Wristwatch Market Size 2024-2028

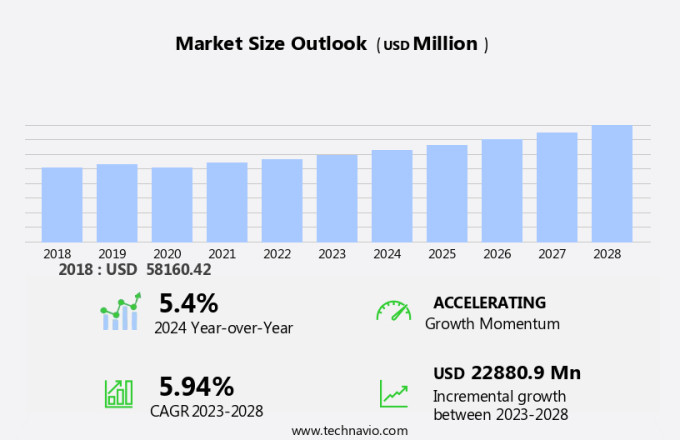

The wristwatch market size is forecast to increase by USD 22.88 billion at a CAGR of 5.94% between 2023 and 2028. The market is experiencing significant growth, driven by the rising demand for premium timepieces and the fashion trend of wearing stylish watches among the youth. This trend is particularly prominent in the United States, where wristwatches continue to serve as status symbols and expressions of personal style. Further, they are utilizing various high-end materials, such as magnesium, polyether ether ketone (PEEK), ceramic, ceramic matrix composite (CMC), ferrite, and carbon fiber, to create watches with distinctive finishes. Handcrafted luxury watches featuring intricate designs and expensive materials remain popular choices for those seeking to make a statement. Additionally, the market is witnessing increased demand for specialized watches, such as those designed for professional scuba diving or other extreme sports. However, the market is also facing challenges, including the proliferation of counterfeit products available online from merchants, which threaten to undermine the value and authenticity of genuine luxury watches. To stay competitive, manufacturers must focus on product innovation, quality, and brand reputation.

The market in the developed world continues to evolve, driven by the changing preferences of the younger generation. Fashion accessories remain an essential part of daily life, and watches have long been a staple item for both practicality and style. Quartz watches have dominated the market in recent years due to their affordability and accuracy. Seiko, a leading manufacturer, has been a significant player in this segment, offering a wide range of designs and features. However, the landscape is not limited to quartz watches alone. Mechanical watches, a symbol of luxury and craftsmanship, continue to hold appeal for some consumers.

Similarly, Swiss manufacturers, renowned for their precision and heritage, cater to this segment. The luxury watch market is a distinct subsegment, with price ranges extending into the thousands. Smartwatches have emerged as a new category, blurring the lines between fashion accessory and technology device. Apple, a major player, leads the way with its popular smartwatch offerings. Fitness trackers, heart rate monitors, and smartphone connectivity are among the features that differentiate these devices from traditional timepieces. Automation and artificial intelligence are influencing the market in various ways. For instance, 3D printing technology is enabling customization and innovation in watch design.

In addition, some manufacturers are exploring the potential of AI to enhance watch functionality and user experience. Digital watches, another subsegment, cater to consumers seeking a more functional and affordable option. Price ranges for digital watches span from the low end to the mid-range, making them accessible to a broader audience. Retail stores, online stores, and specialty stores are the primary channels for wristwatch sales. The internet has transformed the market, enabling consumers to compare prices, read reviews, and make purchases from the comfort of their homes. Smartphones have also played a role in the growth of the market, as they provide a convenient platform for watch apps and notifications.

In conclusion, the market in the developed world is shaped by various trends, including changing consumer preferences, technological advancements, and retail channels. Quartz, mechanical, smartwatches, and digital watches each cater to distinct segments, with price ranges spanning from the low end to the luxury segment. The market is poised for continued growth, driven by the evolving needs and expectations of consumers.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Quartz

- Digital

- Others

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Distribution Channel Insights

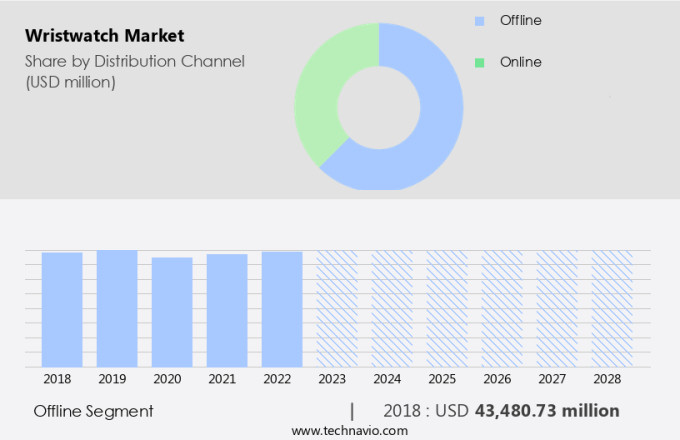

The offline segment is estimated to witness significant growth during the forecast period. The market is a significant segment of the fashion accessories industry, attracting both the younger generation and developed economies. Quartz watches, manufactured by brands like Seiko, dominate the market due to their affordability and accuracy. However, mechanical watches from luxury watch manufacturers continue to hold appeal for those seeking a more traditional timepiece.

Get a glance at the market share of various segments Request Free Sample

The offline segment was valued at USD 43.48 billion in 2018 and showed a gradual increase during the forecast period.

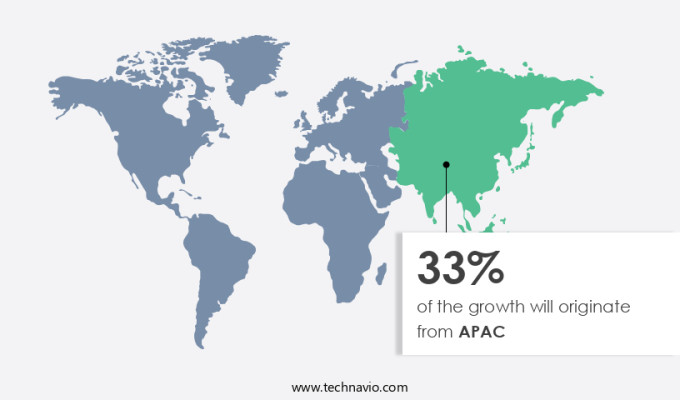

Regional Insights

APAC is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Another region that is dominating the market includes North America. The wristwatch market in North America is expected to grow at a steady rate during the forecast period. The key market in North America is the US. The key factors contributing to the market in the US are the launch of designer products, the growing use of online platforms to shop for fashion accessories, and the increased demand for customized watches. The saturating economic condition of the US is expected to hamper the growth of the market during the forecast period. However, the market in North America is witnessing a growth in demand for wristwatches and customized watches, which is expected to support the growth of the regional market.

In addition, the wristwatch market in North America is also witnessing a huge demand for smartwatches. This is largely due to the growing health-conscious and tech-savvy population in the region. In addition, customized watches and smartwatches are priced higher compared with regular watches. Therefore, the aforementioned factors are anticipated to drive value sales in North America during the forecast period.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The rising demand for premium watches is the key driver of the market. The market is experiencing significant growth due to the increasing preference for premium timepieces. Companies in the fashion, accessories, and luxury goods sectors are investing heavily in research and development to stay competitive. Innovations in technology, performance, and design are leading to the premiumization of watches. Consumers are drawn to watches with unique features and aesthetics. To cater to these evolving consumer needs, companies are expanding their product offerings and introducing new designs.

Furthermore, dial colors and strap designs are also being customized to cater to diverse consumer preferences. Themes ranging from sports to luxury are being incorporated into watch designs to appeal to a wider audience. Additionally, the availability of discounted secondhand watches is providing an opportunity for price-sensitive consumers to purchase premium watches. Overall, the market is witnessing continuous innovation and growth.

Market Trends

The rising fashion trend of wearing stylish wrist watches among youth is the upcoming trend in the market. The market is experiencing significant growth due to the increasing popularity of smartwatches among the youth demographic. Young consumers, who place a high value on fashion and self-expression, are being drawn to the advanced features of smartwatches.

Similarly, one notable example is the Apple Watch Ultra, which includes functions such as a diving computer, depth gauge, and water temperature sensors. These features cater to the adventurous and active lifestyles of many young people.

Market Challenge

The increased availability of wrist watch counterfeit products is a key challenge affecting the market growth. The market is experiencing challenges due to the proliferation of counterfeit timepieces. With the rising popularity of wristwatches, authenticating their origin has become a significant concern for both manufacturers and consumers. These imitations, predominantly of luxury brands, not only impact the financial losses for the original brands but also tarnish their reputation.

However, online merchants have made it easier for consumers to purchase these counterfeit watches at lower prices, often targeting the budget-conscious segment. The authenticity and quality of these watches are questionable, making it crucial for consumers to exercise caution. Despite these challenges, the market for handcrafted luxury watches continues to thrive, with professionals in various industries, such as scuba diving, relying on specialized watches for their specific needs.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Le petit fils de L.U. Chopard and Cie SA. - The company offers wristwatches such as Top Time, Premier, Chronomat, and others.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apple Inc.

- CASIO Computer Co. Ltd.

- Citizen Watch Co. Ltd.

- Compagnie Financiere Richemont SA

- DIFFUSIONE ITALIANA PREZIOSI S.P.A

- Fossil Group Inc.

- LVMH Moet Hennessy Louis Vuitton SE

- Magnus Brand

- Patek Philippe SA

- Rolex SA

- Samsung Electronics Co. Ltd.

- Seiko Holdings Corp.

- SUED Watches

- Talley and Twine Watches LLC

- The Swatch Group Ltd.

- Titan Co. Ltd.

- Breitling SA

- Jaeger LeCoultre

- ASOROCK Watches LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a thriving industry, catering to the fashion-conscious younger generation in developed countries. Quartz watches from Seiko and mechanical watches from luxury watch manufacturers, including those from Swiss manufacturers, continue to dominate the market. However, the advent of technology has led to the emergence of smartwatches, with Apple leading the charge. These devices offer features such as fitness trackers, heart rate monitors, and smartphone connectivity, making them more than just timepieces. Technological advancements, including 3D printing, automation, and artificial intelligence, have revolutionized the watch industry. Digital watches and smartwatches are increasingly popular, with the smartwatch subsegment showing significant growth.

In summary, price ranges vary widely, from low range to mid range and luxury segment, with retail stores, online stores, and specialty stores catering to different segments. Luxury watches, with their unique materials, dial colors, strap designs, and themes, remain a status statement for many. Handcrafted luxury watches continue to be in demand, with specialized watches for professional scuba diving and specialized features such as oceanic+ software, depth gauges, and water temperature sensors. The watch market is driven by the desire for innovation and the need to stay connected, with revenue expected to grow significantly in the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.94% |

|

Market growth 2024-2028 |

USD 22.88 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.4 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 33% |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Apple Inc., CASIO Computer Co. Ltd., Le petit fils de L.U. Chopard and Cie SA, Citizen Watch Co. Ltd., Compagnie Financiere Richemont SA, DIFFUSIONE ITALIANA PREZIOSI S.P.A, Fossil Group Inc., LVMH Moet Hennessy Louis Vuitton SE, Magnus Brand, Patek Philippe SA, Rolex SA, Samsung Electronics Co. Ltd., Seiko Holdings Corp., SUED Watches, Talley and Twine Watches LLC, The Swatch Group Ltd., Titan Co. Ltd., Breitling SA, Jaeger LeCoultre, and ASOROCK Watches LLC |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch