Data Center Colocation And Managed Hosting Services Market Size 2025-2029

The data center colocation and managed hosting services market size is valued to increase USD 306.2 billion, at a CAGR of 18.5% from 2024 to 2029. Rising demand for data center colocation facilities will drive the data center colocation and managed hosting services market.

Major Market Trends & Insights

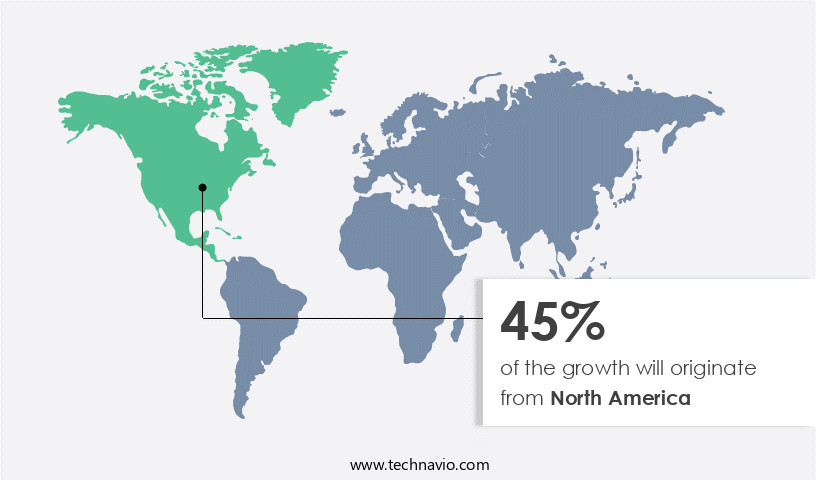

- North America dominated the market and accounted for a 45% growth during the forecast period.

- By End-user - BFSI segment was valued at USD 40.80 billion in 2023

- By Type - Colocation Services (Wholesale and Retail) segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 318.02 billion

- Market Future Opportunities: USD 306.20 billion

- CAGR from 2024 to 2029 : 18.5%

Market Summary

- The market represents a dynamic and continuously evolving landscape, driven by the increasing demand for reliable and secure IT infrastructure solutions. With businesses increasingly relying on digital transformation and cloud computing, the market for data center colocation and managed hosting services is experiencing significant growth. According to recent reports, the colocation market is projected to account for over 30% of the global data center market by 2025. Core technologies and applications, such as artificial intelligence and machine learning, are driving the need for more advanced and powerful data center solutions. Service types, including managed hosting and hybrid cloud services, are gaining popularity due to their flexibility and scalability.

- However, challenges such as high power consumption in data centers and the need for regulatory compliance continue to pose significant hurdles. Despite these challenges, the market presents numerous opportunities for growth, particularly in emerging regions such as Asia Pacific and the Middle East. For instance, growing investments in hyper-scale data centers by colocation providers in these regions are expected to fuel market expansion. Overall, the market is poised for continued growth and innovation, offering significant opportunities for businesses and investors alike.

What will be the Size of the Data Center Colocation And Managed Hosting Services Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Data Center Colocation And Managed Hosting Services Market Segmented ?

The data center colocation and managed hosting services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- BFSI

- Healthcare

- E-commerce

- Telecommunication

- Others

- Type

- Colocation Services (Wholesale and Retail)

- Managed Hosting Services

- Enterprise Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The bfsi segment is estimated to witness significant growth during the forecast period.

In the dynamic and ever-evolving the market, businesses seek reliable solutions for their IT infrastructure management. Providers offer various services such as server colocation, managed hosting, and cloud connectivity. These solutions include virtual machine management, network traffic analysis, and system performance optimization. Network connectivity options range from redundant power systems and bandwidth allocation methods to environmental monitoring systems and software-defined networking. Capacity planning strategies ensure high-availability clusters, power usage effectiveness, and cooling system efficiency. Compliance certifications, such as those for data center infrastructure, IP address management, and network security appliances, are crucial for businesses. Remote hands support, physical security measures, and disaster recovery planning add an extra layer of protection.

Virtualization technologies and network latency monitoring further enhance scalability and flexibility. With the increasing importance of data security and regulatory compliance, companies in the BFSI segment must adhere to guidelines from regulatory bodies like the GDPR, which can impose significant fines for breaches.

The BFSI segment was valued at USD 40.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 45% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Data Center Colocation And Managed Hosting Services Market Demand is Rising in North America Request Free Sample

The market is experiencing substantial expansion, fueled by substantial investments in hyperscale colocation facilities. For instance, in December 2023, DC Blox unveiled plans to construct a new data center campus in Conyers, Georgia, to cater to the escalating demand for hyperscale colocation services. Likewise, in January 2025, DAMAC Properties disclosed a substantial USD20 billion investment to develop new data centers in multiple states, including Arizona, Illinois, Indiana, Louisiana, Michigan, Ohio, Oklahoma, and Texas, to bolster their data infrastructure. Furthermore, the Stargate Initiative, a joint venture by OpenAI, SoftBank, and Oracle, was launched in January 2025, with a colossal USD500 billion investment to establish up to 20 new data centers.

These developments underscore the expanding requirements of AI and cloud technologies.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is witnessing significant growth due to the increasing demand for power consumption reduction strategies and high-density server solutions. Companies are turning to colocation providers to optimize their IT infrastructure, minimize energy usage, and reduce capital expenditures. Network bandwidth optimization techniques are also crucial, as businesses require high-speed connectivity to support their digital transformation initiatives. Disaster recovery site selection criteria and hybrid cloud integration strategies are essential considerations for organizations seeking business continuity and agility. Data center security best practices, including virtual machine resource allocation, software-defined networking implementation, and server virtualization, are increasingly prioritized to protect sensitive information.

Data center cooling system optimization and remote hands support service level agreements are vital for maintaining optimal IT infrastructure performance. Network performance monitoring dashboards and high availability database design patterns enable real-time data access and reliability. IT infrastructure modernization strategies, capacity planning for cloud environments, and hardware lifecycle management policies are essential for businesses to remain competitive and efficient. Data center compliance audits and remediation, automated data center management systems, network security incident response plans, backup and recovery solution comparisons, and business continuity planning are critical components of a robust data center strategy. According to market intelligence, adoption rates for advanced data center solutions, such as automated management systems and hybrid cloud integrations, are nearly double those for traditional, non-automated approaches.

This underscores the growing importance of digital transformation and the need for businesses to adapt to evolving market trends.

What are the key market drivers leading to the rise in the adoption of Data Center Colocation And Managed Hosting Services Industry?

- The surge in demand for data center colocation facilities serves as the primary driver for the market's growth.

- Colocation services, offered by cloud service providers (CSPs), enable businesses, both small and large, to securely house their hardware, including servers, storage devices, and network equipment, in a shared environment. The rising costs associated with building and maintaining data centers, which can reach approximately USD800 per sq. Ft. For tier 3 facilities and USD1,000 per sq. Ft. For tier 4 facilities, have led many enterprises to adopt colocation and managed hosting services. This trend is particularly significant for small and medium-sized enterprises (SMEs) that face budget constraints.

- In response, CSPs are forming partnerships with data center service providers to manage the design, architecture, electrical, and mechanical aspects of constructing data center facilities. This collaborative approach allows businesses to focus on their core competencies while benefiting from the economies of scale and expertise of these service providers.

What are the market trends shaping the Data Center Colocation And Managed Hosting Services Industry?

- Colocation providers are increasingly investing in hyper-scale data centers, setting a new market trend. This growth in investment signifies a significant shift in the data center industry.

- The market is experiencing significant growth due to increasing investments in hyper-scale data centers. The smart revolution, which encompasses the development of smart cities, smart grids, and smart homes, is generating vast amounts of data that require efficient processing. This data processing need is driving the construction of hyper-scale data centers, addressing the growing information management requirements of our interconnected world. Notable colocation and infrastructure service providers have announced the availability of such facilities.

- For instance, in 2023, Amazon Web Services (AWS) introduced a new hyperscale data center in Hyderabad, India. This expansion underscores the market's continuous evolution and the increasing demand for advanced data processing capabilities.

What challenges does the Data Center Colocation And Managed Hosting Services Industry face during its growth?

- Data center power consumption poses a significant challenge to the industry's growth due to the high energy requirements of these facilities.

- Data traffic is experiencing exponential growth due to the increasing utilization of social media platforms, the integration of blockchain and automation technologies, and the expansion of smart city initiatives. This trend is driving substantial investments in data center infrastructure to manage and store vast amounts of data. By 2030, data centers are projected to be the largest global energy consumers. The ICT sector is anticipated to account for approximately one-quarter of the world's electricity consumption by this date.

- Energy-intensive components, such as servers and cooling systems, contribute significantly to data centers' electricity usage. Developing energy-efficient solutions that minimize power consumption and carbon emissions is a major challenge for companies in this sector.

Exclusive Technavio Analysis on Customer Landscape

The data center colocation and managed hosting services market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the data center colocation and managed hosting services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Data Center Colocation And Managed Hosting Services Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, data center colocation and managed hosting services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

BT Group Plc - This company specializes in data center colocation and managed hosting services, enabling businesses to modernize and expand their data center infrastructure, enhance cloud application performance, and mitigate operational and commercial risks. By leveraging advanced technologies and expertise, it empowers organizations to optimize their IT operations and focus on core competencies.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BT Group Plc

- Chunghwa Telecom Co. Ltd.

- Cogent Communications Holdings Inc.

- CoreSite Realty Corp.

- CyrusOne LLC

- Cyxtera Technologies Inc.

- Digital Realty Trust Inc.

- Equinix Inc.

- Flexential Corp.

- Internap Holding LLC

- KDDI Corp.

- Lumen Technologies Inc.

- Navisite LLC

- NTT DATA Corp.

- phoenixNAP LLC

- Rackspace Technology Inc.

- Sabey Corp.

- Vantage Data Centers

- Verizon Communications Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Data Center Colocation And Managed Hosting Services Market

- In January 2024, Equinix, a leading global colocation data center provider, announced the acquisition of Verizon's international data center business for approximately USD3.6 billion. This acquisition expanded Equinix's footprint in key markets and strengthened its position as a major player in the market (Equinix Press Release, 2024).

- In March 2024, IBM and Google Cloud announced a strategic partnership to offer joint managed hosting services, combining IBM's industry expertise and security capabilities with Google Cloud's infrastructure and technology. This collaboration aimed to provide enterprise clients with a more comprehensive suite of managed hosting services (IBM Press Release, 2024).

- In May 2024, NTT Communications, a global ICT solutions provider, launched its new MEGAi (Middle East and Africa Interconnect) service in Dubai. This service enabled direct connectivity between data centers in the Middle East and Africa, enhancing the company's global network and catering to the growing demand for interconnected data centers in these regions (NTT Communications Press Release, 2024).

- In February 2025, Amazon Web Services (AWS) announced the launch of its new Outposts product, which brought fully managed AWS services and infrastructure to on-premises data centers. This offering aimed to provide businesses with more flexibility and control over their data while still benefiting from AWS's managed services (AWS Press Release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Data Center Colocation And Managed Hosting Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.5% |

|

Market growth 2025-2029 |

USD 306.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

15.2 |

|

Key countries |

US, Canada, China, Germany, UK, India, France, Japan, Italy, Spain, USA, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of IT infrastructure, data center colocation and managed hosting services continue to gain traction. These services enable businesses to house their IT equipment in third-party facilities, benefiting from advanced capabilities and economies of scale. Virtual machine management and network traffic analysis are integral components of this ecosystem. Virtual machine management ensures optimal performance and resource allocation, while network traffic analysis provides valuable insights for capacity planning and system performance optimization. Network connectivity options, a critical factor in managed hosting services, continue to expand. Redundant power systems, environmental monitoring systems, and software-defined networking are among the innovations enhancing data center infrastructure's reliability and efficiency.

- IT infrastructure management, encompassing server colocation, disaster recovery planning, and hardware lifecycle management, is a key driver of market activity. Remote hands support, physical security measures, and cloud connectivity solutions further bolster the value proposition of managed hosting services. Compliance certifications, such as those related to data security and privacy, are increasingly important. Scalability and flexibility, high-availability clusters, power usage effectiveness, and cooling system efficiency are essential elements for businesses seeking to minimize downtime and maximize performance. Bandwidth allocation methods and network latency monitoring are crucial for maintaining optimal network performance. Network security appliances are integral to ensuring data protection, while IP address management and virtualization technologies streamline IT operations.

- As businesses continue to navigate the complexities of IT infrastructure management, data center colocation and managed hosting services offer a flexible and efficient solution. With ongoing advancements in technology and market trends, this sector remains a dynamic and vital part of the business landscape.

What are the Key Data Covered in this Data Center Colocation And Managed Hosting Services Market Research and Growth Report?

-

What is the expected growth of the Data Center Colocation And Managed Hosting Services Market between 2025 and 2029?

-

USD 306.2 billion, at a CAGR of 18.5%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (BFSI, Healthcare, E-commerce, Telecommunication, and Others), Type (Colocation Services (Wholesale and Retail) and Managed Hosting Services), Geography (North America, Europe, APAC, Middle East and Africa, South America, and Rest of World), and Enterprise Size (Small and Medium Enterprises (SMEs) and Large Enterprises)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Rising demand for data center colocation facilities, High power consumption in data centers

-

-

Who are the major players in the Data Center Colocation And Managed Hosting Services Market?

-

BT Group Plc, Chunghwa Telecom Co. Ltd., Cogent Communications Holdings Inc., CoreSite Realty Corp., CyrusOne LLC, Cyxtera Technologies Inc., Digital Realty Trust Inc., Equinix Inc., Flexential Corp., Internap Holding LLC, KDDI Corp., Lumen Technologies Inc., Navisite LLC, NTT DATA Corp., phoenixNAP LLC, Rackspace Technology Inc., Sabey Corp., Vantage Data Centers, and Verizon Communications Inc.

-

Market Research Insights

- The market continues to expand, with an increasing number of businesses opting for flexible, scalable solutions to manage their IT infrastructure. According to industry estimates, the global colocation market size is projected to reach USD65 billion by 2025, growing at a CAGR of 12% during the forecast period. This growth is driven by the demand for high-capacity infrastructure, with colocation facilities offering access to large IP address spaces and redundant power supplies to ensure high availability design. Managed hosting providers offer additional benefits, such as on-site support services, data center security, and IT system management.

- These services enable businesses to focus on their core competencies while ensuring optimal system performance through virtual machine migration, hardware refresh cycles, and power efficiency metrics. With the growing complexity of data center design and network architecture, businesses also require advanced tools for capacity planning, network performance monitoring, and business continuity planning. As the market evolves, managed hosting providers are investing in data center automation, industry compliance standards, and hybrid cloud solutions to meet the evolving needs of their clients.

We can help! Our analysts can customize this data center colocation and managed hosting services market research report to meet your requirements.