Data Resiliency Market Size 2024-2028

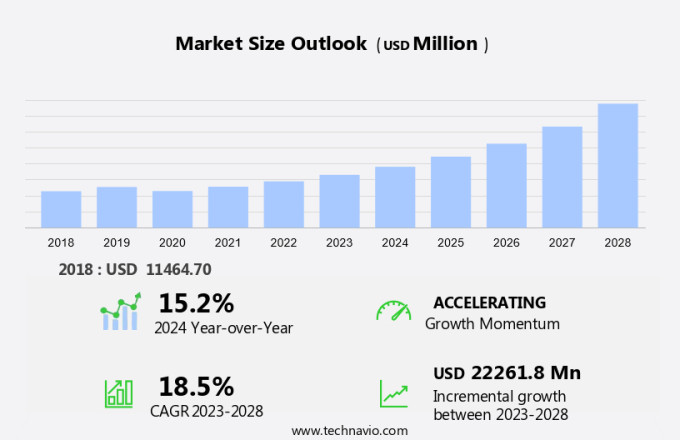

The data resiliency market size is forecast to increase by USD 22.26 billion at a CAGR of 18.5% between 2023 and 2028.

- The market is witnessing significant growth due to the exponential increase in data generation from various sources, including the Aral Sea's evaporation leading to extensive data from satellite imagery, and the Flint water crisis generating vast amounts of data for environmental monitoring. The attractiveness of blockchain solutions for data resiliency is on the rise, offering enhanced security and immutability. Open-source alternatives are also gaining popularity due to their cost-effectiveness and flexibility. Environmental compliance and public health concerns are driving the need for data resiliency in industries dealing with contaminated wastewater, ensuring operational efficiency and employee safety. Accidents and data loss can lead to severe consequences, including financial losses, reputational damage, and even endangering public health. Sustainability goals are another factor fueling market growth, as organizations aim to minimize their carbon footprint and reduce the risk of data loss. In conclusion, the data resiliency market is experiencing strong growth due to the massive increase in data generation, the need for environmental compliance, and the attractiveness of blockchain solutions and open-source alternatives. The market is expected to continue growing as organizations prioritize operational efficiency, employee safety, and sustainability goals.

What will be the Size of the Market During the Forecast Period?

- The market is rapidly evolving as organizations prioritize data protection software to safeguard against both cyber mishaps and physical mishaps. Implementing data backup best practices is crucial, with strategies like air-gapped backups and immutable backups ensuring that critical data remains secure from ransomware attacks. Organizations are focusing on achieving error-free backups to minimize risks associated with accidental deletion. Additionally, the importance of encryption for data at rest and data transit cannot be overstated, enhancing security for sensitive information. Understanding the Recovery Time Objective (RTO) and Recovery Point Objective (RPO) is essential for effective data recovery strategies. As businesses increasingly adopt hybrid workloads and SaaS apps, managing endpoints becomes critical. Emphasizing human validation in backup processes and following security best practices will further fortify data resiliency, ensuring that organizations can effectively respond to potential data loss while maintaining operational continuity.

- Data resiliency can help mitigate these risks by providing real-time monitoring of wastewater quality and treatment processes, enabling timely intervention and reducing the risk of accidents. Sustainability goals are increasingly becoming a priority in water and wastewater management. Data resiliency can help organizations meet these goals by enabling real-time monitoring and optimization of water and wastewater treatment processes, reducing water usage, and minimizing the generation of hazardous waste. In conclusion, data resiliency plays a crucial role in water and wastewater management, ensuring public health, environmental compliance, operational efficiency, and employee safety. By providing accurate, reliable, and timely data on wastewater quality and treatment processes, data resiliency can help organizations optimize their operations, reduce costs, and minimize risks.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- On-premises

- Cloud

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Deployment Insights

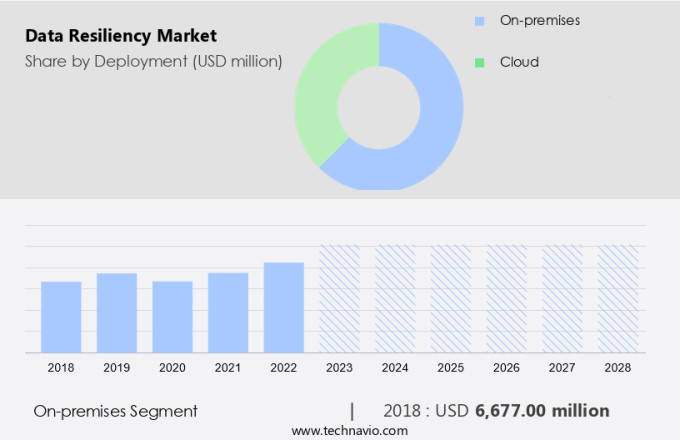

- The on-premises segment is estimated to witness significant growth during the forecast period.

On-premises data resiliency solutions held a significant market share due to their dependable networking communications, resulting in faster performance and lower latency. Organizations prioritizing superior execution across various workload types opt for on-premises implementation. This deployment method is particularly favored by sectors like government, defense, and the Banking, Financial Services, and Insurance (BFSI) industry, as they cannot risk losing sensitive data, financial records, customer information, or monetary transaction details. The relevance of workloads determines the data center's resiliency techniques. Prolonged service interruptions can result in substantial costs, making it crucial for organizations with mission-critical workloads to employ more resiliency measures within their data centers during the forecast period.

Furthermore, contaminated wastewater incidents, such as the Flint water crisis, and environmental compliance issues, like the Aral Sea disaster, underscore the importance of data resiliency in maintaining public health and adhering to regulatory requirements. By ensuring operational efficiency, employee safety, and accident prevention, data resiliency solutions contribute to sustainability goals and safeguard an organization's reputation.

Get a glance at the market report of share of various segments Request Free Sample

The on-premises segment was valued at USD 6.68 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

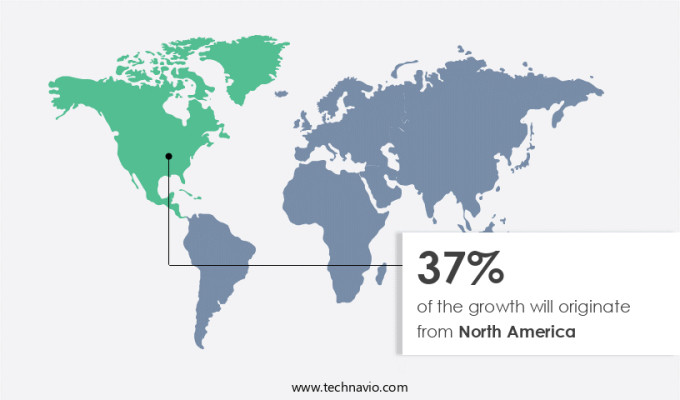

- North America is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

North America held the largest market share in the global Data Resiliency industry. This region is a hub for major companies, with surging demand for flexible solutions driven by the expansion of various industries and the proliferation of connected devices. The risk of cyberattacks affecting this market continues to escalate, impacting individuals, businesses, and governments alike. To counteract these threats, industries such as BFSI, IT, telecom, retail, and healthcare are increasingly focusing on safeguarding their critical enterprise data. Secure containers and advanced treatment methods, including preliminary treatment, secondary treatment, and tertiary treatment, are being employed to ensure data security. Furthermore, nutrient removal and disinfection processes are essential for the proper disposal of waste data.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Data Resiliency Market?

Massive growth in data generated from varied sources is the key driver of the market.

- The proliferation of data from various sources, including the Internet, mobile devices, enterprises, and IoT, has led to an exponential increase in data generation. With the rise of cloud computing and EDGE networks, data is now spread across multiple environments, including servers, virtual machines, mobile devices, and applications. To safeguard against data loss or misuse, it is crucial to implement strong data protection measures. Data resiliency solutions play a vital role in managing large data volumes across diverse environments. These solutions offer comprehensive data backup and recovery services, ensuring business continuity during disasters.

Additionally, they provide features such as air-gapped backups, immutable backups, and error-free backups to ensure data security and integrity. The growing need for securely backing up workloads across multiple sites and ensuring business continuity is driving the demand for data resiliency solutions. As a result, the market for these solutions is expected to experience significant growth during the forecast period. By implementing data resiliency solutions, organizations can protect their data assets and maintain business operations even in the face of unexpected disruptions.

What are the market trends shaping the Data Resiliency Market?

The rising attractiveness of blockchain solutions is the upcoming trend in the market.

- Blockchain technology, a method of securely recording and verifying transactions, offers indisputable data verification when integrated with data resiliency solutions. This integration ensures the unique signature of data blocks is established through consensus rules, providing an additional layer of security. companies can offer data backup and recovery services, storing the hashes of data blocks and verifying them using encrypted and distributed hashes.

- By combining blockchain-based data verification technology with data resiliency solutions, such as SaaS apps, endpoints, and hybrid workloads, companies can deliver more secure data backup and recovery services. Human validation and automation ensure the accuracy and reliability of the data, making this an attractive solution for businesses seeking to enhance their data protection practices.

What challenges does Data Resiliency Market face during the growth?

The availability of open-source alternatives is a key challenge affecting the market growth.

- Open-source technology has revolutionized the data resiliency landscape with its effective and economical solutions for data backup and recovery. Two notable examples are Recuva and TestDisk. Recuva offers superior file recovery capabilities with an advanced deep scan mode, while TestDisk enables users to rebuild boot sectors, freely available across major platforms like Microsoft Windows and Mac OS X. Despite the presence of these open-source alternatives, the demand for commercial data resiliency solutions is not entirely diminished. However, their widespread availability and affordability do pose a challenge to market players.

- Small and medium enterprises (SMEs), in particular, are known for their budget constraints, making open-source solutions an attractive choice for them. Physical mishaps and cyber mishaps, such as accidental deletion, ransomware attacks, and other data loss incidents, continue to threaten critical data. In this context, data resiliency remains a crucial aspect of business continuity and disaster recovery strategies. While open-source solutions offer a cost-effective alternative, they may not always provide the same level of advanced features and support offered by commercial solutions. In summary, open-source data backup and recovery solutions have gained significant traction in the market due to their affordability and effectiveness.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acronis International GmbH

- Amazon.com Inc.

- Arcserve USA LLC

- Asigra Inc.

- Broadcom Inc.

- Commvault Systems Inc.

- Dell Technologies Inc.

- Hewlett Packard Enterprise Co.

- International Business Machines Corp.

- Lumen Technologies Inc.

- Microsoft Corp.

- NetApp Inc.

- Open Text Corp.

- Quest Software Inc.

- Rubrik Inc.

- Unitrends Inc.

- Veeam Software Group GmbH

- Veritas Technologies LLC

- VMware Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The increasing concern for public health and environmental compliance in the wake of water crises, such as the Aral Sea and Flint, has led industries to prioritize data resiliency. Contaminated wastewater, be it domestic or industrial, poses significant risks to operational efficiency, employee safety, and sustainability goals. Characterizing liquid waste involves laboratory analysis of contaminants, pH levels, and other parameters. Proper collection, transport, segregation, and secure containment are crucial to prevent accidents and ensure safe disposal. Implementing a strong backup process that incorporates data backup best practices, such as encryption and secure data transit, is essential to protect against ransomware attacks, ensuring that organizations can meet their (RTO) Recovery Time Objective and (RPO) Recovery Point Objective by automating the backup process. Data resiliency plays a pivotal role in this process.

Furthermore, municipalities and industries must securely back up their data sets through strong backup processes, workload management, and data protection software. Air-gapped backups, immutable backups, and error-free backups are essential for critical data, while hybrid workloads, SaaS apps, endpoints, and security best practices address cyber mishaps. Data resiliency encompasses data at rest and in transit, protecting against physical mishaps and cyber attacks. Disaster recovery plans for accidental deletion, ransomware attacks, and other mishaps are vital. Non-critical data can be automated, while human validation and remedial measures ensure data integrity. Preliminary, secondary, and advanced treatment methods for wastewater mirror the need for preliminary, secondary, and advanced data protection techniques.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.5% |

|

Market Growth 2024-2028 |

USD 22.26 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.2 |

|

Key countries |

US, China, UK, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch