Wine Corks Market Size 2024-2028

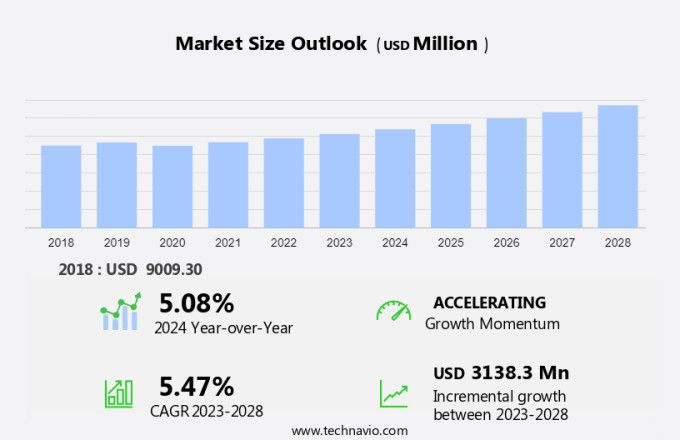

The wine corks market size is forecast to increase by USD 3.14 billion at a CAGR of 5.47% between 2023 and 2028. In the dynamic wine industry, market trends and analysis reveal significant growth factors. The surging demand for wine, fueled by its perceived health benefits and increasing consumer preference for premium labels, is a primary driver. Another trend is the expanding online wine retailing sector, which offers convenience and a broader selection to consumers. However, campaigns against alcohol consumption pose a challenge, potentially impacting market growth. The market is influenced by these trends, with demand driven by rising wine consumption and the convenience offered by online sales. Simultaneously, the industry faces challenges from the growing anti-alcohol sentiment and the increasing popularity of alternative wine packaging solutions. Automation and robotics have streamlined the manufacturing process, ensuring consistent quality and reducing the risk of moisture, spillage, and oxidants affecting the wine.

The market encompasses various types of corks, including natural corks derived from the bark of Cork oak trees and synthetic corks made from plastic or other synthetic materials. Wine corks play a crucial role in preserving the quality of wines by preventing moisture, spillage, oxidants, and microorganisms from entering the bottle. The coronavirus crisis and subsequent lockdowns have significantly impacted the wine industry, with closures of bars, restaurants, and hotels leading to a decrease in demand for still wines and sparkling wines. As a result, the market has experienced fluctuations. Natural corks have been the traditional choice for wine stoppers due to their physical and chemical properties that provide an airtight seal.

However, synthetic corks and glass stoppers, as well as screw caps, have gained popularity due to their cost-effectiveness and reliability. Muselets, a decorative wire cage used to secure natural corks, add aesthetic value to the wine bottles. The market for wine corks is expected to grow as the demand for wine continues to rise, with consumers seeking high-quality wine preservation solutions. In summary, the market is a dynamic and evolving industry that caters to the diverse needs of the wine industry, with natural and synthetic corks, glass stoppers, and screw caps offering various benefits to wine producers and consumers.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Natural

- Synthetic

- Distribution Channel

- Offline

- Online

- Geography

- Europe

- Germany

- France

- Italy

- North America

- US

- APAC

- China

- South America

- Middle East and Africa

- Europe

By Type Insights

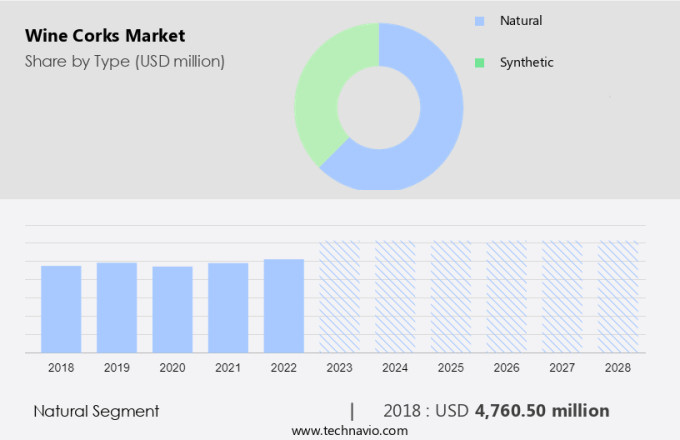

The natural segment is estimated to witness significant growth during the forecast period. The market encompasses a range of closure options for novel wines, including designer corks derived from natural and synthetic materials. Natural corks, primarily sourced from the bark of oak trees in the Mediterranean region, account for a significant market share. These corks are suitable for aging red wines and are sustainably harvested, ensuring minimal impact on the environment. Synthetic corks, made from plastic or plant-based polymers, offer an alternative to natural corks. Synthetic materials, such as polyethylene-based options, have gained popularity due to their consistency and resistance to contamination. However, the coronavirus crisis and subsequent lockdowns have impacted the wine industry, leading to a decrease in wine consumption in bars, restaurants, hotels, and cruise ships.

Wine production and consumption continue to be a significant contributor to heart disease, stroke, diabetes, and digestive tract infections. Recyclable corks, made from recycled sugar cane or cork oak, offer a sustainable solution for the wine industry. Cork recycling services play a crucial role in reducing waste and minimizing the environmental impact of wine corks. The market for wine corks includes various types, such as still wines and sparkling wines, and closure options, including glass stoppers, screw caps, and muselets. Natural corks remain a popular choice for still wines, while synthetic corks are commonly used for sparkling wines.

Sensors are increasingly being integrated into wine corks to monitor wine quality and aging process. In conclusion, the market is diverse and dynamic, with a range of options catering to various wine types and consumer preferences. Natural corks, derived from the bark of oak trees, continue to dominate the market, while synthetic corks offer a sustainable and consistent alternative. The coronavirus crisis has highlighted the importance of sustainability and recycling in the wine industry, with recycled corks and cork recycling services gaining prominence.

Get a glance at the market share of various segments Request Free Sample

The natural segment was valued at USD 4.76 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

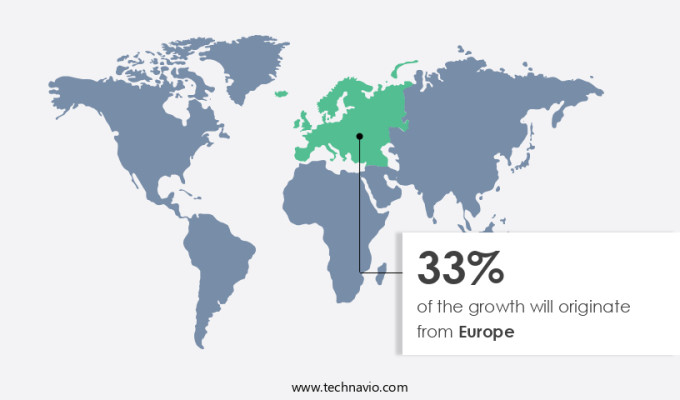

Europe is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market encompasses the production, sales, and export of various types of corks and wine stoppers used to seal wine bottles. Winemakers meticulously consider oxygen transfer rates during the cork selection process to preserve the wine's chemical and physical properties. The market caters to diverse demographics, including Millennials and Boomers, who value the traditional charm of corks versus plastic caps. The export business thrives on the global market potential, with key players showcasing their offerings at international trade fairs such as Vinexpo and Prowein.

Moreover, the microorganisms and oxidants can negatively impact the wine, making product positioning and sales cycle crucial for market opportunities. Competitors in the market include various global players, necessitating strategic product differentiation and advertisement efforts. Developing economies present significant export potential, as consumers in these regions increasingly appreciate fine wines. Importers and wineries rely on the market for their needs, further fueling market growth. Understanding the unique requirements of each demographic and market segment is essential for successful product positioning and maintaining a competitive edge.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rising demand for wine is the key driver of the market. The market has experienced notable growth in recent years, driven by the increasing consumption of alcoholic beverages, particularly novel wines, in various regions such as China. Designer corks, made from both natural and synthetic materials, have gained popularity in this market. Natural cork, derived primarily from the bark of the Cork oak tree, has long been the traditional choice for wine bottles. However, synthetic alternatives, such as plastic and polyethylene-based corks, have gained traction due to their cost-effectiveness and durability. The coronavirus crisis and subsequent lockdowns have significantly impacted the wine industry, with bars, restaurants, hotels, and cruise ships being major consumers of wine experiencing significant disruptions. Despite these challenges, the demand for wine corks has remained relatively stable due to the continued consumption of still and sparkling wines at home. The health benefits associated with moderate wine consumption, including a reduced risk of heart disease, stroke, diabetes, and digestive tract infections, have further fueled the demand for wine corks.

Moreover, the wine tourism industry, which contributes significantly to the overall revenue of the wine industry, has also played a role in the growth of the market. Recyclable corks, made from recycled sugar cane or other plant-based materials, have emerged as a sustainable alternative to traditional corks. Companies such as Burlington Drinks are at the forefront of this trend, offering recycled corks and cork recycling services. The natural type segment of the market is expected to maintain its dominance, with sensors and plant-based polymers being key areas of innovation. The online distribution channel has gained significant traction in the market, with consumers increasingly opting for the convenience and safety of home delivery. Glass stoppers and screw caps are also gaining popularity as alternatives to traditional corks, particularly for sparkling wines and still wines with higher alcohol content. In summary, the market is expected to continue its growth trajectory, driven by the increasing consumption of alcoholic beverages, particularly wine, and the ongoing innovation in sustainable and alternative cork materials.

Market Trends

Growing online wine retailing is the upcoming trend in the market. The global wine market is witnessing a significant shift towards online retailing due to faster delivery services and competitive pricing. Novel wines and designer corks are increasingly becoming popular among consumers, driving the demand for various types of corks. The coronavirus crisis and subsequent lockdowns have led to the closure of bars, restaurants, hotels, and cruise ships, resulting in a decline in traditional sales channels for alcoholic beverages. However, the wine industry continues to thrive, with an increase in wine production and consumption. Heart disease, stroke, diabetes, and digestive tract infections are some health concerns associated with excessive alcohol consumption. As a result, there is a growing trend towards the use of recyclable corks in the wine industry. Companies like Burlington Drinks are leading the way by using recycled sugar cane to produce corks. Cork recycling services are also gaining popularity to reduce the environmental impact of cork production. The natural type segment of the market is expected to dominate due to the traditional association of natural corks with premium wines. However, synthetic corks, made from materials like polyethylene-based, plant-based polymers, and synthetic materials, are gaining popularity due to their durability and consistency. Glass stoppers and screw caps are also used in the wine industry, particularly for still wines and sparkling wines, respectively.

Moreover, the muselet, a traditional wine bottle closure made from natural cork, adds to the aesthetic appeal of the wine bottle. Natural corks are sourced from the bark of the Cork oak tree, while synthetic corks are made from various materials. The online distribution channel is expected to record the fastest growth in the market due to the convenience and accessibility it offers to consumers. Sensors are being integrated into wine corks to monitor the wine's aging process and ensure its quality. In conclusion, the market is undergoing significant changes due to the shift towards online retailing, health concerns, and sustainability. Natural and synthetic corks, glass stoppers, and screw caps are used in the wine industry, with natural corks being the preferred choice for premium wines. The use of recycled materials and cork recycling services is gaining popularity to reduce the environmental impact of cork production. The online distribution channel is expected to dominate the market due to its convenience and accessibility.

Market Challenge

Campaigns against alcohol consumption is a key challenge affecting the market growth. The wine market faces a significant challenge due to the rising number of campaigns against alcohol consumption. Novel wines, such as low-alcohol beer, are increasingly popular, yet the demand for traditional wines remains. Designer corks continue to adorn bottles of high-end wines, with both natural and synthetic options available. The coronavirus crisis and subsequent lockdowns have impacted the wine industry, particularly bars, restaurants, hotels, cruise ships, and other establishments where alcoholic beverages are commonly consumed. Despite these challenges, wine production continues to grow. Wine consumption, however, is a topic of concern due to the potential health risks associated with alcohol, including heart disease, stroke, diabetes, and digestive tract infections. Wine tourism remains a significant contributor to the industry, with many vineyards offering unique experiences for visitors.

However, the wine cork market is diverse, with natural corks derived from the bark of the Cork oak tree and synthetic corks made from synthetic materials or plant-based polymers. Glass stoppers and screw caps are also popular alternatives. Still, wines and sparkling wines each require specific corks, with the use of muselés for sparkling wines. Recyclable corks are gaining popularity due to their eco-friendly nature. Companies like Burlington Drinks are leading the way, using recycled sugar cane to produce their corks. Cork recycling services are also available to ensure the sustainable use of natural corks. The natural type segment dominates the market, but the synthetic materials segment is expected to grow due to its cost-effectiveness and durability. Online distribution channels are increasingly common, with sensors and plant-based polymers used to ensure the quality of the wines during transportation. The use of technology, such as sensors and plant-based polymers, is expected to drive the growth of the market in the coming years.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Allstates Rubber and Tool Corp. - The company offers a wide range of rubber corks, such as A038, A0390, and A0775.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advance Cork International

- BOUCHONS LECLERCQ ET FILS

- Corticeira Amorim S.G.P.S S.A.

- DIAM BOUCHAGE SAS

- J C RIBEIRO

- JACORK

- Jelinek Cork Group

- Korkindustrie Trier GmbH and Co. KG

- M A Silva USA

- Nagpal Cork and Jointing

- Portuguese Cork Association

- Precisionelite

- Sugherificio Martinese and Figli srl

- Vinocor

- Vinventions LLC

- Waterloo Container Co.

- We Cork Inc.

- WidgetCo Inc.

- Zandur

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a significant sector in the global packaging industry. Wine corks are essential components in the wine industry, providing an airtight seal to preserve the wine's quality. The market for wine corks is driven by the increasing consumption of wine worldwide. Natural corks have traditionally been the preferred choice for wine bottles due to their ability to breathe and allow the wine to age gracefully. However, alternatives such as synthetic corks and screw caps have gained popularity in recent years due to their convenience and cost-effectiveness. The market for wine corks is segmented based on material type, application, and region.

Moreover, the material types include natural corks, synthetic corks, and screw caps. The application segments include still wine, sparkling wine, and fortified wine. The market for wine corks is expected to grow due to the increasing demand for wine and the shift towards sustainable and eco-friendly packaging solutions. Corks are used in various wine production processes, including Plastic-coated corks, Coravin systems, and Technical corks. The market for wine corks is competitive, with key players including companies that specialize in the production and distribution of corks. The market for wine corks is expected to continue to grow due to the increasing demand for wine and the shift towards sustainable and eco-friendly packaging solutions.

Further, the market is also driven by the growing trend towards personalized and premium wine packaging. The market for wine corks is expected to be driven by the increasing demand for wine, particularly in emerging markets such as China and India. The market is also expected to be influenced by factors such as changing consumer preferences, increasing competition, and technological advancements in the industry. In conclusion, the market is a dynamic and growing sector in the packaging industry, driven by the increasing demand for wine and the shift towards sustainable and eco-friendly packaging solutions. The market is expected to continue to grow due to the increasing demand for wine and the trend towards personalized and premium wine packaging.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.47% |

|

Market growth 2024-2028 |

USD 3.14 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.08 |

|

Regional analysis |

Europe, North America, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 33% |

|

Key countries |

US, France, Italy, Germany, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Advance Cork International, Allstates Rubber and Tool Corp., BOUCHONS LECLERCQ ET FILS, Corticeira Amorim S.G.P.S S.A., DIAM BOUCHAGE SAS, J C RIBEIRO, JACORK, Jelinek Cork Group, Korkindustrie Trier GmbH and Co. KG, M A Silva USA, Nagpal Cork and Jointing, Portuguese Cork Association, Precisionelite, Sugherificio Martinese and Figli srl, Vinocor, Vinventions LLC, Waterloo Container Co., We Cork Inc., WidgetCo Inc., and Zandur |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch