Chlorinated Polyvinyl Chloride (CPVC) Pipe And Fitting Market Size 2025-2029

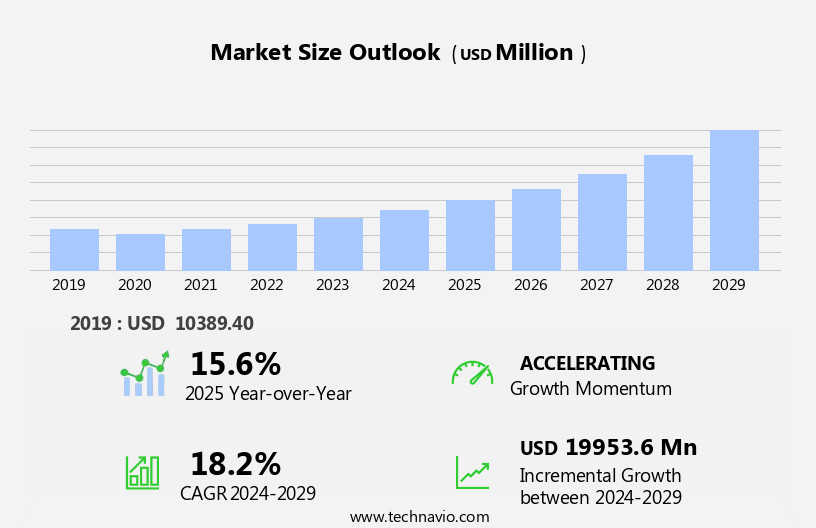

The chlorinated polyvinyl chloride (cpvc) pipe and fitting market size is forecast to increase by USD 19.95 billion, at a CAGR of 18.2% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing preference for these pipes over traditional metal alternatives. The superior qualities of CPVC pipes, including their resistance to corrosion, chemical inertness, and ease of installation, are driving their adoption in various industries, particularly in water supply and wastewater applications. Moreover, the integration of digital technologies and Industry 4.0 concepts in CPVC pipes and fittings is another key trend shaping the market. Smart pipes and fittings equipped with sensors and IoT capabilities are enabling real-time monitoring, predictive maintenance, and energy efficiency, thereby enhancing the overall performance and reliability of water distribution systems.

- However, the high cost and maintenance charges associated with CPVC pipes and fittings remain significant challenges for market growth. These costs can be a barrier for smaller projects and budget-conscious customers. To mitigate these challenges, manufacturers and suppliers can focus on developing cost-effective solutions while maintaining the quality and performance standards of CPVC pipes and fittings. Additionally, exploring alternative financing models, such as leasing or rental options, can help make these products more accessible to a wider customer base.

What will be the Size of the Chlorinated Polyvinyl Chloride (CPVC) Pipe And Fitting Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market exhibit a dynamic and evolving landscape, driven by various market forces and applications across diverse sectors. CPVC pipes, known for their superior corrosion resistance and adherence to ASTM standards, are increasingly utilized in hydraulic systems, fire resistance applications, and chemical processing industries. Supply chain management plays a crucial role in ensuring the seamless delivery of CPVC pipes and fittings. Hydraulic testing, a critical aspect of quality control, ensures the pipes meet the required pressure rating and safety standards. The ongoing development of CPVC fittings, including socket and threaded varieties, enhances pipe routing flexibility.

In the realm of industrial piping, CPVC pipes offer advantages over traditional materials like galvanized steel, such as lighter weight, easier installation, and lower material costs. Leak detection and joint integrity are essential aspects of CPVC pipe maintenance procedures, ensuring optimal system performance. Applications of CPVC pipes extend to various sectors, including HVAC systems, water supply networks, irrigation systems, and drainage systems. The continuous unfolding of market activities and evolving patterns necessitate a focus on material compatibility, temperature rating, and pressure drop considerations. Injection molding and cross-linked polyethylene (PEX) piping are emerging alternatives in the market, challenging CPVC's dominance.

CPVC pipe manufacturers and suppliers must adapt to these evolving market dynamics, ensuring they remain competitive and responsive to the ever-changing demands of their customers. The integration of advanced technologies, such as flow rate monitoring, vibration analysis, and thermal expansion compensation, further enhances CPVC pipe performance and reliability. Inventory management and distribution networks are essential components of the supply chain, ensuring the timely delivery of CPVC pipes and fittings to meet the demands of various industries.

How is this Chlorinated Polyvinyl Chloride (CPVC) Pipe And Fitting Industry segmented?

The chlorinated polyvinyl chloride (cpvc) pipe and fitting industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- CPVC pipes

- CPVC fitting

- End-user

- Industrial

- Residential

- Commercial

- Application

- Hot and cold-water distribution

- Wastewater treatment

- Chemical processing

- Fire sprinkler systems

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

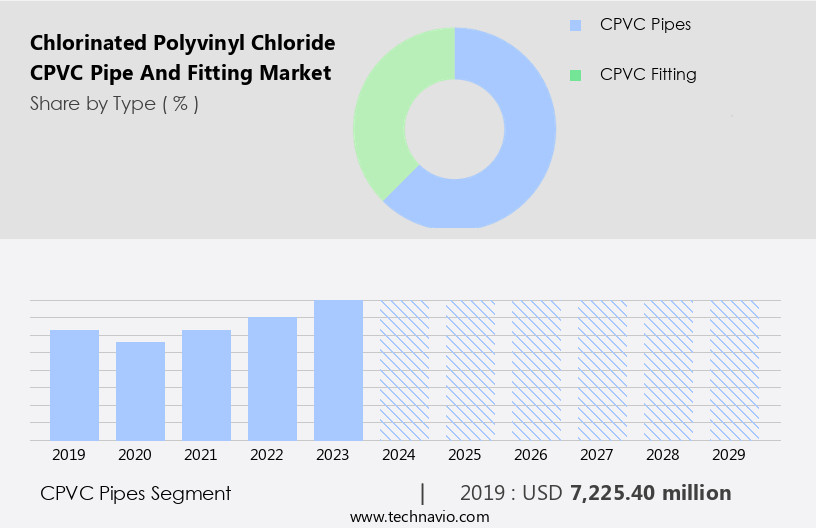

. By Type Insights

The cpvc pipes segment is estimated to witness significant growth during the forecast period.

The CPVC pipes segment in The market is experiencing notable growth due to the material's superior properties. CPVC pipes, manufactured from chlorinated polyvinyl chloride, offer advantages such as high temperature resistance, corrosion resistance, and durability. These qualities make CPVC pipes a preferred choice for various applications across residential, commercial, industrial, and municipal sectors. In the industrial sector, Kaneka introduced a new CPVC pipes product line in June 2023, catering to the increasing demand. Furthermore, in January 2024, Kaneka collaborated with a leading construction company to supply CPVC pipes for a significant infrastructure project. Building codes mandate the use of fire-resistant materials in fire sprinkler systems, driving the demand for CPVC pipes.

CPVC pipes' chemical resistance makes them suitable for drainage systems, while stress analysis ensures their structural integrity during installation. Pipe support systems and pressure drop considerations are essential factors in the selection process for plumbing systems. CPVC fittings' solvent cement bonding ensures joint integrity, and supply chain management plays a crucial role in maintaining inventory levels. CPVC pipes' material compatibility with various chemicals and temperature rating makes them suitable for chemical processing applications. Hydraulic testing and quality control procedures ensure the pipes meet the required standards. CPVC pipes' fire resistance and pressure rating make them suitable for water supply systems and fire resistance applications.

Code compliance and pipe wall thickness are essential factors in distribution networks, and thermal expansion must be accounted for in pipe routing. In industrial piping applications, cross-linked polyethylene (PEX) and CPVC pipes have their unique advantages. PEX offers flexibility, while CPVC pipes provide high temperature resistance and durability. HVAC systems require CPVC pipes for their temperature resistance and chemical compatibility. Safety standards mandate regular maintenance procedures, leak detection, and joint integrity checks to ensure the longevity of the piping systems. In conclusion, the CPVC pipes and fittings market is witnessing growth due to the material's versatility and superior properties.

CPVC pipes' compatibility with various applications, from residential to industrial, makes them a preferred choice for various sectors. The collaboration between Kaneka and the construction company is a testament to the material's increasing popularity and the potential for future growth.

The CPVC pipes segment was valued at USD 7.23 billion in 2019 and showed a gradual increase during the forecast period.

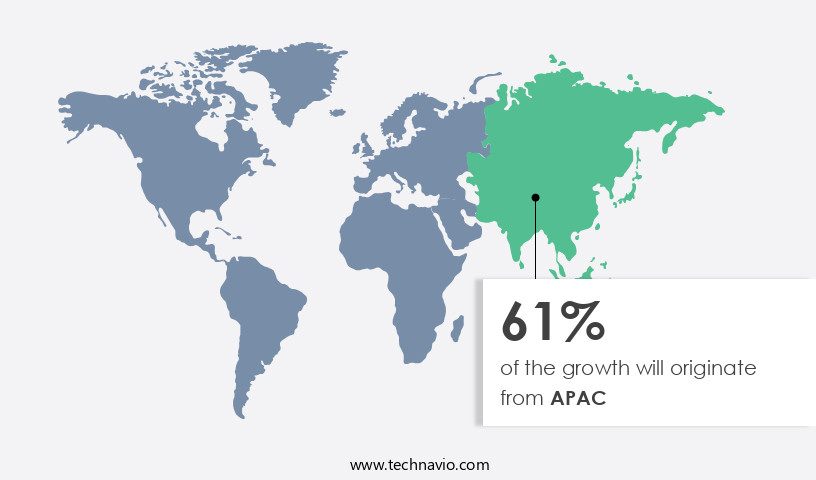

Regional Analysis

APAC is estimated to contribute 61% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The CPVC pipe and fitting market in APAC holds a substantial share of the global market, with China and India being the major contributors. The expanding construction and irrigation sectors, coupled with substantial government investments in water supply system developments, fuel the demand for CPVC pipes and fittings in this region. With approximately 37% of the world's population residing in these countries, the need for reliable food and water supply systems has become a priority. As a result, governments have significantly invested in infrastructure projects, including the development of efficient irrigation facilities and water supply systems.

CPVC pipes and fittings offer several advantages, such as chemical resistance, thermal expansion, and pressure drop management. These advantages make them suitable for various applications, including residential plumbing systems, fire sprinkler systems, drainage systems, and hydraulic testing. The versatility of CPVC pipes and fittings is further enhanced by their compatibility with a wide range of materials, including polyvinyl chloride (PVC), copper piping, and galvanized steel piping. Installation practices, pipe routing, and joint integrity are crucial factors in ensuring the longevity and effectiveness of CPVC pipes and fittings. Proper installation practices, such as solvent cementing, ensure a strong bond between the pipe and fitting.

Hydraulic testing and pressure rating are essential to ensure the pipe's structural integrity and its ability to withstand the required pressure. In addition, CPVC pipes and fittings offer excellent corrosion resistance, making them suitable for use in industrial piping, HVAC systems, and distribution networks. Their fire resistance properties make them an ideal choice for fire sprinkler systems. CPVC fittings are available in various sizes and shapes, including threaded fittings and socket fittings, catering to different pipe diameters and pipe routing requirements. Quality control measures, such as ANSI and ASTM standards, ensure the consistency and reliability of CPVC pipes and fittings.

Inventory management and supply chain optimization are essential to ensure the timely delivery of CPVC pipes and fittings to meet the growing demand. Maintenance procedures, including leak detection and flow rate analysis, help maintain the pipe's performance and longevity. In conclusion, the CPVC pipe and fitting market in APAC is driven by the increasing demand for efficient water supply systems and irrigation facilities due to the large population. The advantages of CPVC pipes and fittings, such as chemical resistance, thermal expansion, and pressure drop management, make them a popular choice for various applications. Proper installation practices, pipe support systems, and maintenance procedures are crucial to ensure the longevity and effectiveness of CPVC pipes and fittings. The market's growth is further fueled by the versatility of CPVC pipes and fittings, their compatibility with various materials, and the stringent quality control measures in place.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Chlorinated Polyvinyl Chloride (CPVC) Pipe And Fitting Industry?

- The growing trend towards utilizing CPVC pipes over traditional metal pipes serves as the primary market driver.

- The CPVC pipe and fitting market has experienced significant growth due to the increasing demand for these products in various industries. CPVC pipes offer several advantages over traditional metal pipes, making them a preferred choice for numerous applications. One of the primary reasons for this shift is the superior properties of CPVC pipes, such as chemical resistance, corrosion resistance, and lightweight nature. These properties address common challenges associated with metal pipes, making CPVC an attractive alternative. Moreover, the lightweight nature of CPVC pipes simplifies handling and installation, leading to reduced labor costs and installation time.

- CPVC pipes can be easily cut, joined, and maneuvered, making them ideal for complex installations, including plumbing systems and fire sprinkler systems. Furthermore, the use of CPVC pipes in drainage systems is increasing due to their stress analysis capabilities and pressure drop efficiency. The installation practices for CPVC pipes involve the use of threaded fittings or solvent cement, ensuring a secure and reliable connection. Additionally, pipe support systems are essential for maintaining the stability and integrity of CPVC piping systems. In conclusion, the global CPVC pipe and fitting market is witnessing an upward trend due to the numerous benefits offered by these products.

- Their superior properties, ease of installation, and versatility make CPVC pipes a preferred choice for various applications, including plumbing systems, drainage systems, and fire sprinkler systems.

What are the market trends shaping the Chlorinated Polyvinyl Chloride (CPVC) Pipe And Fitting Industry?

- The integration of digital technologies and Industry 4.0 concepts is becoming a significant trend in the CPVC pipes and fittings market. This advancement involves the implementation of smart technologies, automation, and data analytics to enhance production efficiency, improve product quality, and enable better customization.

- The CPVC pipe and fitting market has been significantly transformed by the integration of digital technologies and Industry 4.0 concepts in its manufacturing and supply chain processes. This innovation has led to improved operational efficiency, predictive maintenance, and agile supply chain management. In the manufacturing sector, the implementation of digital technologies such as IoT sensors, advanced data analytics, and automation has optimized production processes. For instance, smart sensors embedded within manufacturing equipment collect real-time data on production parameters, enabling proactive monitoring and control. This data can be analyzed to identify trends and potential issues before they become major problems, reducing downtime and increasing productivity.

- Moreover, the use of CPVC piping offers several advantages over traditional materials like galvanized steel, including superior corrosion resistance and fire resistance. ASTM standards ensure the quality and consistency of CPVC pipes and fittings, while hydraulic testing and joint integrity procedures ensure leak-free installations. Leak detection technologies have also advanced, making it easier to identify and address any issues promptly. Quality control measures are essential in the production and supply of CPVC pipes and fittings. Chemical processing techniques are used to ensure the purity and consistency of the raw materials, while rigorous testing procedures are employed to ensure the finished products meet the required standards.

- Maintenance procedures are also critical to ensure the longevity and performance of CPVC piping systems. Overall, the CPVC pipe and fitting market is poised for continued growth, driven by the increasing demand for reliable and efficient piping systems in various industries.

What challenges does the Chlorinated Polyvinyl Chloride (CPVC) Pipe And Fitting Industry face during its growth?

- The high cost and maintenance requirements of chargers represent a significant challenge to the growth of the industry.

- The market face challenges due to their higher initial cost and maintenance expenses. These factors influence consumer purchasing decisions, limiting the adoption of CPVC piping systems in cost-sensitive industries, such as residential construction and smaller-scale industrial applications. The cost of CPVC pipes varies, with a 1-inch pipe priced between USD1.15 and USD3.60, and a 2-inch pipe priced between USD2.40 and USD4.80. This significant upfront investment deters potential customers. Moreover, the maintenance costs of CPVC piping systems can be substantial, especially when compared to traditional metallic piping systems. This added expense further restricts the market growth. Despite these challenges, CPVC piping systems offer advantages such as high flow rate, resistance to vibration, and excellent pressure rating.

- They are widely used in industrial piping, HVAC systems, and water supply systems due to their code compliance and pipe wall thickness, which ensures durability and reliability. In distribution networks, CPVC piping systems exhibit minimal thermal expansion, making them suitable for long-distance transport of fluids. Effective inventory management is crucial to mitigate the high initial investment and ongoing maintenance costs. In conclusion, while the high initial cost and maintenance expenses pose challenges to the CPVC pipe and fitting market, the advantages of these systems, including high flow rate, resistance to vibration, and excellent pressure rating, continue to make them a preferred choice for various industries. Effective inventory management is essential to offset the high upfront investment and ongoing maintenance costs.

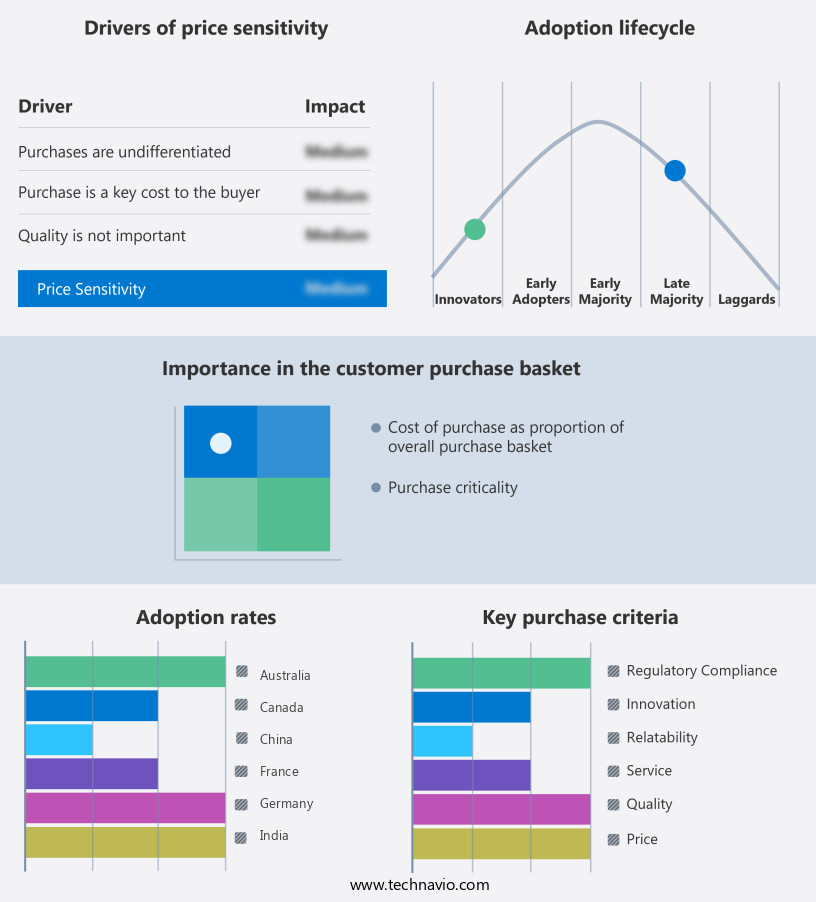

Exclusive Customer Landscape

The chlorinated polyvinyl chloride (cpvc) pipe and fitting market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the chlorinated polyvinyl chloride (cpvc) pipe and fitting market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, chlorinated polyvinyl chloride (cpvc) pipe and fitting market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aliaxis Holdings SA - The company specializes in the manufacturing and distribution of CPVC pipes and fittings under the brands Nicoll, IPEX, and Durman.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aliaxis Holdings SA

- Astral Ltd.

- Charlotte Pipe and Foundry Co.

- Dutron Polymers Ltd.

- Finolex Industries Ltd

- Georg Fischer Ltd.

- Minimax Viking GmbH

- NIBCO INC.

- Ori-Plast Limited

- Petron Thermoplast LLP

- Prince Pipes and Fittings Limited

- Skipper Ltd.

- Spears Manufacturing Co.

- The Supreme Industries Ltd.

- Utkarsh India Limited

- Vectus Industries Ltd.

- Wengs Huajian Co., Ltd.

- Westlake Corp.

- Zhuji Fengfan Piping Co., Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Chlorinated Polyvinyl Chloride (CPVC) Pipe And Fitting Market

- In February 2023, upon receiving approval from the United States Environmental Protection Agency (EPA), Dupont, a leading chemical company, launched a new line of CPVC pipes and fittings, featuring enhanced chlorination technology. This innovation is expected to improve the product's resistance to chlorine-based disinfectants, making it an ideal choice for potable water applications in the water and wastewater industries (Dupont Press Release, 2023).

- In April 2024, PVC leader LyondellBasell formed a strategic partnership with leading plumbing solutions provider, Wirsbo, to expand its presence in the North American residential and commercial plumbing markets. This collaboration is expected to leverage LyondellBasell's CPVC pipe manufacturing expertise and Wirsbo's distribution network (LyondellBasell Press Release, 2024).

- In July 2024, Hanwha Chemical, a South Korean chemical company, announced a USD500 million investment in its CPVC pipe manufacturing facility in South Korea. This expansion is aimed at increasing the company's production capacity and strengthening its position in the global CPVC pipe market (Hanwha Chemical Press Release, 2024).

Research Analyst Overview

- The market exhibit dynamic growth, driven by the increasing demand for reliable and durable piping systems. CPVC pipes offer several advantages, including corrosion prevention, noise reduction, and vibration damping, making them ideal for various applications, such as water supply, industrial processes, and HVAC systems. The market for CPVC pipe and fittings encompasses various pipe joining methods, including solvent welding, threaded connections, and pressurized class ratings. Pipe maintenance and repair are crucial aspects of this market, with pipe supports, pipe insulation, and pipe replacement playing significant roles. Moreover, the market includes pipe accessories like expansion loops, pipe straps, pipe hangers, pipe clamps, mechanical fittings, and pipe sizing software.

- Pipe routing software and hydraulic modeling are essential tools for pipe installation, ensuring optimal design and functionality. ABS pipe and PEX pipe are alternative piping materials, but CPVC maintains its position due to its unique properties and versatility. The market for CPVC pipe and fittings continues to evolve, with ongoing research and development in areas like pipe fabrication and water hammer mitigation.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Chlorinated Polyvinyl Chloride (CPVC) Pipe And Fitting Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

232 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.2% |

|

Market growth 2025-2029 |

USD 19953.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

15.6 |

|

Key countries |

US, China, Japan, India, South Korea, UK, Canada, Australia, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Chlorinated Polyvinyl Chloride (CPVC) Pipe And Fitting Market Research and Growth Report?

- CAGR of the Chlorinated Polyvinyl Chloride (CPVC) Pipe And Fitting industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the chlorinated polyvinyl chloride (cpvc) pipe and fitting market growth of industry companies

We can help! Our analysts can customize this chlorinated polyvinyl chloride (cpvc) pipe and fitting market research report to meet your requirements.