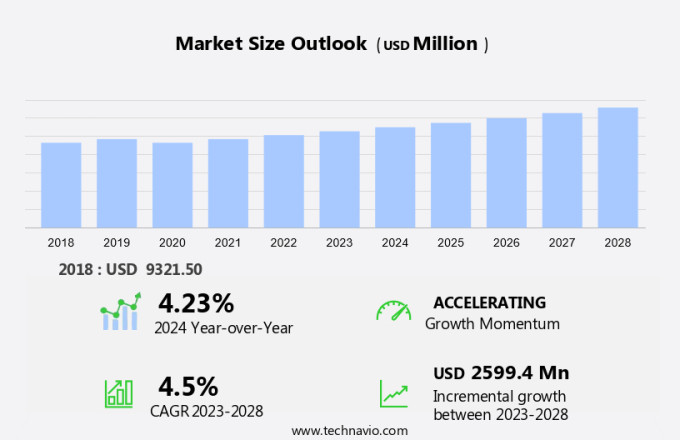

Automotive Adhesive Tapes Market Size 2024-2028

The automotive adhesive tapes market size is forecast to increase by USD 2.6 billion at a CAGR of 4.5% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for cost-effective bonding and joining solutions in the automobile industry. High-performance adhesive tapes, such as double-sided tapes, silicone rubber tapes, and polyurethane foam tapes, are increasingly being used for advanced applications, including harness wrap, protective masking, and masking. The adoption of these tapes is driven by their ability to provide superior bonding strength and durability, even in harsh environments. Adhesive chemistry plays a crucial role in the selection of the appropriate tape for various applications. Solvent-based, emulsion, and hot melt adhesives are commonly used in the automotive industry.

What will the size of the market be during the forecast period?

The market is witnessing significant growth due to the increasing demand for lightweight vehicles and advancements in vehicle production technologies. These tapes play a crucial role in the manufacturing process of passenger automobiles and public transportation vehicles, as well as in aftermarket services. In the context of the US automotive industry, electric vehicles (EVs), hybrid vehicles, and battery-operated vehicles are gaining popularity due to stricter environmental standards and emission norms. The use of automotive adhesive tapes in these vehicles is essential for holding components such as electric car batteries, nut bolts fasteners, and mechanical fasteners in place. Automotive adhesive tapes are available in various materials, including polyurethanes, liquid adhesive residues, double-sided tape, and silicone rubber tape. Polyurethane foam tape, for instance, is commonly used for sealing and insulating applications in vehicles, while double-sided tape is utilized for attaching various components during the assembly process. Moreover, the trend towards autonomous driving is driving the demand for automotive adhesive tapes in the market. These tapes are used extensively in the production of sensors, cameras, and other critical components that enable autonomous driving technology. In the realm of public transportation, automotive adhesive tapes are employed in various applications, including buses, trains, and trams.

Further, the tapes help in ensuring the holding power of various components, such as nut bolts fasteners and mechanical fasteners, which are essential for the safe and efficient operation of these vehicles. The market is expected to grow at a steady pace due to the increasing demand for lightweight vehicles and the continuous advancements in vehicle production technologies. Furthermore, the increasing popularity of electric and hybrid vehicles, as well as the trend towards autonomous driving, is expected to create new opportunities for market growth. In conclusion, the market is an essential component of the automotive industry, playing a crucial role in vehicle production and aftermarket services. The market is driven by various factors, including the increasing demand for lightweight vehicles, advancements in vehicle production technologies, and the growing popularity of electric and hybrid vehicles. The use of automotive adhesive tapes is essential for ensuring the holding power of various components, enabling the safe and efficient operation of vehicles.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Interior

- Exterior

- Others

- Material

- Polypropylene

- Paper

- Others

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

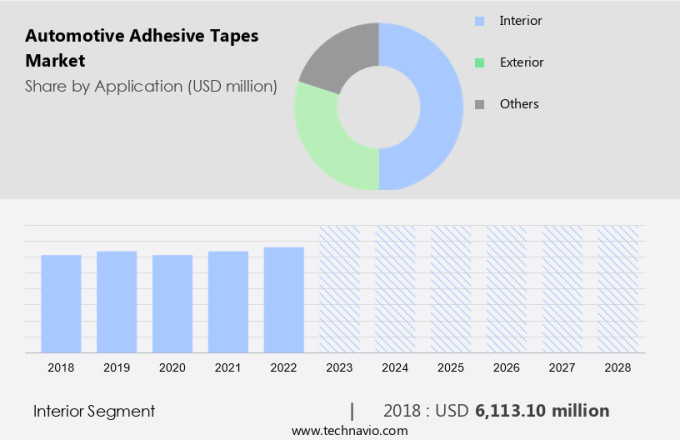

By Application Insights

The interior segment is estimated to witness significant growth during the forecast period. The market encompasses a wide range of applications within the cabin of vehicles, including asphalt sheets, cabin insulations, sealants and primary coverings, wire harnesses and clamps, and dashboard assembly components. Various types of adhesive tapes are utilized for these applications, such as paper tape, masking tape, transfer tape, double-sided tape, and foam tape. The specific functions of these tapes depend on the backing material and adhesive type. These functions can be categorized as adhesion, damping, padding, aesthetics, and others. According to industry estimates, adhesion accounts for the largest share of the interior automotive adhesive tape application. Automotive adhesive tapes play a crucial role in the production of passenger automobiles and public transportation vehicles, as well as battery-operated and hybrid vehicles. Solvent-based adhesives and acrylic adhesives are commonly used in the production of these tapes due to their strong bonding properties.

Further, polyvinyl chloride is a popular backing material due to its durability and resistance to moisture and temperature extremes. Environmental standards and emission norms continue to influence the market, with a growing emphasis on the use of eco-friendly adhesives and backing materials. The increasing trend towards autonomous driving also presents opportunities for innovation in the market. In summary, electric vehicle battery manufacturers and OEMs are increasingly adopting pressure-sensitive adhesive tape and high-quality nut bolt fasteners, including bolts and screws, to support the design and functionality of battery-operated vehicles, which operate without petroleum-based fuel.

Get a glance at the market share of various segments Request Free Sample

The interior segment accounted for USD 6.11 billion in 2018 and showed a gradual increase during the forecast period.

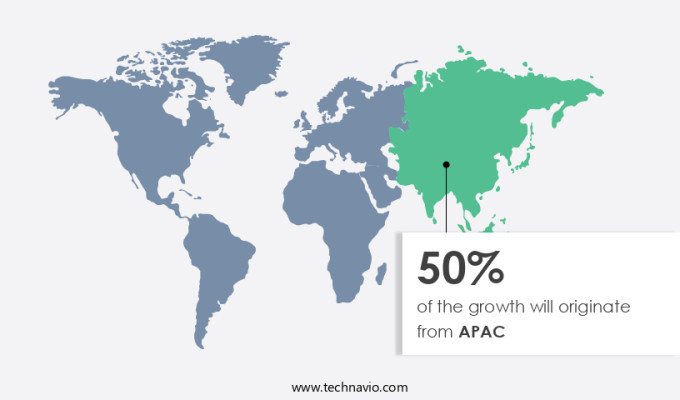

Regional Insights

APAC is estimated to contribute 50% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in the Asia Pacific (APAC) region is significant due to the production of a large number of vehicles, particularly in China, Japan, and India. In 2020, approximately 32 million passenger vehicles were sold, representing 23% of the global automotive adhesive tape consumption. APAC is a crucial region for this market due to the economies of scale it offers. Both passenger vehicles and commercial vehicles exhibit steady growth rates throughout the forecast period. Furthermore, the adoption of adhesive tapes contributes to the production of Lightweight components, thereby reducing Fuel consumption. However, it is crucial to address the potential Environmental hazards associated with adhesive tapes, such as Air quality, Water pollution, and Soil pollution, due to Liquid adhesive residues. Companies in this industry are investing in research and development to create eco-friendly adhesive tapes that mitigate these concerns.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The cost of operation for adhesive tape application is low is the key driver of the market. In the automotive industry, adhesive tapes play a significant role in the assembly process due to their numerous benefits. Compared to other joining methods like welding, adhesive application, design locking, bolting, and clamping, adhesive tapes offer several advantages. These advantages include lower material costs, easier assembly, reduced labor requirements, and shorter post-assembly curing times. The cost savings associated with using adhesive tapes can be attributed to the lower cost of raw materials. For instance, hot melt adhesives and acrylic foam tapes are commonly used in the automotive industry. These materials have lower raw material costs than those used in welding and other joining methods.

Additionally, the use of adhesive tapes eliminates the need for labor-intensive processes like bolting and clamping. Furthermore, the curing time for adhesive tapes is significantly shorter than that of other methods, allowing for faster production lines. Moreover, the environmental impact of adhesive tapes is a crucial consideration in today's automotive industry. Groundwater contamination and hazardous waste are significant concerns. However, the use of sustainable products, such as green adhesives, and advanced manufacturing techniques can help mitigate these issues. Luxury car manufacturers are increasingly adopting these practices to meet the growing demand for eco-friendly vehicles. In conclusion, the adoption of adhesive tapes in the automotive industry offers several advantages, including cost savings, ease of use, and environmental sustainability.

Market Trends

High-performance adhesive tapes for advanced aerodynamic application is the upcoming trend in the market. Adhesive tapes are gaining popularity in various industries due to their versatility and cost-effectiveness. These tapes, which come in high-performance variants, offer several advantages such as strong bonding strength, low net thickness, high flexibility, and superior functionality. They also boast excellent peel resistance and load capability, making them suitable for both axial and transverse loads. In the automotive sector, these tapes can be utilized extensively for exterior applications, particularly in wire harnessing. The use of adhesive tapes in this process can lead to lighter, more aerodynamic vehicle structures. This can result in fuel efficiency and reduced carbon emissions.

Furthermore, the growth is attributed to the increasing production of electric and hybrid vehicles, the rising demand for lightweight and fuel-efficient vehicles, and the growing trend of automotive customization. In conclusion, adhesive tapes are a valuable solution for various industrial applications, including the automotive sector. Their high-performance characteristics make them an ideal choice for exterior applications such as wire harnessing.

Market Challenge

Adhesive tapes cannot be used for critical functions is a key challenge affecting market growth. In the automotive industry, certain applications require joining methods beyond traditional double-sided tapes, such as silicone rubber tape and polyurethane foam tape. However, these applications often involve high-temperature or chemical exposure, which can limit the effectiveness of adhesive tapes.

About, by enhancing the capabilities of adhesive tapes, they can better meet the demands of the automotive industry and expand their application in bonding and joining processes. In the realm of automotive manufacturing, the pursuit of innovation continues to drive advancements in adhesive technology.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

3M Co. - The company offers automotive adhesive tapes that have high friction, fine resilient textured, slip resistant material and reverse side coated with pressure-sensitive adhesive protected by a removable liner.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Avery Dennison Corp.

- Berry Global Inc.

- Coating and Converting Technologies Inc.

- Compagnie de Saint Gobain

- Coroplast Fritz Muller GmbH and Co. KG

- GERGONNE INDUSTRIE

- Henkel AG and Co. KGaA

- Intertape Polymer Group Inc.

- L and L Products Inc.

- LINTEC Corp.

- Lohmann GmbH and Co.KG

- Nitto Denko Corp.

- ORAFOL Europe GmbH

- PPI Adhesive Products Ltd.

- Schweitzer Mauduit International Inc.

- Shurtape Technologies LLC

- Sika AG

- tesa SE

- THREEBOND INTERNATIONAL Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing production of passenger automobiles and public transportation vehicles. With the focus on lightweight vehicles to reduce fuel consumption and improve energy security, the use of adhesive tapes in vehicle manufacturing is increasing. The market is segmented into various types of adhesive tapes, including solvent-based adhesives, acrylic adhesives, and water-based adhesives. Electric vehicles, including battery-operated and hybrid vehicles, are also driving the demand for automotive adhesive tapes. These vehicles require adhesive tapes for bonding and joining various components, such as electric car batteries and electronic components. The automotive industry is also adopting sustainable manufacturing techniques and producing green adhesives to reduce environmental hazards. The use of adhesive tapes in vehicle interiors, exterior applications, and wire harnessing is also increasing due to their excellent adhesive strength and holding power.

Moreover, the growing trend of autonomous driving and the increasing production of premium cars are also expected to boost the market growth. However, the environmental impact of adhesive tapes, including liquid adhesive residues and hazardous waste, is a concern. The market is also witnessing the use of alternative backing materials, such as thermoplastic resin and rubber-based solvents, to reduce the environmental impact. In conclusion, The market is expected to witness significant growth due to the increasing production of passenger automobiles and public transportation vehicles, the shift towards electric vehicles, and the adoption of sustainable manufacturing techniques. The market is segmented into various types of adhesive tapes and applications, including bonding and joining, protective masking, and interior and exterior applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

173 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 2.60 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 50% |

|

Key countries |

China, US, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3M Co., Avery Dennison Corp., Berry Global Inc., Coating and Converting Technologies Inc., Compagnie de Saint Gobain, Coroplast Fritz Muller GmbH and Co. KG, GERGONNE INDUSTRIE, Henkel AG and Co. KGaA, Intertape Polymer Group Inc., L and L Products Inc., LINTEC Corp., Lohmann GmbH and Co.KG, Nitto Denko Corp., ORAFOL Europe GmbH, PPI Adhesive Products Ltd., Schweitzer Mauduit International Inc., Shurtape Technologies LLC, Sika AG, tesa SE, and THREEBOND INTERNATIONAL Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch