Commercial Aircraft Gas Turbine Engine Market Size 2025-2029

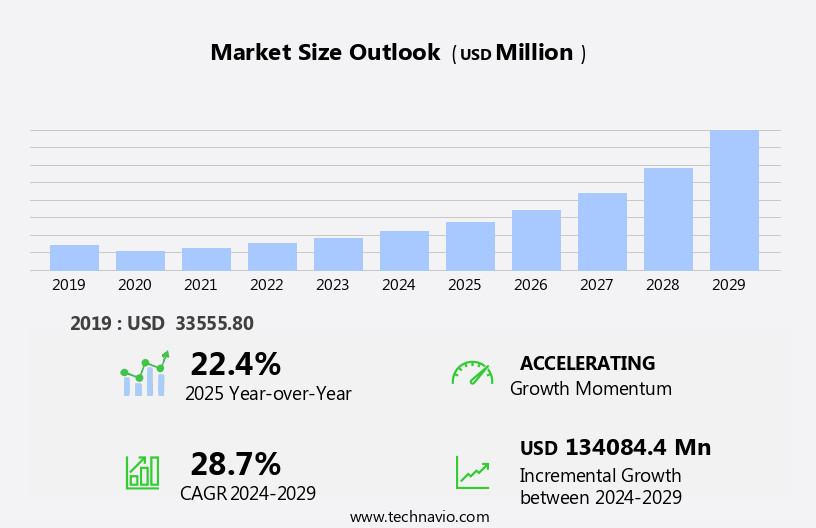

The commercial aircraft gas turbine engine market size is forecast to increase by USD 134.08 billion at a CAGR of 28.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by advancements in engine technologies such as the usage of ceramic matrix composites. These materials offer improved fuel efficiency, increased durability, and reduced emissions, making them a popular choice for aircraft manufacturers and operators. However, market expansion is not without challenges. Regulatory hurdles impact adoption, as stringent emission norms and certification requirements necessitate extensive testing and validation processes. Additionally, grounding of fleets due to technical issues can disrupt the supply chain and temper growth potential.

- To capitalize on market opportunities and navigate challenges effectively, companies must stay abreast of regulatory changes and invest in robust quality control measures. Collaborative efforts between engine manufacturers, airlines, and regulatory bodies can help streamline certification processes and ensure a consistent supply of reliable engines. Moreover, the integration of alternative fuels, such as biofuels and synthetic fuels, into hybrid propulsion systems is a significant trend in engine development.

What will be the Size of the Commercial Aircraft Gas Turbine Engine Market during the forecast period?

- The market is characterized by continuous advancements in engine technology, driven by the need for improved efficiency, reliability, and safety. Engine upgrade options, such as thrust-to-weight ratio enhancements, are increasingly popular, enabling airlines to extend the lifecycle of their fleets while reducing operating costs. Engine repair services play a crucial role in maintaining engine health, with safety records and reliability improvement being key considerations. Engine health monitoring and diagnostics have become essential tools for predictive maintenance, minimizing unscheduled downtime and reducing maintenance costs. Engine overhaul facilities employ advanced testing procedures and fault detection systems to ensure engines meet certification requirements and maintain optimal performance.

- Engine lifecycle costs, including maintenance scheduling and development programs, are a significant focus for engine manufacturers and operators. Engine emissions standards continue to evolve, necessitating ongoing research and development efforts. Engine training programs equip maintenance personnel with the necessary skills to effectively manage engine operating costs and specific fuel consumption. Engine certification requirements and maintenance costs remain critical factors influencing market dynamics. Overall, the market is witnessing a balanced blend of technological advancements and regulatory compliance, shaping the future of commercial aircraft gas turbine engines.

How is this Commercial Aircraft Gas Turbine Engine Industry segmented?

The commercial aircraft gas turbine engine industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- Turbofan

- Turboprop

- Type

- Narrow-body aircraft

- Widebody aircraft

- Regional aircraft

- Product

- Conventional jet engines

- Geared turbofan (GTF) engines

- Open rotor or (UDF) concepts

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Technology Insights

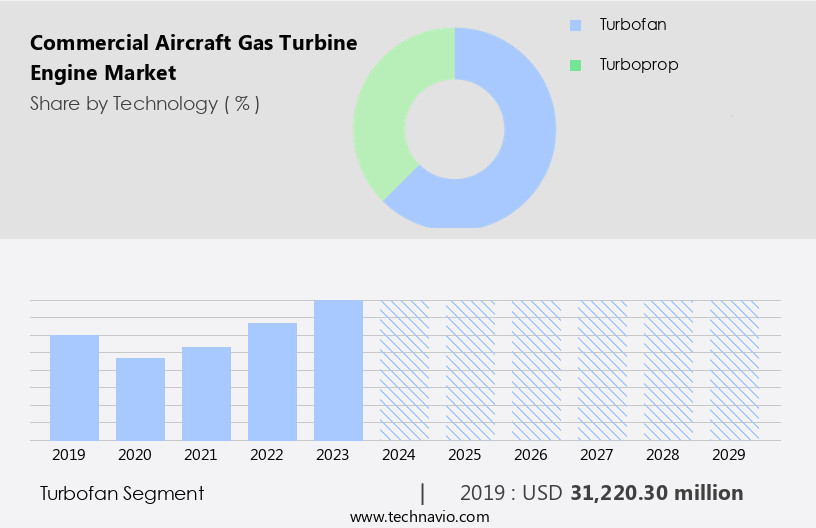

The turbofan segment is estimated to witness significant growth during the forecast period. The market is set for significant advancements in the turbofan segment between 2025 and 2029. Fuel efficiency and emission reduction are key focus areas, driving engine technology innovations. Sustainability is a top priority, leading to material and design improvements to meet environmental regulations. In June 2024, General Electric Company announced the development of hybrid electric engines, integrating electric motor/generators into high-bypass commercial turbofans for optimal performance. Manufacturers are also investing in advanced materials, such as lightweight composites, to boost engine performance and reduce weight, thereby enhancing fuel efficiency. Engine design and testing are undergoing digital transformation, with digital engine control systems and predictive maintenance programs gaining traction.

Engine upgrades and overhauls are also essential for maintaining safety standards and optimizing engine performance. The aviation industry's shift towards sustainable aviation fuels and electric propulsion systems is influencing engine development, with new engine technologies and engine components coming to the forefront. Engine health management and engine data analytics are crucial for ensuring engine reliability and longevity. The market is witnessing a wave in engine efficiency optimization, with high-bypass engines and composite materials playing a pivotal role. The wide-body and commercial aircraft sectors are experiencing notable growth, necessitating engine repair and maintenance programs for regional and business jets.

The Turbofan segment was valued at USD 31.22 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

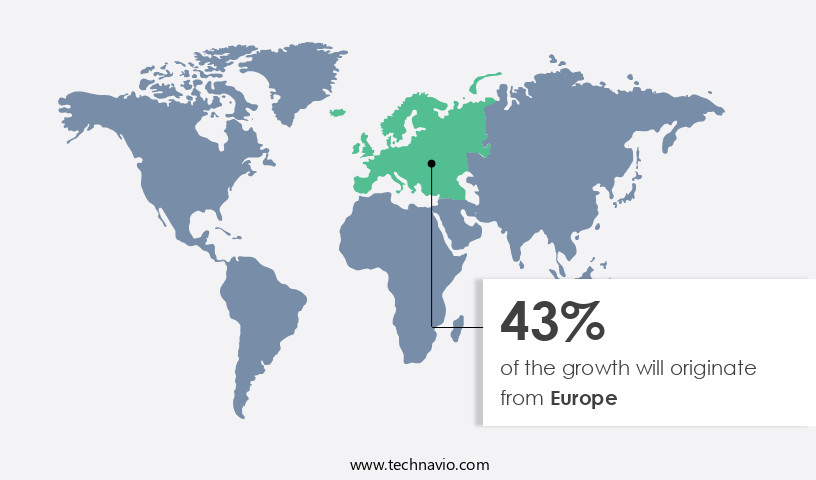

Europe is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European airline industry, serving over 970 million passengers annually, necessitates an efficient network of operators providing top-tier services at competitive prices. To manage this high volume of travelers, airlines are exploring ways to reduce fleet operating costs, leading to an increased demand for fuel-efficient engines and fleet upgrades. This trend is anticipated to fuel the growth of the market in Europe. The European Union (EU) is a significant player in aerospace research and development, hosting numerous aircraft engine Original Equipment Manufacturers (OEMs). New aircraft with advanced gas turbine engines, featuring digital engine control, lightweight materials, and high bypass ratios, are attracting significant investment due to their fuel efficiency and improved engine performance.

The integration of electric propulsion, hybrid propulsion, and sustainable aviation fuels in engine design is also gaining momentum. Engine manufacturers are focusing on engine health management, predictive maintenance, and engine monitoring to enhance engine life cycle and safety standards. Engine upgrades, engine overhaul, and engine certification are essential aspects of the market, ensuring the continuous optimization of engine efficiency and performance. The aviation industry's ongoing innovation, driven by engine components, engine materials, engine testing, and engine development, is shaping the future of commercial aircraft gas turbine engines.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Commercial Aircraft Gas Turbine Engine market drivers leading to the rise in the adoption of Industry?

- Advancements in engine technologies serve as the primary catalyst for market growth, driving innovation and progress within the industry. The market is driven by the demand for fuel-efficient and cost-effective engines. Advanced materials, such as carbon fibers and titanium alloys, are utilized in engine design to enhance durability and performance throughout the engine life cycle. In the current era, digital engine control systems are prevalent, enabling real-time monitoring of engine parameters, including temperature, pressure, vibration, and oil debris.

- These sensors, mounted on engines like the Trent XWB by Rolls-Royce, check engine parameters at a high frequency and can quickly identify faults or errors. Engine testing and maintenance programs play a crucial role in ensuring optimal engine performance and longevity.

What are the Commercial Aircraft Gas Turbine Engine market trends shaping the Industry?

- The use of ceramic matrix composites is currently a significant market trend. These advanced materials offer superior strength and heat resistance, making them highly sought after in various industries. Gas turbine engines in the commercial aviation sector are undergoing significant advancements, with the integration of ceramic-matrix composites (CMCs) becoming a key trend. These materials, made up of a ceramic-based oxide or non-oxide matrix reinforced with treated carbon fibers or whiskers, offer a 66% weight reduction compared to nickel superalloys. Moreover, they can operate at temperatures above 500 degrees F, surpassing the endurance threshold of nickel superalloys. The adoption of CMCs enables engines to achieve higher service temperatures and increased efficiency through two primary methods: a reduced need for diverted cooling air or lower fuel consumption due to higher engine temperatures.

- Consequently, engines produce more thrust per unit of fuel, leading to enhanced efficiency. Engine health management plays a crucial role in the aviation industry, with predictive maintenance and engine monitoring becoming essential practices. Engine upgrades and safety standards continue to evolve, requiring engine data analytics for effective decision-making. The bypass ratio in gas turbine engines is another critical factor, as it significantly influences the overall efficiency of the propulsion system. By focusing on these aspects, the gas turbine engine market continues to advance, offering opportunities for innovation and growth.

How does Commercial Aircraft Gas Turbine Engine market faces challenges face during its growth?

- Technical issues resulting in fleet groundings represent a significant challenge to the industry's growth trajectory. The market is witnessing significant advancements, with Pratt & Whitney's new PurePower line of geared turbofan engines being a notable development. These engines, represented by the PW1100G series, have garnered industry-wide attention for their potential to enhance fuel efficiency and reduce emissions. The engines were initially chosen to power next-generation narrow-body airliners, such as the Bombardier CSeries, Mitsubishi Regional Jet (MRJ), and Embraer's second-generation E-Jets. However, recent safety and reliability concerns have cast a shadow over their reputation. Despite these challenges, the pursuit of engine efficiency optimization continues, with a focus on engine components, materials, and engine performance.

- Composite materials, such as carbon fiber, are increasingly being adopted to reduce weight and improve engine durability. Additionally, the push towards sustainable aviation is driving the market, with engine manufacturers investing in research and development of advanced engine technologies. Engine parts are also undergoing significant innovations, with a focus on improving engine performance and extending engine life.

Exclusive Customer Landscape

The commercial aircraft gas turbine engine market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the commercial aircraft gas turbine engine market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, commercial aircraft gas turbine engine market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

General Electric Co.- The company offers commercial aircraft gas turbine engines such as CF6, GEnx, GE90, GE9X, and CFM56 and LEAP.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- EuroJet Turbo GmbH

- GKN Aerospace Services Ltd.

- Honeywell International Inc.

- IHI Corp.

- JSC Klimov

- Kawasaki Heavy Industries Ltd.

- Mitsubishi Heavy Industries Ltd.

- MTU Aero Engines AG

- PBS Group AS

- Pratt and Whitney

- Rolls Royce Holdings Plc

- Rostec

- Safran SA

- Textron Inc.

- TurbAero

- UEC Aviadvigatel JSC

- UEC Saturn

- Williams International Co. LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Commercial Aircraft Gas Turbine Engine Market

- In February 2024, Rolls-Royce, a leading manufacturer of commercial aircraft gas turbine engines, unveiled its latest innovation, the UltraFan engine, which promises a 10% fuel efficiency improvement and a 50% noise reduction (Rolls-Royce Press Release, 2024). This technological advancement is expected to significantly enhance the competitiveness of Rolls-Royce in the commercial aviation engine market.

- In May 2025, Pratt & Whitney, another major player, announced a strategic partnership with Airbus to develop and produce a new generation of gas turbine engines for the A320neo family of aircraft (Pratt & Whitney Press Release, 2025). This collaboration is expected to strengthen the competitive edge of both companies in the commercial aircraft engine market.

- GE Aviation, a significant player in the market, secured a major contract from Boeing in August 2024 to provide the LEAP-1B engines for the 737 MAX aircraft (GE Aviation Press Release, 2024). This contract is valued at approximately USD23 billion and is expected to contribute significantly to GE Aviation's market share in the commercial aircraft engine sector.

- In December 2025, Safran, a French multinational aircraft engine manufacturer, received regulatory approval from the European Union Aviation Safety Agency (EASA) for its new LEAP-X engine, which is expected to power the Airbus A320neo family of aircraft (Safran Press Release, 2025). This approval marks a significant milestone in the development and commercialization of the LEAP-X engine and is expected to boost Safran's market presence in the commercial aircraft engine sector.

Research Analyst Overview

The market continues to evolve, driven by advancements in engine design, materials, and digital technologies. Single-aisle aircraft rely on core engines with high bypass ratios and advanced materials for improved fuel efficiency and reduced emissions. Gas turbines undergo rigorous testing and certification processes to ensure safety standards are met. Engine health management systems employ predictive maintenance and monitoring techniques, utilizing engine data analytics to optimize performance and extend engine life cycle. Engine upgrades and overhauls are essential for maintaining engine efficiency and extending their operational life. Safety standards and engine certification remain paramount in the aviation industry, with continuous innovation in engine design and digital engine control systems.

The integration of electric propulsion and alternative fuels into gas turbine engines is a developing trend, with potential for significant impact on engine performance and sustainability. Bypass ratios and propulsion systems are key factors in engine efficiency optimization, with high-bypass engines and composite materials reducing noise and improving overall engine performance. Engine repair and maintenance programs play a crucial role in ensuring engine reliability and minimizing downtime. The commercial aircraft engine market is characterized by ongoing innovation, with business jets, regional aircraft, and wide-body aircraft all requiring unique engine solutions. The evolving landscape of engine technologies continues to shape the aviation industry, with a focus on sustainability, fuel efficiency, and safety.

The Commercial Aircraft Gas Turbine Engine Market continues to evolve with a strong focus on engine reliability improvement and efficient engine maintenance scheduling. Airlines aim to reduce engine maintenance costs while enhancing operational efficiency through advanced engine diagnostics and engine fault detection technologies. The industry prioritizes engine reliability metrics and maintains stringent engine safety records to ensure compliance with aviation standards. Efforts to minimize engine noise levels contribute to environmental and regulatory adaptations. Rigorous engine testing procedures are integrated into engine development programs to refine performance and longevity. With continuous technological advancements, manufacturers optimize engine systems for improved fuel efficiency, sustainability, and overall market competitiveness. These innovations play a crucial role in shaping the future of commercial aviation.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Commercial Aircraft Gas Turbine Engine Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 28.7% |

|

Market growth 2025-2029 |

USD 134.08 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

22.4 |

|

Key countries |

US, China, Germany, Canada, France, Japan, UK, India, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Commercial Aircraft Gas Turbine Engine Market Research and Growth Report?

- CAGR of the Commercial Aircraft Gas Turbine Engine industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the commercial aircraft gas turbine engine market growth and forecasting

We can help! Our analysts can customize this commercial aircraft gas turbine engine market research report to meet your requirements.