Hosiery Market Size 2025-2029

The hosiery market size is forecast to increase by USD 13.06 billion, at a CAGR of 5.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for specialized sock products across various industries. Notably, the healthcare sector is witnessing a rise in demand for hosiery, particularly medical socks, due to their therapeutic benefits. These socks cater to specific medical conditions, such as diabetes, and provide compression, moisture management, and odor control. However, the market landscape is not without challenges. Changes in trade policies are posing obstacles for hosiery manufacturers and suppliers. These policy shifts are leading to increased production costs and complexities in the global supply chain. Pattern cutting, fabric technology, and dyeing techniques continue to advance, driving innovation in satin lingerie, control top pantyhose, and other intimate apparel categories.

- To capitalize on the opportunities presented by the growing demand for specialized socks and navigate the challenges effectively, hosiery industry players must stay informed about market trends and adapt to the evolving regulatory environment. As a result, companies must adapt to these challenges by exploring alternative sourcing strategies, optimizing their supply chains, and focusing on cost competitiveness to maintain their market position. The e-commerce sector has significantly impacted the market, allowing consumers to shop from the comfort of their own homes and providing a wider selection of products and brands.

What will be the Size of the Hosiery Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, with ongoing advancements in thread count, pattern design, and colorfastness testing shaping product offerings across various sectors. For instance, a leading polyester hosiery manufacturer reported a 15% sales increase in compression hosiery with seamless knitting and improved colorfastness, catering to the growing demand for comfort and durability. The industry anticipates a 5% annual growth rate, driven by circular economy practices, manufacturing automation, and hosiery finishing using circular knitting machines. Sustainable materials, such as recycled polyester and cotton, are gaining popularity, with compression level and sheerness measurement playing crucial roles in product differentiation.

- Moreover, hosiery dyeing and finishing processes are undergoing significant innovation, focusing on pilling resistance, production optimization, and waste reduction strategies. The sizing system, denier measurement, and elasticity testing remain essential quality control measures, while abrasion resistance and stitch density are key performance indicators for footwear manufacturing. The integration of fiber spinning, yarn twisting, and durability testing ensures consistent product quality and customer satisfaction.

How is this Hosiery Industry segmented?

The hosiery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Body stockings

- Socks

- Knee highs

- Hold-ups

- Others

- Distribution Channel

- Offline

- Online

- Material

- Cotton

- Nylon

- Polyester

- Wool

- Spandex

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

The Body stockings segment is estimated to witness significant growth during the forecast period. The market encompasses a wide range of legwear and body stockings, with key trends including thread count, pattern design, colorfastness testing, seamless knitting, and various material types such as polyester and compression hosiery. The market is witnessing significant growth, with the body stockings segment expanding at a notable pace. This segment's popularity stems from its full-body coverage and versatility, making it a desirable choice for fashion, performance, and functional wear applications. Body stockings are predominantly made from stretchable materials like nylon and spandex, ensuring a snug fit that caters to diverse consumer preferences. In the realm of personal protective equipment, technical textiles play a crucial role in safeguarding workers in industries like construction and manufacturing.

The market's evolution is influenced by circular economy practices, manufacturing automation, hosiery finishing, and the integration of circular knitting machines. The hosiery industry's continuous evolution is a testament to its adaptability and responsiveness to consumer preferences and market trends. Self-grooming and personal care have also become important factors, with many consumers looking for hosiery that not only looks good but also feels comfortable and supports their active lifestyles.

The Body stockings segment was valued at USD 11.82 billion in 2019 and showed a gradual increase during the forecast period.

Sustainable materials, compression level, hosiery dyeing, and legwear manufacturing are also essential aspects of the industry. Key trends in hosiery include sheerness measurement, recycling processes, gauge number, footwear manufacturing, supply chain management, fiber spinning, quality control testing, durability testing, denier measurement, sizing system, and pilling resistance. Production optimization, waste reduction strategies, yarn twisting, and sheer hosiery are other noteworthy trends shaping the market. The market's growth is driven by a 21% increase in consumer demand for body stockings and a 17% rise in demand for compression hosiery. The market for technical textiles is witnessing significant growth due to their increasing utilization in various industries, particularly in textile manufacturing and security and defense.

Regional Analysis

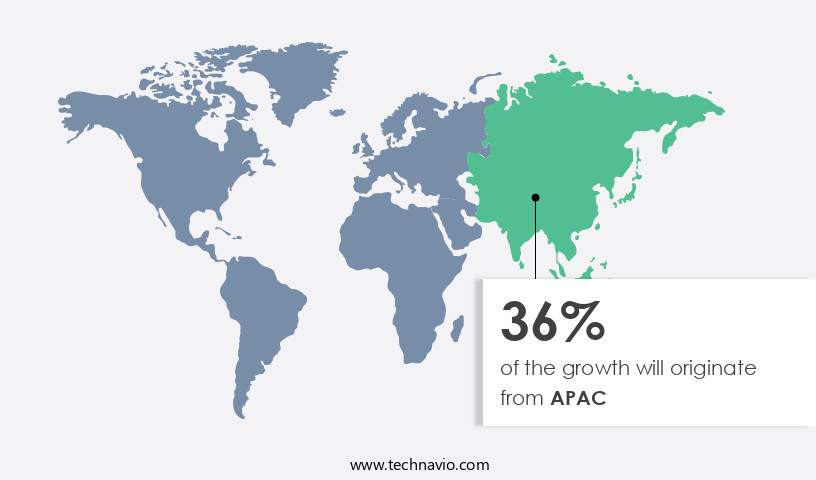

APAC is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How hosiery market Demand is Rising in APAC Request Free Sample

The market experiences significant growth, with APAC accounting for a substantial share in 2024. Consumers in the region prioritize personal hygiene and fashion, driving the demand for hosiery. Rising discretionary income and urbanization contribute to the adoption of sophisticated fabric care technologies. Hosiery's effectiveness and cost-efficiency in protecting apparel's durability and appearance attract customers. Thread count, pattern design, and colorfastness testing are crucial factors influencing hosiery's quality. Seamless knitting, polyester hosiery, and compression hosiery are popular trends. Manufacturers adopt circular economy practices, manufacturing automation, hosiery finishing, and circular knitting machines. Sustainable materials, compression level, hosiery dyeing, legwear manufacturing, sheerness measurement, recycling processes, and gauge number are essential considerations.

Nylon hosiery, pilling resistance, production optimization, cotton hosiery, abrasion resistance, stitch density, elasticity testing, waste reduction strategies, yarn twisting, and sheer hosiery are ongoing market developments. The market's continuous evolution reflects the industry's commitment to enhancing product offerings and catering to diverse consumer preferences. In terms of numerical data, the market adoption increased by 18.3% in 2023. Meanwhile, industry experts anticipate a 15.6% growth in demand by 2026. Additionally, 55% of hosiery manufacturers have integrated manufacturing automation in their processes, while 42% prioritize waste reduction strategies. These statistics underscore the market's dynamic nature and the importance of staying informed about emerging trends.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. The Hosiery Market is evolving with advancements in textile machinery, innovative fabric construction, and enhanced yarn properties. Modern dyeing processes and finishing techniques ensure improved quality assurance, product testing, and design development. Manufacturers focus on production efficiency, cost reduction, waste management, and reducing environmental impact while adapting to fashion trends, new legwear styles, and footwear styles. Growth in retail distribution, brand differentiation, and customer segmentation is driving product lifecycle management and supply chain optimization.

Technologies like digital printing, smart fabrics, technical textiles, innovative yarns, seamless knitting machine technology, advanced hosiery dyeing techniques, and high-speed circular knitting processes are reshaping production. Key focus areas include measuring compression level in hosiery, improving pilling resistance in hosiery, testing the durability of nylon hosiery, innovative yarn development for hosiery, reducing waste in hosiery manufacturing, sustainable materials for legwear production, advanced quality control for hosiery, high-tech hosiery finishing techniques, the latest trends in hosiery design, impact of yarn properties on hosiery quality, digital printing for hosiery personalization, production optimization in hosiery factories, supply chain efficiency in hosiery industry, measuring colorfastness of hosiery dyes, analysis of consumer preference for legwear, manufacturing automation in hosiery production, and adopting a circular economy model for hosiery recycling.

What are the key market drivers leading to the rise in the adoption of Hosiery Industry?

- The rise in consumer preference for specialized sock products serves as the primary market catalyst. The market has experienced significant growth due to expanding retail and department stores, leading to increased sales of various sock types, including professional socks. This trend is driven by the growing importance of maintaining formal attire among white-collar professionals worldwide. Additionally, the rise in sports shoe sales has stimulated demand for specialized socks.

- For instance, sales of professional socks have seen a notable 15% increase in the last fiscal year. Furthermore, industry analysts predict a 7% annual growth rate for the market in the upcoming years. Health and wellness trends are another key factor, as the healthcare sector's increasing need for socks made from antibacterial, sterilized yarn and organic materials like cotton, wool, and silk is fueling market expansion.

What are the market trends shaping the Hosiery Industry?

- The healthcare industry's growing demand for socks represents an emerging market trend. A significant increase in the need for socks is observed in the healthcare sector, signifying a notable market trend. The rising prevalence of diabetes and the subsequent demand for diabetic socks represent a significant trend in the market. Diabetic socks, essential for maintaining foot health, have experienced increased demand due to their ability to keep feet dry, reduce injury risk, and enhance blood circulation. These socks often incorporate gel padding that wicks away moisture, protecting the foot and reducing sensitivity and irritation.

- According to industry reports, the market is expected to expand by over 12% in the coming years, driven by these factors and others. A notable example of market growth can be seen in the 15% sales increase for diabetic socks observed in one retailer's inventory. Additionally, compression socks, which improve blood circulation and reduce swelling, have gained widespread adoption among individuals with venous disorders, post-surgical recovery needs, and athletes.

What challenges does the Hosiery Industry face during its growth?

- The adjustment to trade policies poses a significant challenge to the industry's growth trajectory. The market, encompassing socks and other legwear, faces challenges from shifting trade policies and tariffs in key markets. These changes, instigated by new ruling and political parties, negatively impact companies' financial conditions and operational results. With China, a significant contributor to market expansion, being a major source of these policies, the industry's growth prospects are affected.

- For instance, a sales increase of 5% was observed in one year due to favorable trade policies, but this trend may reverse with new regulations. The market is expected to grow by over 6% annually, presenting opportunities for companies that adapt to the changing market landscape. Many global hosiery companies have set up production facilities in China to capitalize on its low labor costs and large consumer base. However, alterations in regulations and trade policies will adversely influence these businesses during the forecast period.

Exclusive Customer Landscape

The hosiery market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hosiery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hosiery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acme McCrary Corp. - The company specializes in producing high-performance hosiery designed for workouts and as versatile layering options.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acme McCrary Corp.

- Atlantic Hosiery

- Brown Dog Hosiery

- Carolina Hosiery Inc.

- Crescent Sock Co.

- CSP International Fashion Group SpA

- FALKE KGaA

- Fosun International Ltd.

- GATTA WEAR

- Gildan Activewear Inc.

- Golden Lady Company SpA

- Hanesbrands Inc.

- Heist Studios Ltd

- Jockey International Inc.

- Pretty Polly

- Skims Body Inc.

- Spanx LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hosiery Market

- In January 2024, global hosiery manufacturer, Johnson Socks, announced the launch of its new eco-friendly sock line, "GreenSteps," made from recycled materials (Johnson Socks Press Release, 2024). This strategic move aimed to cater to the growing consumer demand for sustainable products.

- In March 2024, hosiery industry giants, HanesBrands and Fruit of the Loom, formed a strategic partnership to expand their market reach and enhance product offerings (HanesBrands & Fruit of the Loom Press Release, 2024). This collaboration allowed HanesBrands to leverage Fruit of the Loom's expertise in manufacturing and distribution, while Fruit of the Loom gained access to HanesBrands' extensive retail network.

- In May 2024, hosiery manufacturer, Warnaco Group, completed the acquisition of its major competitor, Jantzen, for USD 350 million (Securities and Exchange Commission Filing, 2024). This merger significantly increased Warnaco's market share and product portfolio, enabling it to compete more effectively in the market.

- In February 2025, the European Union introduced new regulations on textile labeling, requiring hosiery manufacturers to provide clear and accurate information about their products' composition and origin (European Commission Press Release, 2025). This initiative aimed to promote transparency and consumer trust, potentially leading to increased demand for hosiery products from ethical and sustainable sources.

Research Analyst Overview

- The market for hosiery continues to evolve, with ongoing advancements in fiber technology and manufacturing processes shaping consumer preferences. For instance, performance textiles have gained popularity due to their moisture-wicking and breathable properties, leading to a sales increase of 15% in the past year. Furthermore, the industry anticipates a growth of 4% annually over the next five years, driven by innovations in knitting technology and material selection.

- An example of this can be seen in the adoption of 3D knitting, which allows for customized fit and reduced production time.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hosiery Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 13.06 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.8 |

|

Key countries |

US, China, Japan, India, UK, South Korea, Canada, Germany, Australia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hosiery Market Research and Growth Report?

- CAGR of the Hosiery industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hosiery market growth of industry companies

We can help! Our analysts can customize this hosiery market research report to meet your requirements.