EUV Lithography Market Size 2024-2028

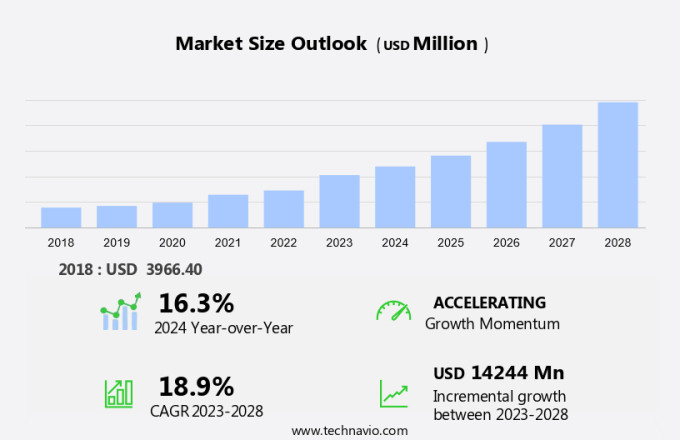

The EUV lithography market size is forecast to increase by USD 14.24 billion at a CAGR of 18.9% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for advanced semiconductors in various industries, particularly in the development of microchips for leading-edge nodes. The implementation of EUV lithography systems, which utilize optics and advanced technology, is essential for producing smaller and more complex microchips. This trend is driven by the growing need for miniaturized electronic devices in sectors such as autonomous vehicles and telecom services. Moreover, research and development in the field of lithography systems is ongoing to reduce the high implementation cost and improve efficiency. The monopoly of ASML in the market is a significant challenge, as it limits competition and increases prices. However, advancements in technology and potential new entrants may disrupt this trend. In summary, the market is witnessing growth due to the increasing demand for miniaturized electronic devices, ongoing research and development, and the challenges posed by market dynamics.

What will the size of the market be during the forecast period?

- The market is witnessing significant growth due to the increasing demand for next-generation semiconductors. The semiconductor industry is undergoing a digital transformation, with a focus on high-performance computing (HPC), electric vehicles, and data centers. The adoption of EUV technology is essential to overcome the limitations of Moore's Law, which has governed the semiconductor industry for decades. EUV lithography enables the production of smaller, more efficient chips, which is crucial for the development of next-generation computing and advanced memory technologies. Technology advancements in the semiconductor ecosystem, including nanotechnology, photonics, and silicon photonics, are driving the need for EUV lithography. These technologies require smaller features and higher precision, which can only be achieved through EUV lithography. Moreover, the semiconductor industry is investing heavily in innovation to meet the demands of the digital age. Semiconductor equipment manufacturers are developing advanced packaging solutions, such as 3D chip stacking and heterogeneous integration, to enhance chip performance and memory efficiency.

- Furthermore, the semiconductor industry is also exploring the potential of EUV lithography in the development of AI hardware, quantum computing, and advanced memory technologies. These technologies are expected to revolutionize various industries, from autonomous vehicles to healthcare, and EUV lithography is a critical enabler. The market is also influenced by the silicon wafer supply chain. The availability and cost of silicon wafers impact the production costs of semiconductors, making it essential to maintain a stable and efficient wafer fabrication process. In conclusion, the market is a critical component of the semiconductor industry's digital transformation. It enables the production of smaller, more efficient chips, which is essential for the development of next-generation computing, advanced memory technologies, and various other applications. The market's growth is driven by technology advancements, semiconductor investment, and the increasing demand for high-performance computing, data centers, and electric vehicles.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Foundry

- IDM

- Geography

- APAC

- China

- Japan

- South Korea

- North America

- US

- Europe

- South America

- Middle East and Africa

- APAC

By End-user Insights

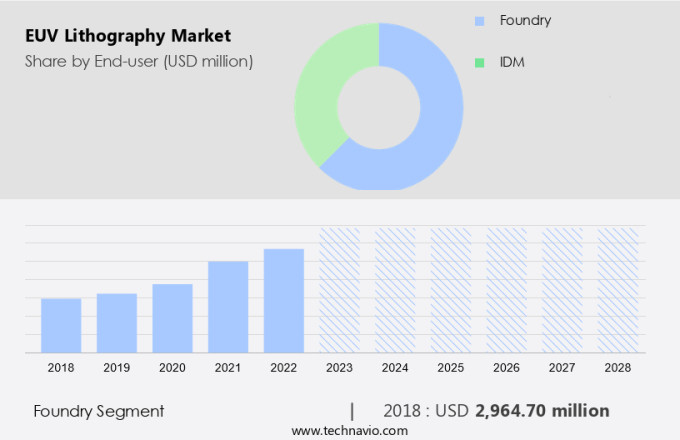

- The foundry segment is estimated to witness significant growth during the forecast period.

The market continues to expand, particularly in the business-to-business sector. This segment caters to corporations and organizations, supplying desktops, laptops, and workstations for professional applications. The business-to-business market thrives due to the escalating requirement for digitalization, work-from-home policies, and automation in diverse industries. Factors propelling this expansion include the escalating demand for dependable computing devices that foster collaboration, video conferencing, and streamlined workflows as businesses adjust to remote work setups. The market is categorized into several product classes, with laptops holding approximately 30% of the market share in 2023.

Furthermore, the market's growth is further fueled by the increasing internet penetration and the rise in e-commerce, digital content creation, digital services, and online learning. This trend is expected to continue as the gaming community and digital literacy gain traction in the corporate world.

Get a glance at the market report of share of various segments Request Free Sample

The foundry segment was valued at USD 2.96 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

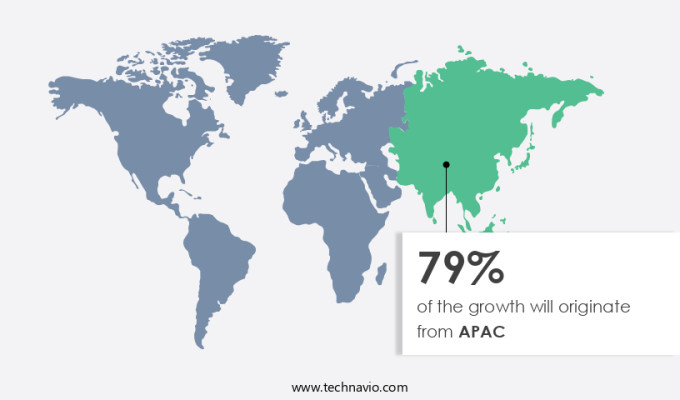

- APAC is estimated to contribute 79% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asia-Pacific (APAC) region is a significant contributor to the market, which plays a vital role in advanced semiconductor manufacturing. Countries such as China, Taiwan, Japan, and South Korea are leading this growth due to substantial investments in semiconductor technology and the development of advanced fabrication facilities. The increasing demand for miniaturized, high-performance chips for various applications, including consumer electronics and artificial intelligence, is driving the adoption of EUV lithography in APAC. Moreover, major semiconductor manufacturers based in APAC, are embracing EUV lithography to stay competitive in the global market. EUV lithography enables the production of high-density chips with smaller features, making it an ideal solution for meeting the evolving demands of the semiconductor industry. The technology utilizes laser-produced plasma and EUV light sources, which offer improved efficiency and accuracy compared to traditional lithography methods. The adoption of EUV lithography is expected to continue, fueled by the increasing need for more advanced and energy-efficient electronic devices.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of EUV Lithography Market?

Strong demand for miniaturized electronic devices is the key driver of the market.

- The electronic industry has witnessed significant advancements in technology, leading to the production of compact and dependable miniaturized electronic devices. The miniaturization of semiconductor components, including integrated circuits (IC), has fueled the interest in EUV lithography technology due to its ability to create smaller and more precise patterns on wafers. This technology is crucial for manufacturers in producing miniaturized electronic devices, such as smartphones, tablets, laptops, and video cameras. By reducing the size of these electronics, manufacturers can make devices denser, leading to an increased number of components in some cases, or a reduction in the overall number of components required.

- The demand for these miniaturized devices is on the rise due to consumer preferences for smaller, more efficient devices. EUV lithography technology plays a vital role in enabling these advancements, and major players in the industry, such as Intel and Canon, are investing heavily in this technology to stay competitive. The increasing adoption of 5G technology and the supply constraint of other lithography technologies are some of the factors contributing to this growth.

What are the market trends shaping the EUV Lithography Market?

An increase in wafer size is the upcoming trend in the market.

- In the realm of semiconductor manufacturing, next-generation technology known as Extreme Ultraviolet Lithography (EUVL) is revolutionizing the production of integrated circuits. EUVL is a data-driven strategy that utilizes EUV lithography to create smaller and more efficient electronic devices. This technology allows for increased wafer capacity by enabling the production of more microchips on a single wafer. As the demand for smaller, high-performance devices continues to grow, technology providers have responded by increasing wafer sizes, now available in the range of 300-450 mm.

- This development empowers manufacturers to produce larger quantities of integrated circuits, resulting in cost savings and enhanced product quality. Automation plays a crucial role in the implementation of EUVL, ensuring the efficiency and accuracy of the lithography process. In summary, the Lithography Market is witnessing significant advancements through the adoption of EUV technology, larger wafer sizes, and automation, ultimately leading to increased productivity and competitiveness. Thus, such trends will shape the growth of the market during the forecast period.

What challenges does EUV Lithography Market face during its growth?

Rapid technological changes is a key challenge affecting the market growth.

- The semiconductor industry is undergoing rapid advancements, with a focus on creating smaller, more efficient chips for applications in cloud computing, data centers, and other tech-driven sectors. However, achieving higher transistor density and miniaturization requires advanced lithography techniques that can deliver high resolution and precision. Traditional lithography methods are no longer sufficient for these demands, leading manufacturers to explore EUV lithography as a solution. EUV technology offers the potential for significant improvements in chip performance, but its high cost is a significant barrier to entry for many players in the market.

- As the competition intensifies, investing in EUV lithography becomes a strategic imperative for semiconductor manufacturers seeking to stay competitive. Despite the challenges, the potential benefits of EUV lithography are substantial, making it a critical area of focus for the industry's future growth. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advantest Corp.

- ASML

- Canon Inc.

- Carl Zeiss AG

- Intel Corp.

- Lasertec Corp

- Nikon Corp.

- NTT Advanced Technology Corp.

- NuFlare Technology Inc.

- Samsung Electronics Co. Ltd.

- SUSS MICROTEC SE

- Taiwan Semiconductor Manufacturing Co. Ltd.

- Toppan Photomasks

- Ushio Inc.

- Zygo Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for next-generation technology in various industries, particularly in the semiconductor sector. EUV lithography, which utilizes extreme ultraviolet light, is the latest technology in lithography, offering higher resolution and lithography intensity compared to traditional methods. This technology is crucial for the production of integrated circuits at leading-edge nodes, enabling the miniaturization of semiconductor devices and the creation of high-performance chips. Automation and data-centric strategies are key trends driving the growth of the lithography market. EUV lithography systems are being implemented in the production of microchips for various applications, including autonomous vehicles, 5G connectivity, and high-performance chips for cloud computing and data centers.

Furthermore, technology providers are investing heavily in research and development to improve EUV lithography systems, focusing on the development of high-numerical aperture EUV light sources and advanced mask technologies. The implementation cost of EUV lithography is high, but the benefits, including higher transistor density and miniaturization, outweigh the costs. The market for EUV lithography is not a monopoly, with several technology providers competing to offer the most advanced and cost-effective solutions. Optics, laser-produced plasma, and silicon wafer are essential components of EUV lithography systems, and advancements in these areas are expected to drive further growth in the market. EUV lithography is also essential for the production of three-dimensional structures, including through-silicon vias, which are crucial for the development of advanced semiconductor devices.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

135 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.9% |

|

Market Growth 2024-2028 |

USD 14.24 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

16.3 |

|

Key countries |

Taiwan, South Korea, China, US, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch