Smartphone Power Management IC Market Size 2024-2028

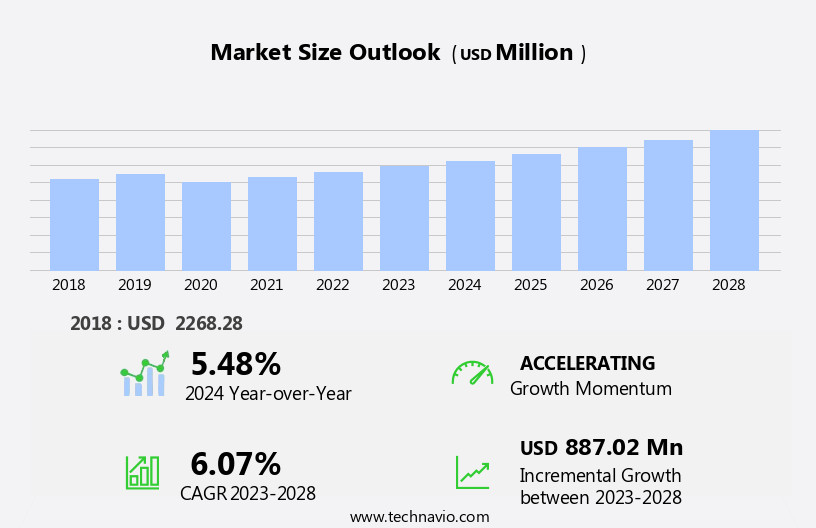

The smartphone power management ic market size is forecast to increase by USD 887.02 million at a CAGR of 6.07% between 2023 and 2028.

What will be the Size of the Smartphone Power Management IC Market During the Forecast Period?

How is this Smartphone Power Management IC Industry segmented and which is the largest segment?

The smartphone power management ic industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Price

- Premium range

- Medium range

- Low range

- Type

- Integrated ASSP power management ICs

- Battery management ICs

- Others

- Geography

- APAC

- China

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Middle East and Africa

- South America

- APAC

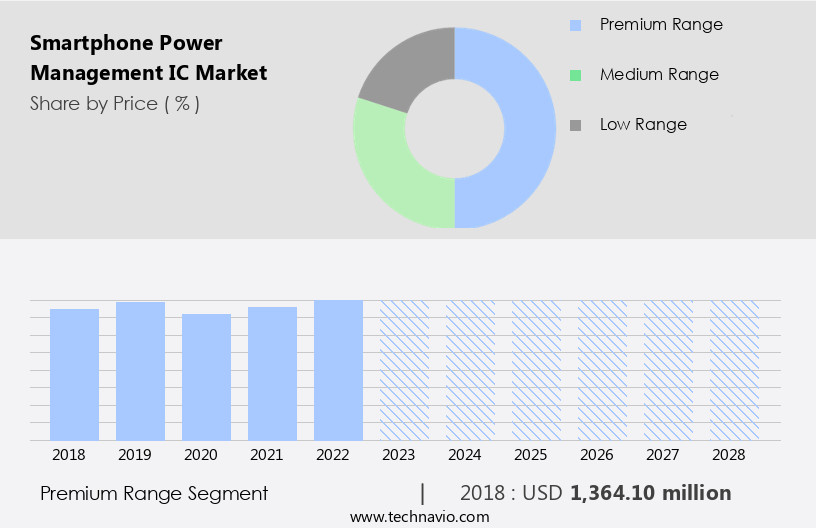

By Price Insights

- The premium range segment is estimated to witness significant growth during the forecast period.

Power management ICs play a crucial role In the efficient electrical power flow and power controls of various electronic systems, including portable electronics such as smartphones, tablets, smartwatches, IoT devices, and wearable electronics. These components ensure voltage safety, monitoring, and heat dissipation for battery-operated devices. Power management ICs are also integral to the operation of electric vehicles (EVs), renewable energy systems like solar and wind power, data centers, and automation in industries. They are essential for data processing, storage, and data security In these applications, emphasizing energy efficiency and integration with motor control ICs, low voltage regulators, and precision voltage references.

Semiconductor companies produce these chips for various consumer electronic devices, automotive applications, and ODMs and OEMs, addressing the increasing demand for mobile services, next-generation mobile networks, and integration into various sectors. Power management ICs are a vital component In the electrical power flow of machines and devices, ensuring optimal performance and longevity.

Get a glance at the Smartphone Power Management IC Industry report of share of various segments Request Free Sample

The Premium range segment was valued at USD 1364.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

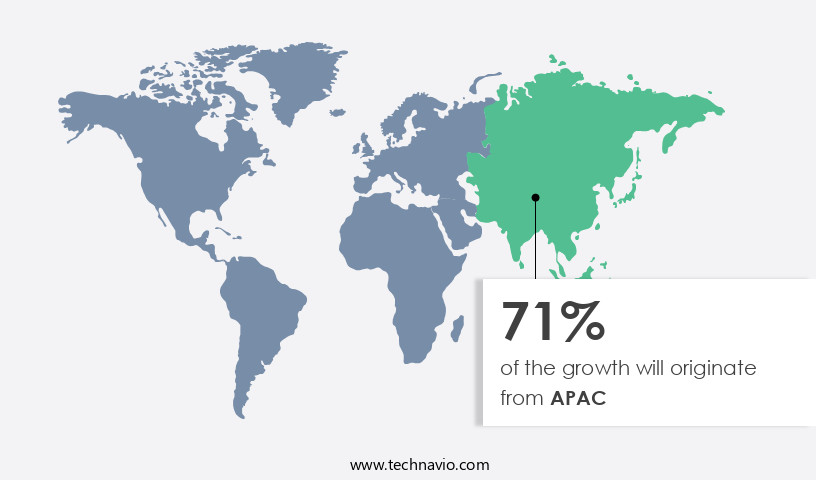

- APAC is estimated to contribute 71% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The APAC market for power management ICs in portable electronics, including smartphones, tablets, smartwatches, IoT devices, and wearable electronics, is experiencing significant growth due to the increasing adoption of these devices In the region. Major manufacturers such as Samsung Electronics, Huawei Technologies, ZTE, OPPO, Xiaomi, and LG Electronics are based in APAC and are driving market growth through innovation. Advanced features like triple-lens cameras, AI, virtual assistants, fingerprint sensors, and facial recognition are becoming standard in new smartphone models. Power management ICs play a crucial role in managing electrical power flow, ensuring voltage safety, monitoring voltage levels, and facilitating heat dissipation In these battery-operated devices.

Additionally, the integration of motor control ICs, low voltage regulators, automation, and data processing in various sectors such as electric vehicles, renewable energy, data centers, and automotive applications further boosts the demand for power management ICs. Energy efficiency, precision voltage references, and programmable voltage references are essential semiconductor components for power management ICs, ensuring optimal performance and longevity for consumer electronic devices and connected devices.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Smartphone Power Management IC Industry?

Growing internet penetration and data traffic is the key driver of the market.

What are the market trends shaping the Smartphone Power Management IC Industry?

Miniaturization of semiconductor devices is the upcoming market trend.

What challenges does the Smartphone Power Management IC Industry face during its growth?

Increasing complexity of power management IC design is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The smartphone power management ic market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smartphone power management ic market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, smartphone power management ic market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Analog Devices Inc. - The company provides a range of power management integrated circuits (ICs) for smartphones, including uModule LED Drivers, µModule Buck Regulators, Battery Status Monitors, isoPower technology, and Xenon Photoflash Chargers. These advanced IC solutions ensure efficient power consumption, extended battery life, and optimal charging for various smartphone components. The offered technologies cater to diverse smartphone applications, enhancing overall system performance and user experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Analog Devices Inc.

- Infineon Technologies AG

- MagnaChip Semiconductor Corp.

- MediaTek Inc.

- Microchip Technology Inc.

- Nisshinbo Holdings Inc.

- NXP Semiconductors NV

- ON Semiconductor Corp.

- Qorvo Inc.

- Qualcomm Inc.

- Renesas Electronics Corp.

- Richtek Technology Corp.

- ROHM Co. Ltd.

- Samsung Electronics Co. Ltd.

- Semtech Corp.

- STMicroelectronics International NV

- Texas Instruments Inc.

- Toshiba Corp.

- Diodes Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The global market for power management integrated circuits (ICs) in electronic systems is experiencing significant growth due to the increasing demand for energy-efficient solutions in various applications. These applications include portable electronics such as smartphones, tablets, smartwatches, and IoT devices, as well as electric vehicles (EVs), renewable energy systems, data centers, and other battery-operated devices. Power management ICs play a crucial role in optimizing electrical power flow and ensuring voltage safety and monitoring In these systems. They are essential components in managing the power consumption of electronic devices, enabling longer battery life and improved performance. The integration of advanced features such as precision voltage references, programmable voltage references, and motor control ICs has further expanded the capabilities of power management ICs.

These features enable more efficient power management in various applications, including automotive systems, consumer electronics, and industrial automation. The growing adoption of next-gen mobile networks, such as 4G and 5G, has also driven the demand for power management ICs in mobile services. The integration process of these networks requires efficient power management to ensure seamless connectivity and longer battery life for mobile devices. Moreover, the increasing focus on energy efficiency and the integration of renewable energy sources, such as solar and wind power, in various applications has further boosted the demand for power management ICs. These ICs help in managing the power flow from renewable sources and ensuring voltage stability and safety.

The semiconductor industry is also witnessing a chip shortage, which has led to an increased focus on energy efficiency and power management in chip production. Power management ICs are essential components in optimizing the power consumption of semiconductor processes, enabling higher yields and reduced energy costs. Despite the challenges posed by the chip shortage and the ongoing trade tensions, the power management IC market is expected to continue its growth trajectory. The increasing demand for energy-efficient solutions and the continuous advancements in power management technology are expected to drive the market growth In the coming years. In conclusion, the power management IC market is witnessing significant growth due to the increasing demand for energy-efficient solutions in various applications.

These applications include portable electronics, electric vehicles, renewable energy systems, data centers, and other battery-operated devices. Power management ICs play a crucial role in optimizing electrical power flow, ensuring voltage safety and monitoring, and improving overall system performance. The market is expected to continue its growth trajectory, driven by the increasing focus on energy efficiency and the continuous advancements in power management technology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

185 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.07% |

|

Market growth 2024-2028 |

USD 887.02 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.48 |

|

Key countries |

US, Canada, China, South Korea, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Smartphone Power Management IC Market Research and Growth Report?

- CAGR of the Smartphone Power Management IC industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the smartphone power management ic market growth of industry companies

We can help! Our analysts can customize this smartphone power management ic market research report to meet your requirements.