Diamond Coatings Market Size 2024-2028

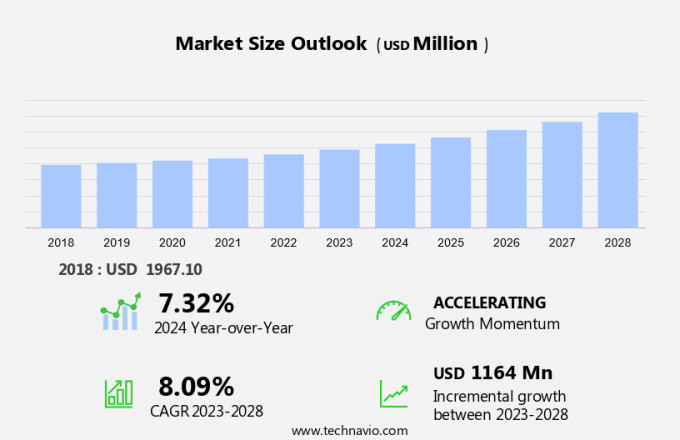

The diamond coatings market size is forecast to increase by USD 1.16 billion at a CAGR of 8.09% between 2023 and 2028. The diamond market is experiencing significant growth due to the cost advantages and ongoing research initiatives to expand the application scope of these coatings. However, the market faces challenges from the easy availability of substitute materials. Unstructured data, such as video files, picture files, and audio files, are increasingly being stored using high-speed storage solutions like FlashArray, FlashBlade, FlashStack, Portworx, and Pure1. Evergreen technology, including Evergreen/Flex and Evergreen architecture, is gaining popularity due to its ability to ensure regulatory compliance and reduce the total cost of ownership. These trends and challenges shape the future of the market.

What will the size of the market be during the forecast period?

The market is experiencing significant growth due to the increasing demand for advanced technologies that improve enterprise infrastructure efficiency and reduce power consumption. Enterprises are seeking solutions to address the challenges posed by the exponential growth of data generated from various sources, including financial systems, virtual servers, and IoT devices. Data analytics is a critical function in today's business landscape, with enterprises relying on accurate and timely insights to make informed decisions. However, the massive amounts of data being generated daily can put a strain on existing storage systems, leading to potential performance issues and increased power consumption. Enterprises are turning to diamond coatings as a solution to enhance the performance of their storage systems. These coatings are applied to hard disk drives (HDDs), solid-state drives (SSDs), all-flash arrays (AFAs), and other storage technologies to reduce power consumption and improve data access times.

Additionally, the adoption of cloud technology has further fueled the demand for diamond coatings. Mega data centers and public cloud resources require large-scale storage systems that can handle vast amounts of data while maintaining high performance levels. Diamond coatings help achieve these goals by reducing the power consumption of storage systems and improving their overall efficiency. Moreover, the digitization of end-user industries such as healthcare, finance, and retail has led to an increase in data generation. IT services are under pressure to provide reliable and efficient storage solutions to their clients. Hybrid cloud environments, which combine the benefits of private and public clouds, are becoming increasingly popular. Diamond coatings offer a cost-effective solution to improve the performance of storage systems in these environments, enabling IT services to deliver better services to their clients and achieve a higher return on investment. Cache and persistent buffer are essential components of storage systems that can significantly impact their performance.

Further, diamond coatings can enhance the effectiveness of these components by reducing power consumption and improving data access times. This leads to faster response times and improved user experience, making diamond coatings an attractive option for enterprises looking to optimize their storage infrastructure. In conclusion, the market is poised for growth due to the increasing demand for storage solutions that offer improved performance, reduced power consumption, and cost savings. Enterprises across various industries are adopting diamond coatings to enhance their storage infrastructure and meet the challenges posed by the exponential growth of data. By reducing power consumption and improving data access times, diamond coatings offer a cost-effective solution for enterprises looking to optimize their storage infrastructure and achieve a higher return on investment.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Electronics

- Mechanical

- Industrial

- Medical

- Others

- Technology

- Chemical vapor deposition

- Physical vapor deposition

- Geography

- Europe

- Germany

- UK

- North America

- Canada

- US

- APAC

- China

- Middle East and Africa

- South America

- Europe

By End-user Insights

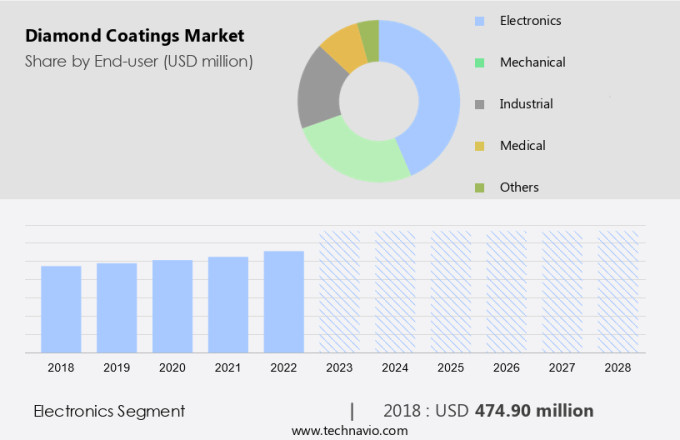

The electronics segment is estimated to witness significant growth during the forecast period. Diamond coatings have gained significant traction in the technology sector due to their unique properties, making them indispensable in mission-critical applications. These coatings are particularly useful in high-performance computers and electronic devices, such as heat exchangers, sinks, electrical components, optical windows, and prosthetics. The increasing adoption of NVMe technology, real-time analytics, and demanding databases in various industries, including financial systems, virtual servers, and data analytics, is driving the demand for diamond-coated components.

Moreover, the digitization trend and the shift towards virtual desktop platforms and mega data centers are expected to boost market growth. Public cloud resources and enterprise infrastructure, including hybrid cloud environments, cache, and persistent buffers, also require diamond coatings for their high thermal conductivity, efficient electrical insulation, high chemical inertness, and superior mechanical strength. End-user industries, such as IT services, are expanding their global presence, leading to an increased demand for these advanced coatings. Therefore, the market is poised for substantial growth during the forecast period.

Get a glance at the market share of various segments Request Free Sample

The electronics segment accounted for USD 474.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

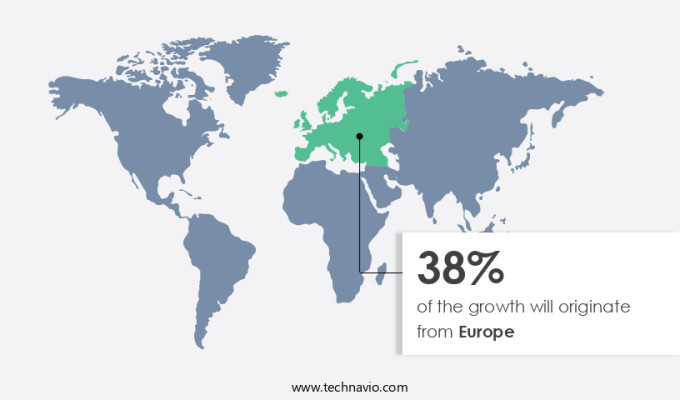

Europe is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The European market is poised for significant expansion over the forecast period, driven primarily by the growing utilization of diamond coatings in sectors including automotive, aerospace, mechanical engineering, and construction. In microelectronics and telecommunications, the adoption of advanced digital technologies, smart consumer electronics, the Internet of Things, and electromechanical components and accessories is fueling industry growth in Europe. Europe is among the world's leading automotive producers, which is expected to boost the use of diamond coatings in the automotive industry. Additionally, the increasing implementation of next-generation technologies such as 4K/8K video, VR/AR applications, smart manufacturing, remote inspection, intelligent security protection, 5G, AI, and service innovation platforms in various industries is creating a demand for high-performance materials like diamond coatings.

Further, the T-bit and P-bit level data storage market is also experiencing a wave, further driving the demand for diamond coatings in the storage industry. Power outages, cyberattacks, and other disruptions can cause significant downtime and financial losses, making the need for reliable and efficient solutions more crucial than ever. Diamond coatings offer superior durability and resistance to wear and tear, making them an attractive option for industries seeking to minimize downtime and enhance productivity. In summary, the European market is set to benefit from the increasing adoption of advanced technologies and the growing demand for high-performance materials in various industries.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The cost advantages of diamond coatings is the key driver of the market. In the realm of IT and computer technology, the adoption of diamond coatings has emerged as a significant trend due to their cost-effective nature compared to industrial diamonds. The similar physical and chemical properties of diamond coatings and industrial diamonds ensure the same level of durability and other desirable traits. Traditional diamond tools, such as those used in the taxi industries, hospitals, public education, manufacturing, and Internet of Things (IoT) penetration, often face issues with diamond grains breaking off, leading to decreased tool life.

In contrast, diamond-coated tools, employed by companies undergoing digital transformation, boast a longer service life due to the uniform distribution of diamond particles. This enhancement in tool longevity translates to increased business agility and scale, enabling organizations to innovate and manage their data more efficiently. Companies like Pure Storage have capitalized on these advantages, offering diamond-coated solutions for improved data management in the US market.

Market Trends

R&D initiatives to enhance the use of diamond coatings is the upcoming trend in the market. Diamond coatings have witnessed significant research and development (R&D) efforts in recent times, expanding their potential uses across various industries. Currently, these coatings are utilized in sectors such as semiconductors, electronics, mechanical, construction, industrial, glass and stone cutting, computer chip manufacturing, medical and healthcare, oil and gas exploration, and mining. The ongoing R&D activities have paved the way for new industrial applications.

For example, researchers at the Indian Institute of Technology Madras (IIT-M) in India developed innovative diamond coatings in February 2020, suitable for heat dissipation purposes in industries like electronics, aerospace, military, medical, and others. This exemplifies the continuous progress in the field of diamond coatings and their potential to address diverse industry needs.

Market Challenge

The easy availability of substitutes is a key challenge affecting the market growth. The market for diamond coatings faces competition from alternative high-performance coatings such as titanium nitride, chromium carbide, and titanium carbonitride. These substitutes, which also include chromium nitride, aluminum titanium nitride, and zirconium nitide, are gaining traction due to their ability to deliver comparable performance to diamond coatings. Additionally, the expanding consumer base for high-strength tools is expected to influence market growth during the forecast period. Selecting the appropriate cutting tool is crucial for producing defect-free, productive, and intricate machining processes, including cutting, milling, grinding, turning, and drilling. High-speed steel (HSS) metal-cutting tools, renowned for their superior quality compared to traditional tools, are witnessing increased adoption due to their effectiveness in such applications.

Further, in the realm of data management, unstructured data from video files, picture files, and audio files pose challenges for businesses seeking to ensure regulatory compliance and optimize high-speed storage solutions. By prioritizing data management best practices and leveraging advanced technologies, businesses can effectively manage their unstructured data and maintain regulatory compliance while maximizing the potential of their high-speed storage systems.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Acree Technologies Inc. - The company offers diamond coatings such as carbon coatings. Also, they offer DLC coatings, TCO coatings, wear-resistant coatings, and erosion-resistant coatings.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anglo American plc

- Blue Wave Semiconductors Inc.

- Calico Coatings

- CemeCon AG

- Creating Nano Technologies Inc.

- Crystallume Corp.

- Diamond Materials GmbH and Co. KG

- Diamond Product Solutions

- Element Six UK Ltd.

- Endura Coatings

- Entegris Inc.

- IBC Coatings Technologies Inc.

- JCS Group

- NeoCoat SA

- OC Oerlikon Corp. AG

- Sandvik AB

- SP3 Inc.

- Surface Technology Inc.

- United Protective Technologies LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has gained significant traction in the IT industry due to the increasing demand for high-performance, scalable, and energy-efficient storage solutions. With the exponential growth of data generated from various end-user industries, enterprises face a data storage crisis, leading them to adopt advanced storage technologies. Enterprise storage users are shifting from traditional HDDs and SSDs to All-Flash Arrays (AFAs) and NVMe-based solutions to address performance and power consumption concerns. The cloud technology revolution has further fueled the adoption of flash storage, enabling businesses to store, manage, and access data more efficiently in hybridcloud environments. Financial systems, virtual servers, IT services, and mega data centers are some of the key sectors driving the market growth.

Further, technological advancements in flash storage, such as real-time analytics, AI, and machine learning, have made it an essential component for mission-critical applications, including demanding databases, financial transactions, and virtual desktop platforms. The integration of AI and ML in flash storage solutions has led to service innovation platforms, enabling businesses to process massive amounts of data at t-bit and p-bit levels. Despite the benefits, the market faces challenges such as the shortage of raw data storage resources, higher prices, and the need for regulatory compliance. The lockdown and the resulting economic downturn have also affected the market, leading to a slowdown in demand and a potential bottleneck in data center operations. However, the market is expected to recover as businesses continue to prioritize digital transformation and IT innovation.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market Growth 2024-2028 |

USD 1.16 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Regional analysis |

Europe, North America, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

Europe at 38% |

|

Key countries |

US, China, Germany, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Acree Technologies Inc., Anglo American plc, Blue Wave Semiconductors Inc., Calico Coatings, CemeCon AG, Creating Nano Technologies Inc., Crystallume Corp., Diamond Materials GmbH and Co. KG, Diamond Product Solutions, Element Six UK Ltd., Endura Coatings, Entegris Inc., IBC Coatings Technologies Inc., JCS Group, NeoCoat SA, OC Oerlikon Corp. AG, Sandvik AB, SP3 Inc., Surface Technology Inc., and United Protective Technologies LLC |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch