Corrugated Box Making Machine Market Size 2025-2029

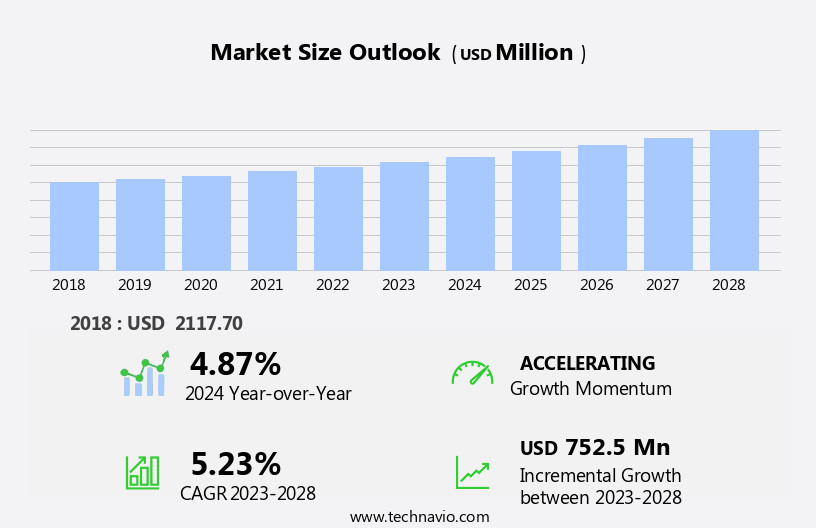

The corrugated box making machine market size is forecast to increase by USD 821.2 million at a CAGR of 5.4% between 2024 and 2029.

- The corrugated box making market is experiencing significant momentum, driven by the exponential growth of the e-commerce industry. E-commerce and electronics packaging segments are also significant contributors to the market. The increasing preference for convenient and efficient packaging solutions, particularly for online retail, is fueling the demand for corrugated boxes. Another key trend shaping the market is the adoption of smart packaging, which offers enhanced product protection, extended shelf life, and improved consumer engagement. However, the market faces challenges as well.

- To navigate these challenges and capitalize on opportunities, companies must focus on optimizing production processes, exploring alternative raw materials, and collaborating with suppliers to ensure a steady supply chain. Another trend shaping the market is the adoption of smart packaging, which offers enhanced product protection and branding opportunities. By staying abreast of these market dynamics, businesses can effectively strategize and adapt to the evolving landscape of the corrugated box making industry. The rising cost of raw materials, such as paper and adhesives, poses a significant obstacle for manufacturers.

What will be the Size of the Corrugated Box Making Machine Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The corrugated box making market continues to evolve, driven by advancements in packaging technology and the shifting priorities of businesses. Product protection remains a key focus, with logistics optimization and cost reduction top of mind for many companies. Sheet feeders and converting machinery enable efficient production planning, while digital transformation and automation integration streamline processes. Packaging materials, including paper chemistry and sustainable options, are under scrutiny for their environmental impact and shelf life extension. Brand enhancement through innovative designs and post-printing processes is also a trend, as is compliance with packaging regulations and environmental standards. Circular economy principles are influencing the market, with waste management technologies and supply chain optimization becoming increasingly important.

- Quality assurance and demand forecasting are essential components of profit maximization, while packaging lifecycle management and glue applicators ensure optimal performance and longevity. Innovations in packaging technology, such as rotary cutters and printing presses, continue to push the boundaries of what is possible in the industry. As businesses seek to stay competitive, they are investing in packaging solutions that offer cost savings, enhanced branding, and improved sustainability. The increasing preference for convenient and efficient packaging solutions, particularly for online retail, is fueling the demand for corrugated boxes.

How is this Corrugated Box Making Machine Industry segmented?

The corrugated box making machine industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

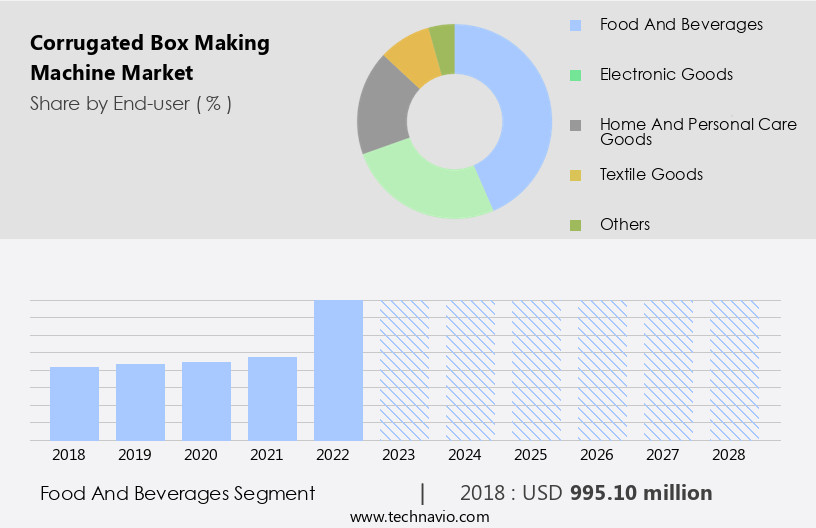

- End-user

- Food and beverages

- Electronic goods

- Home and personal care goods

- Textile goods

- Others

- Technology

- Automatic

- Semi-automatic

- Manual

- Product Type

- High-capacity machines

- Medium-capacity machines

- Low-capacity machines

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The food and beverages segment is estimated to witness significant growth during the forecast period. The market experiences significant growth due to the increasing demand for efficient and sustainable packaging solutions across various industries. In particular, the food and beverages sector, encompassing manufacturers of alcoholic and non-alcoholic beverages, processed meats, and ready-to-eat products, drives market expansion. The rise in global food consumption and population growth fuel the industry's development. Corrugated boxes have gained popularity due to their ability to protect and preserve the quality of food products during transportation and storage. This demand is further fueled by the trend towards processed and ready-to-eat foods. Advanced technologies, such as artificial intelligence, data analytics, and machine vision, are integrated into corrugated box making machines to enhance production efficiency, improve quality control, and ensure water resistance.

The rise of online shopping and the need for secure and protective packaging for electronics have increased demand for corrugated boxes and making machines. Box design software and automation technologies, such as die-cutting dies, rotary die cutting, and folding cartons, streamline production processes and improve product customization. Ink selection, production speed, and glue suppliers are essential considerations to ensure optimal machine performance and minimize downtime. The market is expected to continue growing as businesses seek innovative and sustainable packaging solutions to meet evolving consumer demands and regulatory requirements.

The Corrugated Box Making Machine Market is advancing to meet the evolving demands of modern logistics and retail. The rise of ecommerce packaging is reshaping production priorities, with manufacturers emphasizing durability and efficiency. Machines are now optimized to work with diverse flute types, enabling varying levels of cushioning and strength. Attention to board thickness is critical, as it influences load-bearing capacity and material usage. To ensure quality, equipment increasingly supports integration with edge crush test metrics, vital for structural integrity assessment. In addition to corrugated formats, folding carton compatibility is gaining relevance for lightweight, retail-ready packaging. Innovations in printing plates are also enhancing visual branding directly at the production stage, making packaging both protective and promotional.

The Food and beverages segment was valued at USD 1.03 billion in 2019 and showed a gradual increase during the forecast period.

Sustainability is a crucial factor influencing market trends. The use of recycled paperboard, pre-consumer recycled content, and post-consumer recycled content in corrugated boxes is increasing. Lean manufacturing and waste reduction strategies are also gaining traction to minimize environmental impact. Pharmaceutical packaging and industrial packaging sectors also contribute to market growth. Pharmaceutical companies require secure and reliable packaging for their products, while industrial packaging ensures the safe transportation of goods. Compliance with safety standards and regulations is essential in these industries, making corrugated boxes an attractive option due to their strength and durability.

The Corrugated Box Making Machine Market is witnessing robust growth, fueled by rising demand for efficiency and eco-conscious packaging solutions. Key components such as the rotary cutter, sheet feeder, glue applicator, and printing press are being enhanced with automation and precision controls to streamline production. Rising focus on packaging innovations and evolving packaging trendsâespecially in e-commerce and FMCGâare prompting manufacturers to adapt quickly. Influenced by current packaging design trends, there's a growing emphasis on aesthetic appeal and functionality. The integration of material science is enabling better structural performance and adaptability. Additionally, the shift toward sustainable materials is being driven by increasing consumer demand and stricter environmental compliance standards, positioning this market as a key player in green manufacturing evolution.

Regional Analysis

APAC is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific is experiencing significant growth, with China and India leading the demand. The region's increasing urbanization and rising middle-class population are driving the need for various products across numerous industries. This trend is expected to continue as these markets have not yet reached maturity. Additionally, employment rates are increasing in developing Asian countries, leading to an increase in purchasing power among the population. To meet the rising demand for packaging solutions, the industry is embracing advancements in technology. Artificial intelligence and data analytics are being integrated into production processes to optimize efficiency and improve quality control.

Sustainable packaging solutions, such as those made from recycled paperboard and post-consumer recycled content, are also gaining popularity. Moreover, the market is witnessing the adoption of advanced packaging machinery, including automated packaging systems and warehouse automation. These technologies enable faster production speeds, reduce machine downtime, and enhance overall process optimization. Ink selection and color management are also crucial factors in the production of high-quality corrugated boxes. The pharmaceutical and consumer goods industries are significant end-users of corrugated boxes due to their need for robust and water-resistant packaging. The electronics and e-commerce sectors are also adopting corrugated boxes for their lightweight and protective properties.

Spare parts and machine downtime are critical factors that impact production efficiency and must be managed effectively to minimize disruptions. The market in Asia Pacific is witnessing significant growth, driven by the increasing demand for various products across different industries. The industry is embracing technology to optimize production processes, improve quality control, and reduce waste. Sustainability and safety are key considerations, and the market is adapting to meet these demands through the use of advanced packaging solutions and waste reduction strategies.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Corrugated Box Making Machine market drivers leading to the rise in the adoption of Industry?

- The e-commerce industry's exponential growth serves as the primary catalyst for market expansion. The e-commerce sector's significant expansion, particularly in developed markets like the US and Europe, has been a major catalyst for the market. With the e-commerce industry's exponential growth in 2023, driven by increasing disposable incomes and global internet penetration, the demand for corrugated boxes has risen. These boxes are essential for product protection during shipping and often require additional packaging for e-commerce orders. Process optimization, a critical factor in the corrugated box manufacturing process, is another significant market trend. Advanced technologies like die-cutting dies, rotary die cutting, and data analytics are being adopted to enhance efficiency and reduce production costs.

- Furthermore, there is a growing emphasis on sustainability, with the use of recycled paperboard and post-consumer recycled content becoming increasingly popular. Moreover, lean manufacturing practices and material handling systems are being implemented to improve overall productivity and reduce waste. Color management and compressive strength are essential considerations in packaging design, ensuring the boxes meet the necessary standards for various industries, particularly electronics. The market is also witnessing a focus on operator training and safety measures to ensure the efficient and safe operation of corrugated box making machines.

What are the Corrugated Box Making Machine market trends shaping the Industry?

- Smart packaging adoption is on the rise, representing a significant market trend. This trend reflects the increasing demand for advanced and technologically innovative packaging solutions. The corrugated box making market is witnessing significant growth due to the rising trend of smart packaging in various industries, particularly in the e-commerce sector. Traditional corrugated boxes, which are typically dismantled for recycling, are being replaced by reusable and reclosable boxes that offer multiple uses with minimal damage. This shift is driven by the increasing demand for sustainable packaging solutions and the need for efficient supply chain management. In the production of corrugated boxes, various printing techniques such as digital printing, flexographic printing, offset printing, and inkjet printing are used. Ink selection plays a crucial role in the printing process, with ink suppliers providing solutions that cater to different printing techniques and substrates, including virgin paperboard.

- Production speed is another critical factor, with machine downtime being a significant concern for manufacturers. To address this issue, packaging automation and warehouse automation systems are being integrated into the production process. Glue suppliers provide adhesives that ensure the boxes are securely sealed and can withstand the rigors of transportation and storage. Digital printing technology is gaining popularity due to its ability to produce high-quality graphics and customization options. Folded cartons, which are a type of corrugated box, are also seeing increased demand due to their versatility and cost-effectiveness. Overall, the corrugated box making market is expected to continue its growth trajectory, driven by the increasing demand for sustainable and efficient packaging solutions.

How does Corrugated Box Making Machine market face challenges during its growth?

- The escalating costs of raw materials poses a significant challenge to the expansion and growth of the corrugated box industry. Corrugated box making machines utilize key raw materials, including linerboards and fluting paper, to manufacture high-quality packaging solutions. Linerboards serve as the outer layers, providing strength and shape to the corrugated sheets. Fluting paper, the middle layer, features a space between the linerboards and offers cushioning protection for the packaged goods. The cost of these raw materials has risen steadily over the past five years, impacting the market. To mitigate these rising costs, industry players are focusing on various strategies such as waste reduction, inventory management, and the use of pre-consumer recycled content in paperboard supplies.

- Automated packaging systems, machine vision, and cloud computing are also being adopted to enhance efficiency and productivity. Additionally, there is a growing trend towards sustainable packaging solutions, including biodegradable packaging and heavy-duty packaging made from recycled materials. Spare parts and maintenance are essential aspects of corrugated box making machines, ensuring the longevity and optimal performance of the machinery. Edge crush tests and food packaging regulations further contribute to the market's dynamics. Overall, the market is driven by the evolving needs of businesses for custom packaging solutions and the continuous advancements in packaging machinery technology.

Exclusive Customer Landscape

The corrugated box making machine market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the corrugated box making machine market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, corrugated box making machine market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acme Machinery Co. - The company specializes in manufacturing advanced corrugated box-making machinery, including the ACME Single Facer and ACME Single Facer with Two Profile.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acme Machinery Co.

- Bobst Group SA

- EMBA Machinery AB

- Fosber Spa

- Guangdong Hongming Intelligent Joint Stock Co. Ltd.

- Hebei Shengli Carton Equipment Manufacturing Co. Ltd.

- ISOWA Corp.

- KOLBUS GmbH and Co. KG

- Mitsubishi Heavy Industries Ltd.

- Natraj Corrugating Machinery Co.

- Panotec Srl

- Serpa Packaging Solutions LLC

- Shanghai PrintYoung International Industry Co. Ltd.

- Shinko Machine Mfg. Co. Ltd.

- SUN Automation Group

- Sunrise Pacific Co. Ltd.

- Valco Cincinnati Inc.

- Wenzhou Zhongke Packaging Machinery Co. Ltd.

- Zemat Technology Group Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Corrugated Box Making Machine Market

- In January 2024, Tetra Pak, a leading food processing and packaging solutions company, announced the launch of its new corrugated box making machine, the Master Cartoner 300, designed for the beverage market (Tetra Pak Press Release, 2024). This machine reportedly increases production speed by 30% compared to its predecessor, making it a significant technological advancement in the sector.

- In March 2024, DS Smith, a global packaging solutions provider, entered into a strategic partnership with Schoeller Allibert, a leading European manufacturer of reusable plastic containers, to expand its product offerings and cater to a broader customer base (DS Smith Press Release, 2024). This collaboration is expected to create synergies and strengthen both companies' positions in the packaging industry.

- In May 2025, Sealed Air Corporation, a leading provider of food safety and protective packaging solutions, completed the acquisition of Automated Packaging Systems, a major manufacturer of vertical form-fill-seal machines and automated bagging systems (Sealed Air Corporation Press Release, 2025). This acquisition significantly expands Sealed Air's product portfolio and enhances its capabilities in the market.

Research Analyst Overview

The market continues to evolve, driven by the dynamic interplay of various factors. Flatbed die cutting, ink selection, and production speed are key considerations in the manufacturing process, with glue suppliers and machine downtime also playing crucial roles. The applications of these machines span various sectors, including consumer goods, pharmaceutical packaging, industrial packaging, and e-commerce. Digital printing and flexographic printing are transforming the industry, offering increased customization and flexibility. Virgin paperboard and recycled paperboard, with their unique properties, are shaping the market, as are sustainability concerns, such as moisture content, safety standards, and waste reduction. Ink suppliers and paperboard suppliers are essential partners in the supply chain, ensuring the highest quality and efficiency.

Process optimization, lean manufacturing, and automation are integral to maintaining production efficiency and reducing downtime. The evolving nature of the market is further influenced by factors like bursting strength, operator training, rotary die cutting, packaging design, data analytics, color management, and compressive strength. Material handling, post-consumer recycled content, and pre-consumer recycled content are also significant trends. Sustainability remains a top priority, with a focus on biodegradable packaging, waste reduction, and recycling programs. The integration of machine vision, cloud computing, and automation is revolutionizing the industry, enabling real-time data analysis and improved process control. The ongoing unfolding of market activities and evolving patterns underscores the importance of continuous innovation and adaptation in the market.

Safety standards and moisture content are essential considerations in the production of corrugated boxes. The use of bursting strength testing and edge crush tests ensures the boxes can withstand the rigors of transportation and storage. Machine vision technology is employed to ensure consistent box design and maintain product integrity. The market is also focused on waste reduction and packaging waste management. Biodegradable and heavy-duty packaging options are gaining traction as companies strive to reduce their environmental impact. Inventory management and lean manufacturing practices are essential for maintaining efficient supply chain management. Glue suppliers and paperboard suppliers play a crucial role in the production process, providing essential raw materials for the manufacturing of corrugated boxes.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Corrugated Box Making Machine Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

227 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market growth 2025-2029 |

USD 821.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.0 |

|

Key countries |

US, China, India, Japan, Germany, Canada, South Korea, Australia, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Corrugated Box Making Machine Market Research and Growth Report?

- CAGR of the Corrugated Box Making Machine industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the corrugated box making machine market growth of industry companies

We can help! Our analysts can customize this corrugated box making machine market research report to meet your requirements.