Coworking Spaces Market Size 2024-2028

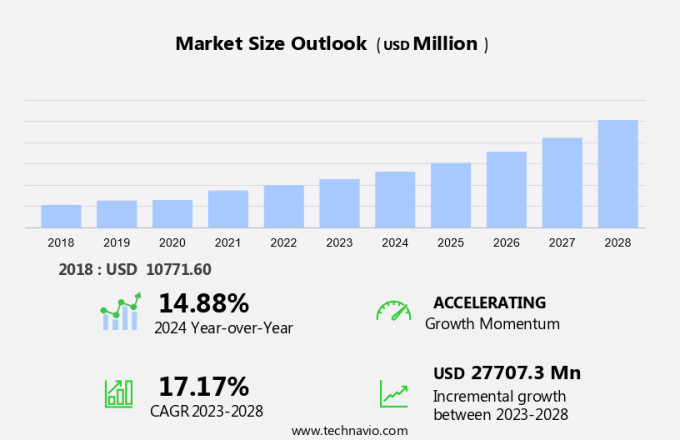

The coworking spaces market size is forecast to increase by USD 27.71 billion at a CAGR of 17.17% between 2023 and 2028. The market is experiencing significant growth, driven by the increasing demand for flexible and cost-effective workspace solutions. Key amenities, such as high-speed internet, meeting rooms, office equipment, administrative support, and advanced technologies like IoT and Big Data, are attracting entrepreneurs, freelancers, and small businesses to coworking spaces. However, challenges persist, including the need for more privacy and quiet spaces, security concerns, and the potential for distractions. To address these challenges, some coworking spaces are offering incubator programs and specialized zones to cater to specific industries or needs. As the market continues to evolve, it is essential for providers to offer competitive pricing, innovative amenities, and a supportive community to remain competitive.

The coworking spaces market is rapidly evolving, driven by a growing demand for flexible office solutions across corporate and professional segment. Large size enterprise segment and healthcare and life sciences organizations are increasingly adopting coworking models to meet their dynamic space needs. These spaces offer high speed internet, technology integration, and specialized environments designed to support productivity and innovation. Professional co working spaces cater to various industries, including those leveraging VR and AR technologies for advanced collaboration. Accelerator partnerships further enhance the coworking experience, providing startups and established companies with resources and networking opportunities. With a shift from traditional office space lease and rental office premises, coworking is reshaping the landscape of office rentals and office premises, offering a more adaptable and cost-effective solution for businesses of all sizes.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Enterprises and SMEs

- Freelancers and start ups

- Type

- Conventional coworking spaces

- Professional coworking spaces

- Others

- Geography

- APAC

- India

- Europe

- Germany

- UK

- Spain

- North America

- US

- South America

- Middle East and Africa

- APAC

By End-user Insights

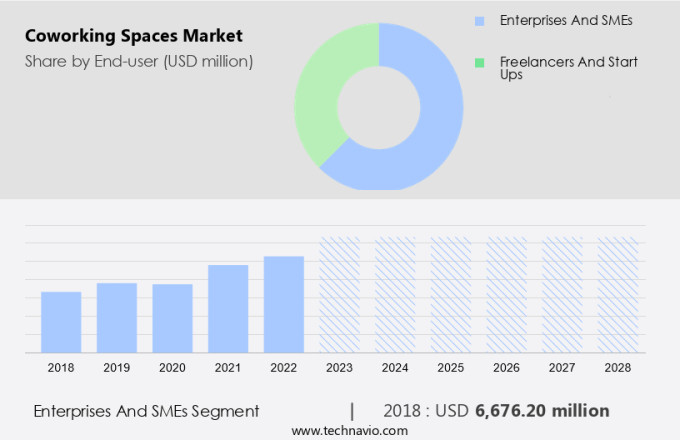

The enterprises and SMEs segment is estimated to witness significant growth during the forecast period. In the modern business landscape, coworking spaces have gained significant traction as an innovative solution for enterprises and small to medium-sized businesses (SMEs). These flexible workspace environments cater to the expanding needs of companies, enabling them to accommodate a diverse workforce and foster collaboration. The United States, home to a large number of SMEs, is witnessing a notable trend toward coworking spaces due to their numerous advantages over traditional office leases.

Further, SMEs form the backbone of the American economy, accounting for approximately 95% of all businesses and generating around 50% of the private sector employment, according to the Small Business Administration. Informal and formal SMEs collectively contribute to over 60% of the country's net new jobs annually. In the real estate sector, landlords, developers, and real estate brokers have recognized the potential of coworking spaces and are investing in this growing market. Technological improvements, including high-speed internet, advanced security systems, and flexible workspace design, further enhance the appeal of coworking spaces for businesses.

Get a glance at the market share of various segments Request Free Sample

The enterprises and SMEs segment accounted for USD 6.68 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Another region offering significant growth opportunities to vendors is North America. The market in North America has experienced substantial expansion in recent years, driven by the proliferation of startup communities, the increasing preference for flexible work environments among both individuals and corporations, and technological advancements, including data analytics and cloud computing, enabling remote work. These factors have made coworking spaces an attractive and cost-effective alternative to traditional offices, leading to their widespread adoption. Major cities in the region, such as New York, San Francisco, and Boston, have seen a high concentration of coworking spaces. Infrastructure and utilities are essential considerations for coworking space providers in the US, ensuring a professional and productive environment for lone contractors and remote workers. Real estate players are increasingly recognizing the potential of coworking spaces as a lucrative investment opportunity.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The advantages of coworking spaces is the key driver of the market. The preference for coworking spaces among small and medium-sized enterprises (SMEs) and independent entrepreneurs in the United States has experienced notable growth. Some primary reasons account for this trend. Firstly, coworking spaces provide flexibility that is often absent in conventional office environments. In contrast to the lengthy leases required for traditional office spaces, which typically span several years, coworking spaces offer more adaptable arrangements, such as month-to-month leases. This adaptability is particularly appealing to SMEs and start-ups, whose growth trajectories can be uncertain, making long-term lease commitments less desirable. Moreover, coworking spaces accommodate various business operations, fostering a cooperative and collaborative atmosphere.

Further, with multiple entrepreneurs working under one roof, there is an increased potential for cross-industry knowledge sharing and networking opportunities. Additionally, coworking spaces cater to the IT and telecom needs of businesses, ensuring a reliable and high-speed internet connection. Furthermore, they offer amenities such as mobile and entertainment facilities, making them an attractive option for businesses in the travel and hospitality industries. Lastly, large enterprises have also begun recognizing the benefits of coworking spaces, using them as satellite offices or for project-based work.

Market Trends

Strategic partnerships and acquisitions between market participants is the upcoming trend in the market. In the competitive landscape of the market in the United States, companies are forming strategic partnerships and making acquisitions with various market players to enhance their offerings and expand their reach. These collaborations include alliances with software and technology providers, SMEs, start-ups, and other industry participants. By engaging in such partnerships, companies can expedite product development, broaden their geographical presence, and gain access to advanced technological capabilities. Moreover, these strategic moves enable companies to explore new market segments and generate revenue through the sale of their products and services to a diverse clientele. The increasing number of such collaborations is projected to significantly contribute to the growth of the market in the US during the forecast period.

Key players in the market are focusing on integrating technology, such as the Internet of Things (IoT), to provide advanced and innovative solutions to their customers. The gig economy and the trend towards flexible work arrangements are also driving the demand for coworking spaces, making this an opportune time for companies to form strategic partnerships and expand their offerings.

Market Challenge

The disadvantages of coworking spaces is a key challenge affecting the market growth. Coworking spaces have witnessed significant growth in popularity among businesses, particularly start-ups and small and medium enterprises (SMEs), due to their cost-effective nature. However, there are certain challenges that may hinder the expansion of the market in the forecast period. One of the primary concerns is the potential for distractions and a lack of focus in shared workspaces. With a variety of businesses, roles, and personalities occupying a limited space, it can be challenging for individuals to maintain concentration and productivity. Moreover, coworking spaces offer several amenities, including high-speed internet, meeting rooms, office equipment, and administrative support.

However, to mitigate these challenges, some coworking spaces have started offering private offices and soundproofed areas for those who require a more focused work environment. Additionally, some coworking spaces have partnered with incubators and accelerators to provide resources and support to start-ups and entrepreneurs. These collaborative spaces offer opportunities for networking and learning from peers, making them an attractive option for businesses looking to grow and innovate. In conclusion, while coworking spaces offer numerous benefits, such as cost savings and access to essential amenities, it is crucial to consider the potential distractions and lack of focus that can arise in a shared workspace.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Betahaus GmbH - The company offers coworking spaces which include 36 private offices, 4 event spaces, and a rooftop terrace.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Blink Roppongi LLC

- Boxer Property

- CIC

- Convene

- Expansive

- Firmspace LP

- Greendesk LLC

- Impact Hub GmbH

- Industrious

- Knotel Inc.

- MESH cowork LLC

- Regus Group Companies

- Servcorp Ltd.

- Spaces Holding BV

- Synergy Office Spaces

- The District Coworking and Flex Office

- Unicorn Workspaces GmbH

- United Franchise Group

- WeWork Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to technological improvements and the rise of the freelance economy. In the real estate sector, landlords, developers, and real estate brokers are recognizing the potential of coworking spaces as an alternative to traditional office spaces. Freelancers, entrepreneurs, startups, and small and medium-sized enterprises (SMEs) in the information technology segment, as well as MSMEs in the IT and telecom, mobile and entertainment, travel and hospitality, and large enterprise sectors, are increasingly turning to coworking spaces. These open space providers offer flexible and affordable office solutions, catering to the needs of remote workers, lone contractors, and startups.

Further, amenities such as high-speed internet, meeting rooms, office equipment, administrative support, and incubator partnerships are becoming essential. The business model of coworking spaces is attractive to tenants due to the shared infrastructure and utilities, which reduces overhead costs. Additionally, the integration of technology such as the Internet of Things, funding opportunities, mentoring, and CXOs further enhances the value proposition. The gig economy and startup culture have also contributed to the growth of the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 17.17% |

|

Market growth 2024-2028 |

USD 27.71 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

14.88 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 38% |

|

Key countries |

US, India, UK, Germany, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

betahaus GmbH, Blink Roppongi LLC, Boxer Property, CIC, Convene, Expansive, Firmspace LP, Greendesk LLC, Impact Hub GmbH, Industrious, Knotel Inc., MESH cowork LLC, Regus Group Companies, Servcorp Ltd., Spaces Holding BV, Synergy Office Spaces, The District Coworking and Flex Office, Unicorn Workspaces GmbH, United Franchise Group, and WeWork Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch