Aircraft Electrical Systems Market Size 2024-2028

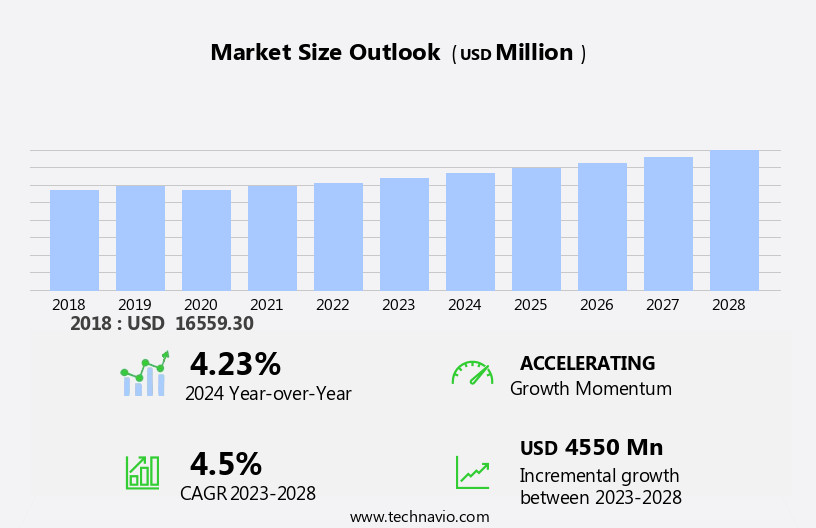

The aircraft electrical systems market size is forecast to increase by USD 4.55 billion, at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing demand for commercial aircraft. This trend is fueled by the continuous expansion of air travel and the subsequent need for a larger fleet of commercial aircraft to meet the rising passenger traffic. Furthermore, technological innovations in aircraft electrical systems are playing a pivotal role in market growth. These advancements include the integration of lightweight and efficient batteries, the development of smart systems for real-time monitoring and diagnostics, and the implementation of electric propulsion systems. However, the market faces challenges as well. The ongoing COVID-19 pandemic has significantly impacted the aviation industry, leading to a decline in air travel demand and, consequently, a reduction in new aircraft orders.

- Additionally, the high cost of research and development for advanced electrical systems and the complex regulatory environment pose significant challenges for market participants. To capitalize on the market opportunities and navigate these challenges effectively, companies must focus on cost-effective solutions, collaborate with regulatory bodies, and invest in research and development to stay ahead of the competition.

What will be the Size of the Aircraft Electrical Systems Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market is characterized by its continuous evolution and dynamic nature, driven by the ever-advancing requirements of aviation technology. Avionics systems, engine controls, aircraft lighting, wiring harnesses, fault detection, power distribution, and environmental testing are integral components of this market, each playing a crucial role in ensuring the safe and efficient operation of aircraft. The demand for safety-critical systems, such as cooling fans, heat sinks, and EMI/RFI shielding, continues to grow as aviation technology advances. Cockpit displays and cabin lighting require weight optimization, adhering to ARINC standards for power monitoring and data buses. Environmental testing and certification standards ensure the reliability of components, including fuse boxes and circuit breakers, in various operating conditions.

Wiring integrity and power quality are essential considerations in the design and implementation of electrical systems. Exterior lighting, load management, and instrument panels are essential for ensuring flight safety and enhancing passenger comfort. Safety-related systems, such as electromagnetic compatibility (EMC) and flight control systems, require rigorous electrical load analysis and thermal management. Power system architecture, fuel efficiency, and redundancy systems are key trends shaping the market. DC-DC converters and system efficiency are critical components in optimizing power distribution and ensuring the reliability of electrical systems. The ongoing development of fiber optics and power system architecture continues to drive innovation and growth in the market.

How is this Aircraft Electrical Systems Industry segmented?

The aircraft electrical systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Platform

- Commercial aviation

- Military aviation

- Business and general aviation

- System Type

- Power Generation

- Power Distribution

- Power Conversion

- Energy Storage

- Application Type

- Cabin Systems

- Flight Control Systems

- Avionics

- Lighting

- Technology

- Conventional Electrical Systems

- More Electric Aircraft (MEA)

- Hybrid Systems

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- APAC

- China

- Rest of World (ROW)

- North America

By Platform Insights

The commercial aviation segment is estimated to witness significant growth during the forecast period.

In the dynamic aviation industry landscape of 2023, the commercial aviation segment emerged as the largest application sector for global aircraft electrical systems. This segment encompasses electrical systems for passenger planes, cargo aircraft, and business jets. The expansion of this segment can be attributed to the escalating number of air travelers and the burgeoning air cargo market. The growth of commercial aviation is driven by technological innovations and the growing consumer preference for air travel. The global population's rising per capita income has made air travel more accessible and affordable, leading to a surge in passenger traffic.

Consequently, aircraft operators are investing in new fleets to meet the demands of the tourism sector. Aircraft electrical systems are integral to the functionality of safety-critical components such as fault isolation, cooling fans, heat sinks, EMI/RFI shielding, cockpit displays, cabin lighting, and weight optimization. Compliance with ARINC standards, power monitoring, and power distribution are essential for the efficient operation of avionics systems, engine controls, aircraft lighting, wiring harnesses, and fault detection. Environmental testing and certification standards ensure component reliability and system efficiency.

The Commercial aviation segment was valued at USD 8.27 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market experiences significant growth, driven by the thriving aviation industry in North America. Aviation manufacturing is propelled by the escalating demand for air travel globally and the necessity for fleet renewal among aircraft operators. The US economic recovery has stimulated a surge in domestic air travel, contributing substantially to the demand for commercial aircraft. To maintain the rapid development pace, engine Original Equipment Manufacturers (OEMs) are investing heavily in expanding their production facilities. In June 2021, United Airlines announced a commercial agreement with Boom Supersonic, a Colorado-based aerospace company, to incorporate their supersonic aircraft into its global fleet and collaborate on sustainability initiatives.

Safety-critical systems, such as fault isolation, cooling fans, and heat sinks, are essential components in aircraft electrical systems. EMI/RFI shielding, cockpit displays, cabin lighting, and weight optimization are integral to enhancing passenger comfort and safety. ARINC standards, power monitoring, and avionics systems ensure efficient power distribution and management. Engine controls, aircraft lighting, and wiring harnesses are crucial for aircraft functionality. Fault detection and power distribution systems undergo rigorous environmental testing to meet certification standards. Component reliability, environmental control systems, lightning protection, circuit breakers, wiring integrity, power quality, and exterior lighting are essential for ensuring aircraft safety and performance.

Load management, data buses, instrument panels, and safety-related systems adhere to electromagnetic compatibility (EMC) regulations. Flight control systems, electrical load analysis, fiber optics, power system architecture, fuel efficiency, and thermal management are integral to optimizing aircraft performance. RTCA/DO-254 and redundancy systems ensure system reliability, while dc-dc converters and system efficiency contribute to overall aircraft efficiency.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global aircraft electrical systems market size and forecast projects growth, driven by aircraft electrical systems market trends 2024-2028. B2B electrical system solutions leverage advanced aerospace technologies for reliability. Aircraft electrical systems market growth opportunities 2025 include electrical systems for electric aircraft and systems for commercial aviation, meeting demand. Electrical system management software optimizes operations, while aircraft electrical systems market competitive analysis highlights key manufacturers. Sustainable electrical system practices align with eco-friendly aviation trends. Aircraft electrical systems regulations 2024-2028 shapes electrical system demand in North America 2025. High-efficiency electrical solutions and premium electrical system insights boost adoption. Electrical systems for drones and customized electrical designs target niches. Aircraft electrical systems market challenges and solutions address complexity, with direct procurement strategies for electrical systems and electrical system pricing optimization enhancing profitability. Data-driven electrical system analytics and green aviation trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Aircraft Electrical Systems Industry?

- The increasing need for commercial aircraft is the primary market driver, fueled by growing demand from the global air travel industry.

- Aircraft operators are responding to the continuous growth in air traffic by procuring new aircraft to meet demand. Major Original Equipment Manufacturers (OEMs) have responded by expanding their production capabilities to ensure timely deliveries. For instance, Airbus reported 611 commercial aircraft deliveries in 2021, a significant increase from the 566 deliveries in 2020. In the same year, Airbus announced a total of 483 A320 deliveries and more than doubled its gross order intake compared to 2020. Emerging economies, such as India and China, have also contributed to the production of aircraft in recent years. This trend is expected to continue, as the demand for air travel remains strong.

- The efficiency of electrical systems in aircraft plays a crucial role in ensuring optimal performance and reducing maintenance costs. OEMs are focusing on developing advanced electrical systems that can handle increased power demands while maintaining system harmony and immunity to surges. These innovations aim to improve overall aircraft efficiency and reduce downtime.

What are the market trends shaping the Aircraft Electrical Systems Industry?

- The trend in the aviation industry is shifting towards technological innovations in electric aircraft systems. This sector is poised for significant growth.

- Aircraft electrical systems continue to evolve, with a focus on safety-critical systems, fault isolation, and weight optimization. Key components include cooling fans, heat sinks, and Electromagnetic Interference/Radio Frequency Interference (EMI/RFI) shielding. Cockpit displays and cabin lighting are essential for passenger comfort and safety. ARINC standards guide power monitoring and distribution. Collins Aerospace, a Raytheon Technologies business, recently completed a critical design review for a 500-kilowatt electric motor for hybrid-electric aircraft.

- NASA awarded contracts to two US companies to develop electric propulsion technologies, aiming for their integration into US aviation fleets by 2035. These advancements underscore the industry's commitment to innovation and sustainability.

What challenges does the Aircraft Electrical Systems Industry face during its growth?

- The significant impact of COVID-19 on the aviation industry poses a major challenge to its growth. This global health crisis has brought about unprecedented disruptions to air travel, resulting in decreased demand, cancelled flights, and financial losses for airlines and related businesses. The industry's recovery is uncertain, with ongoing concerns over travel restrictions, quarantines, and the evolving nature of the pandemic.

- The market encompasses avionics systems, engine controls, aircraft lighting, wiring harnesses, fault detection, power distribution, and environmental testing. These components are crucial for maintaining the safe and efficient operation of aircraft. However, the ongoing COVID-19 pandemic has significantly impacted the aviation industry, leading to a substantial decrease in air travel and a financial strain on airlines. Consequently, new aircraft orders have been canceled, deferred, or renegotiated. Despite these challenges, the importance of reliable electrical systems in aircraft remains paramount.

- Certification standards, such as those set by the Federal Aviation Administration (FAA), ensure the safety and reliability of electrical components, including fuse boxes and wiring harnesses. Manufacturers focus on component reliability and environmental testing to meet these stringent standards. In the face of the pandemic, the emphasis on maintaining aircraft electrical systems to preserve operational readiness is more critical than ever.

Exclusive Customer Landscape

The aircraft electrical systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aircraft electrical systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aircraft electrical systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AMETEK Inc. - This company specializes in manufacturing primary power distribution units for aircraft. These units facilitate power bus connectivity, transfer, and distribution to onboard systems, ensuring efficient energy management for optimal aircraft performance.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AMETEK Inc.

- Amphenol Corp.

- Astronics Corp.

- B and C Specialty Products Inc.

- BAE Systems Plc

- Carlisle Companies Inc.

- Collins Aerospace

- Crane Aerospace and Electronics

- EaglePicher Technologies LLC

- Electric Power Systems

- General Electric Co.

- HEICO Corp.

- Honeywell International Inc.

- Meggitt Plc

- Nabtesco Corp.

- PBS Aerospace Inc.

- Safran SA

- Thales Group

- TransDigm Group Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Aircraft Electrical Systems Market

- In January 2024, Honeywell Aerospace announced the certification of its Electric Power and Propulsion (EPP) System for the Bell Nexus autonomous air taxi, marking a significant technological advancement in the market. This system, which integrates electric propulsion and energy storage, is expected to increase the efficiency and reduce the carbon footprint of electric aircraft (Honeywell, 2024).

- In March 2024, Safran Electrical & Power signed a strategic partnership with Rolls-Royce to develop and manufacture electrical power systems for hybrid-electric and electric aircraft. This collaboration aims to combine Safran's expertise in electrical systems and Rolls-Royce's experience in aerospace engines to create more efficient and eco-friendly aircraft (Safran, 2024).

- In May 2024, United Technologies Corporation's Collins Aerospace received a contract worth over USD100 million from Boeing to provide electrical power conversion systems for the 737 MAX aircraft. This contract underscores the growing demand for electrical systems in the commercial aviation sector (Collins Aerospace, 2024).

- In April 2025, Lithium Polymer Battery Systems (LPBS), a leading supplier of lithium-ion batteries for aerospace applications, secured a USD50 million investment from Boeing HorizonX Ventures. This investment will support the expansion of LPBS's production capacity and the development of advanced battery technologies for electric and hybrid-electric aircraft (LPBS, 2025).

Research Analyst Overview

- The market is experiencing significant advancements, driven by the integration of electric propulsion, software-defined avionics, and actuator technology. Supply chain management plays a crucial role in ensuring the timely delivery of technology upgrades, including embedded systems and system integration. Lightweight materials and obsolescence management are essential for maintaining the efficiency and sustainability of aviation, aligning with the trend towards sustainable aviation. Warranty support and certification processes are critical components of the market, as manufacturers and operators navigate the challenges of implementing new technology while maintaining safety and reliability. Solid-state power supplies and low-voltage systems are gaining popularity due to their energy efficiency and reduced weight.

- Hybrid electric propulsion and fuel cells are emerging technologies that offer potential for significant reductions in emissions and operational costs. System safety assessment and sensor technology are essential for ensuring the safe operation of these advanced systems. Modification kits and energy storage solutions enable the retrofitting of existing aircraft with new technology, extending their useful life and enhancing their performance. Testing and inspection processes are essential for ensuring the quality of components and systems, particularly in the context of high-voltage systems and certification requirements. The market for aircraft electrical systems is dynamic and evolving, with a focus on innovation, efficiency, and safety.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Aircraft Electrical Systems Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 4550 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, France, Germany, China, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aircraft Electrical Systems Market Research and Growth Report?

- CAGR of the Aircraft Electrical Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aircraft electrical systems market growth of industry companies

We can help! Our analysts can customize this aircraft electrical systems market research report to meet your requirements.