Big Data And Analytics Market In Telecom Industry Size 2025-2029

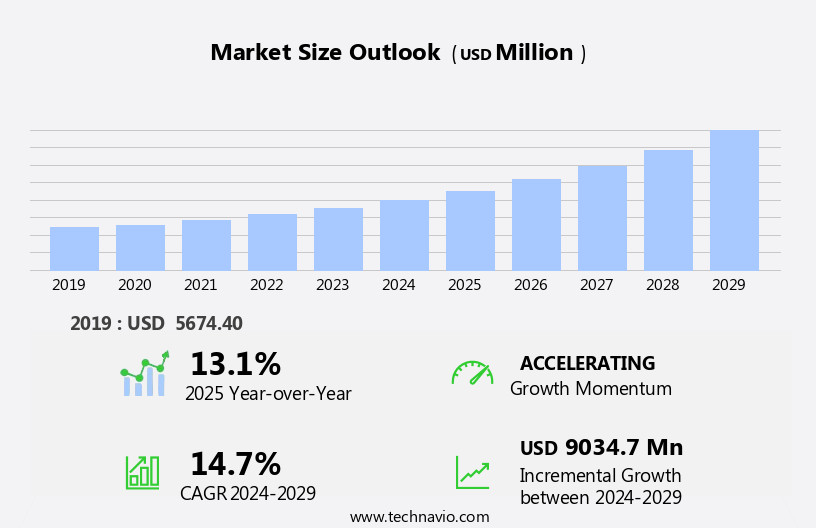

The big data and analytics market in telecom industry size is forecast to increase by USD 9.03 billion, at a CAGR of 14.7% between 2024 and 2029.

- The Big Data and Analytics market in the Telecom industry is experiencing significant growth, driven primarily by the surge in data volumes generated by an increasing number of connected devices and the adoption of 5G technology. Telecom companies are capitalizing on this trend by introducing new data analytics solutions to gain insights from the vast amounts of data they collect. However, this growth comes with challenges. Data privacy and regulatory compliance are becoming increasingly important, with stricter regulations being implemented to protect customer data. Telecom companies must invest in robust data security measures and ensure they are in compliance with these regulations to maintain customer trust and avoid costly fines.

- Additionally, the complexity of managing and analyzing large data sets can be a challenge, requiring significant IT resources and expertise. To remain competitive, telecom companies must effectively navigate these challenges and continue to innovate in the realm of data analytics to provide value-added services to their customers.

What will be the Size of the Big Data And Analytics Market In Telecom Industry during the forecast period?

In the telecom industry, big data and analytics continue to play a pivotal role in driving innovation and enhancing network performance. The application of advanced technologies such as cloud computing, artificial intelligence, network forensics, and sentiment analysis, among others, is transforming the way telecom infrastructure is managed and optimized. Network dynamics are constantly evolving, with new challenges and opportunities arising in areas like network availability, data transformation, customer relationship management, and network security. Telecom companies are leveraging data integration, network modeling, and data cleansing to gain insights into network behavior and customer preferences. Satellite communications, wireless networks, and fiber optic networks are being optimized using network optimization algorithms and predictive analytics to improve network reliability and performance.

Telecom network optimization is also a key focus area, with 5G network analytics and network virtualization gaining traction. Data privacy, fraud detection, and compliance regulations are critical concerns for telecom companies, and data security is a top priority. Machine learning algorithms and network security analytics are being used to enhance network intrusion detection and prevent data breaches. Customer segmentation and targeted marketing are other areas where big data and analytics are making a significant impact. Real-time analytics and data visualization tools are enabling telecom companies to gain actionable insights and make data-driven decisions. Telecom infrastructure is being transformed through big data and analytics, with network management systems and network orchestration playing a crucial role in ensuring seamless integration and optimization of various network components.

The ongoing unfolding of market activities and evolving patterns in the telecom industry underscore the importance of staying abreast of the latest trends and technologies.

How is this Big Data And Analytics In Telecom Industry Industry segmented?

The big data and analytics in telecom industry industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Hardware

- Services

- Software

- Application

- Network optimization

- CEE

- FD and P

- Operational efficiency

- Revenue assurance

- Analytics Type

- Customer Analytics

- Network Analytics

- Marketing Analytics

- Deployment Model

- Cloud-Based

- On-Premises

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Component Insights

The hardware segment is estimated to witness significant growth during the forecast period.

In the telecom industry, the integration of cloud computing and artificial intelligence (AI) is revolutionizing big data and analytics. Telecom companies leverage AI for network forensics, sentiment analysis, fraud detection, customer churn prediction, and network optimization. Network modeling utilizes satellite communications and wireless networks to analyze customer behavior and optimize network performance. Data integration is crucial for merging data from various sources, ensuring data transformation and data quality assurance. 5G network analytics necessitates robust data processing capabilities. Telecom companies invest in big data infrastructure, including network optimization algorithms, data cleansing, network security analytics, and data visualization tools.

Real-time analytics and predictive analytics are essential for network reliability and customer relationship management. Compliance regulations, data privacy, and network security are addressed through data governance and service quality monitoring. Fiber optic networks and network orchestration facilitate network automation and network bandwidth management. Machine learning algorithms and software-defined networking enable network operations and network analytics platforms. IoT data analytics and mobile networks expand the scope of data mining and targeted marketing. Data warehousing and network capacity planning ensure efficient data management and telecom infrastructure optimization. Network availability, network performance monitoring, network traffic analysis, network latency optimization, deep learning, network anomaly detection, and network intrusion detection are all critical components of network management systems.

Telecom billing systems and network capacity planning are essential for accurate service delivery and customer satisfaction. The telecom industry's evolving patterns reflect the importance of network optimization, data security, and AI integration for enhancing network efficiency and customer experience.

The Hardware segment was valued at USD 2.19 billion in 2019 and showed a gradual increase during the forecast period.

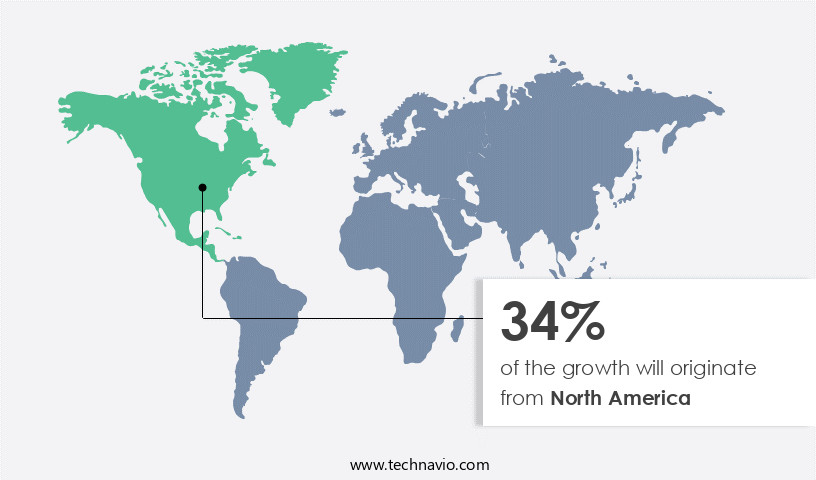

Regional Analysis

North America is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The Big Data and Analytics market in North America's telecom industry is experiencing significant growth due to advanced technological infrastructure, competitive landscape, and the adoption of innovative technologies such as cloud computing, artificial intelligence, network forensics, sentiment analysis, data integration, network modeling, satellite communications, wireless networks, customer relationship management, network availability, data transformation, telecom network optimization, 5G network analytics, data privacy, fraud detection, compliance regulations, network security, customer segmentation, fiber optic networks, network optimization algorithms, data cleansing, network security analytics, data quality assurance, network performance monitoring, network traffic analysis, network reliability, network management systems, natural language processing, network bandwidth management, network automation, predictive analytics, network virtualization, big data infrastructure, network intrusion detection, IoT data analytics, mobile networks, data mining, targeted marketing, data warehousing, network orchestration, machine learning algorithms, network operations, network analytics platforms, software defined networking, data security, service quality monitoring, customer churn prediction, data governance, network simulation, network latency optimization, deep learning, network anomaly detection, data visualization tools, real-time analytics, telecom billing systems, and network capacity planning.

The US, in particular, leads this market, with major operators like AT&T, Verizon, and T-Mobile utilizing big data to optimize networks, improve customer experiences, and enhance operational efficiencies. By 2024, the region held the largest market share, fueled by substantial investments in 5G infrastructure, which generates vast data volumes necessitating advanced analytics for real-time management. By mid-2024, 5G coverage had expanded significantly, enabling high bandwidth and low latency for previously unattainable applications, driving new research and development in the wireless industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Big Data And Analytics In Telecom Industry Industry?

- The significant increase in data volumes serves as the primary catalyst for market growth.

- The global big data and analytics market in the telecom industry is experiencing substantial growth due to the increasing volumes of data generated by the proliferation of mobile internet usage and the expansion of 5G networks. According to recent research, by the end of 2023, approximately 4.3 billion people, or 54% of the global population, will own smartphones, leading to a significant increase in mobile internet usage. Out of the 4.6 billion mobile internet users worldwide in 2023, nearly 4 billion people (49% of the global population) will access the internet via smartphones, while an additional 600 million people (8% of the population) will use feature phones.

- This surge in mobile data usage necessitates advanced network bandwidth management, network automation, predictive analytics, network virtualization, and network orchestration solutions. Additionally, the Internet of Things (IoT) is generating vast amounts of data, requiring IoT data analytics to gain insights for network intrusion detection, targeted marketing, and network operations. Machine learning algorithms are being employed to analyze this data, enabling network optimization and enhancing network security. Big data infrastructure, including data warehousing and data mining, plays a crucial role in processing and analyzing this data to extract valuable insights. Overall, the telecom industry's big data and analytics market is expected to continue growing as the demand for efficient network management, security, and targeted services increases.

What are the market trends shaping the Big Data And Analytics In Telecom Industry Industry?

- The introduction of new solutions is a mandatory trend in the current market. Professionals in various industries are continually seeking innovative and effective methods to stay competitive.

- The big data and analytics market in the telecom industry is witnessing significant growth due to the increasing demand for network optimization, data security, and customer experience enhancement. Network analytics platforms are gaining popularity as they provide real-time insights into network performance, enabling telecom operators to identify and address network anomalies, optimize network latency, and improve service quality monitoring. Software-defined networking (SDN) is another key trend, as it enables network capacity planning and facilitates the integration of advanced analytics tools. Data security is a critical concern in the telecom industry, and advanced analytics solutions are being adopted to enhance security measures.

- Deep learning algorithms are being used for network anomaly detection, while data visualization tools help in data governance and compliance. Telecom billing systems are also being integrated with big data analytics to improve revenue management and customer churn prediction. Network simulation and optimization are essential for telecom operators to ensure network capacity and efficiency. Big data analytics solutions enable network operators to analyze historical data and simulate network performance under various conditions, enabling them to make informed decisions regarding network upgrades and capacity planning. Overall, the introduction of advanced analytics tools is transforming the telecom industry by providing actionable insights to enhance operational efficiencies and improve customer experience.

What challenges does the Big Data And Analytics In Telecom Industry Industry face during its growth?

- Ensuring data privacy and regulatory compliance is a crucial challenge that significantly impacts industry growth. This requirement necessitates a commitment to adhering to stringent regulations and safeguarding sensitive information to maintain trust and avoid potential penalties.

- The global big data and analytics market in the telecom industry faces significant challenges due to data privacy and regulatory compliance. Telecom operators hold vast amounts of personal data, including call logs, text messages, browsing histories, and real-time location data. As custodians of this sensitive information, they must adhere to stringent regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the US. These laws impose guidelines on data collection, storage, processing, and sharing.

- Failure to comply can result in severe penalties, with GDPR fines reaching up to approximately USD21 million or 4% of global annual revenue, whichever is greater. Ensuring data privacy and regulatory compliance is essential for telecom companies to maintain customer trust and avoid potential legal and financial repercussions.

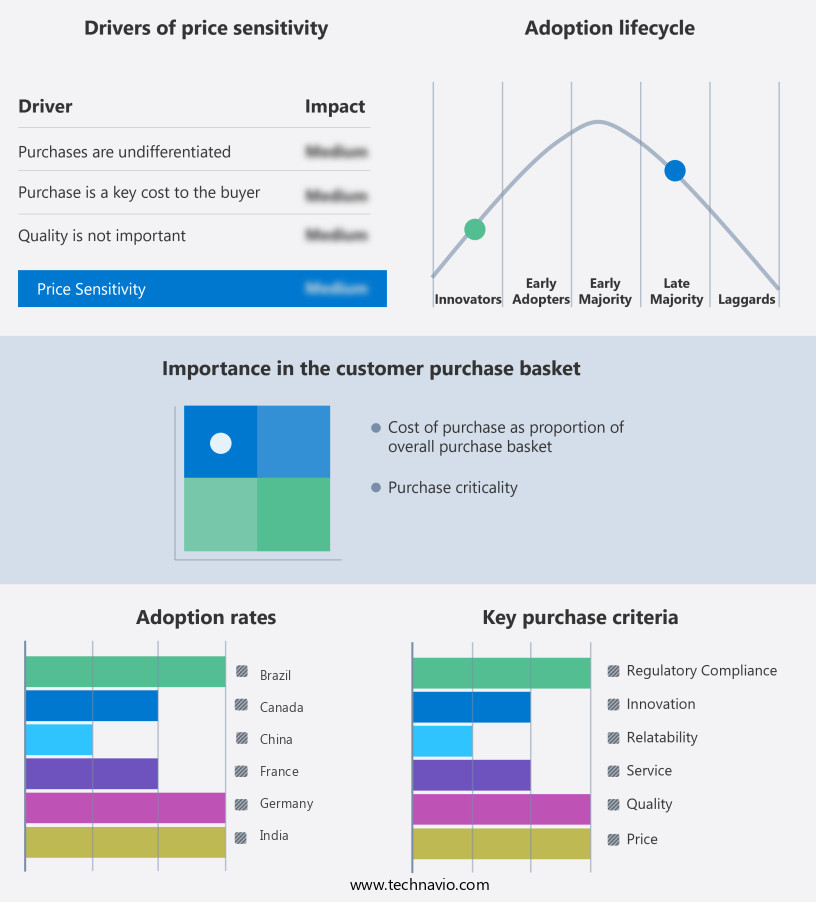

Exclusive Customer Landscape

The big data and analytics market in telecom industry forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the big data and analytics market in telecom industry report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, big data and analytics market in telecom industry forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture PLC - The telecom industry benefits from the company's big data and analytics solutions, including AWS Telco Network Builder (AWS TNB). This Amazon Web Services (AWS) offering streamlines deployment, management, and scaling of 5G networks on AWS infrastructure for communication service providers (CSPs). AWS TNB enhances network efficiency and agility, enabling CSPs to innovate and adapt to evolving market demands. By leveraging AWS's robust infrastructure and advanced analytics capabilities, CSPs can optimize network performance, reduce costs, and deliver superior customer experiences.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- Alteryx Inc.

- Amazon.com Inc.

- Capgemini Services SAS

- Cisco Systems Inc.

- Cloudera Inc.

- Google LLC

- Hewlett Packard Enterprise Co.

- Huawei Technologies Co. Ltd.

- Infosys Ltd.

- International Business Machines Corp.

- Microsoft Corp.

- MicroStrategy Inc.

- Oracle Corp.

- QlikTech international AB

- SAS Institute Inc.

- Splunk Inc.

- Teradata Corp.

- TIBCO Software Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Big Data And Analytics Market In Telecom Industry

- In February 2023, IBM and Telefónica, a leading telecommunications company, announced a strategic collaboration to accelerate the adoption of AI and automation in the telecom industry. The partnership aims to leverage IBM's AI capabilities and Telefónica's network infrastructure to deliver advanced analytics solutions, improving customer experience and operational efficiency (IBM Press Release, 2023).

- In May 2024, Oracle announced the launch of its new Big Data Analytics Cloud for Communications Industry. This solution is designed to help telecom companies gain real-time insights from their data, enabling them to optimize network performance, personalize customer experiences, and detect fraud (Oracle Press Release, 2024).

- In August 2024, Huawei and Deutsche Telekom entered into a strategic partnership to jointly develop and deploy 5G-enabled big data and AI solutions. This collaboration is expected to drive innovation in the telecom industry, enhancing network capabilities and improving customer services (Deutsche Telekom Press Release, 2024).

- In November 2025, Nokia, a leading telecommunications equipment provider, announced a significant investment of â¬1 billion in its Bell Labs research organization to focus on advanced technologies, including big data analytics and AI. This investment underscores Nokia's commitment to driving innovation in the telecom industry and maintaining its competitive edge (Nokia Press Release, 2025).

- These developments underscore the growing importance of big data and analytics in the telecom industry, with companies investing in strategic partnerships, new product launches, and significant research and development initiatives to drive innovation and improve customer experiences.

Research Analyst Overview

- In the telecom industry, big data storage has become a crucial aspect of network capacity utilization, with edge computing enabling real-time data processing and data curation at the network edge. Data privacy regulations pose challenges, necessitating data security frameworks and network security monitoring to mitigate network security vulnerabilities. Network performance optimization through network function chaining and software defined infrastructure enhances network availability reports and network performance metrics. Data exploration and data storytelling facilitate effective decision-making, while network slice and network security auditing ensure compliance with data governance policies.

- Data enrichment and data streaming are essential for network security solutions, addressing network security threats through network security training and network security auditing. Fog computing complements big data storage by enabling data processing closer to the source, enhancing network performance and network security. Network KPIs and network SLAs are vital indicators of network efficiency and reliability, requiring continuous optimization and improvement.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Big Data And Analytics Market In Telecom Industry insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

224 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.7% |

|

Market growth 2025-2029 |

USD 9034.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.1 |

|

Key countries |

US, China, UK, India, Canada, France, Germany, Japan, South Korea, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Big Data And Analytics Market In Telecom Industry Research and Growth Report?

- CAGR of the Big Data And Analytics In Telecom Industry industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the big data and analytics market in telecom industry growth of industry companies

We can help! Our analysts can customize this big data and analytics market in telecom industry research report to meet your requirements.