Winding Wire Market Size 2024-2028

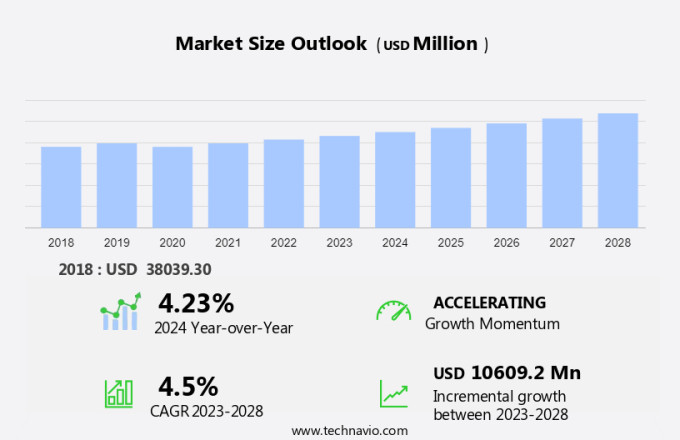

The winding wire market size is forecast to increase by USD 10.61 billion, at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth due to key driving factors, including the expansion of power generation and transmission and distribution networks. This trend is being fueled by the increasing focus on energy efficiency and the need for reliable and high-performance winding wires in various industries such as power generation, electrical equipment, and transportation. However, the market's high fragmentation limits consistent increases in average selling prices. This market analysis report provides an in-depth examination of these growth factors and the challenges they present for market participants.

- The expansion of power generation and T&D networks is a major driver of market growth, as the demand for electricity continues to rise. At the same time, there is a growing emphasis on energy efficiency and the use of advanced materials in winding wires to improve performance and reduce energy consumption. Despite these opportunities, the market's fragmented nature and intense competition can make it challenging for companies to consistently increase their prices. Overall, the market is poised for continued growth, driven by these key trends and the increasing demand for reliable and efficient electrical infrastructure.

What will be the Size of the Winding Wire Market During the Forecast Period?

- The market is experiencing significant growth, driven by increasing demand from various industries, including industrial, electric vehicles, and telecommunications. Stator windings for electric motors, compact motors, and electric chargers are primary applications for winding wire. The market is segmented based on the type of material used, with both stranded copper wire and solid copper wire holding substantial market shares. The electrical properties of winding wire, such as conductivity, malleability, and corrosion resistance, are crucial factors influencing demand. Additionally, the trend toward energy efficiency and reduced energy loss is driving the adoption of winding wire in power transmission and distribution systems. Flexibility, bending, and shaping capabilities are also essential for installation in various applications. Environmental factors, such as moisture and oxidation, are key challenges for the market, necessitating continuous research and development efforts to improve the durability and performance of winding wire.

How is this Winding Wire Industry segmented and which is the largest segment?

The winding wire industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Copper

- Aluminum

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- France

- North America

- US

- South America

- Middle East and Africa

- APAC

By Product Insights

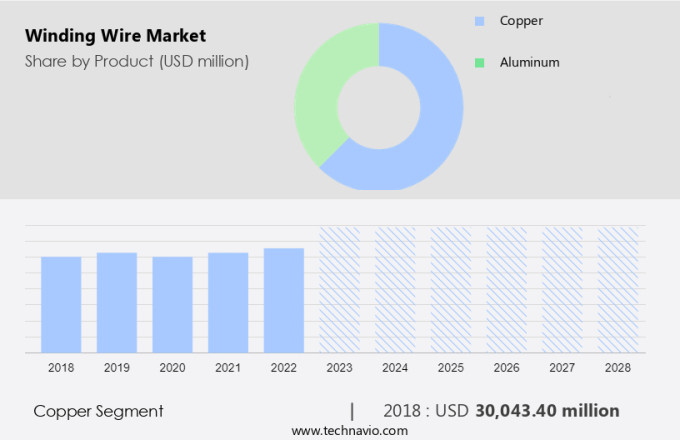

- The copper segment is estimated to witness significant growth during the forecast period.

The market is primarily driven by the increasing demand for battery systems, charging infrastructure, residential and commercial buildings, electric appliances, gadgets, and emerging economies. Among the various materials used in winding wires, copper is the largest segment due to its superior mechanical and electrical properties, including lesser thermal expansion, higher corrosion resistance, and less frequent inspection and maintenance requirements. Copper winding exhibits better performance in various applications, including electrical grids, urbanization, industrialization, infrastructure projects, substations, power lines, and replacements in green energy infrastructure. The copper segment is projected to maintain its dominance in the market during the forecast period.

Get a glance at the Winding Wire Industry report of share of various segments Request Free Sample

The copper segment was valued at USD 30.04 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

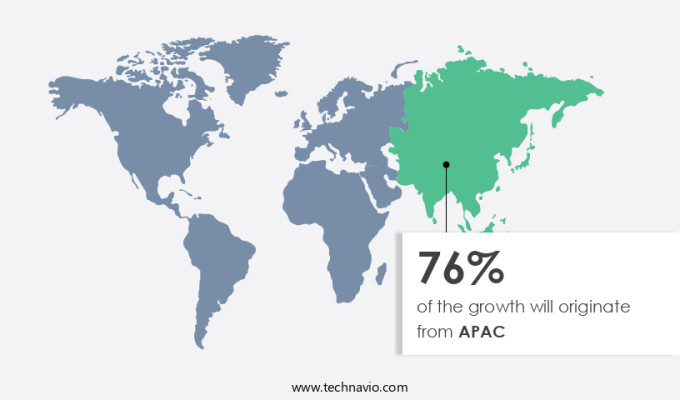

- APAC is estimated to contribute 76% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific (APAC) region is the largest consumer and producer of various electrical and electronic devices, making it the leading geographical segment in The market. APAC's dominance is primarily due to its significant contributions to power generation and automotive industries. In 2020, APAC accounted for nearly 46% of the global power generation and approximately 50% of the global automotive production. The region's high demand for electrical and electronic devices, such as motors, transformers, electric generators, inductors, inverters, and various consumer appliances, drives the market's growth. Winding wires are essential components in these devices, ensuring their efficient performance and longevity. APAC's eco-friendly initiatives and increasing focus on sustainable manufacturing processes are also expected to boost the market's growth by promoting the use of natural and recycled materials in winding wire production.

Market Dynamics

Our winding wire market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Winding Wire Industry?

Expansion of power generation and T&D network is the key driver of the market.

- The market experiences growth due to the increasing demand for electric generators and transformers in the power generation and transmission (T&D) sector. With the expansion of electrical infrastructure in urbanizing and industrializing economies, such as India and China, the consumption of electricity has been on the rise. For instance, China's total power consumption reached 8.31 trillion kilowatt-hours (kWh) in 2021, according to the National Energy Administration (NEA). Similarly, India's power consumption grew by 4.7% in 2020. This increasing electricity demand leads to a higher requirement for electric generators and transformers, which in turn fuels the market growth for winding wires.

- Moreover, the electric vehicles (EV) market, including hybrid vehicles, is another significant consumer of winding wires. The growing adoption of EVs, driven by environmental concerns and sustainability, necessitates the production of electric motors and battery systems, which require winding wires for their stator windings. Additionally, the charging infrastructure for EVs also requires electric chargers, which further boosts the demand for winding wires. The industrial segment, energy segment, and infrastructure segment are the primary end-users of winding wires. Industrial applications include motor applications, such as compact motors, and electrical appliances, like home appliances and transformers. Copper and aluminum magnet wires, available in round, rectangle, and square shapes, are commonly used due to their electrical properties, such as conductivity, malleability, and corrosion resistance.

- Insulations, made of resin, are crucial in ensuring the dielectric strength, thermal resistance, and insulation resistance of the winding wires. The renewable energy sector, including wind power, solar power, and battery systems, is another significant consumer of winding wires. Wind turbines and solar panels require copper wire as an electrical conductor for power transmission and distribution. Lithium-ion batteries, used in EVs and other electrical appliances, also require winding wires for their battery systems and charging infrastructure.

What are the market trends shaping the Winding Wire Industry?

Increasing focus on energy-efficient winding wires is the upcoming trend in the market.

- The market encompasses winding wires utilized in various electrical applications, including electric vehicles (EVs), industrial equipment, and home appliances. In the industrial sector, winding wires are integral to electric motors, transformers, and generators, facilitating energy transformation from electrical to mechanical or vice versa. This process, however, results in energy loss as heat. To mitigate this issue, there is a growing emphasis on employing efficient winding wires that minimize heat generation, thereby reducing overall energy consumption. The increasing demand for energy efficiency in industrial applications, such as motors and transformers, propels the market growth. Moreover, the electric vehicles market, including hybrid vehicles and EV charging infrastructure, presents a significant opportunity for winding wire manufacturers.

- The adoption of renewable energy sources, like wind power and solar power, further fuels the demand for winding wires in battery systems and charging infrastructure. The market caters to diverse applications, including motor applications, electrical appliances, and power transmission and distribution. Copper and aluminum wires, available in various shapes such as round, rectangle, and square, are commonly used due to their electrical properties, including conductivity, malleability, corrosion resistance, and thermal and insulation resistance.

- The market is influenced by factors like dielectric strength, thermal resistance, insulation resistance, and flexibility, bending, and shaping capabilities. The infrastructure segment, including residential and commercial buildings, and the energy segment, including renewable energy and electrical grids, are significant markets for winding wires. Rapid urbanization and industrialization, along with the increasing demand for data transmission and 5G network expansion, create opportunities for winding wire manufacturers. Additionally, emerging technologies, sustainability, and environmental concerns are driving the adoption of eco-friendly materials in the market.

What challenges does the Winding Wire Industry face during its growth?

High fragmentation of the market limits consistent increases in ASP is a key challenge affecting the industry growth.

- The market encompasses a diverse range of applications within the Industrial, Energy, and Infrastructure segments. Industrial applications include stator windings for compact motors and various electrical appliances, while the Energy segment caters to transformers, generators, and electrical power cables. In the Infrastructure segment, winding wires are utilized in urban areas for electrical infrastructure development, renewable energy projects, and electric vehicle charging infrastructure. Two primary types of magnet wires dominate the market: Copper and Aluminum. Copper magnet wires offer superior electrical conductivity, malleability, and corrosion resistance, making them ideal for motor applications and electrical appliances. Aluminum magnet wires, on the other hand, are preferred for their lower cost and lighter weight, making them suitable for large-scale applications such as power transmission and distribution, telecommunications, and renewable energy projects.

- The market dynamics are influenced by various factors, including the increasing adoption of electric vehicles (EVs) and hybrid vehicles, the demand for energy-efficient technology, and the growing urbanization and industrialization trends. The renewable energy sector, particularly wind power and solar power, is also driving market growth due to the increasing focus on sustainability and environmental concerns. The market is characterized by a high degree of competition, with numerous small and medium-sized enterprises (SMEs) catering to the demand for winding wires. The availability of technology and equipment to produce winding wires and the relatively low capital investment required make it an accessible market for new entrants.

Exclusive Customer Landscape

The winding wire market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The winding wire industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bharat Insulation Co. Pvt. Ltd.

- EL Sewedy Electric Co.

- Elcowire Group AB

- Fujikura Co. Ltd.

- Furukawa Electric Co. Ltd.

- G. K. Winding Wires Ltd.

- Hitachi Ltd.

- International Wire Group Inc.

- KEI Industries Ltd.

- Khaitan Winding Wire Pvt. Ltd.

- LS Cable and System Ltd.

- Prysmian Spa

- REA MAGNET WIRE Co. Inc.

- Sam Dong America

- Shanghai Metal Corp.

- Sumitomo Electric Industries Ltd.

- SUZHOU WUJIANG XINYU ELECTRICAL MATERIAL Co. Ltd.

- SynFlex Elektro GmbH

- Vimlesh Industries Pvt. Ltd.

- Zhengzhou LP Industrial Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is an essential component of various industries, playing a crucial role in power transmission, distribution, and conversion. This market encompasses a diverse range of applications, from industrial machinery and electrical appliances to renewable energy and electric vehicles. The industrial segment is a significant consumer of winding wires due to the extensive use of electrical motors and generators. These applications require winding wires with specific electrical properties, such as high dielectric strength, thermal resistance, and insulation resistance. Copper and aluminum are the primary metals used for manufacturing winding wires due to their excellent electrical conductivity, malleability, and corrosion resistance. The energy segment is another critical area where winding wires find extensive applications. Power transmission and distribution networks rely on electrical cables, which require insulation made of resins to ensure safe and efficient power transfer.

Moreover, the infrastructure segment also utilizes winding wires in various applications, such as substations, power lines, and transformers. The emergence of renewable energy sources, such as wind and solar power, has significantly increased the demand for winding wires. Wind turbines and solar panels require copper wire as an electrical conductor for power transmission. Additionally, the growing adoption of electric vehicles (EVs) and the development of charging infrastructure have created new opportunities for the market. The EV market comprises electric and hybrid vehicles, which require compact motors and battery systems. These applications require winding wires with specific electrical properties, such as high conductivity, flexibility, and resistance to moisture and oxidation. Aluminum magnet wires are commonly used in EV applications due to their lightweight and high thermal conductivity.

Further, the home appliance sector is another significant consumer of winding wires. Appliances such as refrigerators, washing machines, and air conditioners use electrical motors and transformers, which require winding wires for their operation. Copper and aluminum winding wires are commonly used in this sector due to their excellent electrical conductivity and cost-effectiveness. The technology sector also utilizes winding wires in various applications, such as telecommunications and data transmission. The growing demand for 5G network expansion and emerging technologies, such as eco-friendly materials, sustainability, and environmental concerns, are expected to drive the growth of the market. The market for winding wires is diverse and dynamic, with applications ranging from industrial machinery and electrical appliances to renewable energy and electric vehicles.

|

Winding Wire Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

148 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 10.61 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

China, Japan, US, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Winding Wire industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch