Boat Rentals Market Size 2024-2028

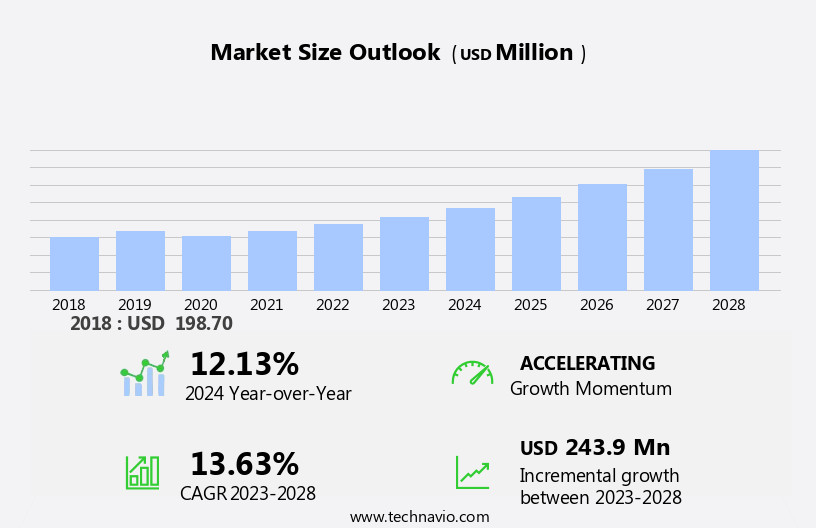

The boat rentals market size is forecast to increase by USD 243.9 million, at a CAGR of 13.63% between 2023 and 2028.

- The market is witnessing significant growth, driven by the increasing customer engagement in marinas and recreational boating activities. This trend is fueled by the development in the boating and sustainable tourism industry, which includes advancements in technology, design, and safety features. However, the market faces a high risk of maritime accidents, posing a significant challenge. This risk can be attributed to various factors, including inclement weather, inexperienced operators, and equipment malfunctions.

- To capitalize on market opportunities and navigate challenges effectively, boat rental companies must prioritize safety measures, invest in technology, and offer exceptional customer experiences. By doing so, they can differentiate themselves in a competitive landscape and build long-term customer loyalty.

What will be the Size of the Boat Rentals Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by diverse sectors and dynamic market dynamics. Luxury boating experiences remain a significant segment, with marine radios and advanced navigation systems enhancing on-water adventures. Simultaneously, revenue management strategies and charter services cater to seasonal demand, optimizing operational efficiency and customer satisfaction. Pontoon boats and outboard motors dominate the recreational sector, while fishing boats cater to a niche market. Pricing strategies vary, influenced by factors such as boat size, rental duration, and seasonal demand. Rental agreements and engine maintenance are crucial aspects, ensuring transparency and reliability. Boat maintenance, including hull cleaning, fuel tank management, and regular maintenance schedules, is essential for ensuring safety and longevity.

Environmental impact is a growing concern, with eco-friendly practices and technologies gaining traction. Online booking systems, customer service, and safety equipment, such as life jackets and bilge pumps, are essential components of the rental process. Fuel consumption and operational efficiency are key considerations for both renters and rental companies. Marketing strategies, including social media and mobile apps, play a significant role in attracting customers and increasing bookings. Docking systems, boat repair, and storage facilities are additional services that cater to the evolving needs of the boat rental industry.

How is this Boat Rentals Industry segmented?

The boat rentals industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Propulsion

- Fuel powered

- Electric boats

- Others

- Boat Type

-

Inboard Boats

-

Outboard Boats

-

Sail Boats

-

Yachts

-

Catamarans

-

Motorboats

-

Others

-

-

Activity

-

Sailing and Leisure

-

Fishing

-

Water Sports

-

Others

-

- Geography

- North America

- US

- Canada

- Europe

- Germany

- Italy

- UK

- Rest of World (ROW)

- North America

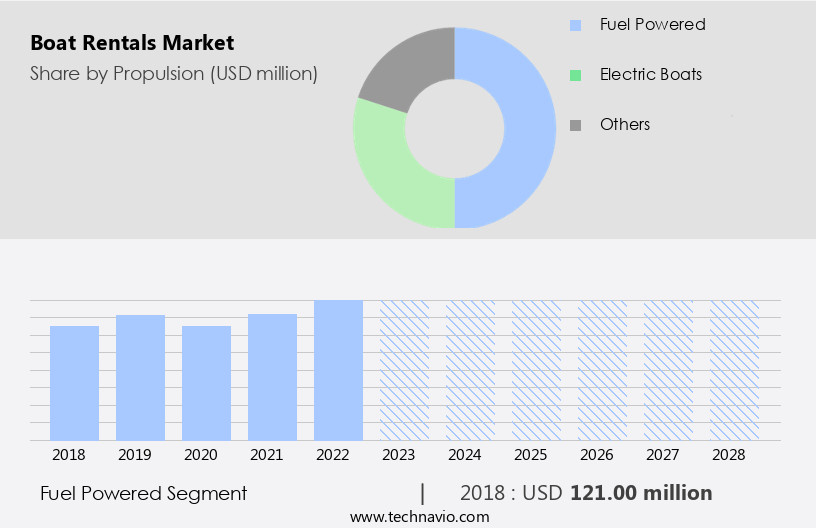

By Propulsion Insights

The fuel powered segment is estimated to witness significant growth during the forecast period.

The market encompasses various types of watercraft, including wakeboarding boats, personal watercraft (pwc), pontoon boats, ski boats, fishing boats, and jet skis. These motorized vessels are fuel-powered, with engines ranging from inboard to outboard. Maintenance schedules and engine maintenance are crucial for operational efficiency and safety. Boat cleaning, hull cleaning, and boat detailing are essential services to maintain the aesthetic appeal and longevity of these watercraft. Seasonal demand, particularly during peak seasons, drives revenue management for boat rental businesses. Luxury boating experiences catering to high-end clientele are a growing trend. Marine radios, navigation systems, and safety equipment are integral components of any boat rental agreement.

Fuel consumption and environmental impact are significant considerations for boat rental companies. Operational efficiency and effective pricing strategies are essential to maximize revenue. Online booking systems, customer service, and booking platforms facilitate easy access to boat rentals. Boat repair and storage facilities ensure the readiness and availability of the fleet. Life jackets (pfds) and safety equipment are mandatory for water safety. Bilge pumps and fuel tanks are essential components for boat functionality. Marketing strategies, such as partnerships with travel agencies and tour operators, expand the reach of boat rental services.

The Fuel powered segment was valued at USD 121.00 million in 2018 and showed a gradual increase during the forecast period.

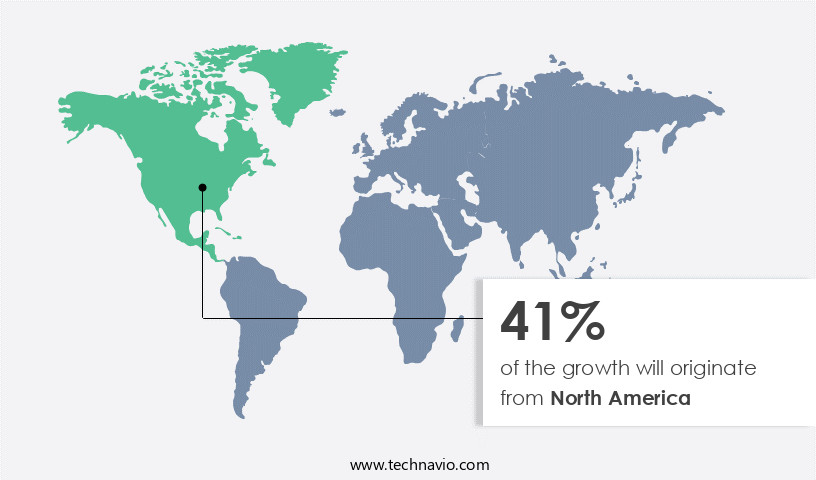

Regional Analysis

North America is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In North America, the preference for recreational boating experiences over boat ownership has led to a significant increase in demand for boat rentals. The US and Canada are the primary markets for boat rentals in this region, with the US being the largest market. The US economy's positive growth over the last decade, rising consumer confidence, and technological advancements by boat manufacturers are key drivers for the market's growth. Boat rentals cater to various preferences, from family boating and wakeboarding in wakeboarding boats to fishing in fishing boats and water sports in personal watercraft (PWC). Boaters prioritize safety, ensuring they have essential safety equipment such as life jackets (PFDS), bilge pumps, and navigation systems.

Seasonal demand for boat rentals is high, particularly during peak seasons. Operational efficiency is crucial for boat rental businesses, with online booking systems, customer service, and maintenance schedules playing significant roles in ensuring a smooth rental experience. Luxury boating and charter services have gained popularity, with inboard motors, marine radios, and boat detailing adding to the overall experience. Environmental impact is a growing concern, with boat rental companies focusing on fuel consumption, hull cleaning, and boat repair to minimize environmental damage. Pricing strategies and rental agreements are essential aspects of the boat rental business. Revenue management, engine maintenance, and fuel tanks are critical factors that impact the profitability of boat rental companies.

Marketing strategies, including mobile apps, booking platforms, and docking systems, are essential for attracting and retaining customers. Boat rental businesses must prioritize operational efficiency and customer satisfaction to remain competitive. This includes providing excellent customer service, ensuring safety equipment is readily available, and offering a wide range of boats, from pontoon boats to ski boats.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global boat rentals market size and forecast projects growth, driven by boat rentals market trends 2024-2028. B2B boat rental solutions leverage smart booking technologies for convenience. Boat rentals market growth opportunities 2025 include boat rentals for tourism and luxury yacht rentals, meeting demand. Boat rental management software optimizes operations, while boat rentals market competitive analysis highlights key providers. Sustainable boat rental practices align with eco-friendly marine trends. Boat rentals regulations 2024-2028 shapes boat rental demand in North America 2025. Eco-friendly boat solutions and premium boat rental insights boost adoption. Boat rentals for events and customized rental packages target niches. Boat rentals market challenges and solutions address safety, with direct procurement strategies for boat rentals and boat rental pricing optimization enhancing profitability. Data-driven boat rental analytics and smart boating trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Boat Rentals Industry?

- Enhancing customer engagement is a crucial factor in driving market growth within the marina and recreational boating industries.

- The global boat rental market experiences significant growth driven by the increasing popularity of marina and recreational boating activities. The US and Europe are major markets for recreational boating, with the industry in the US projected to exceed USD28 billion by 2024, exhibiting consistent expansion over the past decade. However, the market faced a setback in 2020 due to pandemic restrictions, leading to the closure of boating activities.

- Nevertheless, the market has rebounded with the easing of restrictions, large-scale vaccination drives, and a decline in pandemic cases. Marina and charter services in the US contribute substantially to this growth.

What are the market trends shaping the Boat Rentals Industry?

- The boating industry is experiencing significant development, representing an emerging market trend. Your inquiry indicates a keen interest in this sector's advancements.

- The market is a thriving sector in the global economy, with a significant presence in regions like North America and Europe. Europe, in particular, boasts an ideal setting for over 48 million citizens who engage in recreational water activities regularly. Among them, approximately 36 million are boaters, and the number of tourists is substantial. These factors are anticipated to fuel market expansion in Europe throughout the forecast period. Moreover, the increasing popularity of water sports such as wakeboarding and the growing trend of family boating have led companies to adopt various strategies to capture market share.

- For instance, in February 2022, Yanmar Holdings Co. Introduced advanced inboard motors to cater to the demand for high-performance boats. Additionally, the importance of water safety and regular maintenance, including hull cleaning and maintenance schedules, is emphasized to ensure the longevity of boats and personal watercraft (PWC). companies are also focusing on offering comprehensive boat cleaning services to attract customers. Overall, the market is expected to witness steady growth due to these factors and the seasonal demand for water activities.

What challenges does the Boat Rentals Industry face during its growth?

- The maritime industry faces significant challenges from the high risk of accidents, which poses a major threat to its growth. The recreational boating industry, which includes luxury boating, charter services, and pontoon boats, among others, has seen significant attention due to the increasing number of accidents. According to global maritime statistics, recreational boats account for a substantial percentage of maritime accidents, with the US reporting over 4,000 accidents resulting in 636 fatalities, 2,222 injuries, and approximately USD63 million in property damage in 2022 alone. Operator inattention, inexperience, failure to recognize potential hazards, excessive speed, and machinery failure are the leading causes of these accidents. Stakeholders in the market, including boat rental companies, are concerned about this trend.

- To mitigate risks, they are focusing on various strategies such as revenue management, pricing, and boat maintenance. For instance, marine radios and engine maintenance are essential for ensuring safety and reducing the likelihood of accidents. Effective pricing strategies and rental agreements can also help manage risk by ensuring that customers are well-informed about safety procedures and boat operation. Boat rental companies are investing in technology to improve safety and maintenance. For example, they are using outboard motors with advanced features such as automatic shut-off systems and remote diagnostics. These technologies can help prevent machinery failure and reduce the risk of accidents.

- In conclusion, the recreational boating industry is facing challenges due to the increasing number of accidents. However, stakeholders are taking steps to address these challenges through various strategies, including revenue management, pricing, and boat maintenance. By focusing on safety and ensuring that customers are well-informed, boat rental companies can help reduce the risk of accidents and provide a safe and enjoyable experience for their customers.

Exclusive Customer Landscape

The boat rentals market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the boat rentals market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, boat rentals market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

BLUE BAY MARINE - This company specializes in boat rentals, featuring innovative models such as the 2022 Sun Tracker pontoon 22FT and the luxurious 33 Sea Ray Sundancer sport yacht, as well as the robust Scout Dorado. Each vessel offers unique benefits to maritime enthusiasts, enhancing their waterborne experiences.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BLUE BAY MARINE

- Blue Boat Yacht Entertainment Co.

- Boating Inc.

- Boatjump SL

- CLICKANDBOAT SAS

- GETMYBOAT INC.

- GlobeSailor SAS

- Groupe Beneteau

- NAVIGARE YACHTING AB

- Odyssey Boats

- Sailo Inc.

- SamBoat

- Travelopia Group

- West Coast Marine Yacht Services Pvt. Ltd.

- Yachtico GmbH

- Zizooboats GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Boat Rentals Market

- In January 2024, Sea rentals, a leading boat rental company, announced the launch of its new electric boat rental service in Florida, marking a significant stride towards Sustainable Tourism (Sea Rentals Press Release). In March 2024, Boatsetter, a peer-to-peer boat rental marketplace, entered into a strategic partnership with BoatUS, the largest recreational boating organization in the U.S., to expand its customer base and offer enhanced services (BoatUS Press Release).

- In April 2024, Navigate360, a leading marine technology provider, raised USD15 million in a Series B funding round to expand its offerings and strengthen its position in the boat rental market (Crunchbase News). In May 2025, the European Union passed a new regulation allowing boat rental companies to operate across EU borders, paving the way for increased competition and growth opportunities in the European boat rental market (European Commission Press Release).

Research Analyst Overview

- In the dynamic the market, synthetic materials have gained traction in hull design for their durability and lightweight properties. Marketing campaigns leverage data analytics to target specific customer segments, while Fleet Management incorporates technology integration, including electric propulsion and digital dashboards, for improved fuel efficiency. Safety regulations mandate the use of marine coatings and corrosion prevention measures, such as anti-fouling paint. Inventory management and risk assessment are optimized through automated systems and remote controls. Social media marketing and email campaigns engage customers, while customer loyalty programs and accident prevention initiatives foster long-term relationships. Emissions reduction and waste management are key concerns, with hybrid propulsion and water conservation technologies on the rise.

- Pricing models adapt to digital transformation, and insurance claims are managed through electronic controls. Staff training and reputation management ensure exceptional customer relations, while engine diagnostics and PPC advertising attract new renters. Safety, efficiency, and sustainability are the driving forces shaping the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Boat Rentals Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

131 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.63% |

|

Market growth 2024-2028 |

USD 243.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.13 |

|

Key countries |

US, UK, Germany, Italy, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Boat Rentals Market Research and Growth Report?

- CAGR of the Boat Rentals industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the boat rentals market growth of industry companies

We can help! Our analysts can customize this boat rentals market research report to meet your requirements.