Automotive Power Window Motor Market Size 2024-2028

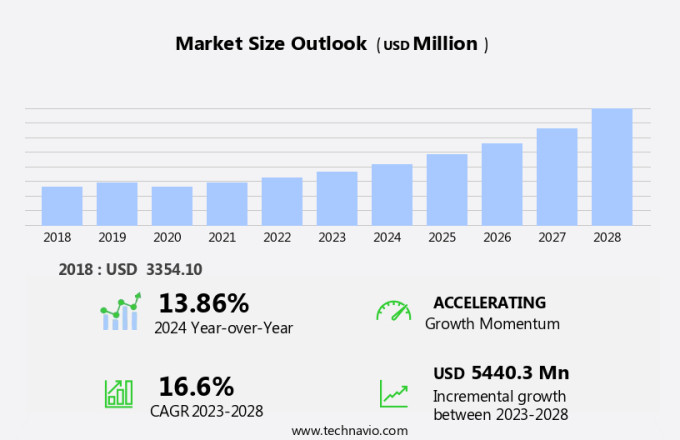

The automotive power window motor market size is forecast to increase by USD 5.44 billion at a CAGR of 16.6% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing adoption of power window systems in vehicles. This trend is driven by the convenience and comfort they offer to passengers. Additionally, the integration of advanced technologies such as anti-pinch sensors is gaining popularity, ensuring safety and preventing injuries. However, the market also faces challenges, including potential malfunctions in power window motors, which can lead to customer complaints and negative brand image. Manufacturers must focus on improving the reliability and durability of these components to maintain customer satisfaction and trust. Furthermore, the adoption of electric vehicles and the integration of power window systems with other vehicle features, such as smartphone connectivity, are expected to create new opportunities In the market.

What will be the Size of the Automotive Power Window Motor Market During the Forecast Period?

- The market is a critical component of passenger cars, enabling seamless glass platform movement with the push of a button. According to industry experts, this market is experiencing significant growth due to increasing automobile production and the integration of antipinch automotive power features for enhanced safety and convenience. Furthermore, the trend toward vehicle electrification and the rise of autonomous vehicles are driving demand for advanced power window motors. These systems require semiconductors, switches, cables, gears, and other components, which are increasingly being sourced from lightweight materials such as composites, plastics, and rubber to reduce vehicle weight and improve fuel efficiency.

- Additionally, the integration of batteries into electric vehicles presents new opportunities for power window motor manufacturers. The market is also witnessing innovation In the form of 3D printed parts and the use of advanced materials to create more efficient and durable motors. Overall, the market is poised for continued growth, driven by technological advancements and evolving consumer preferences.

How is this Automotive Power Window Motor Industry segmented and which is the largest segment?

The automotive power window motor industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger cars

- Commercial vehicles

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Application Insights

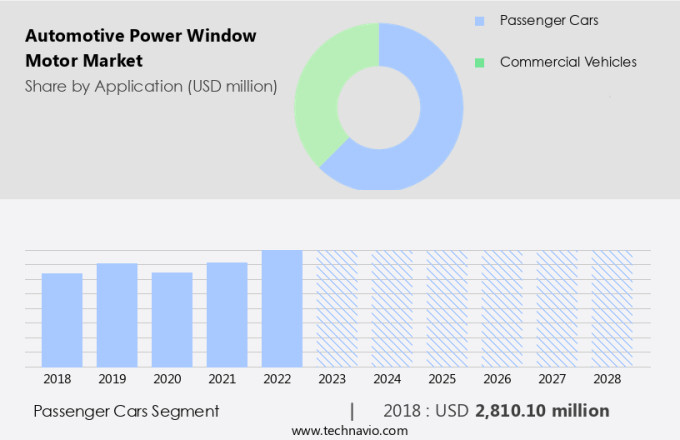

- The passenger cars segment is estimated to witness significant growth during the forecast period.

The market for passenger cars is experiencing steady growth due to the standard inclusion of power windows in new models. This trend extends to entry-level vehicles as well. The safety feature of anti-pinch power window systems, which prevent windows from closing on obstacles, is a significant contributor to the market's expansion. Power window motors In these systems incorporate sensors that detect obstacles and halt window movement accordingly. The automotive industry's shift towards vehicle electrification and automation further boosts the market's growth. Semiconductors, batteries, switches, cables, gears, and other components are integral to power window systems. Lightweight materials like aluminum, plastic, rubber, and composites are increasingly used to reduce vehicle weight and improve fuel efficiency.

Electric vehicles are also driving demand for advanced power window systems. Market experts project continued growth in this sector, with key players including Brose, Aisin Corporation, and Shiroki Corporation.

Get a glance at the Automotive Power Window Motor Industry report of share of various segments Request Free Sample

The Passenger cars segment was valued at USD 2.81 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

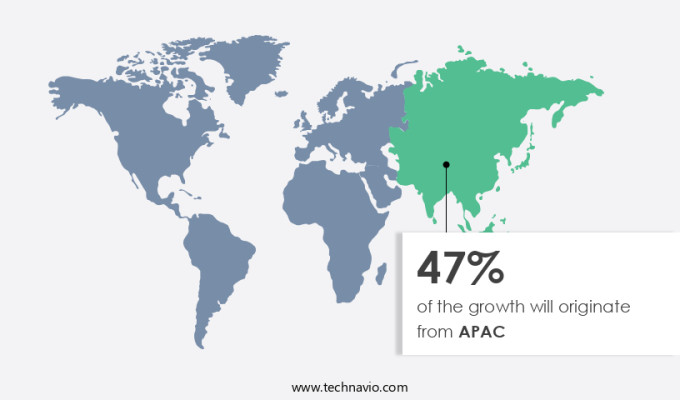

- APAC is estimated to contribute 47% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market In the Asia Pacific (APAC) region is experiencing significant growth due to the increasing prioritization of safety and convenience in vehicles. Advanced safety standards are being adopted in countries like South Korea and China, leading to the widespread use of power window systems in passenger cars and commercial vehicles. India is also making progress in this regard, albeit at a slower pace. This trend is expected to boost the demand for power window motors in APAC. Power window motors are essential components of these systems, enabling smooth and efficient window operation. These motors are typically made of materials such as aluminum, plastic, rubber, composites, and gears.

Semiconductors and batteries are also integral to their functioning. Key players In the market include Brose, Aisin Corporation, and Shiroki Corporation, among others. The automobile industry's shift towards vehicle electrification and autonomous vehicles is also driving demand for power window motors. These vehicles require lightweight and efficient components to optimize performance and reduce weight. Furthermore, the use of 3D printers and advanced materials like composites is enabling the production of more durable and cost-effective window regulators. In conclusion, the power window motor market in APAC is poised for growth due to the increasing adoption of power window systems in passenger cars and commercial vehicles, as well as the broader trend towards vehicle electrification and automation.

Companies that can offer high-performance, lightweight, and cost-effective power window motors are likely to succeed in this market.

Market Dynamics

Our automotive power window motor market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Power Window Motor Industry?

Growing adoption of power window system is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for safety and convenience features in both passenger cars and commercial vehicles. Power window systems, a key component of these features, are no longer exclusive to premium vehicles but are increasingly being incorporated into mid- and entry-level models. This trend is driving the adoption of automotive power window motors. Moreover, the automobile industry's shift towards vehicle electrification and automation is also fueling the demand for power window motors. Semiconductors and electric vehicles are at the forefront of this trend, with companies like Denso, Brose, Aisin Corporation, and Shiroki Corporation leading the way In the development and production of advanced power window motor technology.

- The use of lightweight materials, such as aluminum, plastic, rubber, composites, and batteries, in power window systems is another factor contributing to their growing popularity. The integration of 3D printers In the manufacturing process is also enabling the production of more complex and efficient power window motor designs. Despite the strong growth In the market, particularly in North America and Europe, penetration In the APAC region remains relatively low. However, with increasing consumer awareness and demand for advanced safety and convenience features, this trend is expected to change In the coming years. In conclusion, the market is poised for significant growth, driven by the increasing demand for safety and convenience features, vehicle electrification, and automation.

- The use of advanced materials and manufacturing technologies is also contributing to the market's growth. While the market is currently dominated by players like Denso, Brose, Aisin Corporation, and Shiroki Corporation, new entrants are expected to joIn the fray as the market continues to evolve.

What are the market trends shaping the Automotive Power Window Motor Industry?

Increasing adoption of anti-pinch technology in power window systems is the upcoming market trend.

- The market is experiencing significant growth, particularly In the realm of passenger cars. Experts predict that the integration of anti-pinch technology in power windows will be a major driving factor for market expansion. This safety feature, which prevents windows from closing on obstacles, is no longer exclusive to luxury vehicles but is gradually being incorporated into mid-trim passenger cars. The seventh generation of anti-pinch technology is under development, and it will incorporate semiconductors instead of relays. This innovation will enhance the efficiency and reliability of the power window system. Moreover, the trend toward vehicle electrification and automation is fueling the demand for advanced power window motor systems.

- Manufacturers of door control devices, such as Brose, Aisin Corporation, and Shiroki Corporation, are at the forefront of this development. They are focusing on producing lightweight materials, including aluminum, composites, and plastics, to reduce vehicle weight and improve fuel efficiency. Additionally, the integration of 3D printers In the manufacturing process is enabling the production of intricate and customized parts. The power window motor system comprises several components, including switches, cables, gears, and batteries. The switch is an essential component that enables the driver to control the window's movement, while the power range determines the window's speed. The use of advanced materials, such as aluminum and composites, is reducing the weight of these components and improving their durability.

- Denso, a leading supplier of automotive components, is also investing In the development of power window motors. They are focusing on producing high-performance motors that can handle the demands of electric vehicles and autonomous vehicles. Overall, the market is poised for substantial growth as the automobile industry continues to evolve.

What challenges does the Automotive Power Window Motor Industry face during its growth?

Possible malfunctions in power window motor markets is a key challenge affecting the industry growth.

- The market in passenger cars is subject to wear and tear due to frequent use and harsh environmental conditions. Power window systems, essential components in modern vehicles, can malfunction due to various reasons. For example, power window motors and regulators can jam, leading to difficulties in opening and closing windows. Faulty window regulators, cables, pulleys, and switches can also cause malfunctions. In colder regions, freezing temperatures can lead to window glass sticking to the frame, requiring the motor to exert more force, resulting in premature motor wear. Moreover, the increasing trend of vehicle electrification and automation is driving the demand for advanced power window systems.

- Automobile production companies are integrating antipinch automotive power window systems to ensure passenger safety. These systems prevent windows from closing when an object is detected In the closing zone. Additionally, semiconductors and lightweight materials such as aluminum, plastic, rubber, and composites are increasingly being used in power window systems to enhance vehicle performance and reduce weight. Furthermore, electric vehicles (EVs) are gaining popularity, and the power window market is witnessing significant growth in this sector. Door control devices, including power window systems, are crucial components in EVs, as they require precise control and energy efficiency. Companies such as Aisin Corporation, Shiroki Corporation, and Brose are leading players In the market for door control devices.

- In conclusion, the power window motor market in passenger cars is subject to wear and tear due to frequent use and harsh environmental conditions. However, the increasing trend of vehicle electrification and automation is driving the demand for advanced power window systems. The market is witnessing significant growth In the electric vehicle sector, and companies are focusing on using lightweight materials and energy-efficient technologies to enhance vehicle performance and reduce weight.

Exclusive Customer Landscape

The automotive power window motor market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive power window motor market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive power window motor market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AISIN CORP. - The Chassis and Vehicle Safety Systems division of the company manufactures and markets automotive power window motors. These motors are integral components of modern vehicles, enabling seamless and convenient window operation. With advancements in technology, power window motors have become more efficient and reliable, enhancing the overall driving experience. The division's product offerings cater to various vehicle types and models, ensuring compatibility and versatility. The company's commitment to innovation and quality has positioned it as a trusted supplier In the global automotive industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AISIN CORP.

- Brose Fahrzeugteile SE and Co. KG

- Continental AG

- DENSO Corp.

- General Motors Co.

- HI-LEX Corp.

- Inteva Products LLC

- Jiangxi Dellsun Auto Motor Co. Ltd.

- Johnson Electric Holdings Ltd.

- KUSTER Holding GmbH

- Mabuchi Motor Co. Ltd.

- Magna International Inc.

- Mitsuba Corp.

- Ningbo Hengte Auto Parts Co. Ltd.

- Robert Bosch GmbH

- Shenzhen Power Motor Industrial Co. Ltd.

- Standard Motor Products Inc.

- Valeo SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the production and supply of electric motors used In the automobile industry for powering the opening and closing of vehicle windows. These motors are integral components of the window system, which also includes door control devices, button switches, and wiring. The market for automotive power windows has experienced significant growth due to the increasing demand for automobile production and the electrification of vehicles. The market is driven by several factors. The shift towards vehicle electrification and the integration of automation in vehicles have led to an increased demand for electric motors. Furthermore, the use of lightweight materials such as aluminum, composites, and plastics in vehicle manufacturing has fueled the need for efficient and powerful electric motors.

Experts predict that the market for automotive power windows will continue to grow due to the increasing popularity of electric vehicles. Electric vehicles (EVs) require electric motors for various functions, including power windows. Additionally, the trend towards autonomous vehicles is expected to further boost the demand for electric motors, as these vehicles require advanced window systems for optimal functionality. The production of automotive power window motors involves the use of semiconductors, batteries, switches, cables, gears, and other components. Manufacturers are constantly seeking to improve the efficiency and performance of these motors by using advanced materials and manufacturing techniques.

For instance, some manufacturers are exploring the use of 3D printers to produce lightweight and customized components for electric motors. The market is competitive, with several key players contributing to its growth. Companies such as Brose, AISIN Corporation, and Shiroki Corporation are major suppliers of automotive power window motors. These companies have established a strong presence In the market through their innovative products and global reach. The market for automotive power window motors is expected to continue its growth trajectory In the coming years. The increasing demand for electric and autonomous vehicles, coupled with the ongoing efforts to improve the efficiency and performance of electric motors, will drive the market forward.

Additionally, the use of advanced materials and manufacturing techniques is expected to lead to new innovations and applications for automotive power window motors. In conclusion, the market is an essential component of the automobile industry, providing electric motors for power windows in passenger cars and other vehicles. The market is driven by the increasing demand for electric and autonomous vehicles, as well as the ongoing efforts to improve the efficiency and performance of electric motors. Companies such as Brose, AISIN Corporation, and Shiroki Corporation are major players In the market, contributing to its growth through their innovative products and global reach.

|

Automotive Power Window Motor Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

152 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.6% |

|

Market growth 2024-2028 |

USD 5440.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

13.86 |

|

Key countries |

China, US, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Power Window Motor Market Research and Growth Report?

- CAGR of the Automotive Power Window Motor industry during the forecast period

- Detailed information on factors that will drive the Automotive Power Window Motor growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive power window motor market growth of industry companies

We can help! Our analysts can customize this automotive power window motor market research report to meet your requirements.