5G mmWave Technology Market Size 2024-2028

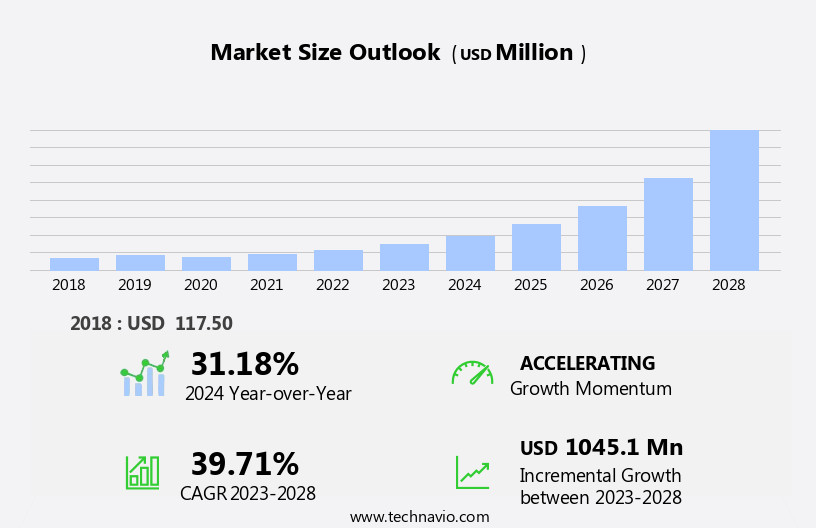

The 5g mmwave technology market size is forecast to increase by USD 1.05 billion at a CAGR of 39.71% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for high-speed networks and the proliferation of next-generation LTE wireless networks. This technology, which utilizes millimeter wave frequencies to deliver ultra-fast data transfer rates, is poised to revolutionize the telecommunications industry. However, uncertain economic conditions pose a challenge to market expansion. Despite this, key drivers such as the increasing adoption of IoT devices, the rise of smart cities, and the growing demand for real-time data transfer are fueling market growth.

- Companies seeking to capitalize on these opportunities must navigate regulatory complexities and invest in infrastructure development to meet the demands of this emerging market. Strategic partnerships and collaborations are also crucial for success in this competitive landscape. Overall, the market presents significant potential for innovation and growth, offering companies the chance to stay ahead of the curve in the rapidly evolving telecommunications sector.

What will be the Size of the 5G mmWave Technology Market during the forecast period?

- The market in the US is experiencing significant growth due to the increasing demand for high-bandwidth applications and advanced communication technologies. This market encompasses various components and services, including interface components, antennas and transceiver components, communication and networking components, sensors, and controls. The adoption of 5G mmWave technology is driven by the proliferation of bandwidth-intensive applications, such as virtual and augmented reality, ultra-high-definition video streaming, and real-time surveillance cameras. The development of transport connectivity and power solutions is essential for the successful implementation of 5G mmWave technology.

- Additionally, managed services, consulting, integration, maintenance, and support are becoming increasingly important as the market matures. The market is expected to continue growing, surpassing the capabilities of 4G networks and offering gigabits per second speeds. The millimeter wave spectrum is a key enabler for this technology, providing the necessary frequency bands for high-speed wireless communication.

How is this 5G mmWave Technology Industry segmented?

The 5g mmwave technology industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Wired/fiber connection replacement

- Cellular backhaul/fronthaul

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

By Application Insights

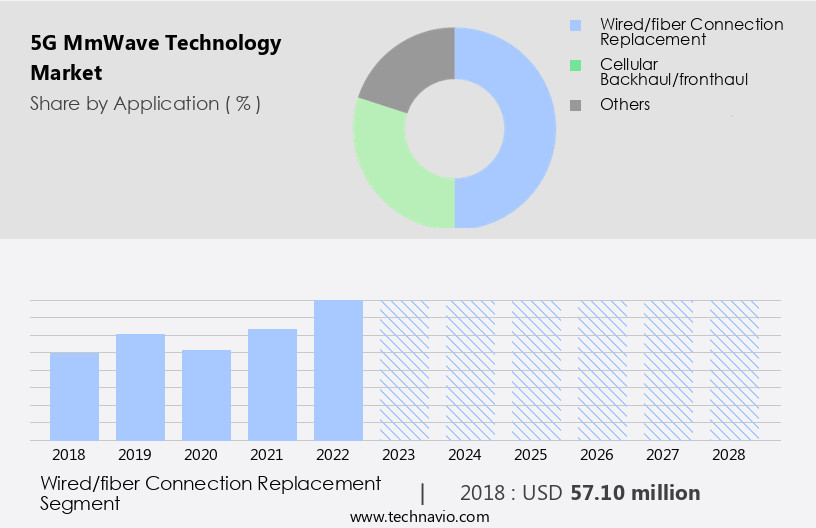

The wired/fiber connection replacement segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth in the communication and networking sector due to the increasing replacement of wired connections with 5G network infrastructure. The deployment of 5G networks is on the rise, driven by the development of smart cities and the need for efficient communication networks in developing economies. Additionally, the proliferation of the Internet of Things (IoT) and the increasing demand for high-speed Internet connectivity are major factors fueling the adoption of 5G networks. For instance, in some countries, 5G telecom services are expected to be launched by mid-2022. This technology's advancements extend to various industries, including commercial sectors, automotive and transportation, surveillance cameras, cloud gaming, and more.

Antennas and transceiver components are critical communication components in 5G mmWave technology. These components enable point-to-point communications, high-speed data transfer, and improved network capacity, reliability, and signal strength. The technology's ability to support real-time surveillance cameras, virtual and augmented reality applications, and ultra-high-definition video streaming makes it an essential tool for various industries. Moreover, 5G mmWave technology's potential applications extend beyond the commercial sector. It is also being used in sectors such as aerospace and defense, telecommunication equipment, media and entertainment, and healthcare. The technology's ability to provide high-speed connections and low latency makes it ideal for mission-critical use cases, such as tactical networks, transport hubs, and smart manufacturing.

Despite its advantages, 5G mmWave technology faces challenges such as interference from trees, walls, and other structures, which can impact signal loss. However, advancements in technologies such as beamforming frequency, edge cloud technology, and wavemaker gateways are helping to mitigate these challenges. The technology's potential applications are vast, and its adoption is expected to continue growing as more industries recognize its benefits. In , the market is experiencing significant growth due to the increasing demand for high-speed, reliable wireless communication technologies. Its applications extend to various industries, including commercial sectors, automotive and transportation, surveillance cameras, and more. Despite challenges such as interference, the technology's potential benefits, such as high-speed data transfer, low latency, and improved network capacity, make it an essential tool for various industries.

Get a glance at the market report of share of various segments Request Free Sample

The Wired/fiber connection replacement segment was valued at USD 57.10 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

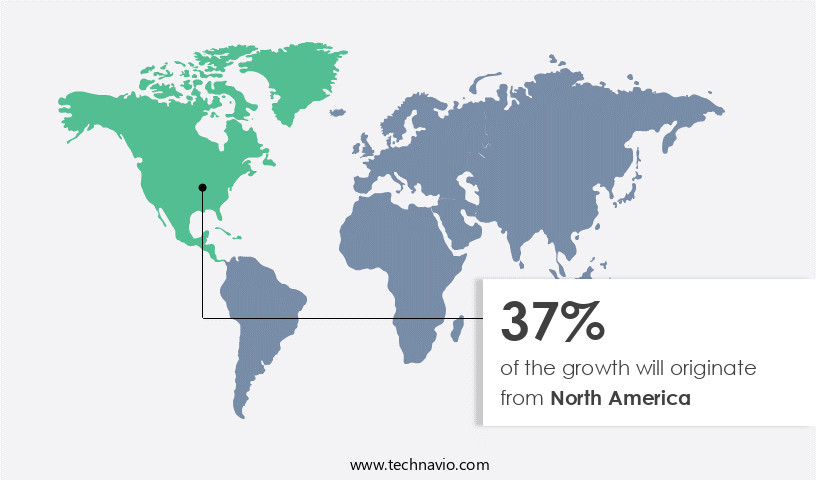

North America is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is poised for significant growth due to the increasing adoption of smartphones, industrial automation, and the presence of leading technology companies. This region's market expansion can be attributed to the widespread implementation of 5G mmWave technology for mobile and telecom applications. Key components of this technology include communication and networking components, antennas and transceiver components, and radio frequency components. The technology's applications span various sectors, including commercial, automotive and transportation, surveillance cameras, and urban connectivity. In the commercial sector, 5G mmWave technology is utilized for point-to-point communications, cloud gaming, and virtual and augmented reality experiences.

In the automotive and transportation industry, it powers real-time surveillance cameras, autonomous vehicles, and transport hub connectivity. Network congestion, interference, and signal loss are addressed through advanced features like beamforming frequency, network capacity, reliability, and edge cloud technology. The technology's capabilities cater to mission-critical use cases, such as tactical networks, smart manufacturing, and healthcare, as well as entertainment applications like UHD videos, HD streaming, and live events. The market's growth is driven by the increasing demand for high-speed data transfer, smart devices, and digitization across various industries. Market participants include hardware providers, consulting firms, and service operators, offering services like managed services, development, integration, and maintenance.

The market's infrastructure deployment involves the integration of various components, including antennae, transceivers, and battery components. The technology's applications extend to aerospace and defense, media and entertainment, and telecommunication equipment, providing solutions for applications like inter-satellite links, mobile data services, and fiber optics. The market's future potential lies in its ability to support emerging technologies like virtual reality, augmented reality, and tactical networks, as well as enabling applications in smart manufacturing, buildings, and public safety.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of 5G mmWave Technology Industry?

- Rising demand for high-speed networks is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for high-capacity networks to support the rising number of Internet users and their increasing reliance on smartphones for connectivity. The depletion of bandwidth availability as a result of the increasing number of users on the same bandwidth has necessitated the implementation of 5G mmWave technology to enhance network speed and capacity. This technology, which is a key component of 5G networks, enables high-frequency waves to transmit data at faster speeds and with greater capacity than previous network technologies.

- The availability of various network standards on smart devices, such as GSM, CDMA, and LTE/5G, has further fueled the market's growth. The integration of 5G mmWave technology is expected to address the capacity requirements of 5G networks and meet the increasing demand for faster and more efficient communication solutions.

What are the market trends shaping the 5G mmWave Technology Industry?

- Proliferation of next-generation LTE wireless networks is the upcoming market trend.

- The market is poised for significant growth due to the increasing demand for high-speed data consumption. With the proliferation of consumer electronics, the need for advanced telecommunication networks has become imperative. Network carriers are responding to this demand by adopting next-generation LTE networks, such as 5G, making it the mobile technology of the future. The deployment of high-speed networks will pave the way for the launch of consumer electronics that can support these networks.

- OnePlus Technology Co. Ltd., for instance, recently announced the launch of its OnePlus 10 Pro 5G smartphone, further underscoring the market's potential. This trend is expected to continue, leading to increased data consumption and the development of more advanced consumer electronics.

What challenges does the 5G mmWave Technology Industry face during its growth?

- Uncertain economic conditions is a key challenge affecting the industry growth.

- The expansion of the market is contingent upon the capital expenditure (CAPEX) of companies, sourced primarily from companies' retained earnings. However, the global economy faces disparate growth prospects. For example, Britain's exit from the EU led to a significant decrease in the market's expansion. Moreover, in 2020, the economic downturn in China due to the pandemic resulted in a depreciation of the Chinese yuan against the dollar, casting a shadow over the entire global economy, including the market.

- As the pandemic persisted in 2021, the manufacturing sectors of various end-users of 5G mmWave technology, including communications, military, and aerospace, were adversely impacted due to the economic slowdown. These factors pose challenges to the market's growth trajectory.

Exclusive Customer Landscape

The 5g mmwave technology market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the 5g mmwave technology market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, 5g mmwave technology market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Anokiwave Inc. - The company specializes in providing 5G millimeter wave (mmWave) solutions, focusing on urban backhaul applications. MmWave technology enables high-capacity, low-latency wireless communications essential for next-generation networks. Our offerings enhance network efficiency and support advanced services like autonomous vehicles and IoT devices. By leveraging cutting-edge mmWave technology, we cater to the evolving connectivity demands of businesses worldwide.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anokiwave Inc.

- Aviat Networks Inc.

- Axxcss Wireless Solutions Inc.

- Cambium Networks Corp.

- Eravant

- Farran

- IgniteNet

- Keysight Technologies Inc.

- KYOCERA Corp.

- L3Harris Technologies Inc.

- Millimeter Wave Products Inc.

- NEC Corp.

- Proxim Wireless Corp.

- QuinStar Technology Inc.

- RAD Data Communications Ltd.

- Siklu Inc.

- Smiths Group Plc

- Spacek Labs Inc.

- Trex Enterprises Corp.

- Vubiq Networks Inc.

- Wireless Excellence Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses various communication and networking components, with antennas and transceiver components playing a pivotal role in enabling high-speed data transfer and urban connectivity. This technology is poised to revolutionize numerous sectors, including commercial, surveillance, automotive and transportation, and telecom, among others. Antennas, a crucial component of 5G mmWave technology, are designed to operate in the millimeter wave spectrum. These antennas are essential for point-to-point communications, enabling ultra-high-speed data transfer and low latency. The densest part of urban environments, where digital traffic is most congested, is a primary focus for the deployment of 5G mmWave infrastructure.

Cloud gaming and streaming services are set to benefit significantly from the increased network capacity and reliability offered by 5G mmWave technology. The technology's ability to deliver gigabits per second speeds and reduce signal loss makes it an ideal choice for applications such as virtual reality (VR) and augmented reality (AR), which require high-bandwidth, real-time data transfer. The commercial sector is expected to be an early adopter of 5G mmWave technology, with applications ranging from smart buildings and offices to event venues and transport hubs. The technology's ability to support mission-critical use cases, such as real-time surveillance cameras and tactical networks, is a significant draw for the public safety and aerospace and defense sectors.

The deployment of 5G mmWave infrastructure is not without challenges, however. Interference from trees, walls, and other structures can disrupt the signal, necessitating the need for consulting services and maintenance. Spectrum auctions and the integration of fiber optics and edge cloud technology are also essential considerations for service operators looking to optimize network performance. The market is expected to grow significantly in the coming years, driven by the increasing demand for high-speed data transfer and the digitization of various industries. The technology's ability to support applications such as autonomous vehicles, smart manufacturing, and healthcare, among others, makes it a valuable investment for businesses looking to stay competitive in the digital age.

The technology's potential use cases are vast, from providing high-speed mobile data services to enabling ultra-high-definition video streaming and supporting the growth of the media and entertainment industry. The market for 5G mmWave technology is expected to be a dynamic one, with continuous innovation and development driving new applications and use cases. In , the market represents a significant opportunity for businesses looking to stay competitive in the digital age. With its ability to deliver high-speed data transfer, ultra-low latency, and support for emerging applications such as VR, AR, and autonomous vehicles, 5G mmWave technology is poised to transform various industries and drive innovation for years to come.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 39.71% |

|

Market growth 2024-2028 |

USD 1045.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

31.18 |

|

Key countries |

US, Germany, China, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this 5G mmWave Technology Market Research and Growth Report?

- CAGR of the 5G mmWave Technology industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the 5g mmwave technology market growth of industry companies

We can help! Our analysts can customize this 5g mmwave technology market research report to meet your requirements.