Automotive Wheel Market Size 2024-2028

The automotive wheel market size is forecast to increase by USD 11.05 billion at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing number of vehicles globally. This trend is driven by the development of ultra-lightweight automotive wheels for commercial vehicles, which enhance fuel efficiency and reduce emissions. However, the limitations of steel wheels, such as their heavy weight and susceptibility to corrosion, are hindering their adoption. To address these challenges, manufacturers are focusing on producing wheels made from advanced materials like aluminum and carbon fiber. These materials offer superior strength, durability, and weight reduction, making them an attractive alternative to steel wheels. Additionally, the growing demand for electric and autonomous vehicles is expected to create new opportunities for wheel manufacturers, as these vehicles require specialized wheels to support their unique features. Overall, the market is poised for growth, with innovation and technological advancements playing a crucial role in shaping its future.

What will be the Size of the Automotive Wheel Market During the Forecast Period?

- The market encompasses the production and sale of wheels, including rims, for passenger vehicles, light commercial vehicles, and heavy commercial vehicles. Wheels are available in various materials such as alloy, steel, aluminum, magnesium, and carbon fiber. Alloy wheels, a popular choice for their strength and lightweight properties, are increasingly preferred due to their contribution to vehicle dynamics and improved fuel efficiency. Middle-class people and luxury-priced consumers seek customized wheels with varied diameter and color options, often achieved through powder-coating.

- Lightweight metal alloys continue to gain traction In the market due to their cost-effectiveness and performance benefits. The market caters to diverse industries, including passenger vehicles, light commercial vehicles, construction & mining, agriculture tractors, and heavy commercial vehicles. Repair and maintenance of wheels remain significant, with ongoing demand for both standard and customized replacements. Automotive wheel manufacturers continue to innovate, offering advanced materials and designs to meet evolving consumer preferences and industry requirements.

How is this Automotive Wheel Industry segmented and which is the largest segment?

The automotive wheel industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Vehicle Type

- Commercial vehicles

- Passenger cars

- Geography

- Europe

- Germany

- France

- Italy

- North America

- US

- APAC

- Japan

- Middle East and Africa

- South America

- Europe

By Vehicle Type Insights

- The commercial vehicles segment is estimated to witness significant growth during the forecast period.

The commercial vehicle market is driven by the growth in the construction and manufacturing sectors, which require the transportation of raw materials and finished goods. The global increase in foreign direct investments, particularly in developing regions, is expected to accelerate these industries' activities, leading to a higher demand for commercial vehicles. Lightweight materials, such as alloy wheels made of aluminum, magnesium, and carbon fiber, are increasingly being used in commercial vehicles to improve vehicle dynamics and fuel economy. Advanced materials and engineering innovations are addressing engineering barriers, enabling the production of more efficient and durable commercial vehicles.

The market caters to various segments, including passenger vehicles, light commercial vehicles, heavy commercial vehicles, and vehicles used in construction, agriculture, and e-mobility. The aftermarket and OEM segments serve both passenger car and commercial vehicle sectors. Financial institutions offer loan schemes and scrapage incentives to facilitate vehicle purchases. Governmental laws and regulations influence the components sector, while manufacturing capabilities and trends shape the market landscape.

Get a glance at the Automotive Wheel Industry report of share of various segments Request Free Sample

The commercial vehicles segment was valued at USD 30.36 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

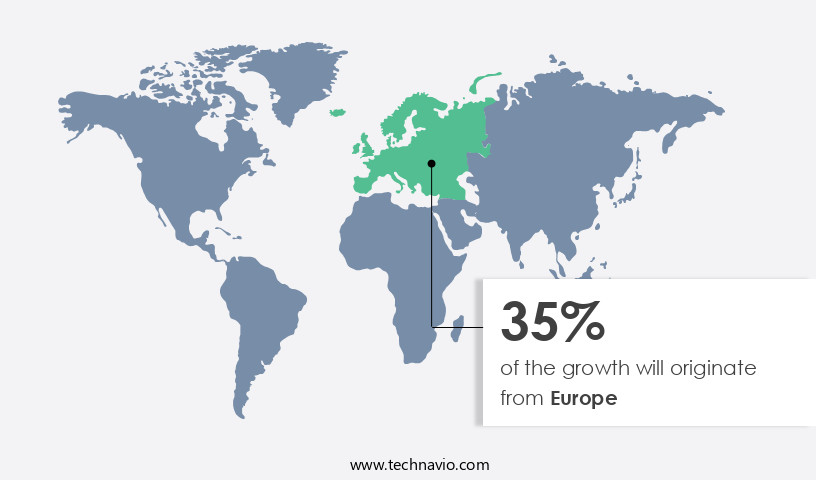

- Europe is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European market experiences significant growth due to high vehicle production in key countries like Germany, France, Italy, Spain, and the UK. Stringent emission regulations drive the adoption of fuel-efficient technologies, encouraging automakers to incorporate advanced materials such as alloy, aluminum, magnesium, and carbon fiber into their wheels. These materials offer lighter weight and improved vehicle dynamics. The passenger vehicle, light commercial vehicle, and heavy commercial vehicle segments, including passenger cars, light commercial vehicles, and heavy commercial vehicles, are major consumers of automotive wheels. The construction equipment and agriculture tractor sectors also utilize specialized wheels. OEMs, vehicle maintenance companies, banks, and financial institutes offer loan schemes and scrapage incentives to boost sales.

Technological advancements, including vehicle electrification and engineering barriers, impact the market dynamics. The components sector plays a crucial role In the manufacturing capabilities of these materials. Middle-class consumers prioritize repair and maintenance, customized wheel diameters, colors, and textures, leading to a demand for powder-coating, engraving, rhinestones, and other customizations. E-mobility and electric vehicles are emerging trends, requiring specialized wheel designs. Governmental laws and regulations influence market growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Wheel Industry?

The increasing number of vehicles globally is the key driver of the market.

- The market is experiencing significant growth due to various factors. One of the primary drivers is the increasing lifespan of vehicles, leading to a larger vehicle population in major automotive markets. In the US, for instance, the average age of vehicles in use surpassed 12 years in 2020. This trend is a global phenomenon, with the average age of vehicles increasing steadily for the past decade and a half. Automotive wheel demand is influenced by several factors, including the production of passenger vehicles, light commercial vehicles, and heavy commercial vehicles. Advanced materials like alloy, aluminum, magnesium, and carbon fiber are increasingly being used to manufacture wheels due to their lightweight properties, which contribute to improved vehicle dynamics and fuel economy.

- Automotive OEMs are investing in manufacturing capabilities to produce these advanced wheels for the OE segment and the aftermarket. The use of lightweight metal alloys is also gaining popularity In the construction equipment, agriculture tractor, and e-mobility sectors. Middle-class people are increasingly focusing on repair and maintenance, leading to a growing demand for customized wheel diameters, colors, and finishes like powder-coating, textures, engraving, rhinestones, and more. Governmental laws and regulations, as well as financial incentives from banks and financial institutes, are also driving the market growth. Loan schemes and scrapage incentives are encouraging consumers to upgrade their vehicles, thereby increasing the demand for new wheels.

What are the market trends shaping the Automotive Wheel Industry?

The development of ultra-lightweight automotive wheels for CVs is the upcoming market trend.

- The market is experiencing significant advancements in wheel technology, with a focus on lightweight materials such as alloy, aluminum, magnesium, and carbon fiber. These materials offer enhanced vehicle dynamics and improved fuel economy for passenger vehicles, light commercial vehicles, and heavy commercial vehicles. Automotive Original Equipment Manufacturers (OEMs) are increasingly investing In the production of lightweight wheels to meet the demands of the passenger car segment and the growing e-mobility market. The use of advanced materials in wheel engineering is helping to overcome manufacturing capabilities and engineering barriers, leading to customized wheel designs with customized diameter and color options.

- Vehicle maintenance companies also play a crucial role In the market, offering repair and maintenance services for both alloy and steel wheels. Governmental laws and regulations are driving the adoption of lightweight metal alloys In the components sector, making middle-class people more inclined towards purchasing vehicles with fuel-efficient wheels. The aftermarket and OE segments are expected to continue growing, with banks and financial institutes offering loan schemes and scrapage incentives to encourage the replacement of old wheels with new, lightweight designs.

What challenges does the Automotive Wheel Industry face during its growth?

Limitations of steel wheels is a key challenge affecting the industry growth.

- The market encompasses various types of wheels, including alloy, steel, aluminum, magnesium, and carbon fiber, used in passenger vehicles, light commercial vehicles, and heavy commercial vehicles. The selection of wheels depends on vehicle dynamics, fuel economy, and vehicle production requirements. Lightweight materials, such as alloy, aluminum, magnesium, and carbon fiber, are increasingly being used due to their engineering advantages in enhancing vehicle performance and reducing weight. However, the use of steel wheels In the automotive industry faces certain challenges. Steel wheels, while cost-effective, have limitations that hinder their growth In the market. Their heavy weight negatively impacts vehicle agility, acceleration, and deceleration.

- Thermal stress on the suspension system and other adjacent components is another concern. Furthermore, steel wheels have compatibility issues, as they are not suitable for large wheels or vehicles with large alloy wheels. Performance vehicles, such as sports cars and supercars, require wheels that can handle the powertrain's rapid acceleration and deceleration, making steel wheels an unsuitable choice. The automotive OEMs and aftermarket segments are significant consumers of wheels. Middle-class people and commercial vehicle segments, including construction equipment, agriculture tractors, and passenger vehicles, also contribute to the market's growth. E-mobility and electric vehicles are emerging trends, and the manufacturing capabilities of lightweight metal alloys are essential to meet the demand for lightweight and durable wheels.

Exclusive Customer Landscape

The automotive wheel market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive wheel market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive wheel market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accuride Corp.

- BBS GmbH

- BORBET GmbH

- Central Motor Wheel of America Inc.

- CITIC Ltd.

- CLN Coils Lamiere Nastri Spa

- Enkei Corp.

- Foshan Nanhai Zhongnan Aluminum Wheel Co. Ltd.

- Fuel Off Road Wheels

- Hitachi Ltd.

- Iochpe Maxion SA

- Klassic Wheels Ltd.

- Mangels Industrial SA

- RONAL AG

- Steel Strips Wheels Limited

- Topy Industries Ltd.

- Trelleborg AB

- TSW Group

- Wanfeng Group Co. Ltd.

- Wheel Pros LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of products, including vehicle tires, rims, and wheels made of various materials such as alloy, steel, aluminum, magnesium, and carbon fiber. These components play a crucial role in enhancing vehicle dynamics and performance, as well as contributing to the aesthetic appeal of passenger vehicles, light commercial vehicles, and heavy commercial vehicles. The automotive industry's ongoing pursuit of lightweight materials and advanced engineering has led to the development of innovative wheel designs and manufacturing capabilities. Lightweight materials like alloy, aluminum, and magnesium have gained popularity due to their ability to reduce vehicle weight, improve fuel economy, and enhance drive quality.

However, engineering barriers related to cost, manufacturing complexities, and material properties continue to pose challenges. The automotive OEM segment represents a significant portion of the wheel market, with manufacturers supplying original equipment for passenger vehicles, light commercial vehicles, and heavy commercial vehicles. The aftermarket segment, which caters to repair and maintenance needs, also contributes substantially to the market's growth. The construction equipment sector, including agriculture tractors, construction & mining vehicles, and heavy commercial vehicles, also utilizes wheels and rims for their machinery. These applications require high durability, load-bearing capacity, and resistance to harsh environmental conditions. The market is influenced by various factors, including vehicle production trends, consumer preferences, and governmental laws.

Further, the shift towards e-mobility and electric vehicles has led to the development of specialized wheel designs and manufacturing processes. Middle-class people and commercial vehicle segment buyers increasingly seek customized wheel diameters, colors, textures, engraving, rhinestones, and other personalization options. Powder-coating and other protective coatings are also popular choices for enhancing wheel durability and appearance. Financial institutions and banks offer loan schemes and scrapage incentives to make vehicle upgrades, including wheel purchases, more accessible to consumers. The components sector, which includes wheel manufacturing, is continuously evolving to meet the evolving demands of the automotive industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

137 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market Growth 2024-2028 |

USD 11.05 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, Germany, Italy, Japan, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Wheel Market Research and Growth Report?

- CAGR of the Automotive Wheel industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive wheel market growth of industry companies

We can help! Our analysts can customize this automotive wheel market research report to meet your requirements.