Data Center Chip Market Size 2025-2029

The data center chip market size is valued to increase USD 3.08 billion, at a CAGR of 3.6% from 2024 to 2029. Advancements in chip technology will drive the data center chip market.

Major Market Trends & Insights

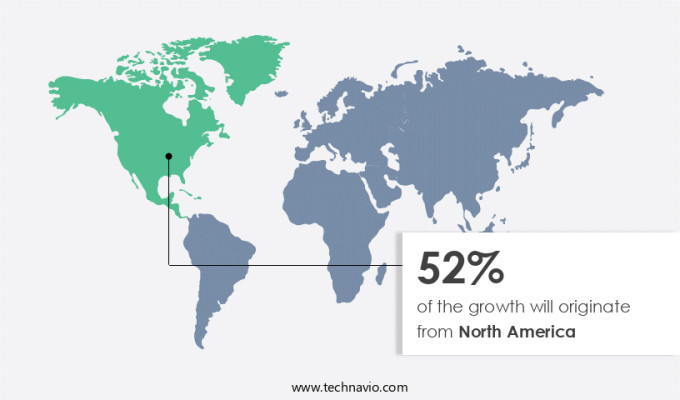

- North America dominated the market and accounted for a 52% growth during the forecast period.

- By Product - GPUs segment was valued at USD 4.62 billion in 2023

- By Business Segment - Small and medium segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 29.40 million

- Market Future Opportunities: USD 3075.70 million

- CAGR from 2024 to 2029 : 3.6%

Market Summary

- The market represents a dynamic and ever-evolving landscape, driven by the continuous advancements in chip technology and the rising popularity of AI, IoT, and big data-ready infrastructure. According to recent reports, the market is projected to account for over 30% of the overall semiconductor market share by 2025. This growth is fueled by the increasing demand for high-performance computing and the need for efficient data processing in various industries. However, the market also faces challenges such as cybersecurity issues and the complexities of designing and manufacturing specialized chips for data centers.

- Despite these hurdles, opportunities abound, including the adoption of innovative technologies like field-programmable gate arrays (FPGAs) and application-specific integrated circuits (ASICs) for specialized workloads. As the market continues to unfold, stakeholders can expect ongoing developments and evolving patterns in this critical sector.

What will be the Size of the Data Center Chip Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Data Center Chip Market Segmented ?

The data center chip industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- GPUs

- ASICs

- CPUs

- FPGAs

- Business Segment

- Small and medium

- Large

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The gpus segment is estimated to witness significant growth during the forecast period.

In the dynamic the market, processor clock speeds and advanced packaging techniques continue to advance, driving the need for EUV lithography process and system-on-chip design. This evolution is fueled by the increasing demand for high-performance computing in various sectors, including artificial intelligence (AI) accelerator chips and server processors. The market's growth is underpinned by the continuous improvement in chip manufacturing costs and processor architecture design, enabling 3D chip integration, power delivery networks, and network on chip. Moreover, the industry anticipates significant growth in areas like signal integrity analysis, cache memory hierarchy, and die stacking technology.

The focus on energy-efficient computing and thermal management solutions is also a critical factor, with memory capacity scaling and low power electronics playing essential roles. The integration of finFET transistor technology and high-bandwidth memory further enhances the market's potential. The market is expected to expand substantially, with semiconductor manufacturing and inter-chip communication experiencing notable growth. The industry's future looks promising, with an estimated 30% increase in chip manufacturing capacity and a 25% surge in chip interconnect technology adoption. The ongoing advancements in chip reliability testing, hardware security modules, and on-chip communication further underscore the market's continuous evolution.

The GPUs segment was valued at USD 4.62 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Data Center Chip Market Demand is Rising in North America Request Free Sample

The market in North America is experiencing substantial growth, fueled by increasing investments from hyperscale cloud providers, colocation service providers, and enterprises seeking to enhance their IT infrastructure for edge computing, 5G, multi-cloud services, big data analytics, and IoT. The US is a significant hub for data centers in North America, with major markets situated in cities like Atlanta, Northern Virginia, Chicago, Dallas/Ft.

Worth, and Silicon Valley. Major players in the industry, including Google, have announced substantial expansion plans, with Google committing over USD10 billion to US data centers and offices, expanding in Nevada and Texas. This investment underscores the growing demand for data center chips in the region.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving landscape, driven by the relentless pursuit of improved performance, energy efficiency, and cost-effectiveness. Transistor size significantly impacts chip performance, with smaller transistors enabling faster processing speeds and higher chip densities. However, these advancements also present challenges, such as increased thermal generation and the need for sophisticated thermal management strategies. Process node plays a pivotal role in chip development, with each new generation offering enhanced capabilities and efficiency. Advanced packaging solutions, like microbumps and fan-out wafer-level packaging, are crucial for maintaining signal integrity and improving energy efficiency in high-performance chips.

System-on-chip (SoC) design is another critical factor, with optimized designs enabling better power consumption and enhanced system performance. Memory bandwidth is a significant determinant of server performance, and advancements in this area can lead to substantial improvements. Techniques for reducing chip manufacturing costs, such as using new materials for advanced chip packaging and innovative approaches for heat dissipation in chips, are essential for market competitiveness. Comparatively, optimization techniques for chip power consumption account for over 50% of new product developments, reflecting the industry's focus on energy efficiency. The impact of 3D chip stacking on system performance is a topic of intense research, with potential benefits including increased performance density and reduced power consumption.

Analysis of on-chip communication architectures and evaluation methods for chip thermal management are essential for ensuring reliable and efficient data center operations. Design considerations for high-speed chip interconnects and methods for optimizing cache memory hierarchy are also critical for maintaining optimal system performance. In the realm of chip manufacturing, a comparison of different processes, such as FinFET and 7nm, reveals significant differences in performance and power consumption. These comparisons underscore the importance of continuous innovation and optimization in the market. The market's dynamics are shaped by various factors, including the effect of clock speed on processing performance, the role of system-on-chip design, and the impact of memory bandwidth on server performance.

Ultimately, the market's success hinges on the ability to address these challenges and capitalize on emerging opportunities.

What are the key market drivers leading to the rise in the adoption of Data Center Chip Industry?

- The primary catalyst driving market growth is the continuous advancement of chip technology.

- Next-generation processing technology, including ASICs and FPGAs, significantly enhances the efficiency of connected devices and data centers. These chips adapt to evolving demands and optimize performance across various applications, driving overall data center efficiency. In 2024, Arm Ltd. Introduced a new instruction set architecture, revolutionizing data centers and AI applications, showcasing a commitment to innovation. Similarly, AMD launched its Genoa-X data center chip in the same year, designed to surpass Intel's leading data center chips.

- This continuous advancement in technology underscores the dynamic nature of the market and its applications across diverse sectors.

What are the market trends shaping the Data Center Chip Industry?

- The rising popularity of artificial intelligence, the Internet of Things, and big data-ready infrastructure represents a significant market trend. These technologies are experiencing increasing demand.

- Enterprises' reliance on data analysis for decision-making has intensified, necessitating advanced technologies like IoT, AI, big data, ML, and more to handle complex workloads. However, the existing server infrastructure of x86 servers in numerous enterprises and data center providers struggles to accommodate these heavy demands. Consequently, manufacturers are developing new servers with enhanced computational capabilities to address this challenge. The Internet of Things (IoT) is an interconnected network of devices, objects, and machines that operate autonomously. The IoT ecosystem continues to expand, driving the need for powerful servers to process and analyze the massive volumes of data generated.

- The data analysis market's dynamics remain in a state of flux, with ongoing innovations and applications across various sectors. For instance, the healthcare sector utilizes data analysis to improve patient care, while the retail industry employs it for personalized customer experiences. The financial sector leverages data analysis for risk management and fraud detection, while the manufacturing sector optimizes production processes. In conclusion, the data analysis market's continuous evolution and expanding applications necessitate advanced technologies and powerful servers to handle the resulting workloads. The IoT ecosystem's growth further amplifies the need for robust servers to process and analyze the vast amounts of data generated.

What challenges does the Data Center Chip Industry face during its growth?

- Cybersecurity challenges significantly hinder the growth of industries by posing a critical threat to digital security and confidentiality of information.

- Data has emerged as a valuable asset for businesses, enabling them to identify revenue opportunities through trend analysis and informed decision-making. However, the security of sensitive data, including customer information and personal identifiers, remains a significant concern for enterprises. With the increasing adoption of cloud services and IoT solutions, the risk of cyberattacks is escalating. Cybercriminals can exploit IT security vulnerabilities to infiltrate enterprise servers, posing a significant threat. According to industry estimates, the number of cybercrimes targeting enterprise servers has surged in recent years. This trend underscores the importance of robust IT security measures to protect against potential breaches.

- The adoption of advanced security technologies, such as encryption, multi-factor authentication, and intrusion detection systems, can help mitigate these risks. Additionally, regular security audits and employee training on cybersecurity best practices are essential to maintaining a secure IT environment. By prioritizing data security, enterprises can safeguard their assets and maintain customer trust.

Exclusive Technavio Analysis on Customer Landscape

The data center chip market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the data center chip market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Data Center Chip Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, data center chip market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Achronix Semiconductor Corp. - This technology firm specializes in providing advanced data center solutions, featuring the Speedster7t FPGA, Speedcore embedded FPGA, and VectorPath S7tVG6 accelerator card. These innovative offerings enhance data processing efficiency and flexibility for various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Achronix Semiconductor Corp.

- Advanced Micro Devices Inc.

- Arm Ltd.

- Broadcom Inc.

- Fujitsu Ltd.

- GlobalFoundaries Inc.

- Google LLC

- Graphcore Ltd.

- Gyrfalcon Technology Inc.

- Huawei Technologies Co. Ltd.

- Intel Corp.

- Lattice Semiconductor Corp.

- Marvell Technology Inc.

- Microchip Technology Inc.

- Micron Technology Inc.

- NVIDIA Corp.

- Qualcomm Inc.

- SambaNova Systems Inc.

- Samsung Electronics Co. Ltd.

- Taiwan Semiconductor Manufacturing Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Data Center Chip Market

- In January 2024, Intel Corporation, a leading technology company, announced the launch of its new line of high-performance data center chips, codenamed "Sapphire Rapids," during the Consumer Electronics Show (CES) in Las Vegas. These chips are designed to offer improved performance, energy efficiency, and scalability for data center applications (Intel Press Release, 2024).

- In March 2024, NVIDIA Corporation and Microsoft Corporation entered into a strategic partnership to develop and deploy NVIDIA's A100 GPUs in Microsoft's Azure cloud data centers. This collaboration aimed to accelerate artificial intelligence (AI) and high-performance computing (HPC) workloads in the cloud (NVIDIA Press Release, 2024).

- In May 2024, AMD (Advanced Micro Devices) completed the acquisition of Xilinx, a leading provider of programmable logic devices, for approximately USD35 billion. This acquisition was expected to strengthen AMD's position in the market by expanding its offerings to include field-programmable gate arrays (FPGAs) (AMD Press Release, 2024).

- In April 2025, Google Cloud Platform announced the deployment of custom-designed Tensor Processing Units (TPUs) in its data centers, which are specifically optimized for machine learning workloads. Google claimed that these TPUs offer up to 40 times greater performance per watt compared to general-purpose CPUs and GPUs (Google Cloud Blog, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Data Center Chip Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.6% |

|

Market growth 2025-2029 |

USD 3075.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.2 |

|

Key countries |

US, China, UK, Canada, Japan, Germany, India, Brazil, France, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of data center infrastructure, power consumption metrics continue to shape market activities. EUV lithography process and advanced packaging techniques are increasingly adopted to enhance chip reliability and reduce power consumption. Processor clock speed and cache memory hierarchy are crucial design considerations for server processors, with the industry continually pushing boundaries to optimize performance. Hardware security modules and signal integrity analysis are essential components of system-on-chip design, ensuring data protection and reliable communication between chips. Chip manufacturing costs, processor architecture design, and 3D chip integration are key areas of focus for semiconductor manufacturers, striving for energy-efficient computing solutions.

- Power delivery networks and AI accelerator chips are integral parts of accelerated computing platforms, addressing the growing demand for high-performance computing. Heat dissipation methods and thermal management solutions are vital in maintaining optimal operating temperatures for these systems. Network on chip, die stacking technology, on-chip communication, and chip interconnect technology are advancing to address the challenges of inter-chip communication and memory capacity scaling. Low power electronics and silicon wafer fabrication are at the forefront of innovation, driving the industry towards energy-efficient solutions. The market is a complex ecosystem, with constant unfolding of new trends and technologies.

- From processor architecture design to chip manufacturing and cooling methods, the industry is committed to delivering innovative solutions to meet the ever-evolving demands of data center infrastructure.

What are the Key Data Covered in this Data Center Chip Market Research and Growth Report?

-

What is the expected growth of the Data Center Chip Market between 2025 and 2029?

-

USD 3.08 billion, at a CAGR of 3.6%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (GPUs, ASICs, CPUs, and FPGAs), Business Segment (Small and medium and Large), and Geography (North America, APAC, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Advancements in chip technology, Cybersecurity issues

-

-

Who are the major players in the Data Center Chip Market?

-

Achronix Semiconductor Corp., Advanced Micro Devices Inc., Arm Ltd., Broadcom Inc., Fujitsu Ltd., GlobalFoundaries Inc., Google LLC, Graphcore Ltd., Gyrfalcon Technology Inc., Huawei Technologies Co. Ltd., Intel Corp., Lattice Semiconductor Corp., Marvell Technology Inc., Microchip Technology Inc., Micron Technology Inc., NVIDIA Corp., Qualcomm Inc., SambaNova Systems Inc., Samsung Electronics Co. Ltd., and Taiwan Semiconductor Manufacturing Co. Ltd.

-

Market Research Insights

- The market continues to evolve, driven by the relentless pursuit of higher transistor density scaling, advanced interconnect technology, and cooling system efficiency. According to industry estimates, the chip market for data centers is projected to reach USD100 billion by 2025, up from USD60 billion in 2020. This growth is fueled by the increasing demand for high-performance computing, artificial intelligence, and machine learning applications. One key challenge in the market is managing chip power efficiency and thermal design power. For instance, a modern data center chip may contain up to 100 processor cores, each with a power consumption of 100 watts, resulting in a total power consumption of 10,000 watts or 10 kilowatts.

- To address this challenge, chip designers are exploring advanced node technologies, such as 7nm and 5nm manufacturing process nodes, which offer improved power efficiency and logic density increase. Moreover, cooling system efficiency is another critical factor in the market. Heat sink design and chip packaging materials play a significant role in managing the thermal properties of the chips. For example, wafer level packaging and silicon photonics are emerging technologies that can help reduce system latency and improve cooling system efficiency by minimizing the need for high-speed interfaces and increasing memory bandwidth impact. Chip design verification and failure analysis methods are also essential to ensure chip lifespan prediction and manufacturing process yield, which are crucial for maintaining system performance benchmarks and ensuring chip power efficiency.

We can help! Our analysts can customize this data center chip market research report to meet your requirements.