Bio Acetic Acid Market Size 2024-2028

The bio acetic acid market size is forecast to increase by USD 68.8 million at a CAGR of 5.6% between 2023 and 2028.

What will be the Size of the Bio Acetic Acid Market During the Forecast Period?

How is this Bio Acetic Acid Industry segmented and which is the largest segment?

The bio acetic acid industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Source

- Fermentation

- Biomass

- End-user

- Chemical manufacturing

- Food industry

- Personal care

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Middle East and Africa

- South America

- Brazil

- APAC

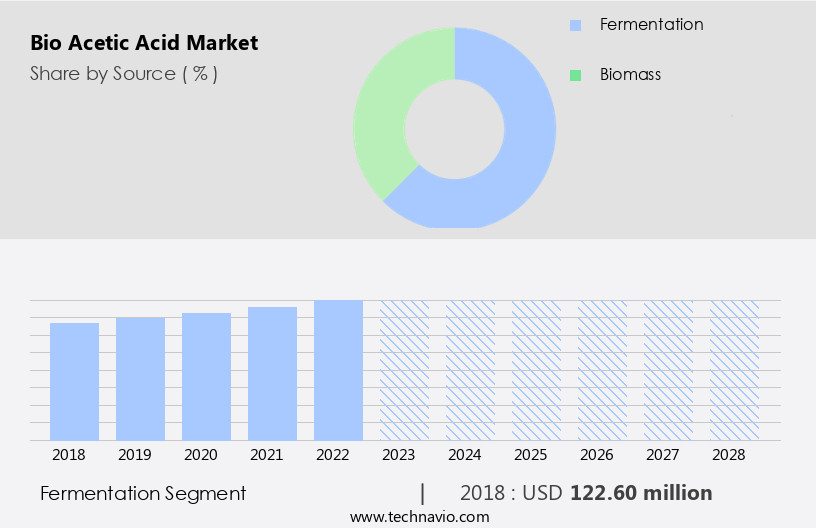

By Source Insights

- The fermentation segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth due to the increasing demand for sustainable and renewable alternatives to petrochemical-based acetic acid. Fermentation, a key process In the production of bio acetic acid, converts natural feedstocks into this valuable chemical. This method, which utilizes fermented sugars, offers a healthier and eco-friendly alternative to traditional acetic acid, derived from methanol, a substance known for its toxicity and carcinogenic properties. The shift towards safer and environmentally friendly options is driving the demand for bio acetic acid in various industries, including polymer production, textiles, solvents, paints and coatings, adhesives, emulsions, acetic anhydride, cellulose acetate, and motor vehicle manufacturing.

Jubilant Ingrevia Limited is one of the leading players in this market, offering Bio Acetic Acid-Food Grade, derived from natural feedstocks through fermentation. This renewable alternative is gaining popularity In the food and beverages, plastics, rubber, ink, textile, terephthalic acid, and pharmaceutical industries. The construction sector, particularly in water-based paints, waterproofing coatings, and paperboard coatings, is also adopting bio acetic acid derivatives. The growth of the market is influenced by factors such as increasing consumer purchasing power, the cosmetics market, and construction activities.

Get a glance at the Bio Acetic Acid Industry report of share of various segments Request Free Sample

The Fermentation segment was valued at USD 122.60 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

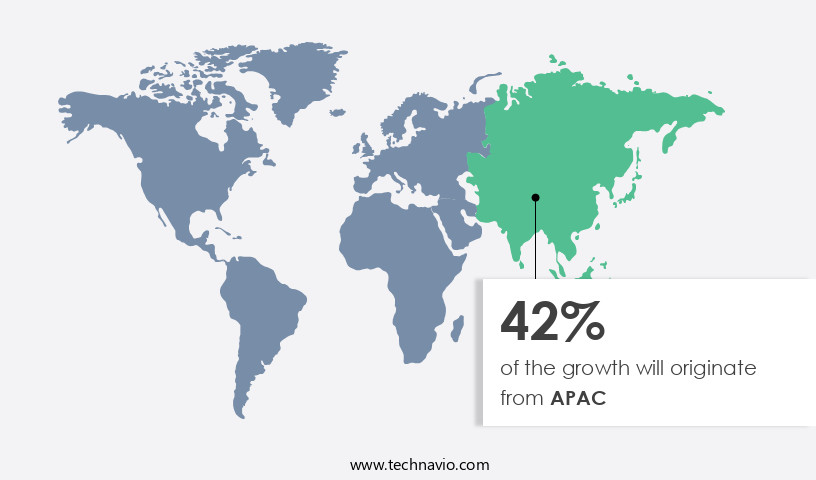

- APAC is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia-Pacific region is experiencing notable growth In the market, primarily due to expanding food processing and cosmetic industries. Countries like India and China are driving this growth, bolstered by government initiatives and evolving consumer preferences. In India, the Pradhan Mantri Kisan Sampada Yojana (PMKSY) focuses on modernizing food processing infrastructure, contributing significantly to the region's the market expansion. This initiative has resulted in a substantial rise in processed food exports, increasing from 13% to 18% of the total food industry output. Additionally, China's growing textile, solvents, and paints industries are significant consumers of bio acetic acid derivatives, further fueling market growth.

The region's the market is expected to continue expanding, with applications in various industries, including polymer production, adhesives, emulsions, and food and beverages.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Bio Acetic Acid Industry?

Growing crude oil prices is the key driver of the market.

What are the market trends shaping the Bio Acetic Acid Industry?

Expansion in production of bio-based acetic acid is the upcoming market trend.

What challenges does the Bio Acetic Acid Industry face during its growth?

High production costs is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The bio acetic acid market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the bio acetic acid market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, bio acetic acid market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Airedale Group - Bio acetic acid is a versatile chemical compound with extensive applications in various industries. Its primary uses include chemical production, where it serves as a crucial intermediate In the manufacture of other chemicals. In the realm of paints, bio acetic acid functions as a key ingredient, contributing to the production of eco-friendly and high-performance coatings. The cleaning industry also leverages this compound for its effectiveness in various applications, from household cleaning products to industrial degreasers. In food production, bio acetic acid acts as a preservative and flavoring agent, while in pharmaceuticals, it is utilized In the synthesis of various drugs. The company specializes in providing bio acetic acid solutions, catering to the diverse requirements of these industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airedale Group

- Bio-Corn Products EPZ Ltd.

- BTG Bioliquids B.V

- Cargill Inc.

- Celanese Corp.

- Chemball HangZhou Chemicals Co. Ltd.

- Daicel Corp.

- Eastman Chemical Co.

- Fisher Scientific GmbH

- Godavari Biorefineries Ltd.

- LanzaTech Global Inc.

- Lenzing AG

- LyondellBasell Industries N.V.

- Novozymes AS

- Sekab

- Shandong Hualu-Hengsheng Chemical Co. Ltd

- Sucroal SA

- Vinipul Inorganics Pvt. Ltd.

- Wacker Chemie AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Bio-acetic acid, a renewable alternative to petrochemical-based acetic acid, is gaining significant attention in various industries due to its sustainable production process and versatile applications. This chemical compound is derived from renewable feedstocks, making it an attractive choice for businesses seeking to reduce their carbon footprint and meet sustainability goals. The demand for bio-acetic acid is driven by its use in several industries, including polymer production, textiles, solvents, and adhesives. In the polymer industry, bio-acetic acid is used as an intermediate In the production of polymers such as polyvinyl alcohol (PVOH) and polyacetate. In the textile industry, it is used as a finishing agent to improve the texture and appearance of fabrics.

Bio-acetic acid also finds applications in various sectors such as paints and coatings, plastics, and composites. In the paints and coatings industry, it is used as an acetic anhydride substitute in water-based paints and waterproofing coatings, as well as in paperboard coatings. In the plastics industry, it is used as a monomer In the production of cellulose acetate and terephthalic acid. The use of bio-acetic acid is not limited to these industries alone. It is also used In the production of acetic acid derivatives such as ethyl acetate and butyl acetate, which are used as solvents in various applications.

In the engineering industry, it is used as a catalyst In the production of industrial chemicals. The demand for bio-acetic acid is influenced by several factors, including consumer purchasing power and the growth of various end-use industries. In the cosmetics market, the trend towards natural and organic products is driving the demand for bio-acetic acid as a sustainable alternative to petrochemical-based acetic acid. In the construction industry, the increasing focus on sustainable building materials and practices is expected to boost the demand for bio-acetic acid In the production of eco-friendly paints, coatings, and adhesives. The production of bio-acetic acid involves the fermentation of renewable feedstocks such as corn, sugarcane, and wheat, making it a sustainable alternative to petrochemical-based acetic acid.

The use of renewable feedstocks reduces the carbon footprint of the production process and aligns with the global trend towards sustainability. In conclusion, the bio-acetic acid market is driven by its versatile applications in various industries and its sustainable production process. The demand for bio-acetic acid is expected to grow as businesses seek to reduce their carbon footprint and meet sustainability goals. The use of bio-acetic acid as a renewable alternative to petrochemical-based acetic acid is expected to gain further momentum as more industries adopt sustainable practices.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

202 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.6% |

|

Market growth 2024-2028 |

USD 68.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.1 |

|

Key countries |

China, US, Germany, Japan, UK, South Korea, India, Canada, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Bio Acetic Acid Market Research and Growth Report?

- CAGR of the Bio Acetic Acid industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the bio acetic acid market growth of industry companies

We can help! Our analysts can customize this bio acetic acid market research report to meet your requirements.