US Blister Packaging Market Size 2024-2028

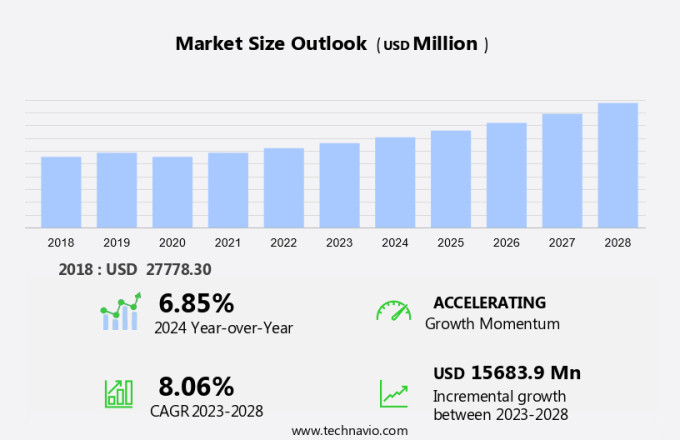

The US blister packaging market size is forecast to increase by USD 15.68 billion at a CAGR of 8.06% between 2023 and 2028. The blister packaging market in the US is experiencing significant growth due to its numerous advantages, particularly in sectors such as food and beverage, cosmetics, electronics, OTC drugs, nutraceuticals, and vitamins. One key trend is the adoption of carded blisters, which offer improved product safety and convenience. Another trend is the integration of smart technologies, including Radio Frequency Identification (RFID) tags and sensors, to enhance supply chain management and traceability. The cost benefits of blister packaging, coupled with the emergence of contract packaging solutions, are also driving market growth. However, the volatility of raw material prices poses a challenge to market growth. In the food and beverage industry, blister packaging is increasingly being used for snacks and confectionery products due to its ability to maintain product freshness and extend shelf life. In the cosmetics sector, blister packaging is preferred for its attractive design capabilities and ease of use. The electronics industry uses blister packaging for the protection and promotion of sensitive components, while OTC drugs and nutraceuticals benefit from the child-resistant properties of blister packaging. Overall, the blister packaging market in the US is expected to continue its growth trajectory, fueled by these trends and the ongoing demand for safe, efficient, and cost-effective packaging solutions.

What will be the Size of the Market During the Forecast Period?

The blister packaging market in the US is witnessing significant growth, driven by the increasing demand for unit-dose packaging solutions across various industries. This market caters to the needs of healthcare, food, consumer goods, industrial goods, and other sectors. Blister packaging is a popular choice for industries due to its numerous advantages. It offers superior product protection, enhanced shelf life, and tamper resistance properties. In the healthcare sector, blister packaging is extensively used for OTC drugs and medical devices, ensuring product safety and patient compliance. In the food and beverage industry, blister packaging in PVC materials or thermoforming processes is used for snacks, confectionery, and other perishable items.

The use of blister packaging in cosmetics has also gained popularity due to its ability to maintain product hygiene and provide a clear view of the product. Smart blister packs, incorporating RFID tags, sensors, and other advanced technologies, are gaining traction in various industries. These innovative solutions offer benefits such as improved supply chain management, enhanced product traceability, and real-time inventory monitoring. The use of materials like polyethylene, polyethylene terephthalate, and polyvinyl chloride in blister packaging production is common. These materials offer benefits such as durability, flexibility, and cost-effectiveness. Carded blisters, a type of blister packaging, have gained popularity due to their ability to display multiple products in a compact and organized manner.

This packaging solution is widely used in the retail sector for selling various consumer goods. The increasing focus on product safety and consumer convenience is driving the growth of the blister packaging market in the US. The market is expected to continue its growth trajectory, offering significant opportunities for businesses involved in its production and distribution. In conclusion, the blister packaging market in the US is a dynamic and evolving industry, driven by the increasing demand for unit-dose packaging solutions and advanced technologies. It caters to various industries, including healthcare, food, consumer goods, and industrial goods, offering benefits such as product protection, enhanced shelf life, and tamper resistance. The future of this market looks promising, with opportunities for growth and innovation.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technology

- Thermoforming

- Cold forming

- Component

- Forming film

- Lidding material

- Geography

- US

By Technology Insights

The thermoforming segment is estimated to witness significant growth during the forecast period. In the realm of pharmaceutical and consumer goods packaging, thermoformed blister packaging has gained significant traction in the US market. This type of packaging utilizes thermoforming processes to shape plastic films, including PVC, PS, and COC, into small cavity blisters. The demand for thermoformed blister packaging is on the rise due to its numerous advantages over other packaging methods. One of the primary benefits of thermoforming blister packaging is its space productivity. By using this packaging method, manufacturers can eliminate the need for multiple packaging lines and additional manufacturing space. The entire thermoformed blister packaging process can be completed in a single machine flow, thereby streamlining production and reducing overall costs.

Furthermore, the compact design of thermoformed blisters allows for more efficient storage and transportation of tablets, pills, capsules, granules, and lozenges. Plastic films such as polyethylene, polyethylene terephthalate, and polyvinyl chloride are commonly used in the production of thermoformed blister packaging. These materials offer excellent barrier properties, ensuring product protection and extending shelf life. In summary, the increasing adoption of thermoformed blister packaging in the US market is driven by its space productivity, cost-effectiveness, and ability to protect various forms of pharmaceuticals and consumer goods.

Get a glance at the market share of various segments Request Free Sample

The thermoforming segment was valued at USD 21.99 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

US Blister Packaging Market Driver

The cost benefits of blister packaging is the key driver of the market. Blister packaging plays a crucial role in the profitability of pharmaceutical manufacturing in the US. The packaging cost, which accounts for approximately 11% of the production cost of pharmaceutical products, is particularly significant for over-the-counter drugs where the packaging cost may even exceed the cost of the medication itself. Pharmaceutical products are typically packaged in glass bottles, plastic bottles, and blister packs.

Also, among these options, blister packaging is the most economical choice throughout the entire supply chain, including packaging line operations, shipping, distribution, pharmaceutical inventory, and dispensing. Furthermore, blister packaging is more sustainable as it generates less waste compared to plastic and bottle packaging, aligning with the growing trend towards eco-friendly practices in the industry. In the realm of healthcare, food, consumer goods, and industrial goods, blister packaging is an essential component of the production process, ensuring product protection, efficiency, and sustainability.

US Blister Packaging Market Trends

The emergence of contract packaging is the upcoming trend in the market. In the US pharmaceutical industry, stringent regulations, such as the Drug Quality and Security Act of 2013, have led manufacturers to outsource their packaging needs to certified contract packagers. These companies adhere to the Food and Drug Administration's (FDA) detailed standard operating procedures (SOP) and Good Manufacturing Practices (GMP). They provide additional services like barcoding, which is mandatory for all drugs intended for medical use, as per FDA regulations. The blister packaging market in the US includes various types of packaging, such as carded blisters, used for pharmaceuticals, OTC drugs, nutraceuticals, vitamins, cosmetics, and electronics.

Furthermore, contract packaging companies offer advanced solutions, including smart blister packs with Radio Frequency Identification (RFID) tags and sensors, ensuring product safety and traceability.

These technologies provide real-time information on inventory levels, temperature, and other critical factors, enhancing efficiency and reducing wastage. The cosmetics and food and beverage sectors are also embracing blister packaging due to its benefits, such as product protection, easy dispensing, and tamper-evident features. The market for blister packaging in the US is expected to grow significantly due to these factors and the increasing demand for convenience and safety in packaging solutions.

US Blister Packaging Market Challenge

The volatility of raw material prices is a key challenge affecting the market growth. Blister packaging, a popular form of consumer packaging, primarily utilizes plastic films and aluminum as primary materials in the US market. The cost of these raw materials significantly influences the overall price of blister packaging. The plastic films consist of various types such as PVC, Aclar, polyvinylidene chloride (PVDC), COC, and PP. These films are manufactured from polymers and monomers, which are derived from crude oil and natural gas. Consequently, volatility in global crude oil prices may impact the pricing of blister packages. Moreover, other factors such as moisture, gas, light, and temperature also influence the cost and effectiveness of blister packaging.

For instance, the use of cold forming technology in producing carded blister packaging and clamshell blister packaging helps maintain the required temperature and protect the product from external factors. Aluminum, another essential component, is used for blister packaging to ensure product safety and maintain the desired shelf life. The blister packaging market in the US employs various types of packaging, including carded blister packaging and clamshell blister packaging. The choice of packaging type depends on the product's nature, the required level of protection, and consumer preferences. The market is competitive, with key players focusing on innovation, quality, and cost-effectiveness to cater to the evolving consumer demands. From a sustainability perspective, the use of paper and paperboard in blister packaging is gaining popularity due to its eco-friendly nature.

However, the challenge lies in maintaining the required barrier properties to ensure product freshness and safety. The market is expected to witness continued growth due to the increasing demand for convenient and protective packaging solutions. In conclusion, the blister packaging market in the US is driven by various factors, including raw material prices, product requirements, consumer preferences, and sustainability concerns. The market is competitive, with key players focusing on innovation, quality, and cost-effectiveness to cater to the evolving consumer demands. The use of plastic films and aluminum, along with advancements in technology, is expected to drive the growth of the market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Amcor Plc - The company offers Formpack coldform pharmaceutical blister packaging that provides an impermeable barrier to moisture, light, oxygen, extended shelf life, and long-term delamination resistance.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AmerisourceBergen Corp.

- Andex Industries Inc

- Carton Service Inc.

- Combined Technologies Inc.

- Constantia Flexibles Group GmbH

- Deufol SE

- Dow Inc.

- Honeywell International Inc.

- KP Holding GmbH and Co. KG

- Lafayette Industries

- Omnicell Inc.

- Rohrer Corp.

- Sinclair and Rush Inc.

- Sonoco Products Co.

- Southpack

- Tekni Plex Inc.

- Walter Drake Inc.

- WestRock Co.

- Winpak Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Blister packaging is a popular form of packaging used in various industries, including healthcare, food, consumer goods, and industrial goods. This type of packaging involves the use of plastic films or aluminum foils formed over unit-dose medications, medical devices, or other products. The packaging can be in the form of carded blisters or clamshell blisters, with paperboard backing or not. Plastic films used in blister packaging can be thermoformed or cold-formed, while paper and paperboard can be used for backing. Moisture, gas, light, and temperature resistance are essential properties for blister packaging in healthcare applications, ensuring product safety and efficacy.

In the food and beverage industry, blister packaging is used for snacks, confectionery, and other products. For cosmetics and personal care, blister packaging offers tamper resistance and protection against contamination. In the electronics industry, smart blister packs with RDFI tags and sensors are used for product tracking and authentication. Sustainable materials, such as bioplastics, are increasingly used in blister packaging to reduce environmental impact. Pharmaceutical businesses benefit from the tamper resistance properties of blister packaging, while PVC materials are used for certain applications due to their durability and cost-effectiveness. Thermoforming processes are commonly used for large-scale production, while adhesive bonding is used for smaller batches.

Blister packaging is used for various forms of pharmaceutical items, including tablets, pills, capsules, granules, lozenges, medicines, and medicinal items. Aluminum foils are used for certain applications due to their excellent barrier properties. Pharmacy dispensing and physician samples also utilize blister packaging for convenience and safety. Cold-forming technology is used to create complex shapes and designs, while moisture resistance, air resistance, and dust resistance are essential properties for maintaining product quality.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

122 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.06% |

|

Market growth 2024-2028 |

USD 15.68 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.85 |

|

Key companies profiled |

Amcor Plc, AmerisourceBergen Corp., Andex Industries Inc, Carton Service Inc., Combined Technologies Inc., Constantia Flexibles Group GmbH, Deufol SE, Dow Inc., Honeywell International Inc., KP Holding GmbH and Co. KG, Lafayette Industries, Omnicell Inc., Rohrer Corp., Sinclair and Rush Inc., Sonoco Products Co., Southpack, Tekni Plex Inc., Walter Drake Inc., WestRock Co., and Winpak Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles,market forecast , fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch