Aircraft Electrification Market Size 2024-2028

The aircraft electrification market size is forecast to increase by USD 10.2 billion at a CAGR of 18.52% between 2023 and 2028.

What will be the Size of the Aircraft Electrification Market During the Forecast Period?

How is this Aircraft Electrification Industry segmented and which is the largest segment?

The aircraft electrification industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Platform

- Commercial and general aircraft

- Military aircraft

- Technology

- More electric

- Fully electric

- Hybrid electric

- Geography

- Europe

- Germany

- UK

- France

- North America

- US

- APAC

- China

- Middle East and Africa

- South America

- Europe

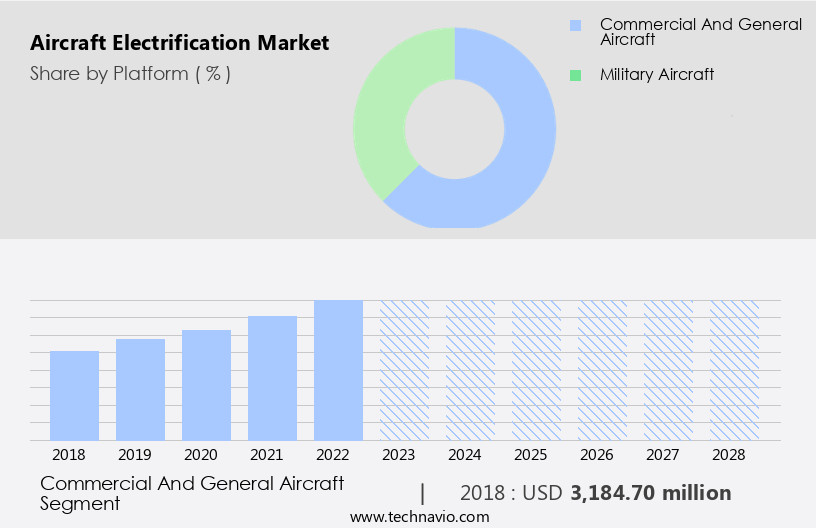

By Platform Insights

- The commercial and general aircraft segment is estimated to witness significant growth during the forecast period.

The market encompasses the design and implementation of electric propulsion systems in both commercial and general aviation sectors. Commercial aircraft, including passenger airlines and cargo carriers, are transitioning towards electric propulsion systems, utilizing electric motors, batteries, and power electronics. These systems offer operational cost efficiency, reduced emissions, and noise reduction. The general aviation segment, consisting of private jets, helicopters, and small regional aircraft, is also adopting hybrid-electric or fully electric propulsion systems. Regulatory initiatives and environmental regulations, such as emission standards, are driving the electrification trend In the aviation industry. Key players in this market include STMicroelectronics, focusing on power electronics, and various electric aviation ventures receiving venture capital funding.

The commercial segment is expected to dominate the market due to its larger fleet size and the potential for significant emissions reduction. The power distribution segment, including mechanical systems, hydraulic systems, and electrical architectures, is a crucial aspect of aircraft electrification.

Get a glance at the Aircraft Electrification Industry report of share of various segments Request Free Sample

The Commercial and general aircraft segment was valued at USD 3.18 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

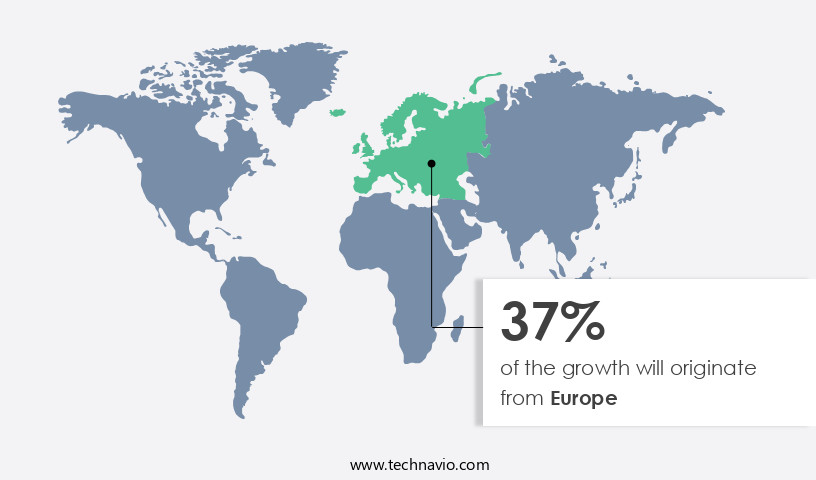

- Europe is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European the market is poised for substantial growth due to the escalating demand for fuel-efficient and eco-friendly aviation solutions. This trend is fueled by the increasing adoption of electric and hybrid-electric propulsion systems, as part of the aviation industry's ongoing commitment to reducing carbon emissions and noise. Notable European players, such as Airbus, Safran, and Rolls-Royce, are spearheading this transition. Regulatory initiatives, including the European Union's Clean Sky program, are also catalyzing innovation in electric and hybrid-electric aircraft technology. The power electronics sector, including companies like STMicroelectronics, plays a crucial role In the development of electric propulsion systems and energy storage systems.

The aviation industry's shift towards electric aviation ventures is driven by operational cost efficiency, environmental sustainability, and the need to address climate change. This transition encompasses the design of hybrid powered aircraft, fully electric aircraft, and energy storage systems, as well as the development of charging infrastructure at airports and charging points. The aerospace sector's evolution includes the integration of electric vertical takeoff, battery technologies, and modular design options for precision control, rapid response, and agility in unmanned aerial systems.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Aircraft Electrification Industry?

Increase in technological advancements is the key driver of the market.

What are the market trends shaping the Aircraft Electrification Industry?

Increased demand for electric aircraft is the upcoming market trend.

What challenges does the Aircraft Electrification Industry face during its growth?

High development cost of aircraft electrification is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The aircraft electrification market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aircraft electrification market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aircraft electrification market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Acme Aerospace Inc and Avionic Instruments LLC - Aircraft electrification, a significant trend in aviation, encompasses advanced technologies such as DC power converters that facilitate the conversion and distribution of electrical power on board. These systems enable aircraft to operate more efficiently and reduce emissions, aligning with industry efforts to promote sustainability and reduce environmental impact. DC power converters convert direct current (DC) power from the aircraft's batteries or external power sources into usable power for various onboard systems. The adoption of these systems is poised to revolutionize aircraft design and operation, offering enhanced performance, improved fuel efficiency, and reduced carbon emissions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acme Aerospace Inc and Avionic Instruments LLC

- Aegis Power Systems Inc.

- AMETEK Inc.

- Astronics Corp.

- BAE Systems Plc

- Carlisle Companies Inc.

- Crane Holdings Co.

- EaglePicher Technologies LLC

- General Electric Co.

- Hartzell Propeller Inc.

- Honeywell International Inc.

- Lee Air Inc.

- magniX

- Nabtesco Corp.

- Parker Hannifin Corp.

- PBS Aerospace Inc.

- RTX Corp.

- Safran SA

- Thales Group

- U.S. Technologies

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The aircraft industry is witnessing a significant shift towards electrification as the global focus on sustainable air travel intensifies. This transition is driven by the need for operational cost efficiency, reduced carbon emissions, and regulatory initiatives aimed at mitigating the environmental impact of conventional aviation. Electric aircraft, which utilize electric propulsion systems instead of traditional fuel-powered engines, are gaining traction as a viable alternative. The mechanical components of electric aircraft are distinct from their conventional counterparts, with fewer moving parts and more reliance on power electronics. Maintenance requirements for electric aircraft differ from those of traditional aircraft due to the absence of mechanical engines.

Instead, maintenance protocols focus on the electrical architectures and energy storage systems. These systems require regular inspections to ensure optimal performance and safety. The aviation industry, comprised of airlines and operators, is exploring the potential of electric aviation ventures to reduce fuel consumption, emissions, and operational costs. STMicroelectronics, a leading player in power electronics, is one of the companies investing in this space. Regulatory initiatives and environmental regulations are catalysts for the growth of the market. Emission standards and noise reduction requirements are driving the demand for electric and hybrid-powered aircraft. Aviation authorities worldwide are working on certifying these new aircraft types for commercial use.

Startups and venture capital funding are playing a crucial role In the development of electric aviation. Companies are investing in research and development to improve battery technology, energy storage capacities, and lightweight solutions for high-performance electric aircraft. The power distribution segment of the market is expected to grow significantly as the industry shifts towards electric propulsion systems. Traditional combustion engines will continue to be used in some applications, but the focus is on improving fuel efficiency and reducing emissions through regenerative energy capture and flexible power management. The unmanned aerial systems (UAS) segment, including drones and electric vertical takeoff and landing (eVTOL) aircraft, is another area where electrification is gaining popularity.

UAS are used in various industries, including healthcare, security solutions, and aerospace, and their electric powertrains offer advantages in terms of noise reduction, agility, and precision control. The aerospace sector is also exploring the use of electric propulsion systems for rocket engines and aerospace components. These applications require high energy density batteries and advanced power management systems to ensure optimal performance and safety. The charging infrastructure for electric aircraft and UAS is an essential consideration for their widespread adoption. Airports and charging points are being developed to support the growing fleet of electric aircraft and UAS. In conclusion, the market is experiencing significant growth due to the need for operational cost efficiency, reduced carbon emissions, and regulatory initiatives.

Electric aircraft, hybrid-powered aircraft, and UAS are leading the way in this transition, with advancements in battery technology, energy storage systems, and power electronics driving innovation In the industry. The future of aviation is electric, and the opportunities for growth and investment are vast.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.52% |

|

Market growth 2024-2028 |

USD 10198.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.18 |

|

Key countries |

US, Germany, UK, China, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aircraft Electrification Market Research and Growth Report?

- CAGR of the Aircraft Electrification industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aircraft electrification market growth of industry companies

We can help! Our analysts can customize this aircraft electrification market research report to meet your requirements.