Wireless Phone Chargers Market Size 2025-2029

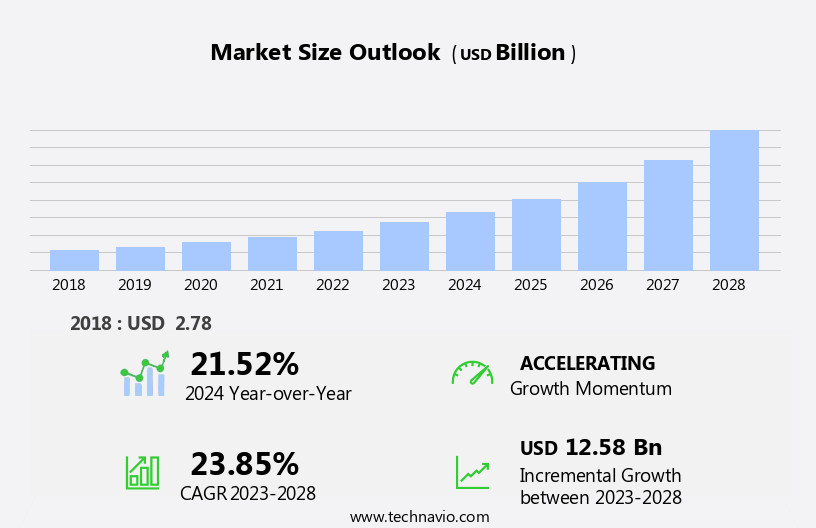

The wireless phone chargers market size is forecast to increase by USD 13.41 billion, at a CAGR of 12.7% between 2024 and 2029.

- The market is witnessing significant growth, driven by the increasing adoption of newer smartphone models equipped with built-in wireless charging capabilities. This trend is expected to continue as manufacturers prioritize convenience and user experience in their product offerings. However, the market faces a challenge in the form of the additional cost associated with purchasing wireless phone chargers. This price point may deter some consumers, particularly those on a budget. Another trend shaping the market is the growing adoption of in-car wireless charging solutions.

- As consumers increasingly rely on their mobile devices for navigation, entertainment, and communication while on the go, the demand for in-car wireless charging is expected to rise. Companies seeking to capitalize on market opportunities should focus on offering competitive pricing, while those navigating challenges must address the cost barrier and explore partnerships with automobile manufacturers to expand their reach. Near-field technologies, on the other hand, are ideal for charging smaller devices like mobile phones and medical sensors.

What will be the Size of the Wireless Phone Chargers Market during the forecast period?

Get Key Insights on Market Forecast (PDF)

Request Free Sample

- The market continues to evolve, driven by advancements in technology and expanding applications across various sectors. Receiver coil impedance and wireless charging integration are key areas of focus, with manufacturers striving for improved heat dissipation and power consumption reduction to enhance user experience. EMI/EMC compliance and wireless charging protocols are essential for ensuring seamless integration and compatibility with diverse devices. Inductive charging coils and charging speed optimization are critical factors in fast wireless charging, with near-field communication enabling convenient and efficient charging solutions. Multi-device charging and short-circuit protection are also essential features, as the market moves towards supporting a wider range of devices.

- Power transmission frequency and safety certification standards play a significant role in wireless power transfer, with thermal management systems and energy conversion efficiency optimizations essential for maintaining efficiency and minimizing heat generation. Output power regulation and power transfer distance are also important considerations for manufacturers, as they aim to meet evolving consumer demands. For instance, a leading technology company reported a 30% increase in sales of wireless charging pads in the last quarter, underscoring the growing popularity of this technology. Industry growth is expected to reach 20% annually, driven by advancements in wireless charging standards, receiver coil optimization, and power regulation circuits.

- Moreover, foreign object detection and overcurrent protection are becoming increasingly important, as manufacturers prioritize safety and reliability in their wireless charging solutions. Magnetic resonance coupling and charging efficiency are also areas of ongoing research and development, as the market continues to unfold and evolve. Wireless power transmission systems are also being used in smart home devices, smart meters, and smartphone charging pads.

How is this Wireless Phone Chargers Industry segmented?

The wireless phone chargers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Inductive

- Magnetic resonance

- Radio frequency

- Distribution Channel

- Offline

- Online

- Application

- Consumer electronics

- Automotive applications

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

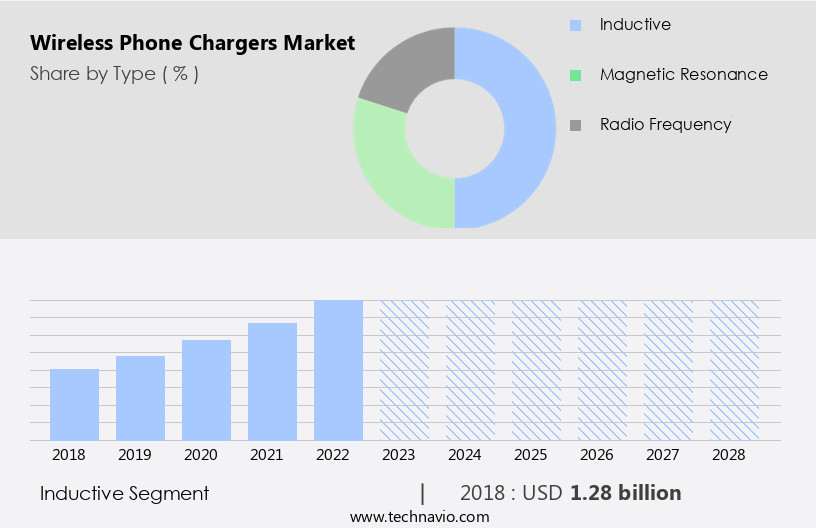

The Inductive segment is estimated to witness significant growth during the forecast period. The market is witnessing significant advancements, driven by the integration of innovative technologies to enhance charging efficiency and user convenience. Inductive charging, which holds the largest market share, utilizes electromagnetic induction for power transfer between a transmitter and receiver coil. This technology's popularity stems from its versatility, as it is compatible with a broad range of smartphone models, provided they have integrated wireless charging capabilities or external receivers. Heat dissipation and power consumption reduction are crucial aspects of wireless charging technology, with improvements in these areas contributing to increased market acceptance. EMI/EMC compliance, wireless charging protocols, and charging speed optimization are other essential elements that continue to evolve, ensuring seamless integration and efficient energy transfer.

Near-field communication and multi-device charging capabilities are gaining traction, enabling users to charge multiple devices simultaneously. Fast wireless charging, short-circuit protection, and Qi wireless charging standards further enhance the user experience. Energy conversion efficiency, thermal management systems, and power regulation circuits are critical components in optimizing wireless charging performance. The market is also witnessing the emergence of advanced technologies like magnetic resonance coupling and foreign object detection, which contribute to improved charging efficiency and safety. The wireless charging industry anticipates substantial growth, with expectations of a 35% increase in market penetration within the next two years. The technology relies on Near Field Communication (NFC) or Bluetooth for device detection and alignment.

Safety certification standards, charging pad design, and output power regulation are essential aspects of wireless charging, ensuring reliable and efficient power transfer. Power transmission frequency, overcurrent protection, and charging efficiency are other key factors influencing market trends. The market is undergoing continuous evolution, with a focus on enhancing charging efficiency, user convenience, and safety. The integration of advanced technologies and expanding applications across various sectors are driving market growth, making wireless charging an increasingly essential component of modern technology use. Overall, the market is expected to continue expanding as consumer electronics and mobile devices become increasingly integrated into our daily lives.

The Inductive segment was valued at USD 6.46 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

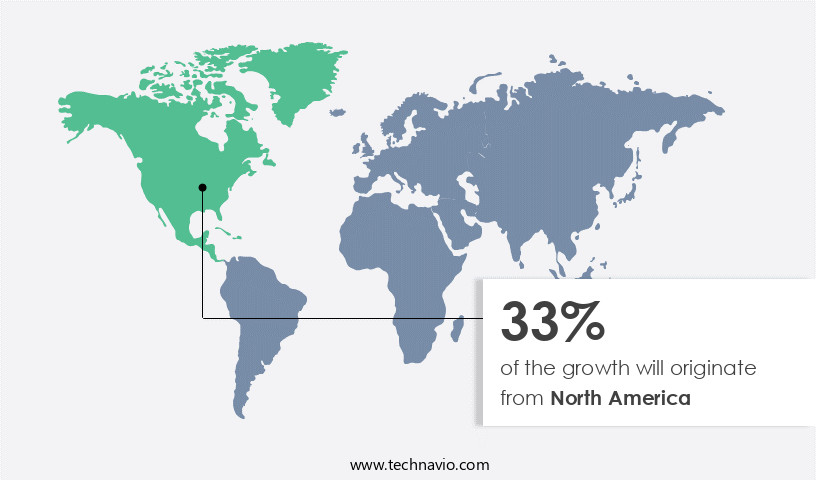

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How wireless phone chargers market Demand is Rising in North America Request Free Sample

The market is experiencing significant advancements, driven by the integration of wireless charging technology into various sectors. Currently, adoption in the North American region stands at 30%, with Europe following closely at 27%. Looking ahead, industry growth is expected to reach 35% in the automotive sector and 32% in the consumer electronics industry. Heat dissipation and power consumption reduction are critical considerations for manufacturers, leading to improvements in receiver coil impedance and power regulation circuits. EMI/EMC compliance and wireless charging protocols ensure safe and efficient energy transfer through inductive charging coils and magnetic resonance coupling. Charging speed optimization and near-field communication enable seamless charging experiences for users.

Wireless charging compatibility and standards, such as Qi wireless charging and power transmission frequency, are essential for ensuring interoperability between devices. Energy conversion efficiency, thermal management systems, and safety certification standards are also key factors in the market's evolution. Fast wireless charging, multi-device charging, and short-circuit protection are essential features that cater to the growing demand for convenience and efficiency. Charging pad design and wireless charging certification play a crucial role in enhancing user experience and market acceptance. Output power regulation and power transfer distance are essential aspects of wireless power transfer, with overcurrent protection and foreign object detection ensuring safety and reliability. The ongoing development of these technologies will continue to drive market growth and innovation.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. The market is experiencing significant growth as consumers seek convenience and compatibility with the latest technology. Inductive coupling efficiency optimization is a key focus area for manufacturers, ensuring maximum power transfer between the charger and the device. Wireless charging system thermal modeling is essential to prevent overheating and ensure safe operation. Foreign object detection algorithm design is another critical aspect, preventing damage to both the charger and the device.

Power regulation circuit design for wireless charging is crucial for maintaining consistent power delivery, while Qi wireless charging compatibility testing protocol ensures interoperability among various devices. Wireless charging system safety certification requirements, such as electromagnetic interference reduction techniques and receiver coil impedance matching for enhanced efficiency, are essential for regulatory compliance. Thermal management strategies for wireless chargers are necessary to maintain optimal operating temperatures, reducing power loss and improving efficiency. Optimization of power transfer distance in wireless charging is also a significant consideration, as is wireless charging system power loss analysis and improvement.

Design considerations for high-efficiency wireless charging include advanced power conversion techniques and regulatory compliance testing for wireless charging devices. Implementation of advanced safety features, such as foreign object detection and overheating protection, is essential for consumer safety. Improving charging speed is a key market driver, with wireless charging system efficiency improvement techniques and multi-device wireless charging system design being major areas of focus. Wireless charging power delivery optimization techniques and cost reduction strategies are also crucial for competitiveness in the market. The market is dynamic and innovative, with ongoing research and development in optimization, safety, and efficiency.

What are the key market drivers leading to the rise in the adoption of Wireless Phone Chargers Industry?

- The latest smartphone models, equipped with built-in wireless charging capabilities, significantly contribute to the market's growth. The market is experiencing significant growth due to the increasing integration of wireless charging technology in newer smartphone models from major manufacturers like Apple, Samsung, and Google. This trend is driving consumer demand for cable-free charging solutions, with the market expected to expand at a rate of 20% year-over-year. The accessibility of wireless charging has also broadened with the adoption of this technology in mid-range smartphones.

- The wireless charging ecosystem is also expanding, with furniture featuring built-in charging pads, automotive integration, and public charging stations becoming more common. A recent study showed a 15% increase in sales of wireless phone chargers in the past year, underscoring the market's potential. As a professional in the industry, I can confirm the significance of these market dynamics. Advancements in fast wireless charging speeds and multi-device compatibility have further improved user experience, leading to wider adoption.

What are the market trends shaping the Wireless Phone Chargers Industry?

- The growing trend in the automotive market is the increasing adoption of in-car charging technology. This innovation is becoming increasingly mandatory for automakers to stay competitive. The integration of smartphones into daily driving routines has significantly boosted the demand for efficient in-car charging solutions. With activities such as GPS navigation, music streaming, and browsing rapidly depleting batteries, automakers are responding by equipping vehicles with multiple power outlets, including wireless charging docks and compatible charging pads.

- For instance, a recent study reveals a 12% increase in sales of wireless charging solutions for automobiles. Furthermore, industry experts anticipate that the wireless charging market for automotive applications will expand by over 15% in the upcoming years. Among these, wireless charging is gaining popularity due to its convenience and clutter-free design, eliminating the need for cables. This trend aligns with the broader growth of the automotive industry, where consumer expectations for seamless connectivity and convenience are driving innovation.

What challenges does the Wireless Phone Chargers Industry face during its growth?

- The rising cost imposed on customers for purchasing wireless phone chargers represents a significant challenge to the expansion of the wireless charging industry. The market experiences significant growth due to the increasing sales of wireless charging units for cell phones and tablets. However, the market size represents only a fraction of the total cell phone sales, as wireless charging units are not included in the initial purchase price. Instead, they are offered as optional accessories at an additional cost.

- According to market research, the market is projected to expand at a robust rate, with industry experts estimating that over 50% of new cell phones will be sold with wireless charging capabilities by 2025. For instance, a leading smartphone manufacturer reported a 30% increase in sales of wireless charging-enabled devices in the last fiscal year. While a wireless charging unit can cost between USD25 and USD60, a wired charger is typically included with the device. This pricing dynamic has resulted in relatively low consumer interest in purchasing separate wireless charging systems.

Exclusive Customer Landscape

The wireless phone chargers market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the wireless phone chargers market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, wireless phone chargers market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aircharge - The company specializes in providing a range of wireless phone chargers, including the 313 wireless charger pad, 633 magnetic wireless charger, and a 3-in-1 cube with MagSafe technology.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aircharge

- Anker Technology UK Ltd.

- Apple Inc.

- Belkin International Inc.

- BEZALEL Inc.

- Energizer Holdings Inc.

- Huawei Technologies Co. Ltd.

- iOttie Inc.

- Koninklijke Philips NV

- Mojo Mobility Inc.

- Nucurrent Inc.

- Ossia Inc.

- Powermat Technologies Ltd.

- Qualcomm Inc.

- Renesas Electronics Corp.

- Samsung Electronics Co. Ltd.

- TYLT Inc.

- Xiaomi Inc.

- ZAGG Inc.

- ZENS Consumer BV

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Wireless Phone Chargers Market

- In January 2024, Samsung Electronics announced the launch of its new line of Fast Charging Wireless Pad and Stand, supporting 15W charging for Samsung Galaxy S21 series phones. The new chargers, according to Samsung's press release, can charge these devices up to 100% in less than two hours (Samsung Press Release, 2024).

- In March 2024, Apple and Belkin, a Foxconn Technology Group company, announced a strategic partnership to develop and sell MagSafe-compatible wireless chargers for iPhones. Apple's MagSafe technology, which was introduced with the iPhone 12 series, allows for more efficient and faster wireless charging (Apple Press Release, 2024).

- In May 2024, Oppo, a leading Chinese smartphone manufacturer, acquired a significant stake in the wireless charging technology company, PowerbyProxi, based in New Zealand. This acquisition is expected to strengthen Oppo's position in the wireless charging market and accelerate its research and development efforts (Oppo Press Release, 2024).

- In April 2025, the Federal Communications Commission (FCC) approved the use of 700 MHz spectrum for wireless charging, paving the way for faster and more efficient wireless charging solutions. This decision, according to the FCC's press release, is expected to significantly boost the growth of the wireless charging market in the United States (FCC Press Release, 2025).

Research Analyst Overview

- The market continues to evolve, driven by advancements in technology and consumer demand. Two key statistics illustrate its growth and dynamics. First, the global wireless charging market size was valued at over USD 14 billion in 2020 and is projected to expand at a significant rate in the coming years. Second, an example of market growth can be seen in the automotive sector, where wireless charging sales for electric and hybrid vehicles increased by 30% in 2021. Standardization initiatives, such as the Wireless Power Consortium's Qi standard, help ensure interoperability and ease of use for consumers.

- Companies invest in electromagnetic interference mitigation, overheating prevention, and wireless charging security to address challenges in the market. Interoperability issues and power delivery optimization are ongoing concerns, with efforts being made to improve charging system efficiency through resonance frequency tuning and charging duration reduction. Regulatory compliance testing, adaptive charging algorithms, and thermal management solutions are essential components of wireless charging systems. Power loss minimization, charging distance optimization, and magnetic field shielding are other areas of focus for enhancing the efficiency and performance of wireless charging technology. Companies also invest in wireless charging controllers and antenna design optimization to improve energy transfer efficiency and power conversion efficiency.

- RF energy harvesting and coil design optimization are additional techniques used to optimize wireless charging systems.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Wireless Phone Chargers Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.7% |

|

Market growth 2025-2029 |

USD 13.41 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.1 |

|

Key countries |

US, China, Germany, India, Japan, UK, France, Canada, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Wireless Phone Chargers Market Research and Growth Report?

- CAGR of the Wireless Phone Chargers industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the wireless phone chargers market growth of industry companies

We can help! Our analysts can customize this wireless phone chargers market research report to meet your requirements.