Corporate Learning Management System Market Size 2025-2029

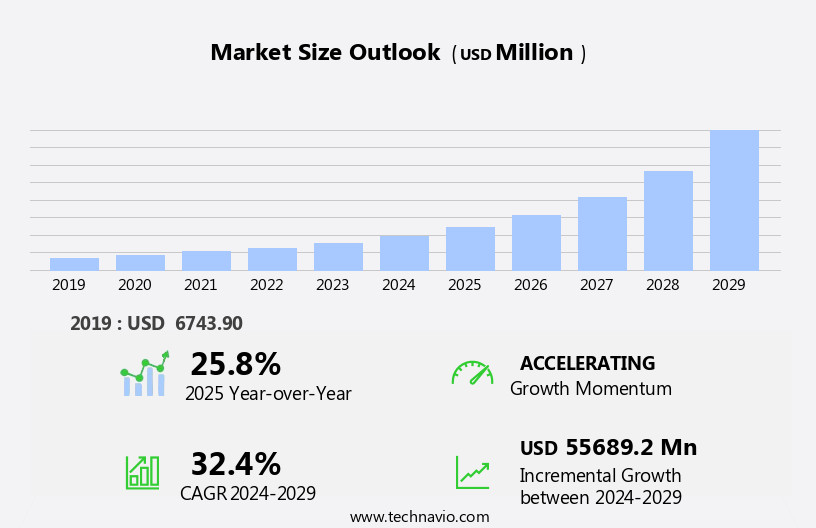

The corporate learning management system market size is forecast to increase by USD 55.69 billion at a CAGR of 32.4% between 2024 and 2029.

- The Corporate Learning Management System (CLMS) market is witnessing significant growth, driven by the increasing adoption of cloud-based solutions and the emergence of mobile learning. Cloud-based CLMS enables organizations to deliver training programs more efficiently and cost-effectively, as they eliminate the need for on-premises infrastructure and offer scalability and flexibility. Furthermore, mobile learning is gaining popularity due to the increasing use of smartphones and tablets for professional development, allowing employees to learn anytime, anywhere. However, the market also faces challenges. The threat from open-source LMS solutions is increasing, as they offer cost-effective alternatives to proprietary systems. Organizations must carefully evaluate the benefits and drawbacks of open-source solutions, including customizability, support, and security, before making a decision.

- Additionally, ensuring data security and privacy in cloud-based CLMS is a major concern, particularly in industries with stringent compliance requirements. Companies must invest in robust security measures and comply with relevant regulations to mitigate these risks. In summary, the CLMS market is experiencing strong growth, driven by cloud-based solutions and mobile learning, but faces challenges from open-source alternatives and data security concerns. Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on offering flexible, secure, and cost-effective solutions.

What will be the Size of the Corporate Learning Management System Market during the forecast period?

- The corporate learning management system (LMS) market continues to evolve, integrating various applications to meet the dynamic training needs of businesses. These systems facilitate employee training, skill development, and performance management through personalized recommendations, content curation, and adaptive learning. Digital transformation drives the adoption of cloud-based LMS, enabling online training, virtual learning, and mobile learning. Collaboration tools foster social learning and knowledge sharing, while learning culture and big data analytics enhance employee engagement and performance. Compliance training, sales training, leadership development, and technical training are seamlessly integrated into these systems. Learning paths, performance dashboards, and assessment tools enable agile learning and continuous workforce development.

- Content management, learning resources, and learning reports provide valuable insights for talent management and talent development. Machine learning and artificial intelligence further enhance these systems by delivering personalized learning experiences. The ongoing integration of these features underscores the importance of LMS in today's business landscape. As market activities unfold, LMS continues to evolve, offering innovative solutions to meet the ever-changing training needs of organizations.

How is this Corporate Learning Management System Industry segmented?

The corporate learning management system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-premises

- Cloud

- End-user

- Large enterprises

- Small and medium enterprises

- Delivery Model

- Online

- Blended

- Instructor-Led

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Deployment Insights

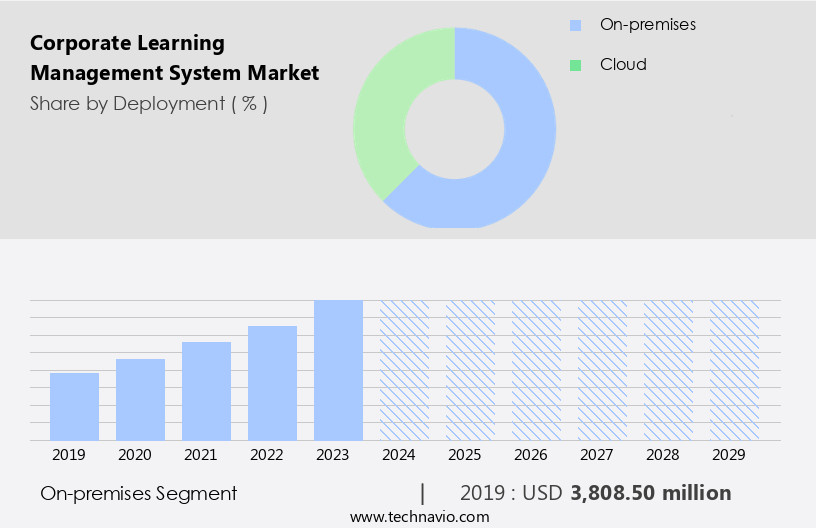

The on-premises segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth as businesses prioritize employee skill development and training to enhance productivity and stay competitive in the digital transformation era. Personalized recommendations powered by artificial intelligence are increasingly being adopted to deliver customized learning experiences. Performance dashboards and training needs analysis enable companies to identify gaps and tailor training programs accordingly. Learning paths and adaptive learning cater to individual employee needs, while cloud-based LMS ensures accessibility and flexibility. Corporate training encompasses various domains, including leadership development, sales training, and soft skills training. Collaboration tools foster a learning culture, while big data analytics provide valuable insights for continuous improvement.

Online and virtual learning, including blended learning, are essential components of modern training strategies. Learning resources, such as content curation and creation, reports, and assessments, support ongoing learning and development. Machine learning and performance management tools help optimize employee engagement and performance. Single sign-on (SSO) and assessment tools streamline the learning process, while compliance training ensures regulatory adherence. Learning communities and knowledge sharing facilitate peer-to-peer learning and knowledge management. Talent management, agile learning, and continuous learning initiatives are crucial for workforce development and career advancement. Employees value personalized learning experiences that cater to their unique needs and objectives.

A strong learning culture and positive employee experience contribute to higher engagement and retention. Customer service training is essential for maintaining high-quality service and ensuring customer satisfaction. Overall, the market will continue to evolve, driven by the need for continuous skill development and the integration of advanced technologies.

The On-premises segment was valued at USD 3.81 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

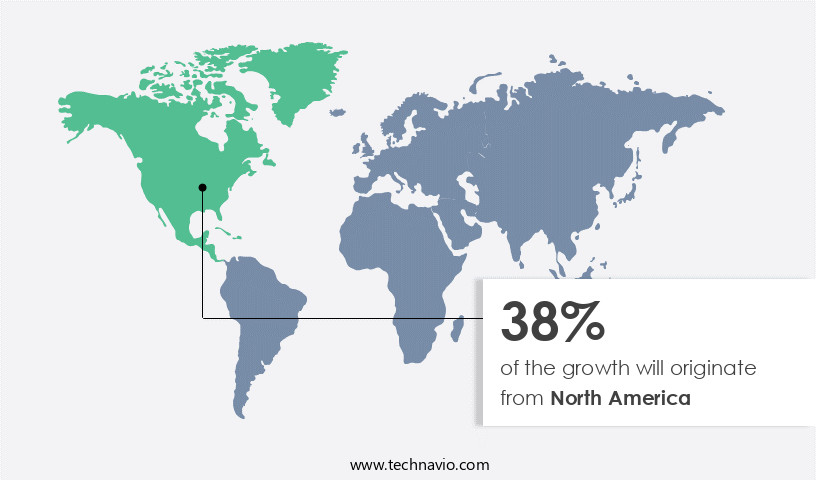

North America is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The corporate learning management systems market in North America is experiencing steady growth, driven by the region's pioneering approach to employee training and talent development. Organizations in North America have long prioritized job-specific and skills-related training, setting a global trend. Some companies develop proprietary training programs in collaboration with leading institutes, while others license customized services. With a large number of multinational corporations and major organizations based in North America, there is significant demand for comprehensive corporate training solutions. As businesses expand globally, there is a growing emphasis on equipping employees with the necessary skills for seamless knowledge transfer and job transitions during the forecast period.

Artificial intelligence and machine learning technologies are increasingly being integrated into learning management systems to deliver personalized recommendations and adaptive learning paths. Performance dashboards and analytics tools enable training needs analysis and real-time progress tracking, while big data analytics facilitate continuous learning and workforce development. Digital transformation initiatives have led to the adoption of cloud-based LMS, virtual learning, and mobile learning, enhancing the flexibility and accessibility of corporate training. Soft skills training, leadership development, sales training, and compliance training are essential components of corporate learning management systems. Collaboration tools and learning communities foster a culture of knowledge sharing and employee engagement, while single sign-on and assessment tools streamline the learning process.

Agile learning and continuous learning initiatives cater to the evolving needs of the workforce, ensuring that employees remain up-to-date with the latest industry trends and best practices. In conclusion, the North American corporate learning management systems market is characterized by its focus on employee training and talent development, driven by the presence of numerous multinational corporations and large organizations. The integration of advanced technologies, such as AI and machine learning, and the adoption of digital learning modalities are key trends shaping the market. The market is expected to continue growing at a moderate pace during the forecast period, as organizations prioritize the development of a skilled and adaptable workforce.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Corporate Learning Management System Industry?

- The implementation of cloud-based Learning Management Systems (LMS) in corporations is a significant market trend, driving growth and innovation in corporate education and training.

- The market is experiencing significant growth due to the adoption of cloud-based solutions. The use of cloud-based learning management systems (LMS) offers numerous benefits, such as cost savings and ease of implementation. Cloud-based LMS providers, including TalentLMS, Haiku Learning, Scholar LMS, and WizIQ, offer flexible and scalable services, allowing small and mid-size enterprises to access advanced learning solutions without the need for extensive IT infrastructure. Cloud-based LMS enables continuous learning and workforce development by providing access to learning content creation, virtual learning, mobile learning, and personalized learning experiences. Learning reports and analytics help organizations track employee progress and performance, enabling talent development and customer service training.

- The immersive and harmonious learning experience offered by cloud-based LMS solutions enhances the overall employee experience, contributing to improved productivity and engagement. The implementation of cloud-based services ensures that users have access to the latest features and updates, allowing organizations to adapt to the ever-changing market dynamics. By leveraging cloud-based LMS, companies can focus on their core business functions while leaving the LMS management to the experts. In conclusion, the adoption of cloud-based LMS is a strategic investment for businesses seeking to stay competitive in today's dynamic business environment.

What are the market trends shaping the Corporate Learning Management System Industry?

- The emergence of mobile learning signifies a significant market trend, with professionals increasingly relying on mobile devices for education and skill development. This shift towards mobile learning is mandatory for staying competitive in today's dynamic business landscape.

- In today's digital transformation era, Human Capital Management (HCM) solutions, including Training Management Systems (TMS), have evolved to cater to the changing learning preferences of employees. Personalized recommendations, powered by Artificial Intelligence (AI), have become a norm in employee training. LMSs are no longer just platforms for managing and delivering training content; they offer skill development, performance dashboards, training needs analysis, learning paths, and social learning. The integration of Bring-Your-Own-Device (BYOD) policies and LMSs is essential, as learners increasingly access content on mobile devices. While BYOD policies enable flexibility and convenience, they also present challenges for IT teams in managing a diverse range of devices.

- Corporate-owned personally enabled (COPE) devices are emerging as an alternative, allowing organizations to maintain control while delivering information effectively. Adaptive learning and immersive experiences are becoming increasingly harmonious in LMSs, focusing on the learner's needs and emphasizing engagement. Cloud-based LMSs offer the flexibility and accessibility required in today's work environment, making them a preferred choice for businesses aiming to enhance their employee training programs.

What challenges does the Corporate Learning Management System Industry face during its growth?

- The open-source Learning Management System (LMS) poses a significant threat that could hinder the growth of the industry, as it challenges traditional LMS providers with its cost-effective and customizable solutions.

- Corporate learning management systems (LMS) are experiencing a shift as open-source solutions gain traction in the market. Open-source LMS solutions offer several advantages over traditional proprietary systems, particularly in cost savings. While proprietary LMS providers charge one-time licensing fees or subscriptions, open-source LMS solutions do not require such initial costs. Moreover, the development and maintenance costs of open-source LMS are generally lower than proprietary alternatives. Open-source LMS solutions enable multiple users to participate at no charge, making them an attractive option for corporations seeking to train their employees cost-effectively. Content curation, leadership development, sales training, blended learning, soft skills training, and technical training are all integral components of corporate training, which open-source LMS solutions can facilitate through collaboration tools and content management systems.

- Big data analytics is another essential feature, allowing companies to track employee progress and performance, and identify areas for improvement. Online training is a crucial aspect of modern corporate learning, and open-source LMS solutions offer flexibility and convenience. By providing a platform for content delivery, assessment, and tracking, open-source LMS solutions contribute to fostering a learning culture within organizations. Ultimately, the adoption of open-source LMS solutions signifies a shift towards more accessible, cost-effective, and collaborative corporate training solutions.

Exclusive Customer Landscape

The corporate learning management system market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the corporate learning management system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, corporate learning management system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Absorb Software Inc. - The company specializes in providing advanced learning management systems, focusing on employee skill development. Our solutions facilitate the creation, management, and delivery of impactful training programs. By leveraging innovative technologies, we ensure effective and engaging learning experiences. Our systems streamline the process of tracking progress, assessing performance, and reporting on key metrics. These features enable organizations to optimize their workforce's potential, fostering a culture of continuous learning and improvement.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Absorb Software Inc.

- Adobe Inc.

- Blackboard Inc.

- Bridge (Instructure)

- Cornerstone OnDemand Inc.

- CrossKnowledge (Wiley)

- D2L Corporation

- Docebo Inc.

- G-Cube Solutions

- Instructure Inc.

- Intellum Inc.

- LearnUpon Limited

- Litmos (CallidusCloud)

- Moodle Pty Ltd.

- Oracle Corporation

- Saba Software Inc.

- SAP SE

- Skillsoft Corporation

- SumTotal Systems LLC

- TalentLMS (Epignosis LLC)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Corporate Learning Management System Market

- In February 2024, Microsoft announced the global availability of its new Microsoft Learn platform, an intelligent and interactive learning system integrated with its Microsoft 365 suite (Microsoft, 2024). This development signified a significant shift towards personalized, self-paced learning experiences for corporate clients.

- In October 2024, IBM and Coursera joined forces to offer IBM's professional certification programs on Coursera's platform (IBM, 2024). This strategic partnership expanded IBM's reach in the corporate learning market and provided Coursera with IBM's renowned certification programs.

- In January 2025, Skillsoft acquired SumTotal Systems, a leading provider of HR and talent management solutions, for approximately USD1.5 billion (Skillsoft, 2025). This acquisition enabled Skillsoft to expand its offerings beyond learning management to talent management, creating a comprehensive Human Capital Management (HCM) solution.

- In March 2025, Google Cloud unveiled its new Re:Work Solo learning platform, designed for individual learners seeking to upskill and reskill (Google Cloud, 2025). This technological advancement showcased Google's commitment to the corporate learning market, offering personalized, self-paced learning experiences to a broader audience.

Research Analyst Overview

In today's business landscape, the learning management system (LMS) market is witnessing significant growth, driven by the increasing importance of data-driven decision making and talent acquisition. Learning insights derived from LMS data enable organizations to assess learning trends, employee productivity, and business performance. Learning content development is a key focus area, with a shift towards personalized learning journeys and immersive experiences, including learning games, gamified learning, augmented reality (AR), and virtual reality (VR). This trend is aimed at improving learning effectiveness and employee retention. Learning platform providers are innovating to meet these demands, offering learning measurement tools and analytics, skills gap analysis, and content personalization.

The future of learning lies in digital learning, learning ecosystems, and learning strategy, all aimed at enhancing employee productivity and learning outcomes. Training software solutions are increasingly incorporating learning technologies such as AR and VR to create engaging and effective learning experiences. Learning simulation and measurement tools help organizations assess the impact of their learning initiatives and adapt their strategies accordingly. The market for learning management software is expected to continue growing, as businesses recognize the importance of investing in their employees' skills development and retention. With the increasing availability of learning analytics tools, organizations can gain valuable insights into their learning ecosystem and make data-driven decisions to optimize their learning strategy.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Corporate Learning Management System Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 32.4% |

|

Market growth 2025-2029 |

USD 55689.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

25.8 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Corporate Learning Management System Market Research and Growth Report?

- CAGR of the Corporate Learning Management System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the corporate learning management system market growth of industry companies

We can help! Our analysts can customize this corporate learning management system market research report to meet your requirements.