Airborne SATCOM Market Size 2024-2028

The airborne SATCOM market size is forecast to increase by USD 933.3 million at a CAGR of 3.27% between 2023 and 2028. The market is experiencing significant growth, driven by the increasing demand for connectivity in special mission aircraft, business jets, light aircraft, rotary wings, and commercial and military helicopters. The aerospace and defense industry's expansion, particularly in the Asia-Pacific region, is fueling this growth. However, the market faces challenges, including the exposure to cybersecurity threats, which necessitates the implementation of advanced security measures. In the US context, the growing importance of real-time data transmission and communication in various sectors, such as emergency services, surveillance, and transportation, is further driving the demand for airborne SATCOM solutions. This market analysis report provides an in-depth examination of these trends and growth factors.

What will be the Size of the Market During the Forecast Period?

The market is witnessing significant growth due to the increasing demand for real-time communication and data transfer in various industries. Airborne satellite communication systems are essential for various applications, including unmanned aerial vehicles (UAVs), aircraft communication systems, airborne intelligence, and IoT systems. SATCOM terminals play a crucial role in enabling seamless communication between aircraft and ground stations. The use of SATCOM terminals in commercial aircraft, such as narrow-body and wide-body aircraft, is becoming increasingly common. Lightweight SATCOM components are gaining popularity due to their ability to reduce the overall weight of the aircraft, thereby improving fuel efficiency and reducing operational costs.

Moreover, the SATCOM market caters to various bands, including Ka-band, Ku-band, X-band, C-band, S-band, L-band, and UHF-band. Ka-band solutions are gaining popularity due to their high data transfer rates and low latency. The integration of 5G networks with SATCOM systems is expected to further boost the market's growth. The SATCOM market is not limited to commercial applications alone. It is also used extensively in military applications, including fighter & combat aircraft and transport aircraft. The use of SATCOM systems in military aircraft enables real-time communication and data transfer, enhancing situational awareness and mission effectiveness. The earth station infrastructure is an essential component of the SATCOM system.

In addition, it provides the necessary ground support for communication between aircraft and ground stations. The increasing demand for reliable and secure communication systems has led to the development of advanced cybersecurity measures to prevent cybersecurity breaches. The use of SATCOM systems in UAVs is another emerging trend in the market. UAVs are increasingly being used for various applications, including surveillance, delivery, and inspection. SATCOM systems enable real-time communication and data transfer, making UAVs an effective tool for various industries. In conclusion, the market is experiencing steady growth due to the increasing demand for real-time communication and data transfer in various industries. The market caters to various applications, including commercial and military aircraft, UAVs, and IoT systems. The integration of advanced technologies, such as 5G networks and cybersecurity measures, is expected to further boost the market's growth.

Market Segmentation

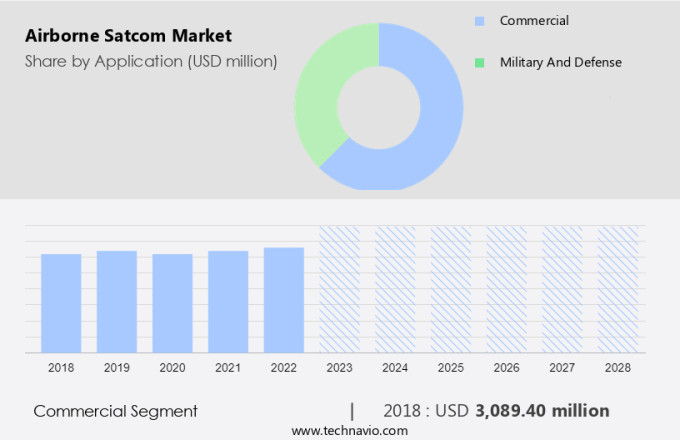

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Commercial

- Military and defense

- Geography

- Europe

- Germany

- UK

- France

- North America

- US

- APAC

- China

- South America

- Middle East and Africa

- Europe

By Application Insights

The commercial segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth due to the expanding commercial aviation industry and the increasing preference for enhanced in-flight experiences. This market growth can be attributed to the rising demand for entertainment and connectivity during long-haul flights. Airborne radio, including receivers, transmitters, modems & routers, and SATCOM radomes, play a crucial role in delivering these services. Low-cost airlines are increasingly adopting these technologies to offer wireless in-flight entertainment and connectivity (IFEC) services, allowing passengers to access a wide range of stored and streaming content on their mobile devices, such as smartphones, laptops, and tablets. The proliferation of these devices has created a strong demand for reliable in-flight connectivity.

Moreover, the market is expected to continue growing as the aviation industry expands and passengers seek more comfort and convenience during their travels. The integration of advanced technologies, such as MALE (Medium Earth Orbit) systems, is expected to further enhance the quality and reliability of in-flight connectivity services. In conclusion, the market is poised for continued growth due to the increasing demand for in-flight entertainment and connectivity services in the commercial aviation sector. The integration of advanced technologies, such as MALE systems, will further drive market growth and enhance the overall in-flight experience for passengers.

Get a glance at the market share of various segments Request Free Sample

The commercial segment was valued at USD 3.09 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

Europe is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In Europe, the airborne satellite communication market experienced significant growth in 2023 due to the increasing competition among airlines in the region. Passenger demand for in-flight connectivity has been on the rise, leading airline operators to invest heavily in advanced in-flight connectivity systems. For instance, KLM, a Dutch airline, partnered with Viasat to offer Wi-Fi connectivity services on two Boeing 737-800 aircraft in the European short-haul market. By the end of 2022, an additional 16 Boeing 737-800 aircraft with flights across Europe are anticipated to be equipped with these connectivity services. This trend is expected to continue as passengers seek to remain connected during their flights.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing air passenger traffic is the key driver of the market. The market is experiencing significant growth due to the increasing use of Unmanned Aerial Vehicles (UAVs) and aircraft communication systems. Airborne Intelligence, gathered through UAVs and other unmanned systems technology, requires reliable communication systems for real-time data transfer. This has led to increased demand for advanced airborne SATCOM systems. Furthermore, the integration of Internet of Things (IoT) systems and 5G networks in aircraft is expected to further boost market growth.

However, with the increasing use of technology comes the risk of cybersecurity breaches. Earth station infrastructure plays a crucial role in securing these communication systems against potential threats. The global economic development, particularly in emerging economies like India, China, and Indonesia, is driving the growth in air travel and consequently, the demand for advanced airborne SATCOM systems. Countries such as Spain, China, Italy, the UK, Germany, and Thailand have reported an increase in tourist arrivals, leading to investments in airport infrastructure and upgrades.

Market Trends

Significant growth of aerospace and defense industry in Asia-Pacific is the upcoming trend in the market. In the Asia Pacific region, the aerospace and defense industry is experiencing significant shifts, particularly in defense strategies and resource allocation. Many countries are prioritizing the development of local industrial bases to foster economic growth and ensure security amidst geopolitical tensions.

Moreover, this trend is driving an increase in design, production, commercial research, and operational activities among aerospace and defense equipment manufacturers in the region. Political conflicts in Southeast Asia and the Middle East have heightened the demand for aerospace and defense equipment, communication systems, devices, vehicles, and more. Special Mission Aircraft, Business Aviation, General Aviation, Business Jets, Light Aircraft, Rotary Wing, Commercial Helicopters, and Military Helicopters are witnessing increased demand in this context. The aerospace and defense sector in APAC is poised for growth, with various opportunities arising from these geopolitical dynamics.

Market Challenge

Exposure to cybersecurity threats is a key challenge affecting market growth. In the aerospace and defense industry, collaboration between stakeholders is crucial for advancements in design, development, and support of various aircraft types, including Fixed Wing aircraft such as Commercial Aircraft (narrow and wide body), Regional Transport Aircraft, Military Aircraft (Fighter & Combat and Transport), and more. However, the exchange of data carries risks, particularly the threat of data breaches, which can lead to unauthorized access and theft of sensitive product information.

However, this data is often used by unscrupulous buyers to undercut prices and gain a competitive edge by replicating original designs. Safety-critical software and embedded electronic systems manage essential aircraft functions, such as landing and braking, flight navigation and control, propulsion, and information systems. Data generated during a flight is analyzed for safety and optimization purposes. The global upgrading of defense systems and increasing focus on Intelligence, Surveillance, and Reconnaissance (ISR) systems have intensified the need for secure information exchange within the supply chain. It is imperative for industry players to prioritize cybersecurity measures to safeguard their intellectual property and maintain a competitive edge.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ASELSAN AS- The company offers Airborne Satellite Communication Terminal, to provide IP based, secure,non secure voice, data, video teleconferencing and fax communication via satellite for Unmanned Air Vehicles, and other airborne platforms.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbus SE

- Cobham Ltd.

- Collins Aerospace

- Comtech

- CPI International Inc

- Digisat International Inc.

- EchoStar Corp.

- General Dynamics Mission Systems Inc.

- Gilat Satellite Networks Ltd.

- Honeywell International Inc.

- Inmarsat Global Ltd.

- Intelsat US LLC

- Israel Aerospace Industries Ltd.

- L3Harris Technologies Inc.

- Northrop Grumman Corp.

- Orbit Communications Systems Ltd.

- RTX Corp.

- Teledyne Technologies Inc.

- Thales Group

- Viasat Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses communication systems for various types of aircraft, including fixed-wing and rotary wing, used in commercial aviation and military applications. These systems enable real-time data transmission for airborne intelligence, IoT systems, and 5G networks, enhancing the capabilities of UAVs, commercial aircraft (narrow body, wide body, regional transport, business jets, light aircraft), military aircraft (fighter & combat, transport, special mission), and helicopters (commercial, military).

In summary, the market is driven by the growing demand for connectivity in the aviation industry, with a focus on cybersecurity to mitigate breaches. Antenna subsystems, transceivers, receivers, transmitters, and modems & routers are essential components of airborne radio communication. SATCOM radomes and networking data units are also crucial for effective data transmission. The market includes antennas, radio frequency units, and transceivers for Ka-band, Ku-band, X-band, C-band, S-band, and L-band frequencies, catering to diverse applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.27% |

|

Market growth 2024-2028 |

USD 933.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.13 |

|

Regional analysis |

Europe, North America, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 36% |

|

Key countries |

US, UK, France, China, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Airbus SE, ASELSAN AS, Cobham Ltd., Collins Aerospace, Comtech, CPI International Inc, Digisat International Inc., EchoStar Corp., General Dynamics Mission Systems Inc., Gilat Satellite Networks Ltd., Honeywell International Inc., Inmarsat Global Ltd., Intelsat US LLC, Israel Aerospace Industries Ltd., L3Harris Technologies Inc., Northrop Grumman Corp., Orbit Communications Systems Ltd., RTX Corp., Teledyne Technologies Inc., Thales Group, and Viasat Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch