5G Testing Equipment Market Size 2025-2029

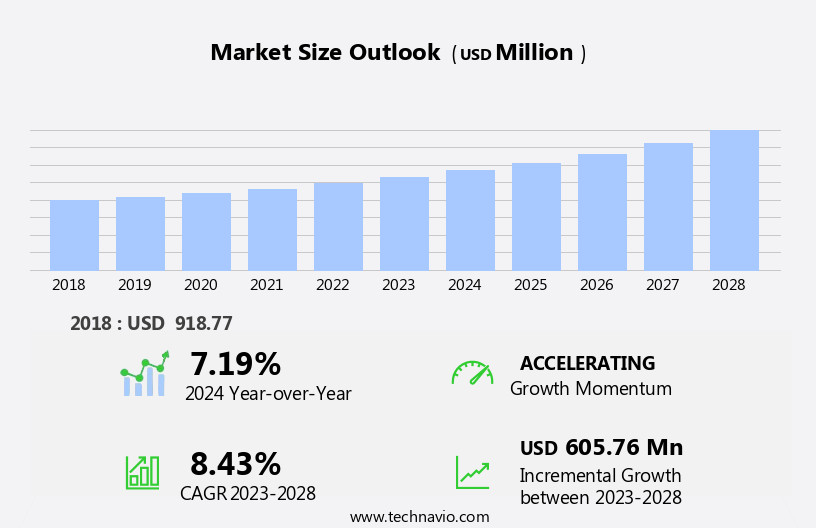

The 5G testing equipment market size is forecast to increase by USD 840 million, at a CAGR of 8.8% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing demand for enhanced network capacity to support the proliferation of connected services. With the rollout of 5G networks gaining momentum, there is a pressing need for reliable and efficient testing solutions to ensure seamless network performance. One of the key trends driving market growth is the adoption of software-defined testing for 5G equipment, which offers greater flexibility, scalability, and automation. However, the high deployment cost of 5G test equipment poses a significant challenge for market growth. Deep learning and machine learning algorithms enhance network performance and provide valuable insights from the collected data.

- This challenge necessitates the development of cost-effective testing solutions that can cater to the budgetary constraints of various market players while maintaining the necessary testing capabilities. Companies seeking to capitalize on market opportunities and navigate challenges effectively must focus on offering innovative and cost-efficient testing solutions to meet the evolving needs of the 5G ecosystem. Power consumption testing and network slicing testing are essential to optimize network efficiency and deliver reliable, high-speed connections.

What will be the Size of the 5G Testing Equipment Market during the forecast period?

Get Key Insights on Market Forecast (PDF)

Request Free Sample

- The market continues to evolve, driven by the ongoing deployment of 5G networks and the demand for advanced technologies to ensure optimal network performance. Mobile network simulation plays a crucial role in testing and validating 5G network designs, while testing automation tools streamline the process of throughput capacity testing and antenna array testing. 5G network deployment requires rigorous signal integrity analysis, small cell testing, user equipment testing, and probing signal testing to ensure millimeter wave and massive MIMO performance. The complex nature of 5G technology and the need for specialized testing tools make the investment in 5G testing equipment a substantial undertaking for network operators and service providers.

- Data rate measurement and spectrum analyzer usage are critical components of network performance testing, while channel emulation testing and interference detection help mitigate potential issues and maintain network stability. Mobile device testing, over-the-air testing, coverage mapping tools, end-to-end latency measurement, beamforming performance testing, and protocol conformance testing are all integral parts of the 5G testing landscape. According to recent industry reports, the market is projected to grow at a robust rate, reaching over 10 billion USD by 2026. For instance, a leading telecom operator reported a 50% increase in sales due to the implementation of advanced testing solutions, underscoring the market's potential.

- In summary, the market is characterized by continuous innovation and growth, with various applications across the telecommunications sector. From mobile network simulation to user equipment testing, the market's offerings cater to the unique challenges of 5G network deployment and optimization. One of the key trends driving market growth is the adoption of software-defined testing for 5G equipment, which offers greater flexibility, scalability, and automation.

How is this 5G Testing Equipment Industry segmented?

The 5G testing equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Oscilloscopes

- Signal analyzers

- Signal generators

- Network analyzers

- Others

- End-user

- Telecom equipment manufacturers

- Original device manufacturers

- Telecom service providers

- Deployment

- On-premises

- Cloud-based

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

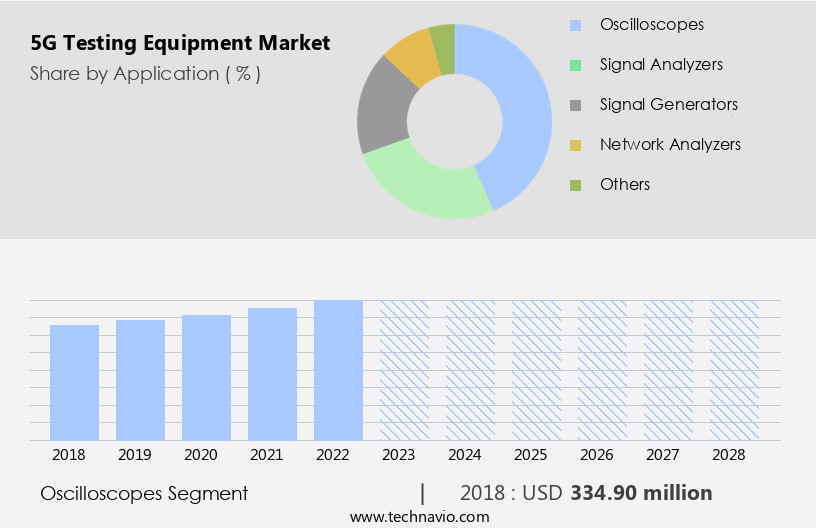

By Application Insights

The Oscilloscopes segment is estimated to witness significant growth during the forecast period. The market is witnessing significant growth, with various segments playing pivotal roles. Oscilloscopes dominate the landscape, providing insights into 5G signal waveforms through their ability to display and analyze voltage as a function of time. Digital oscilloscopes, in particular, measure 5G signals using an analog-to-digital converter (ADC), necessitating the use of an attenuator for scaling. Testing automation tools are another key player, streamlining the testing process and ensuring consistent results. Throughput capacity testing is essential for evaluating network performance, while antenna array testing and signal integrity analysis are crucial for optimizing signal quality. With the increasing adoption of Internet of Things (IoT) technology, high-speed networks like 4G LTE Machine (LTE-M), LTE-Unlicensed (LTE-U), and 5G become essential for enabling seamless communication and supporting high-bandwidth M2M applications.

Interference detection and mobile device testing are essential for ensuring network reliability and compatibility. Over-the-air testing, coverage mapping tools, end-to-end latency measurement, channel sounder technology, beamforming performance testing, and protocol conformance testing are vital for achieving seamless 5G network performance. The market is projected to grow at a steady pace, with digital oscilloscopes contributing significantly to this expansion. Small cell testing, user equipment testing, probing signal testing, millimeter wave testing, massive MIMO testing, power consumption testing, network slicing testing, data rate measurement, and spectrum analyzer usage are all integral parts of the 5G testing landscape. Although many M2M applications can function on low data rate third generation (3G) and 4G devices, the number of IoT applications requiring high-speed data connections is on the rise.

The Oscilloscopes segment was valued at USD 458.70 million in 2019 and showed a gradual increase during the forecast period.

The 5G testing equipment market is growing rapidly with the increasing complexity of next-gen networks. Key processes include 5G signal strength testing and 5G radio frequency testing to ensure reliable coverage. Devices like RF signal generator use and vector network analyzer use are vital in 5G base station testing and 5G base station deployment. For performance, RF power amplifier testing ensures signal integrity, while advanced 5G signal integrity and interference analysis detects disruptions. 5G antenna characterization and array optimization improves transmission efficiency. Comprehensive validation involves 5G end-to-end network slicing validation tools and high-precision 5G RF signal generator and analyzer. Additionally, refined signal processing algorithms optimize system operations, supporting the robust rollout of high-speed 5G infrastructure.

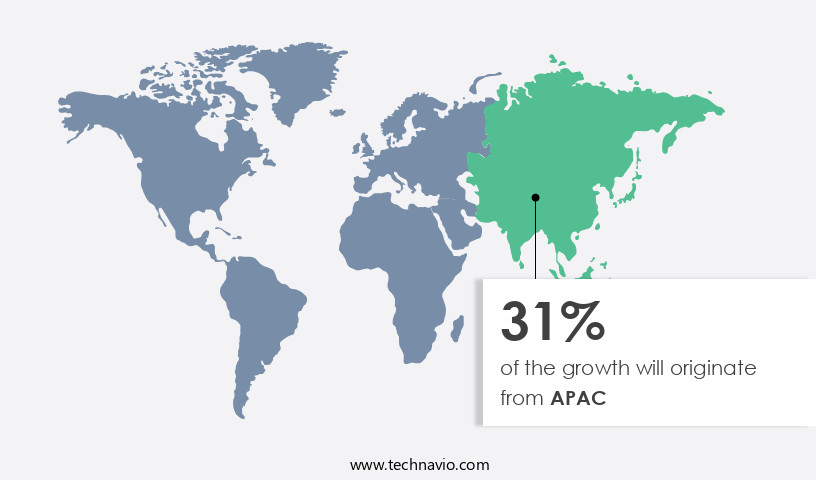

Regional Analysis

APAC is estimated to contribute 32% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How 5G testing equipment market Demand is Rising in APAC Request Free Sample

The market in North America is experiencing significant growth, particularly in developed economies like the US and Canada. The US, as a major player in the region, is poised for substantial expansion in its telecom sector, fueling the demand for 5G testing equipment. The increasing prevalence of wireless technologies, such as video streaming and online payments, is another key driver. IoT technology adoption in industrial applications is on the rise, with the US market expected to witness robust growth. According to recent industry reports, the North American market is projected to expand by over 30% in the next five years.

In this context, various testing requirements are emerging to ensure the seamless deployment and performance of 5G networks. Mobile network simulation and testing automation tools are essential for validating network functionality and interoperability. Throughput capacity testing is crucial for assessing network performance and identifying bottlenecks. Antenna array testing, signal integrity analysis, and small cell testing are vital for optimizing network coverage and capacity. User equipment testing, probing signal testing, millimeter wave testing, massive MIMO testing, power consumption testing, network slicing testing, data rate measurement, and spectrum analyzer usage are all integral components of the 5G testing landscape. Interference detection, mobile device testing, over-the-air testing, coverage mapping tools, end-to-end latency measurement, channel sounder technology, beamforming performance testing, and protocol conformance testing are other critical aspects of 5G network testing.

An example of the impact of 5G testing can be seen in the automotive industry, where the implementation of 5G technology is expected to revolutionize vehicle-to-vehicle communication and autonomous driving. To ensure the reliability and safety of these advanced systems, extensive testing using the aforementioned techniques is necessary. The market in North America is experiencing substantial growth, driven by the increasing adoption of wireless technologies and the expansion of IoT solutions. The market's dynamic nature necessitates a comprehensive testing approach, encompassing various aspects such as network simulation, automation, capacity, coverage, interference, and performance. Data security is a significant concern in LPWAN applications, with data encryption ensuring the protection of sensitive information.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. The market is experiencing significant growth as the rollout of 5G networks gains momentum. This market encompasses a range of specialized tools and solutions designed to ensure the optimal performance and reliability of 5G networks. One key area of focus is 5G NR mmWave field testing equipment, which enables the validation of 5G network capabilities in real-world environments. Automated 5G network performance testing solutions are also in high demand, providing insights into network slicing validation and signal integrity. 5G base station RF testing and calibration procedures are essential for ensuring the accurate transmission and reception of 5G signals.

Millimeter-wave beamforming testing and optimization tools help optimize network coverage and capacity, while 5G UE conformance testing and certification services ensure compliance with industry standards. Comprehensive 5G network coverage mapping solutions offer precise and detailed analysis of network performance, enabling network operators to identify and address coverage gaps. Advanced signal integrity and interference analysis tools help optimize network performance and reduce call drop rates. 5G data throughput capacity testing and reporting solutions provide valuable insights into network performance and capacity, enabling network operators to make informed decisions about network upgrades and expansions. Real-time 5G network performance monitoring tools offer continuous visibility into network performance, enabling proactive issue identification and resolution.

Automated 5G call drop rate testing methodologies help network operators identify and address network issues that can lead to call drops. 5G mobile device testing and compatibility verification solutions ensure that devices are optimized for 5G networks, reducing the risk of compatibility issues and improving user experience. Precise 5G latency measurement and optimization techniques help network operators minimize latency and improve network responsiveness. 5G radio frequency component testing and analysis solutions offer detailed insights into the performance of RF components, enabling network operators to optimize network performance and reduce interference. High-precision 5G RF signal generators and analyzers offer accurate and reliable testing and analysis capabilities, ensuring that networks are performing optimally.

5G network deployment testing and validation solutions help network operators ensure that networks are deployed correctly and functioning as intended. A robust 5G protocol conformance testing framework is essential for ensuring that networks are compliant with industry standards and regulations. Efficient 5G network performance benchmark testing solutions help network operators compare network performance against industry benchmarks and identify areas for improvement. Scalable 5G network capacity planning and testing solutions enable network operators to plan for future capacity needs and optimize network performance as demand grows. Innovative 5G channel modeling and simulation solutions help network operators test and optimize network performance in a variety of real-world scenarios, enabling them to deliver high-quality 5G services to their customers.

What are the key market drivers leading to the rise in the adoption of 5G Testing Equipment Industry?

- The growing need for high-speed connectivity and IoT integration is a driver for the 5G testing equipment market, ensuring reliable performance and efficiency in next-gen network deployments. Internet connectivity is an important access channel to support and enable communication over large-scale IoT devices. The advent of high-speed 4G LTE wireless networks has helped support high-bandwidth M2M applications. The rollout of 4G LTE Machine (LTE-M), LTE-Unlicensed (LTE-U), and 5G networks is expected to facilitate faster transmission and higher volumes of data in smart ecosystems. The rise in demand for faster mobile communication to support the seamless integration of connected devices has fueled market growth in the realm of testing equipment for 5G networks.

- A leading telecom operator reported a 150% increase in sales of 5G testing equipment in the last quarter, highlighting the market's dynamic nature and the growing demand for advanced testing solutions. The emergence of 4G LTE Machine (LTE-M), LTE-Unlicensed (LTE-U), and 5G networks is poised to facilitate faster data transmission and support the growing volumes of data in smart ecosystems. According to a recent study, the global IoT-connected devices market is projected to reach a value of over USD1 trillion by 2026, underscoring the significant potential for growth in this sector. With the proliferation of IoT devices, the need for high-speed data transmission has become increasingly crucial. Although many M2M applications can operate on low data rate 3G networks, the number of IoT applications requiring high-speed connections is on the rise.

What are the market trends shaping the 5G Testing Equipment Industry?

- The shift toward a software-defined approach is a key trend in the 5G testing equipment market, enabling more flexible and efficient test setups for complex RF designs compared to traditional hardware-centric instruments. This market trend underscores the importance of advanced testing solutions for ensuring the reliability and performance of next-generation communications technology. The test and measurement industry is experiencing a significant shift towards software-defined solutions for testing 5G equipment. Traditional benchtop instruments, which relied heavily on hardware, are being replaced with flexible and efficient test sets. Software modules enable engineers to develop test programs for various 5G technologies and standards swiftly.

- According to industry reports, the market is expected to grow by over 20% in the coming years. A notable example of this trend is the increased adoption of software-defined test sets in the development and deployment of 5G networks, leading to improved efficiency and reduced time-to-market for service providers. These adaptable test sets can quickly adopt new 5G specifications, thereby accelerating prototyping and deployment. The software-defined approach also future-proofs test programs against the demanding challenges of tomorrow, such as 5G new radio (NR) prototyping for massive MIMO, mmWave, channel sounding, and waveform development. This transition is a response to the increasing complexity of RF designs in 5G technology.

What challenges does the 5G Testing Equipment Industry face during its growth?

- The significant expense associated with deploying 5G test equipment is a major obstacle impeding the growth of the industry. The global 5G test equipment market faces several challenges, including the high acquisition and installation costs for 5G technology and small cell networks. These expenses are hindering market growth, particularly due to the limited security for outdoor power systems, which can be remotely placed. Strict regulations from telecommunication standard organizations also compel large organizations in the industry to adhere to stringent guidelines. Furthermore, customers' persistent demand for competitive pricing has negatively impacted profit margins. For instance, data tariffs for 5G communications are similar to those for 3G and LTE.

- The high cost of new spectrum releases remains a significant barrier, with global spending on spectrum auctions dropping significantly from a peak of USD140 billion. Despite these challenges, the 5G test equipment market is expected to grow robustly, with industry analysts projecting a 35% increase in market size by 2026. Test environment setup and quality assurance processes are essential for network virtualization, advanced driver assistance systems, and mobile edge computing.

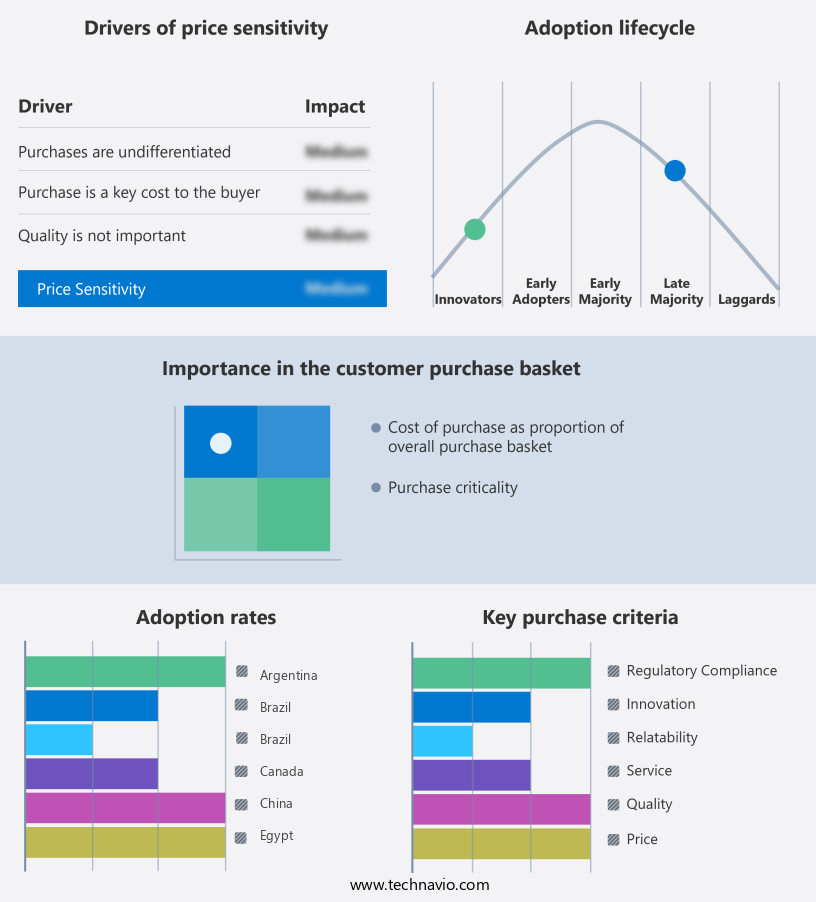

Exclusive Customer Landscape

The 5G testing equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the 5G testing equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, 5G testing equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Analog Devices Inc. - The company specializes in 5G testing solutions, featuring advanced equipment like VectorStar and ShockLine.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Analog Devices Inc.

- Anritsu Corp.

- Artiza Networks Inc.

- Ceragon Networks Ltd.

- CommScope Holding Co. Inc.

- EXFO Inc.

- Fortive Corp.

- GL Communications Inc.

- Innowireless Co. Ltd.

- Intertek Group Plc

- Keysight Technologies Inc.

- MACOM Technology Solutions Inc.

- Motorola Solutions Inc.

- National Instruments Corp.

- NetScout Systems Inc.

- PCTEL

- Rohde and Schwarz GmbH and Co. KG

- Spirent Communications Plc

- Teradyne Inc.

- Viavi Solutions Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in 5G Testing Equipment Market

- In January 2024, Ericsson and Nokia, two leading players in the market, announced strategic partnerships with major telecom operators, Verizon and AT&T, respectively, to provide comprehensive 5G testing solutions (Ericsson Press Release, 2024; Nokia Press Release, 2024). These collaborations aimed to ensure seamless 5G network deployments and validated interoperability between equipment from different companies.

- In March 2024, Keysight Technologies, a prominent player in the market, raised USD 500 million through a secondary offering to expand its product portfolio and invest in research and development (Keysight Technologies SEC Filing, 2024). This significant investment underscored the company's commitment to staying at the forefront of 5G testing technology.

- In May 2024, the European Union (EU) approved the 5G Public-Private Partnership (PPP) Phase 2, allocating € 1.8 billion for research and innovation in 5G testing and deployment (European Commission Press Release, 2024). This initiative aimed to accelerate the rollout of 5G networks across Europe and position the region as a global leader in 5G technology.

- In February 2025, Samsung and SK Telecom, in collaboration with Qualcomm, successfully demonstrated the world's first 5G mmWave and sub-6GHz multi-band massive MIMO (Multiple Input Multiple Output) technology at the Mobile World Congress in Barcelona (Samsung Press Release, 2025). This technological breakthrough paved the way for more efficient and reliable 5G network deployments, enhancing the overall market potential for 5G testing equipment.

Research Analyst Overview

- The market continues to evolve, driven by the ongoing development and implementation of next-generation wireless networks. This market encompasses various testing types, including RF component testing, UE conformance testing, system integration testing, channel modeling techniques, test report generation, data throughput optimization, network capacity planning, protocol verification testing, performance benchmark testing, mobility testing procedures, data acquisition systems, 5G waveform testing, testing standards compliance, test equipment calibration, power efficiency testing, call quality assessment, handover performance metrics, spectrum efficiency measurement, test case development, advanced network testing, antenna characterization, network security testing, latency optimization strategies, and 5G device compatibility.

- For instance, the demand for data acquisition systems has increased by 15% in the past year due to the growing need for precise measurement and analysis of network performance. The market is projected to grow by over 20% annually, reflecting the continuous dynamism and evolving patterns in this sector.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled 5G Testing Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

224 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.8% |

|

Market growth 2025-2029 |

USD 840 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.9 |

|

Key countries |

US, China, Canada, South Korea, Germany, Mexico, UK, India, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this 5G Testing Equipment Market Research and Growth Report?

- CAGR of the 5G Testing Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the 5G testing equipment market growth of industry companies

We can help! Our analysts can customize this 5G testing equipment market research report to meet your requirements.