Cross-Cultural Training Market Size 2025-2029

The cross-cultural training market size is forecast to increase by USD 1.93 billion at a CAGR of 6.8% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing globalization of businesses and the need for effective communication and collaboration across diverse cultures. A key trend shaping the market is the emergence of cost-effective e-learning training modules, which offer flexibility and convenience for learners while reducing travel and training expenses for organizations. Another significant trend is the gamification of cross-cultural training content, which enhances learner engagement and improves knowledge retention. However, the market faces challenges as well. Regulatory hurdles impact adoption, as organizations must navigate complex compliance requirements when implementing cross-cultural training programs.

- Supply chain inconsistencies also temper growth potential, as companies must ensure that training materials and resources are readily available and of high quality in various regions. Additionally, the costs associated with expatriate failure, including recruitment, relocation, and retraining expenses, underscore the importance of effective cross-cultural training to mitigate potential risks and ensure successful international assignments. Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on delivering high-quality, culturally relevant training solutions that address the unique needs of their global workforce.

What will be the Size of the Cross-Cultural Training Market during the forecast period?

- In recent research, the cross- cultural training market has experienced significant growth, driven by the increasing importance of remote team collaboration and global mindset in today's business landscape. This market encompasses various offerings, including cultural intelligence assessments, sensitivity training, and virtual team communication solutions. A key trend is the adoption of cultural competence frameworks and global talent development programs, which emphasize employee engagement and cultural awareness initiatives. These initiatives aim to foster a more inclusive workplace and enhance global team leadership by addressing cultural differences, stereotypes, norms, and biases.

- Moreover, the use of technology, such as augmented reality training and gamified learning, is on the rise, providing immersive and interactive experiences for employees undergoing cultural transition and adjustment challenges. Conflict resolution strategies and cultural immersion programs are also essential components of these cross-cultural training programs. Corporate social responsibility plays a crucial role in this market, as companies strive to promote cultural sensitivity and adapt to diverse workforces. The Globe Project and Hofstede's cultural dimensions are widely used to understand and navigate international negotiation strategies and communication styles. In summary, the market is dynamic and evolving, with a focus on fostering global team collaboration, developing cultural intelligence, and addressing the unique challenges of managing diverse teams in today's globalized business environment.

How is this Cross-Cultural Training Industry segmented?

The cross-cultural training industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

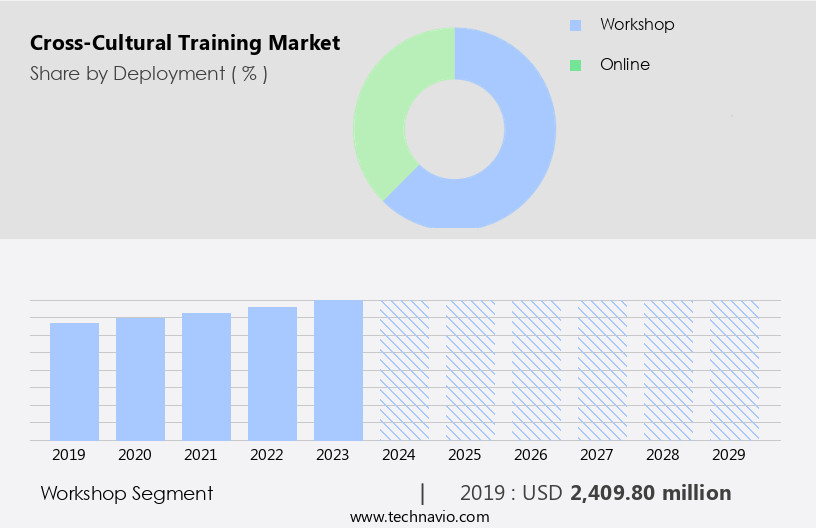

- Deployment

- Workshop

- Online

- End-user

- Large enterprise

- Small and medium enterprise

- End-User

- Corporates

- Individuals

- Application

- Business Skills

- Cultural Awareness

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Deployment Insights

The workshop segment is estimated to witness significant growth during the forecast period.

In today's global business landscape, cultural awareness has become a crucial factor for companies expanding their operations internationally. As economies in countries like China and India continue to grow, businesses must adapt to diverse cultural norms to ensure successful market entry. Cross-cultural training programs have emerged as an essential solution, with workshop models leading the market due to their effectiveness in facilitating better learning experiences. Employees play a pivotal role in implementing these training programs within organizations. Workshops enable corporations to assess employee performance and engagement, fostering a more harmonious and productive work environment. Cultural transition, a significant aspect of cross-cultural training, is addressed through the use of cultural brokers and gamified learning techniques.

Moreover, employee engagement is enhanced through augmented reality training and conflict resolution skills development. Global teams benefit from cross-cultural training programs, as they help mitigate reverse culture shock and promote cultural immersion. Corporate social responsibility is also an integral part of these programs, ensuring that businesses operate ethically and responsibly in diverse cultural contexts. In conclusion, cross-cultural training programs have become indispensable for businesses looking to navigate the complexities of international markets. The integration of innovative training techniques, such as workshop models, gamification, and augmented reality, has further enriched the learning experience and fostered better employee engagement and performance.

The Workshop segment was valued at USD 2.41 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 31% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In North America, countries such as Canada, the United States, and Mexico are significant markets for the expansion of the cross-cultural training industry. This growth can be attributed to the presence of numerous multinational corporations (MNCs) and large organizations headquartered in the US. These companies, including technology giants like Microsoft, AT&T, IBM, international banks, and insurance firms, employ a diverse workforce with various educational and cultural backgrounds. To ensure effective communication and alignment of personal goals with business objectives, these organizations prioritize cross-cultural training. Digital learning platforms, such as virtual reality training and blended learning, are integral components of these programs.

Business etiquette and diversity and inclusion initiatives are essential elements of cross-cultural training, promoting cultural awareness and sensitivity. In a globalized business environment, cultural adaptation is crucial for successful remote work collaborations. Cultural mediators and simulations are essential tools for fostering understanding and effective communication in a multicultural workforce. Case studies and human resources departments play a vital role in implementing and evaluating the impact of cross-cultural training programs. The global supply chain further emphasizes the importance of cross-cultural competence, as businesses increasingly operate in an interconnected and international marketplace.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Cross-Cultural Training market drivers leading to the rise in the adoption of Industry?

- The emergence of cost-effective e-learning training modules serves as the primary catalyst for market growth.

- Cross-cultural training is an essential investment for businesses operating globally, as effective cultural understanding is crucial for productivity and success in diverse work environments. Traditional training methods, such as in-person sessions, incur significant costs due to travel expenses, trainer and employee time, and facility charges. Moreover, additional costs are incurred on printing instructional materials and assessing papers in a traditional setting. To address these challenges, organizations are turning to innovative and cost-effective solutions, such as digital learning platforms. These platforms offer access to digital content, cultural simulations, case studies, and virtual reality training, allowing for blended learning experiences that combine the best of both worlds.

- Human resources teams can leverage cultural mediators and digital tools to ensure effective cultural adaptation and business etiquette training. The adoption of remote work policies further necessitates the use of digital learning platforms, enabling employees to access training materials from anywhere in the world. In conclusion, digital learning platforms offer a cost-effective and flexible solution for cross-cultural training, allowing organizations to enhance diversity and inclusion initiatives and improve overall productivity in a global supply chain.

What are the Cross-Cultural Training market trends shaping the Industry?

- The trend in content development is shifting towards gamification. This approach makes learning or engaging with content more enjoyable and effective by incorporating game elements such as points, badges, and leaderboards.

- Cross-cultural training is a vital component of leadership development in today's global business landscape. As businesses expand their reach across borders, the need to effectively engage and manage diverse teams becomes increasingly important. The market is experiencing steady growth, driven by the demand for training programs that help employees navigate cultural differences and transitions. Gamification is a popular trend in cross-cultural training, making learning more engaging and effective. This approach incorporates elements of competition, rewards, and digital badges to motivate employees and enhance their understanding of different cultures. Augmented reality training is another innovative technique used to provide immersive learning experiences, allowing employees to explore new cultural environments in a simulated setting.

- Conflict resolution and cultural brokering are essential skills in cross-cultural teams. Training programs that focus on these areas help employees to build strong relationships and effectively communicate across cultural boundaries. Additionally, corporate social responsibility is becoming a key consideration in cross-cultural training, as businesses seek to promote cultural sensitivity and inclusivity. Training evaluation is a crucial aspect of cross-cultural programs, ensuring that employees gain the necessary knowledge and skills to succeed in a global business environment. Reverse culture shock, a common challenge for employees returning from international assignments, can be addressed through targeted training and support.

- In conclusion, the market is poised for growth, driven by the need for effective leadership development and employee engagement in a globalized business world. Gamified learning, cultural immersion, conflict resolution, and cultural brokering are key areas of focus for businesses seeking to build successful and inclusive cross-cultural teams.

How does Cross-Cultural Training market faces challenges face during its growth?

- The expense incurred due to the failure of expatriate assignments poses a significant challenge to the industry's growth trajectory.

- Expatriate assignments in international business involve significant financial investment for organizations, with failure leading to substantial monetary loss and talent depletion. Middle- and senior-level managers are frequently deployed, and cultural challenges in countries with complex cultural backgrounds, such as China, can contribute to assignment failure. Cross-cultural training is essential to mitigate these risks and ensure successful international business operations. Intercultural communication and cultural competence are critical components of cross-cultural training. Emotional intelligence plays a significant role in understanding and adapting to new cultural environments. Role-playing exercises, assessment tools, and negotiation skills training are effective techniques for building cultural intelligence and emotional intelligence.

- Cultural adjustment and the prevention of cultural shock are also essential aspects of cross-cultural training. International marketing and business success depend on the ability to navigate cultural differences effectively. Negotiation skills, in particular, are crucial for successful international business transactions. Cross-cultural training programs can be tailored to meet the specific needs of expatriates and their host countries. Assessment tools can be used to identify potential cultural challenges and design training programs accordingly. Expatriate training should be ongoing and adaptive, as cultural norms and business practices evolve over time. In conclusion, cross-cultural training is a vital investment for organizations operating in international markets.

- It helps to mitigate the risks associated with expatriate assignments, build cultural intelligence and emotional intelligence, and ensure successful international business operations.

Exclusive Customer Landscape

The cross-cultural training market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cross-cultural training market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cross-cultural training market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aperian Global Inc. - The company specializes in providing cross-cultural training, focusing on cultural competence to enhance organizational effectiveness in today's globalized business environment. By offering customized training programs, we help businesses and their employees navigate cultural complexities and build strong, collaborative relationships with international partners and clients. Our evidence-based approach incorporates insights from various disciplines, including sociology, psychology, and anthropology, to provide a comprehensive understanding of cultural differences and their impact on business interactions. Through interactive workshops, webinars, and e-learning modules, we equip learners with the skills and knowledge necessary to communicate effectively, build trust, and foster cultural intelligence. Our training solutions are designed to be adaptable to diverse industries and organizations, ensuring a positive impact on overall business performance.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aperian Global Inc.

- Babel Language Consulting

- Commisceo Global Consulting

- Coursera Inc.

- Cultural Savvy and Joyce Millet

- Dwellworks LLC

- ELM Learning

- Global Business Culture

- Global Integration Inc.

- Learnlight Software S.L.U.

- Pearson Plc

- RW3 LLC

- SIMON and SIMON INTERNATIONAL LIMITED

- Smart Culture

- The London School of English

- Udemy Inc.

- Wolfestone Translation Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cross-Cultural Training Market

- In February 2024, Coursera, an online learning platform, announced the launch of a new cross-cultural communication course series in collaboration with the University of California, Berkeley. This initiative aims to provide learners with essential skills to navigate cultural differences in professional settings (Coursera Press Release, 2024).

- In May 2025, PwC, a global professional services network, acquired Cross-Cultural Solutions, a leading provider of cross-cultural training and international internships. The acquisition strengthens PwC's capabilities in diversity and inclusion services, expanding its offerings beyond traditional consulting and auditing services (PwC Press Release, 2025).

- In October 2024, LinkedIn, the professional networking site, introduced a new feature called "Cultural Intelligence," which uses AI to analyze users' profiles and suggests content tailored to help them navigate cross-cultural interactions in their professional lives. This feature is part of LinkedIn's ongoing efforts to provide value-added services to its user base (LinkedIn Press Release, 2024).

- In December 2025, the European Union passed the "European Diversity Charter," a non-binding agreement aimed at promoting diversity and inclusion in the workplace. Companies that sign the charter commit to implementing cross-cultural training programs and fostering a diverse and inclusive work environment (European Commission Press Release, 2025).

Research Analyst Overview

The market witnessing significant growth and evolution in response to the dynamic business landscape. Digital learning platforms are increasingly being adopted for delivering cross-cultural training programs, providing flexibility and accessibility to learners. Business etiquette and diversity and inclusion training are essential components, ensuring effective communication and fostering an inclusive work environment. Cultural adaptation and blended learning strategies are gaining popularity, integrating virtual reality training and cultural simulations to enhance the learning experience. Remote work and global teams necessitate effective intercultural communication, leading to an increased demand for cross-cultural training. Cultural mediators and brokers play a crucial role in facilitating communication and understanding between different cultures in the context of global supply chains.

Corporate social responsibility and reverse culture shock are also becoming integral parts of cross-cultural training, addressing the challenges of working in diverse environments. Augmented reality training and gamified learning are innovative approaches to cross-cultural training, offering interactive and engaging experiences. Conflict resolution and emotional intelligence are essential skills for effective cross-cultural communication and collaboration. Cross-cultural training programs are not limited to human resources and leadership development but extend to international marketing, international business, and talent management. Assessment tools and language training are crucial components of these programs, ensuring training effectiveness and employee engagement. The ongoing evolution of cross-cultural training reflects the changing needs of global organizations, with a focus on adaptive leadership, global citizenship, and cultural competence.

Organizational culture, global branding, and adaptive leadership are critical areas of focus for cross-cultural training, enabling organizations to thrive in an increasingly interconnected world.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cross-Cultural Training Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

194 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 1928.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.2 |

|

Key countries |

US, China, Japan, Germany, France, Spain, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cross-Cultural Training Market Research and Growth Report?

- CAGR of the Cross-Cultural Training industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cross-cultural training market growth of industry companies

We can help! Our analysts can customize this cross-cultural training market research report to meet your requirements.