Artificial Intelligence (AI) in BFSI Sector Market Size 2025-2029

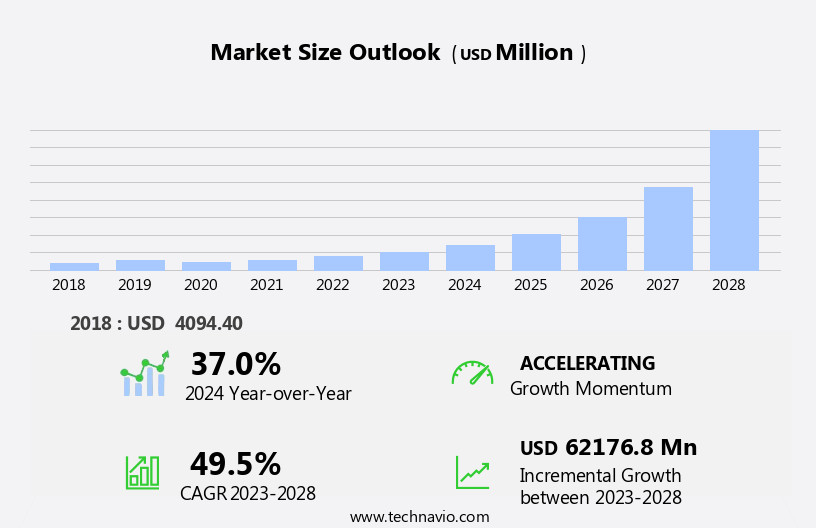

The artificial intelligence (AI) in BFSI sector market size is forecast to increase by USD 101.35 billion, at a CAGR of 54.2% between 2024 and 2029.

- The Artificial Intelligence (AI) market in the BFSI sector is witnessing significant growth, driven by the increasing need for enhanced operational efficiency. AI technologies, such as machine learning and natural language processing, are revolutionizing various BFSI processes, including fraud detection, risk assessment, and customer service. Moreover, the rise of cloud-based AI solutions is enabling smaller financial institutions to adopt these advanced technologies, thereby expanding the market's reach. Deep learning algorithms and machine learning models enhance risk management and algorithmic trading, while AI governance and infrastructure support big data processing and cloud computing.

- Ensuring data security and privacy is another significant challenge, given the sensitive nature of financial data. Furthermore, integrating AI systems with existing legacy systems and ensuring seamless data transfer can be a complex process, requiring substantial resources and expertise. Effective management of these challenges will be crucial for companies seeking to capitalize on the market's opportunities and stay competitive in the rapidly evolving BFSI landscape.

What will be the Size of the Artificial Intelligence (AI) in BFSI Sector Market during the forecast period?

- In the BFSI sector, Artificial Intelligence (AI) is revolutionizing business operations and driving significant market trends. AI-powered customer onboarding streamlines the process, reducing costs and enhancing the customer experience. In capital markets, AI-driven customer segmentation and investment optimization provide data-driven insights for personalized financial recommendations. AI-powered financial modeling and portfolio management increase efficiency, while real-time fraud detection and cybersecurity threat prevention ensure security.

- Furthermore, AI-powered payment processing and lending leverage data-driven risk management and automated underwriting to provide personalized services and improve overall customer satisfaction. Overall, AI is transforming the BFSI sector by automating processes, enhancing decision making, and providing personalized services, leading to increased efficiency and competitiveness. AI-powered investment banking and regulatory reporting automate complex processes, improving accuracy and reducing manual errors. AI-powered insurance underwriting and claims processing enable faster and more accurate risk scoring and claims management. Enhanced decision making is possible through AI-powered wealth management, trade finance, and lending.

How is this Artificial Intelligence (AI) in BFSI Sector Industry segmented?

The artificial intelligence (AI) in BFSI sector industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Banking

- Investment and securities management

- Insurance

- Solution

- Software

- Services

- Type

- Fraud detection and prevention

- Customer relationship management

- Data analytics and prediction

- Anti-money laundering

- Others

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

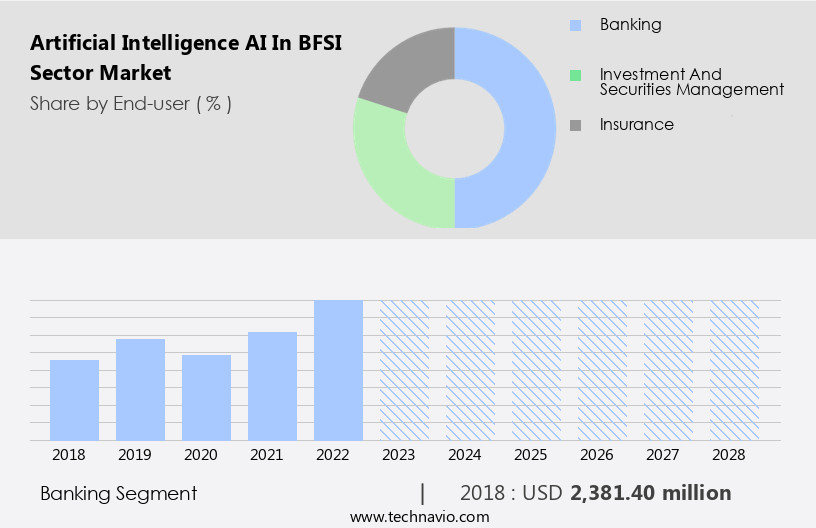

The banking segment is estimated to witness significant growth during the forecast period. In the banking sector, Artificial Intelligence (AI) is revolutionizing business operations and customer experiences. Banks are adopting AI strategies to automate decision-making processes, develop cognitive models, and deploy predictive analytics for fraud detection and investment management. Speech recognition technology enables virtual assistants to handle customer queries, while computer vision and image recognition facilitate personalized banking services. AI ethics and data privacy are essential considerations in model development and deployment. Financial inclusion is a priority, with AI-powered solutions offering access to banking services through digital identity verification and open banking. Biometric authentication and blockchain technology ensure data security and anti-money laundering compliance.

Explainable AI (XAI) is crucial for transparency and trust. Digital transformation continues to shape the banking industry, with AI innovation driving customer service, loan origination, financial advisory, and loan origination. Data analytics and predictive analytics enable banks to gain valuable insights and make informed decisions. AI adoption is a critical trend, with banks investing in AI talent and model monitoring to maintain a competitive edge. The future of banking lies in AI-driven innovation, providing seamless, efficient, and secure services to meet the evolving needs of tech-savvy customers.

The Banking segment was valued at USD 3 billion in 2019 and showed a gradual increase during the forecast period.

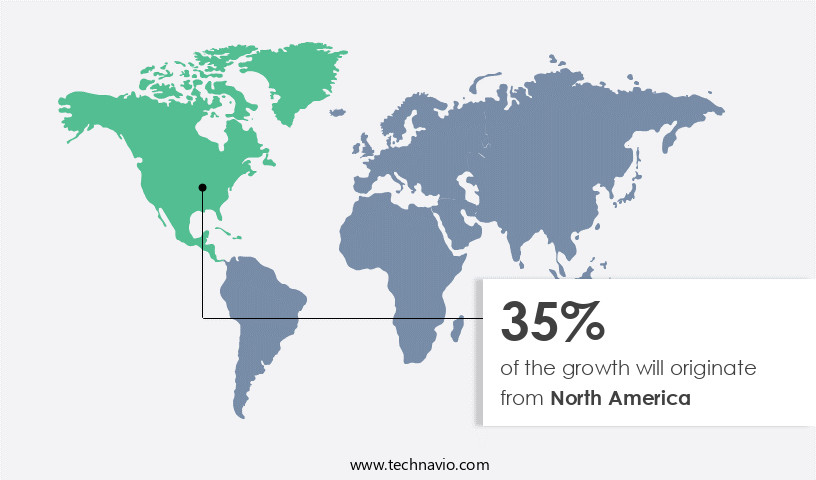

Regional Analysis

North America is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The Artificial Intelligence (AI) market in the BFSI sector in North America is experiencing significant growth, fueled by the early adoption and substantial investments in AI technologies by major tech companies such as IBM, Google, Microsoft, and Amazon Web Services (AWS). These tech giants are driving the market with their advanced offerings in AI model development, cognitive computing, speech recognition, and automated decision making. AI ethics and explainable AI (XAI) are also gaining importance in the region, ensuring transparency and accountability in AI model deployment. AI-powered solutions are revolutionizing various BFSI applications, including fraud detection, investment management, and customer service.

Predictive analytics and data analytics are enabling financial institutions to make informed decisions, while computer vision and image recognition are enhancing risk management and anti-money laundering (AML) efforts. Open banking and digital identity are also facilitating financial inclusion, further expanding the market's reach. The increasing adoption of AI technologies necessitates significant data center infrastructure and computing power. In response, data center providers are installing data centers closer to the edge to reduce latency and improve performance. Deep learning and machine learning are essential components of AI, with deep learning being particularly popular for its ability to process large datasets and learn from them autonomously.

Data security and privacy are critical concerns in the BFSI sector, necessitating robust AI model monitoring and deployment strategies. AI governance and algorithmic trading are also essential components of the market, ensuring compliance with regulations and ethical business practices. The AI market in the BFSI sector is evolving rapidly, with AI innovation and talent being key drivers. Big data and cloud computing are enabling the collection, storage, and analysis of vast amounts of data, while AI infrastructure is providing the necessary foundation for AI adoption. Overall, the market is poised for continued growth, with AI adoption expected to increase across various applications and industries in North America.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Artificial Intelligence (AI) in BFSI Sector market drivers leading to the rise in the adoption of Industry?

- AI's integration in operations significantly boosts market efficiency, serving as the primary market growth catalyst. Artificial Intelligence (AI) is revolutionizing the banking and financial services industry (BFSI) by enhancing operational efficiency and enhancing customer experience. The vast amounts of data generated by traditional banks and financial institutions necessitate advanced technologies like AI and data analytics for gaining valuable insights. Initially, AI was primarily used in front-office operations, such as customer service. However, its application is now expanding to back-office functions, including fraud detection, risk management, and compliance. Deep learning, a subset of AI, is being employed for image recognition in various applications, such as identity verification and check fraud detection. AI is being used to improve operational efficiency, enhance customer experience, and address data security and privacy concerns. The future of the BFSI sector lies in the integration of AI and data analytics to gain valuable insights and provide personalized offerings to customers.

- Personalized banking is another area where AI is making a significant impact, with AI models being trained on customer data to provide customized offerings and recommendations. AI innovation is also transforming customer service, with chatbots and virtual assistants becoming increasingly common. Data security and privacy are critical concerns in the BFSI sector, and AI is being used to address these challenges. AI models are being deployed to detect and prevent fraudulent activities, while digital identity verification is being strengthened through AI-powered biometric authentication. The demand for AI talent is on the rise, as organizations seek to leverage AI to gain a competitive edge. The adoption of AI in the BFSI sector is a response to the growing volume and complexity of data and the evolving customer expectations.

What are the Artificial Intelligence (AI) in BFSI Sector market trends shaping the Industry?

- Cloud-based solutions are gaining increasing popularity in the market, representing an emerging trend for professionals. This trend reflects the growing demand for flexible, efficient, and cost-effective technology solutions. Artificial Intelligence (AI) is revolutionizing the Business Finance Services Industry (BFSI) sector through advanced technologies like machine learning, deep learning, and neural networks. These technologies enable the development of cloud-based AI software and services, such as natural language processing and computer vision, which can handle vast amounts of data for demand forecasting. The financial sector's adoption of AI is driven by the availability of new technologies, including machine learning algorithms and cloud computing.

- AI governance and risk management are crucial considerations for financial institutions as they adopt AI technologies for loan origination, financial advisory, and algorithmic trading. The integration of AI in the BFSI sector is a critical aspect of digital transformation, enabling more accurate predictions, faster decision-making, and improved customer experiences. However, implementing AI technologies in on-premises data centers requires significant compute and storage capabilities, leading to increased capital expenditure. To mitigate this cost, BFSI companies are exploring cost-effective strategies for AI infrastructure.

How does Artificial Intelligence (AI) in BFSI Sector market face challenges during its growth?

- The need for ensuring high data quality is a significant challenge that can hinder industry growth. In today's data-driven business landscape, the consequences of working with inaccurate or incomplete data can be costly and time-consuming. Therefore, prioritizing data quality initiatives and implementing robust data validation processes are essential for companies aiming to stay competitive and innovative. Artificial Intelligence (AI) is revolutionizing the Business Finance Services Industry (BFSI) sector by enabling automated decision-making, speech recognition, and cognitive computing. AI models, such as those used for fraud detection and investment management, require high-quality data to function effectively. Financial institutions must ensure the credibility of their data sources to derive valuable insights. Strict regulations, including GDPR, PSD2, MiFID II, and FinCEN, mandate improved data governance to protect user privacy and prevent data breaches.

- AI model development and monitoring are crucial to maintain the accuracy and effectiveness of these systems. Speech recognition technology enables voice-activated transactions and customer interactions, enhancing the user experience. The implementation of AI-based solutions in the BFSI sector is a strategic move to gain a competitive edge. The ability to process vast amounts of data and derive actionable insights is transforming various aspects of the industry. Ensuring data quality and compliance with regulations are essential to maximize the benefits of AI technology. AI systems are increasingly being used for tasks like sentiment analysis, data analytics, and fraud detection. Virtual assistants, powered by AI, offer personalized customer service and streamline internal processes.

Exclusive Customer Landscape

The artificial intelligence (AI) in BFSI sector market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the artificial intelligence (AI) in BFSI sector market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, artificial intelligence (AI) in BFSI sector market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alphabet Inc. - The company, a global leader in technology, delivers artificial intelligence solutions for the Banking, Financial Services, and Insurance (BFSI) sector via its subsidiary, Google LLC.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alphabet Inc.

- Amazon.com Inc.

- Amelia US LLC

- Baidu Inc.

- Glia Technologies Inc

- Inbenta Holdings Inc.

- Intel Corp.

- International Business Machines Corp.

- Lexalytics Inc.

- Microsoft Corp.

- NVIDIA Corp.

- Oracle Corp.

- Palantir Technologies Inc.

- Salesforce Inc.

- SAP SE

- ServiceNow Inc.

- Verint Systems Inc.

- ZestFinance Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Artificial Intelligence (AI) in BFSI Sector Market

- In February 2023, Mastercard announced the launch of its new AI-powered fraud detection solution, Mastercard Decision Intelligence, which uses machine learning algorithms to analyze transaction data in real-time and identify potential fraud (Mastercard Press Release).

- In June 2024, IBM and JPMorgan Chase signed a multi-year partnership to co-create industry-specific AI solutions for the banking sector, with a focus on areas such as risk management, customer service, and regulatory compliance (IBM Press Release).

- In January 2025, the European Central Bank (ECB) announced the launch of a new AI project, named 'Project Hercules,' aimed at developing advanced AI models to analyze financial data and improve risk management and supervisory processes within the European banking sector (ECB Press Release). These developments underscore the growing importance of AI in the BFSI sector, with a focus on fraud detection, strategic partnerships, investment in innovative technologies, and regulatory compliance.

Research Analyst Overview

In the BFSI sector, artificial intelligence (AI) continues to revolutionize business operations and customer experiences. From loan origination to financial advisory, AI adoption is transforming various sectors within the industry. AI models are being developed to automate decision-making processes, enabling faster and more accurate results. Speech recognition and cognitive computing are being employed for customer service, enhancing the overall experience. Fraud detection is another area where AI is making a significant impact, with machine learning algorithms analyzing vast amounts of data to identify patterns and anomalies. Predictive analytics and AI-powered solutions are driving financial inclusion by providing personalized banking services and investment management.

AI governance and ethical considerations are becoming increasingly important, with explainable AI (XAI) being adopted to ensure transparency and accountability. Big data and cloud computing are essential components of AI infrastructure, enabling the processing and analysis of massive amounts of data. Algorithmic trading and risk management are also benefiting from AI, with deep learning models being used to analyze market trends and identify potential risks. Biometric authentication and computer vision are enhancing security, while open banking and digital identity are enabling more convenient and secure transactions. AI innovation is ongoing, with new applications and use cases emerging regularly. Data privacy and security are critical concerns, with AI models being trained on ethical and diverse data sets.

The Artificial Intelligence (AI) in BFSI Sector Market is revolutionizing financial services through automation and advanced analytics. AI-driven fraud prevention and cybersecurity threat detection enhance security while automated claims processing boosts efficiency. Institutions leverage AI-powered KYC/AML compliance to streamline verification processes, ensuring regulatory adherence. Data-driven customer insights enable personalized marketing, improving client engagement. AI fosters reduced costs and improved accuracy in various financial operations, including AI-powered regulatory reporting, AI-powered portfolio management, AI-powered claims management, and AI-powered trade finance. Moreover, AI-powered lending and AI-powered capital markets optimize decision-making, driving profitability and operational excellence.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Artificial Intelligence (AI) In BFSI Sector Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 54.2% |

|

Market growth 2025-2029 |

USD 101.35 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

41.1 |

|

Key countries |

US, Canada, China, Germany, UK, France, Mexico, Italy, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Artificial Intelligence (AI) In BFSI Sector Market Research and Growth Report?

- CAGR of the Artificial Intelligence (AI) In BFSI Sector industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the artificial intelligence (ai) in bfsi sector market growth of industry companies

We can help! Our analysts can customize this artificial intelligence (ai) in bfsi sector market research report to meet your requirements.