APAC Construction Equipment Market Size 2026-2030

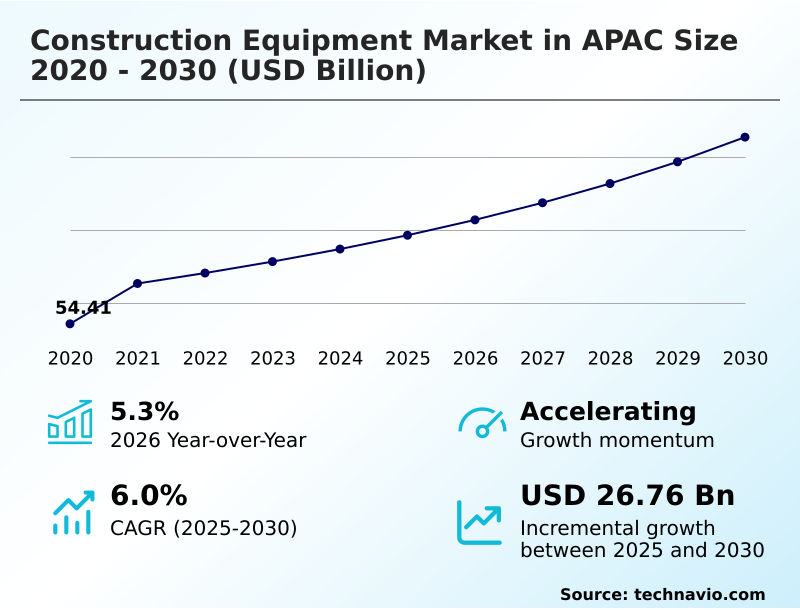

The apac construction equipment market size is valued to increase by USD 26.76 billion, at a CAGR of 6% from 2025 to 2030. Massive government investment in infrastructure development will drive the apac construction equipment market.

Major Market Trends & Insights

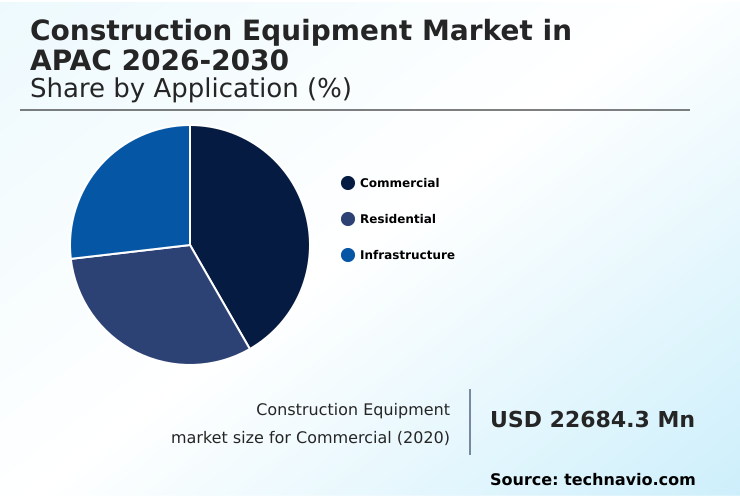

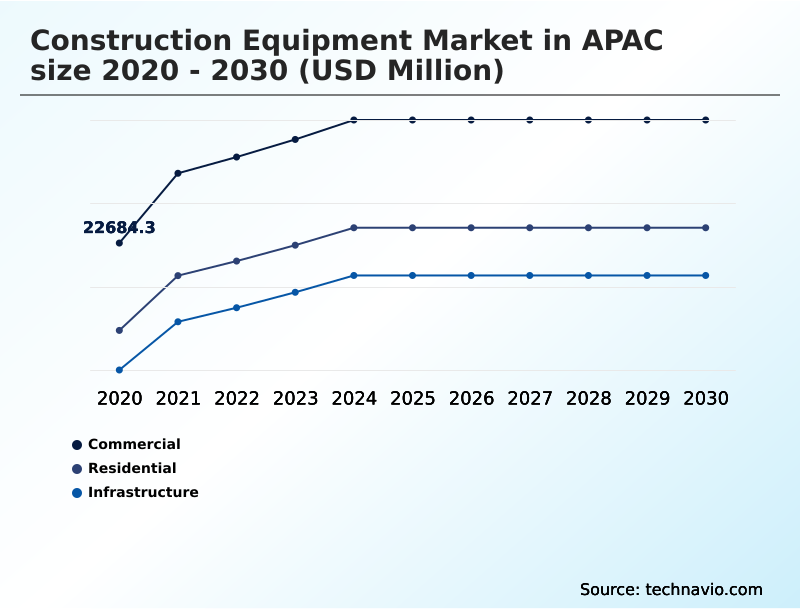

- By Application - Commercial segment was valued at USD 30.52 billion in 2024

- By Product - Earthmoving equipment segment accounted for the largest market revenue share in 2024

Market Size & Forecast

- Market Opportunities: USD 50.92 billion

- Market Future Opportunities: USD 26.76 billion

- CAGR from 2025 to 2030 : 6%

Market Summary

- The construction equipment market in APAC is characterized by a period of sustained expansion, fueled by extensive infrastructure modernization and rapid urbanization. This growth is not merely quantitative; it involves a significant technological transformation, moving machinery from standalone assets to intelligent components within a connected digital worksite ecosystem.

- Key drivers include massive government spending on transportation and energy projects and demographic shifts requiring new residential and commercial construction. A significant business scenario involves contractors leveraging telematics to manage mixed fleets on large-scale civil engineering projects.

- By analyzing real-time data on fuel consumption, operational hours, and predictive maintenance alerts, a firm can optimize asset allocation and schedule service proactively, reducing equipment downtime and improving project profitability. However, the high capital cost of machinery equipped with features like GPS-guided machine control and the pervasive shortage of skilled operators to manage this new technology remain considerable hurdles.

- The market is also shaped by a strong push toward sustainability, driving the alternative powertrain adoption of electric and hybrid solutions to meet stricter emissions regulations.

What will be the Size of the APAC Construction Equipment Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the APAC Construction Equipment Market Segmented?

The apac construction equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2026-2030, as well as historical data from 2020-2024 for the following segments.

- Application

- Commercial

- Residential

- Infrastructure

- Product

- Earthmoving equipment

- Material handling equipment

- Concrete and road construction

- Others

- End-user

- Public works

- Mining

- Military

- Others

- Geography

- APAC

- China

- India

- Japan

- APAC

By Application Insights

The commercial segment is estimated to witness significant growth during the forecast period.

The commercial segment is evolving beyond traditional projects, driven by demand for logistics facilities and data centers.

This shift fuels the need for specialized vertical construction equipment and urban construction machinery capable of zero-emission operation to meet stringent green building standards equipment.

Advanced telematics are crucial for effective construction fleet management on complex, time-sensitive projects, optimizing assets like all-terrain cranes and machinery with operator-assist features.

As contractors increasingly prioritize emissions reduction technology and worksite safety systems, decisions are based on the long-term total cost of ownership (TCO).

The use of prefabricated construction methods and tools with intelligent compaction systems on commercial sites has demonstrated an ability to reduce project timelines by over 15%, enhancing overall efficiency.

The Commercial segment was valued at USD 30.52 billion in 2024 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2025 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

- Strategic decision-making in the construction equipment market in APAC now involves detailed analysis beyond initial purchase price. For instance, a comparative study of an electric mini excavator TCO vs diesel model reveals that while upfront costs are higher, operational savings on fuel and maintenance can lead to a break-even point within three years, influencing long-term fleet acquisition strategies.

- The use of telematics for mixed fleet optimization is becoming standard, allowing firms to manage assets from various manufacturers under one digital umbrella. For infrastructure work, achieving GPS machine control for road grading accuracy is critical, with some projects mandating this technology to reduce rework.

- In the mining sector, the implementation of autonomous haulage systems in iron ore mining has proven to enhance safety and productivity significantly. Businesses are increasingly exploring EaaS models for specialized construction equipment, offloading maintenance burdens and converting capital expenses to operational ones.

- The development of hydrogen fuel cells for heavy-duty excavators represents a long-term goal for decarbonizing the most energy-intensive applications. On-site, intelligent compaction for highway projects and 3D paving control for asphalt quality ensure compliance with stringent quality standards. Safety is paramount, with remote control demolition robot safety features enabling work in hazardous environments.

- Technicians now rely on predictive maintenance for excavator hydraulic systems to prevent failures. Large-scale projects depend on the tunnel boring machine for urban metro projects and have clear modular construction crane selection criteria to ensure efficiency. To address labor shortages, operator-assist features for reducing fatigue are gaining traction.

- Navigating diesel particulate filter retrofitting regulations and leveraging a digital twin for infrastructure project management are key operational tasks. However, the challenges of integrating new construction technology and the impact of skilled operator shortage on productivity are significant hurdles.

- Finally, a thorough analysis of the total cost of ownership for all-terrain cranes and militarized backhoe loader armor specifications informs specialized procurement, while businesses develop strategies for combating economic cycles in equipment acquisition.

What are the key market drivers leading to the rise in the adoption of APAC Construction Equipment Industry?

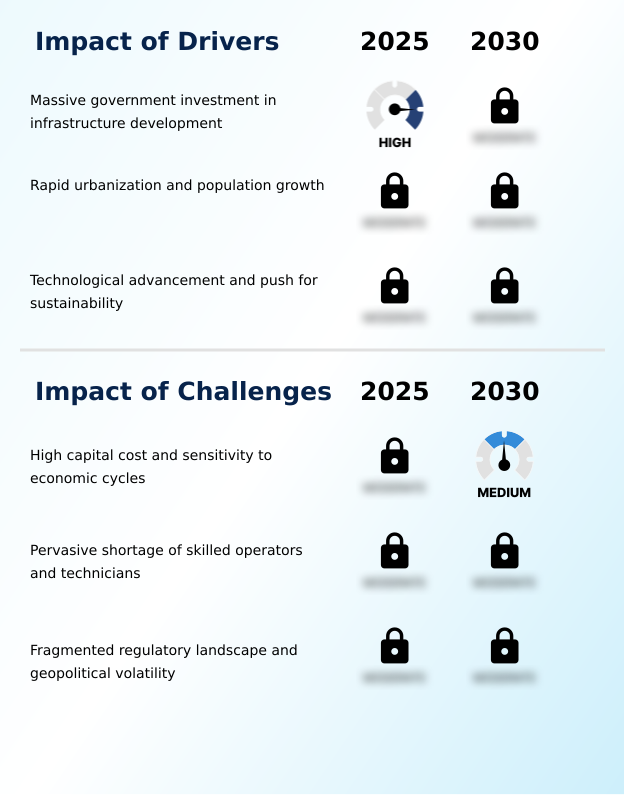

- Massive government-led investment in infrastructure development across the region serves as the most significant and foundational driver for the market.

- Massive government spending on modernization underpins demand for advanced infrastructure project equipment. This creates a consistent need for sophisticated road building machinery and site preparation machinery.

- The skilled operator shortage impact is mitigated by technologies like GPS-guided machine control, which enhances precision, and 3D paving control, improving material usage by over 10%. Integrating machinery data into a digital twin model allows for enhanced project oversight.

- Demand for regulatory compliance machinery, such as equipment fitted with a diesel particulate filter (DPF), is standard.

- This driver also extends to niche areas, including waste management vehicles like landfill compactors and machinery for modular construction, with predictive maintenance now reducing equipment downtime by an average of 20%.

What are the market trends shaping the APAC Construction Equipment Industry?

- The accelerated adoption of electric and alternative powertrains is a transformative trend, fundamentally reshaping equipment design and operational criteria.

- The accelerating alternative powertrain adoption represents a pivotal trend, with sustainable construction equipment becoming a competitive differentiator. This shift involves the deployment of electric powertrain systems for low-noise operation in urban areas and the exploration of hybrid diesel-electric systems for heavier applications.

- This heavy machinery modernization is complemented by new business structures like rental and leasing models and integrated equipment-as-a-service (EaaS) solutions, which optimize equipment lifecycle management. The modern digital worksite ecosystem now incorporates machines with advanced safety features like real-time load monitoring and anti-collision sensors, improving worksite incident avoidance by up to 25%.

- Forward-looking R&D in areas like hydrogen fuel cell technology signals a long-term commitment to decarbonization.

What challenges does the APAC Construction Equipment Industry face during its growth?

- The high capital cost of advanced machinery, combined with the industry's inherent sensitivity to economic cycles, presents a primary challenge to market growth.

- The fragmented regulatory landscape presents a significant challenge, requiring manufacturers to navigate disparate rules like the China IV emissions standards and develop extensive after-sales service networks. Geopolitical volatility can disrupt cross-border infrastructure projects and strain the component supply chain for everything from quarrying machinery to port and industrial equipment.

- In specialized sectors, the high cost of combat support equipment, including militarized backhoe loaders and combat engineer vehicles, limits procurement cycles. Advanced systems like the geological monitoring system and automated segment erection system require substantial upfront investment, which can be a barrier.

- Initiatives like the i-Construction initiative push for remote operation, but this increases technological complexity and cost, with integration challenges causing project delays in over 15% of initial deployments.

Exclusive Technavio Analysis on Customer Landscape

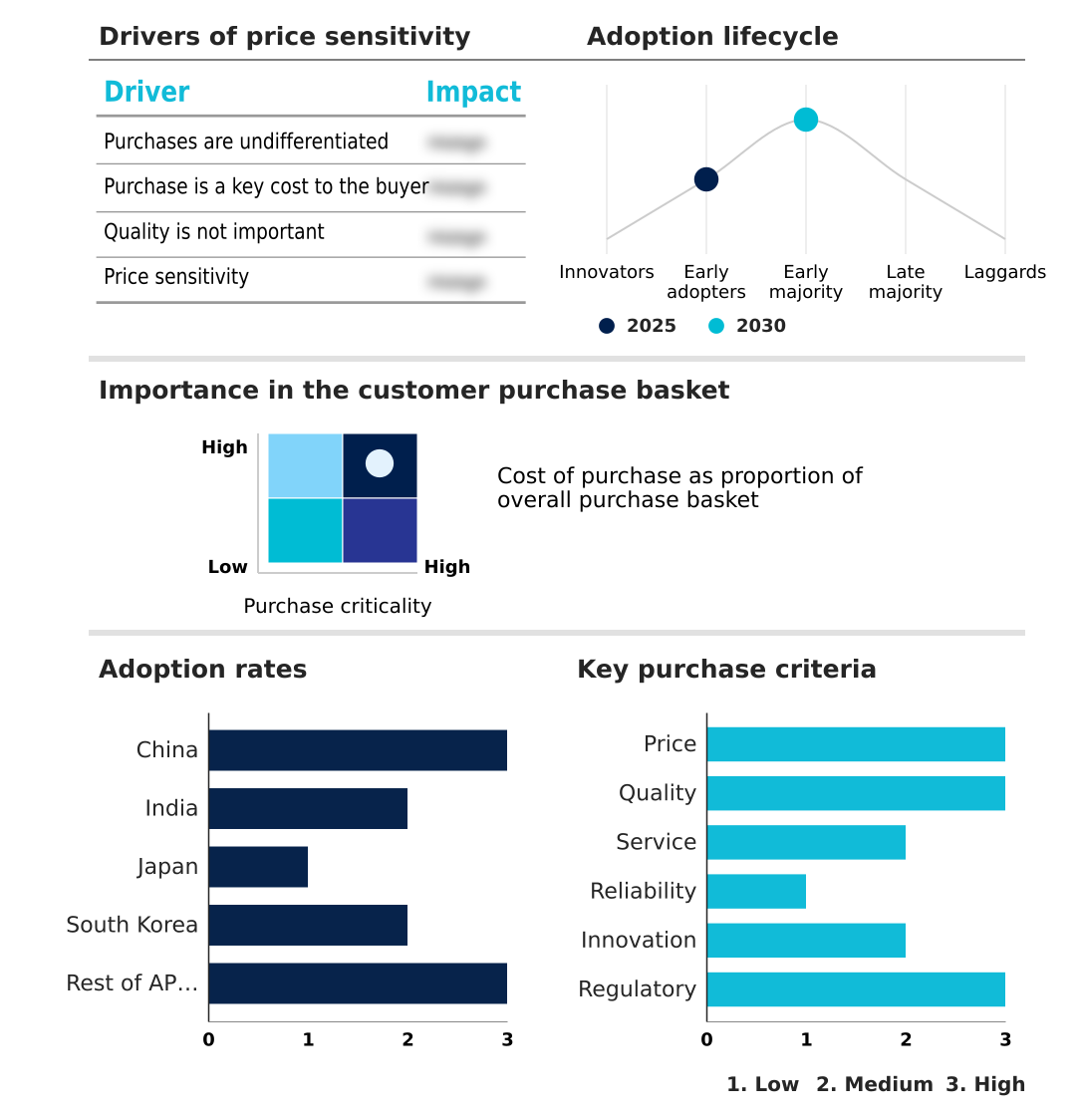

The apac construction equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the apac construction equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of APAC Construction Equipment Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, apac construction equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Volvo - A diverse portfolio of construction and demolition equipment is engineered for applications ranging from earthmoving and paving to material handling and site compaction.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- BEML Ltd.

- Caterpillar Inc.

- Doosan Corp.

- HD Hyundai Construction

- Hitachi Construction Machinery

- J C Bamford Excavators Ltd.

- Kobelco Construction Machinery

- Komatsu Ltd.

- Kubota Corp.

- Liebherr International AG

- Liugong Machinery Co. Ltd.

- Lonking Holdings Ltd.

- Sany Group

- SDLG Construction Machinery

- Sumitomo Heavy Industries Ltd.

- Xuzhou Construction Machinery

- Zoomlion Industry Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Apac construction equipment market

- In April 2025, Herrenknecht AG began excavation on a new Sydney Metro line section using a custom-built earth pressure balance tunnel boring machine (TBM) designed for the city's variable geological conditions.

- In March 2025, Tadano Ltd. launched its new generation of all-terrain cranes for the APAC market, featuring an advanced AI-powered safety system to assist with complex lifts in congested urban and industrial environments.

- In February 2025, Volvo Construction Equipment announced a strategic partnership with a leading South Korean battery manufacturer to co-develop high-capacity, fast-charging power systems for its next-generation electric compact excavators and wheel loaders.

- In January 2025, Caterpillar Inc. inaugurated a new regional parts distribution and technical training center in Vietnam, aiming to enhance service capabilities and reduce equipment downtime for customers across Southeast Asia.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled APAC Construction Equipment Market insights. See full methodology.

| Market Scope | |

|---|---|

| Page number | 219 |

| Base year | 2025 |

| Historic period | 2020-2024 |

| Forecast period | 2026-2030 |

| Growth momentum & CAGR | Accelerate at a CAGR of 6% |

| Market growth 2026-2030 | USD 26760.4 million |

| Market structure | Fragmented |

| YoY growth 2025-2026(%) | 5.3% |

| Key countries | China, India, Japan, South Korea and Rest of APAC |

| Competitive landscape | Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The construction equipment market is undergoing a profound transformation driven by the dual pressures of productivity and sustainability. The integration of telematics and GPS-guided machine control is no longer a niche feature but a core component of modern machinery, enabling capabilities like predictive maintenance and precision work that significantly lowers the total cost of ownership (TCO).

- This technological shift is evident in the development of everything from intelligent compaction systems for roadwork to fully autonomous haulage systems (AHS) in mining. A key boardroom consideration is the investment in electric powertrain and hybrid diesel-electric systems, as compliance with China IV emissions standards and other regulations becomes non-negotiable.

- Firms are achieving over 20% improvement in operational efficiency by adopting operator-assist features. The push for innovation extends to highly specialized equipment, including advanced tunnel boring machine (TBM) models and machinery for prefabricated construction. Even specialized military procurement for combat engineer vehicles now emphasizes advanced, software-driven capabilities, reflecting an industry-wide move toward smarter, more efficient, and cleaner operations.

- The long-term trajectory is pointed towards zero-emission solutions like hydrogen fuel cell technology.

What are the Key Data Covered in this APAC Construction Equipment Market Research and Growth Report?

-

What is the expected growth of the APAC Construction Equipment Market between 2026 and 2030?

-

USD 26.76 billion, at a CAGR of 6%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Commercial, Residential, and Infrastructure), Product (Earthmoving equipment, Material handling equipment, Concrete and road construction, and Others), End-user (Public works, Mining, Military, and Others) and Geography (APAC)

-

-

Which regions are analyzed in the report?

-

APAC

-

-

What are the key growth drivers and market challenges?

-

Massive government investment in infrastructure development, High capital cost and sensitivity to economic cycles

-

-

Who are the major players in the APAC Construction Equipment Market?

-

AB Volvo, BEML Ltd., Caterpillar Inc., Doosan Corp., HD Hyundai Construction, Hitachi Construction Machinery, J C Bamford Excavators Ltd., Kobelco Construction Machinery, Komatsu Ltd., Kubota Corp., Liebherr International AG, Liugong Machinery Co. Ltd., Lonking Holdings Ltd., Sany Group, SDLG Construction Machinery, Sumitomo Heavy Industries Ltd., Xuzhou Construction Machinery and Zoomlion Industry Co. Ltd.

-

Market Research Insights

- The market's dynamics are shaped by a strategic shift toward heavy machinery modernization and the development of a comprehensive digital worksite ecosystem. This evolution is driven by the need to enhance efficiency on large-scale infrastructure project equipment deployments and within dense urban construction machinery applications.

- Adopting sustainable construction equipment is no longer optional, as it aligns with new regulatory frameworks and corporate mandates. For example, firms using telematics for construction fleet management have reported a 15% reduction in fuel costs. Furthermore, the transition to flexible rental and leasing models allows smaller contractors to access advanced technology, improving their competitiveness.

- This shift is critical as the skilled operator shortage impact has been shown to increase project timelines by up to 10% on sites using legacy equipment.

We can help! Our analysts can customize this apac construction equipment market research report to meet your requirements.