, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Wind Turbine Monitoring Systems Market Research and Growth Report?

- CAGR of the Wind Turbine Monitoring Systems industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the wind turbine monitoring systems market growth of industry companies

We can help! Our analysts can customize this wind turbine monitoring systems market research report to meet your requirements.