Burritos Market Size 2025-2029

The burritos market size is forecast to increase by USD 2.66 billion at a CAGR of 7% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing popularity of Latin American cuisines and extensive marketing activities. Consumers' growing preference for convenient and portable meal options, coupled with the rich flavors and versatility of burritos, is fueling market expansion. However, market growth faces challenges. Regulatory hurdles impact adoption, particularly concerning food safety and labeling requirements. Supply chain inconsistencies, such as fluctuations in raw material prices and availability, temper growth potential.

- To capitalize on market opportunities, companies must navigate these challenges effectively. Strategies like investing in research and development for innovative products, adhering to regulatory standards, and implementing robust supply chain management practices can help mitigate these obstacles and ensure long-term success in the market.

What will be the Size of the Burritos Market during the forecast period?

- The burrito market in the US presents a dynamic and evolving landscape, driven by the growing demand for ethnic cuisine and customizable, health-conscious food options. Meat alternatives, such as quinoa and plant-based proteins, are gaining popularity in versatile burrito platforms. Ethnic flavors and innovative flavor combinations offer adventurous food experiences for consumers. Grilled chicken and fish, along with vegan options, cater to various dietary preferences. Calorie-conscious consumers seek ready-to-eat, portable burritos, making on-the-go convenience a winning imperative. Customizable food offerings, including gluten-free burritos and keto options, cater to diverse dietary needs. Sauces and toppings add depth and excitement to these meals.

- The competitive position of foodservice establishments lies in their ability to offer quick, fresh ingredients and cater to various cultural tastes. company analysis and quantitative data reveal that the market is driven by convenience, healthier ingredients, and customization. Market restraints include potential weaknesses in the ingredients list and calorie content, but these challenges are being addressed through the development of healthier options and innovative flavor combinations. The future of the burrito market lies in its ability to cater to the evolving needs and preferences of consumers, offering convenient, healthy, and adventurous dining experiences. Side dishes, such as rice and beans, add to the filling nature of burritos, making them a popular choice for dinner ideas and party fare.

- Food photography and food influencers play a significant role in shaping consumer perceptions and driving sales. In summary, the burrito market in the US is a dynamic and growing industry, driven by the demand for ethnic cuisine, healthier options, and convenience. Customizable offerings, innovative flavor combinations, and quick service are key winning imperatives. The market faces challenges related to ingredient sourcing and calorie content, but these are being addressed through ongoing research and development efforts. The future of the burrito market lies in its ability to cater to the evolving needs and preferences of consumers, offering convenient, healthy, and adventurous dining experiences.

How is this Burritos Industry segmented?

The burritos industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Foodservice sector

- Retail sector

- Distribution Channel

- Offline

- Online

- Product

- Fresh burritos

- Frozen burritos

- Product Type

- Meat-based

- Vegetarian

- Vegan

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Spain

- UK

- APAC

- China

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

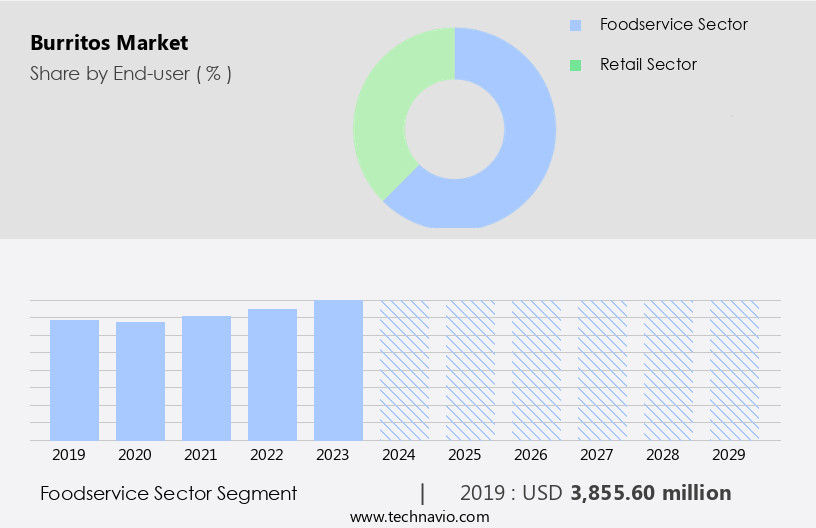

By End-user Insights

The foodservice sector segment is estimated to witness significant growth during the forecast period.

The market is driven by the growing demand for convenient, customizable, and health-conscious on-the-go meals. Fast-casual dining and food trucks have become popular channels for serving made-to-order burritos with diverse flavors, catering to busy lifestyles and various dietary preferences. Plant-based and vegan options, including tofu, beans, and quinoa, have gained popularity among health-conscious consumers and those following keto or flexitarian diets. Salsa and sour cream add to the culinary experiences, while ethical sourcing and organic ingredients further appeal to consumers. The market's current focus is on innovation, offering customizable burritos filled with a variety of proteins like grilled chicken, pork, and meat alternatives.

Foodservice establishments and retailers have embraced this versatile platform, providing consumers with ready-to-eat and vegan options. The convenience of portable, high-fiber, and protein-rich burritos has made them a winning imperative for both restaurants and end consumers. Economic factors and political scenarios can impact the market's scalability, with potential shipping delays and intermediaries affecting the supply chain. However, the market's potential for commercial development and geographical penetration remains strong, as the demand for Mexican cuisine continues to grow. Strategic possibilities include catering to the increasing demand for natural ingredients, low-carb options, and personalization, making burritos a cutting-edge food choice for consumers.

The Foodservice sector segment was valued at USD 3.86 billion in 2019 and showed a gradual increase during the forecast period.

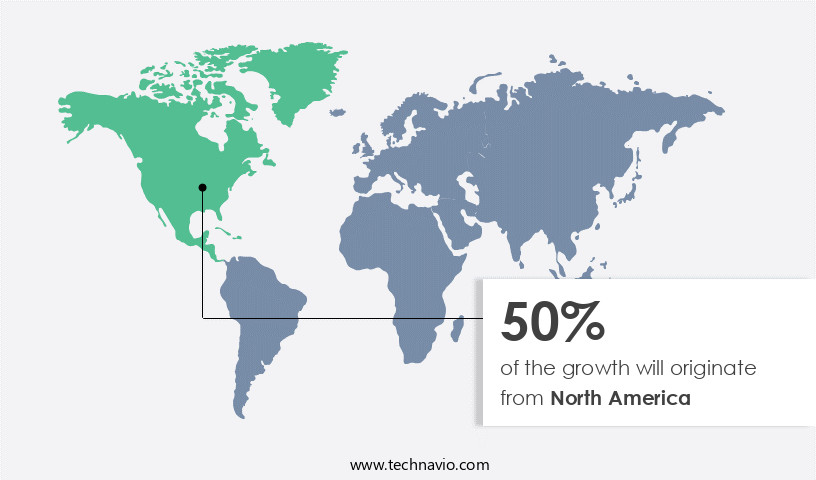

Regional Analysis

North America is estimated to contribute 50% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing consistent growth due to the increasing number of middle-class families and their improved living standards. With hectic lifestyles becoming the norm, consumers are turning to convenient food options, such as burritos, for on-the-go meals. Burrito shops have become popular foodservice outlets, particularly in the US, as many people prefer these portable, customizable meals for breakfast. Made-to-order burritos offer diverse flavors, including plant-based and vegan options, catering to various dietary preferences and personal choices. Fast-casual dining and food trucks are also contributing to the market's growth, providing consumers with made-to-order, fresh ingredients and quick service.

The market's current focus includes offering healthier ingredients, such as whole-food products, organic produce, and natural ingredients, to meet the demands of health-conscious consumers. Additionally, the availability of various fillings, including pork, tofu, beans, and vegetables, allows for customizable varieties that cater to both adventurous and traditional palates. Salsa, sour cream, and queso sauce add to the culinary experiences, while the portability and calorie content make burritos a popular choice for individuals following keto diets or seeking low-carb options. The market's strategic approach includes catering to various dietary preferences, offering ethically sourced food, and ensuring the availability of convenient, ready-to-eat meal options.

The versatility of burritos as a Mexican dish, with its ability to be frozen, retail-ready, or served fresh, makes it a winning imperative in the foodservice industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Burritos market drivers leading to the rise in the adoption of Industry?

- The increasing prevalence of Latin American cuisines is the primary factor fueling market growth.

- The market in the US is experiencing significant growth due to the increasing popularity of Mexican food and the expanding Hispanic population. Consumers' preference for fresh ingredients and exotic flavors is fueling the demand for burritos. Major food service providers, including quick-service restaurants, offer personalized burrito options with plant-based ingredients, such as rice, beans, tofu, and pork, catering to various dietary preferences and personal tastes. Product features like customizable varieties, natural ingredients, and convenience make burritos a winning choice for adventurous food lovers and those seeking healthier food options. The US Hispanic population, which reached a record 63.7 million in 2022, is a significant market driver, as they make up 19.1% of the total population and have a strong affinity for Mexican dishes.

- The market is dominated by major players, offering a range of filling choices, from meat to vegetarian, ensuring a culinary experience for all. The market's commercial development is driven by these social factors and the imperative to provide convenient, low-calorie, and non-GMO food options for consumers.

What are the Burritos market trends shaping the Industry?

- The current market trend is the importance of extensive marketing activities and campaigns. Your professional approach should include the execution of comprehensive marketing efforts to stay competitive.

- The market is experiencing significant growth due to the increasing popularity of ethnic cuisine and the versatility of burritos as a customizable food platform. Consumers are increasingly seeking healthier options, leading to the demand for meat alternatives and fresher ingredients in burritos. Cutting-edge restaurants are responding by offering a range of options, including vegan choices and grilled chicken, while maintaining the convenience and portability of this quick-service food. Food ordering platforms and companies are also capitalizing on the trend, providing ready-to-eat, on-the-go burritos with a variety of toppings, sauces, and customizable ingredients. The nutritional value of burritos is a key consideration for consumers, with many seeking out options with lower calorie content and healthier ingredients.

- Market dynamics indicate a competitive position for foodservice establishments offering burritos, with a focus on both quantitative data, such as sales volume and market share, and qualitative factors, such as culinary experiences and customer satisfaction. As the trend towards convenient, portable meals continues, the market is poised for continued growth.

How does Burritos market faces challenges face during its growth?

- The volatile nature of raw material prices poses a significant challenge to the industry's growth trajectory.

- In the dynamic food industry, fast-casual dining establishments, such as those specializing in burritos, face unique challenges. Economic scenarios, including fluctuating food commodity and raw material prices, pose significant hurdles. These price fluctuations can disrupt production, leading to demand and supply gaps in the market. Moreover, consumers' increasing health consciousness calls for affordable, high-quality foods. For fast-casual dining outlets, maintaining food pricing and quality standards amidst these challenges can be challenging. Burrito restaurants offer diverse flavors, including veggie, queso sauce, meats, and vegan options. They cater to various dietary preferences, including gluten-free and flexitarian diets. Scalability is another essential aspect, as food trucks and intermediaries can help expand the reach of these businesses.

- However, shipping delays and customization requirements can add complexity. To navigate these challenges, a strategic approach is crucial. Companies can benchmark against industry trends, such as the fast-casual dining trend, and focus on offering natural ingredients, nutritious options, and low-carb alternatives. Brown rice, protein, and customizable meal options are popular choices. Addressing potential weaknesses, such as the reliance on beef, can be achieved through sustainable sourcing and offering alternative proteins. By adopting a strategic approach, burrito businesses can thrive in various political and economic scenarios while providing tasty, filling meals for their customers.

Exclusive Customer Landscape

The burritos market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the burritos market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, burritos market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ajinomoto Co. Inc. - The Jose Ole brand showcases a selection of savory burritos, including beef and cheese options.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ajinomoto Co. Inc.

- Amys Kitchen Inc.

- Camino Real Kitchens

- Chick fil A Inc.

- Chipotle Mexican Grill Inc.

- Cofax Coffee

- Conagra Brands Inc.

- El Chile Toreado

- El Metate San Francisco

- Hormel Foods Corp.

- Jack in the Box Inc.

- La Taqueria Taco Bar and Grill

- Lucha Libre Taco Shop

- Nestle SA

- Papalote Mexican Grill

- Ruiz Food Products Inc.

- Taqueria Can Cun

- Taqueria La Cumbre

- YUM Brands Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Burritos Market

- In February 2024, Chipotle Mexican Grill, a leading burrito chain, introduced its digital loyalty program, Chipotle Rewards, allowing customers to earn points for every purchase and redeem them for free menu items (Chipotle Press Release, 2024). This strategic move aimed to enhance customer engagement and boost sales.

- In October 2024, Taco Bell, another major player in the burrito market, announced a partnership with DoorDash to offer contactless delivery at all its U.S. Locations. This collaboration expanded Taco Bell's delivery capabilities and catered to the growing demand for contactless services due to the pandemic (Taco Bell Press Release, 2024).

- In March 2025, Qdoba Mexican Grill, the third-largest burrito chain, completed its acquisition of Fresh To Order, a fast-casual chain specializing in customizable meals. This strategic move aimed to diversify Qdoba's offerings and expand its footprint in the fast-casual segment (Qdoba Press Release, 2025).

- In August 2025, the U.S. Food and Drug Administration (FDA) approved the use of lab-grown meat in burritos and other food items. This regulatory approval paved the way for the burrito industry to adopt more sustainable and ethical protein sources, potentially disrupting traditional production methods (FDA Press Release, 2025).

Research Analyst Overview

Burritos, a beloved Mexican dish known for their convenience and versatility, continue to captivate end consumers with their ability to cater to diverse flavors, busy lifestyles, and dietary preferences. The burrito market is an ever-evolving landscape, shaped by various business strategies and economic factors. Delivery services have significantly influenced the burrito industry, making on-the-go meals more accessible than ever. Fastcasual dining and food trucks have emerged as innovative platforms, offering made-to-order, ethically sourced food with a focus on fresh ingredients and personalization. Plant-based and health-conscious consumers are driving the demand for burritos made with organic, whole-food ingredients, including beans, vegetables, and quinoa.

Salsa, a staple condiment in Mexican cuisine, adds depth and flavor to burritos, with consumers increasingly opting for organic, natural, and non-GMO options. The market is also witnessing an increase in vegan and vegetarian burritos, catering to the growing number of consumers following plant-based diets. Keto diets and flexitarian lifestyles have led to the creation of low-carb and high-protein burrito alternatives. Foodservice outlets and retailers are capitalizing on the convenience factor, offering ready-to-eat, frozen burritos for consumers seeking quick and easy meal options. Customizable burritos with various fillings, such as grilled chicken, tofu, pork, and fish, cater to personal preferences and adventurous food choices.

Chains and quick-service restaurants are focusing on healthier ingredients, calorie content, and nutritional value to meet the evolving needs of consumers. The competitive position of burrito companies is influenced by various factors, including economic scenarios, scalability, and shipping delays. Strategic approaches, such as company benchmarking and quantitative data analysis, help companies stay ahead of the curve and adapt to changing market trends. The future of the burrito market lies in catering to diverse flavors, health consciousness, and convenience, while addressing weaknesses such as sustainability and ethical sourcing. The burrito market is a dynamic and evolving landscape, shaped by various business strategies, economic factors, and social trends.

From fastcasual dining and food trucks to delivery services and convenience foods, burritos continue to cater to the diverse needs and preferences of consumers, offering a versatile platform for culinary experiences and personalization.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Burritos Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

232 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7% |

|

Market growth 2025-2029 |

USD 2657.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Key countries |

US, Canada, UK, Germany, France, Brazil, China, Spain, Mexico, and Argentina |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Burritos Market Research and Growth Report?

- CAGR of the Burritos industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the burritos market growth of industry companies

We can help! Our analysts can customize this burritos market research report to meet your requirements.