Dicamba Herbicide Market Size 2024-2028

The dicamba herbicide market size is forecast to increase by USD 123.2 million, at a CAGR of 4.83% between 2023 and 2028. The market is experiencing significant developments driven by the increasing need to control weed growth in agricultural industries. Farmers are being incentivized to use dicamba due to its effectiveness in managing resilient weeds. Benzoic acid, a common component of dicamba, interferes with the ethylene and abscisic acid signaling pathways in mammalian cells, affecting kidney tissue and potentially leading to chronic kidney disease. However, concerns regarding the potential health risks associated with dicamba, such as its impact on kidney tissue and the production of uremic toxins during tryptophan metabolism, have led to regulatory actions. The Environmental Protection Agency (EPA) has imposed restrictions on the use of dicamba due to its classification as a carcinogen and neurotoxin. These factors are shaping the market dynamics and requiring manufacturers to address safety concerns to maintain market growth.

Market Analysis

The market has witnessed significant growth in recent years due to the increasing demand for effective weed management solutions in North America. Dicamba is a widely used herbicide in the agriculture industry, particularly for the control of broadleaf weeds in crops such as soybeans and cotton. However, the market faces several challenges that require the attention of industry stakeholders. One of the primary challenges in the market is the development of herbicide-resistant weeds. The overuse and misapplication of dicamba have led to the emergence of resistant weeds, making it essential for farmers to adopt new strategies for weed management.

Moreover, the use of herbicide-tolerant crops, such as genetically modified (GM) crops, is one potential solution to this issue. Another challenge in the market is the potential health and environmental risks associated with the herbicide. Dicamba contains benzoic acid, which has carcinogenic characteristics. Epidemiological studies have linked exposure to dicamba to lung cancer, colon cancer, prostate cancer, and hypothyroidism. Herbicide drift, which occurs when dicamba moves off-target and damages non-target crops, is also a concern. Despite these challenges, the market offers significant opportunities for growth. Pre-emergence herbicides, which are applied before the emergence of weeds, are gaining popularity as an effective solution for controlling weeds in winter wheat fields.

Furthermore, supercritical fluid extraction is another emerging technology that can be used to extract dicamba from plants, making it a more sustainable and efficient production method. Moreover, the development of new formulations of dicamba, such as those that are less volatile and less prone to herbicide drift, is expected to address some of the challenges in the market. The use of ethylene and abscisic acid, plant hormones that can enhance the effectiveness of dicamba, is another potential area of research and development. In conclusion, the market faces challenges related to herbicide resistance, health and environmental risks, and herbicide drift.

Market Segmentation

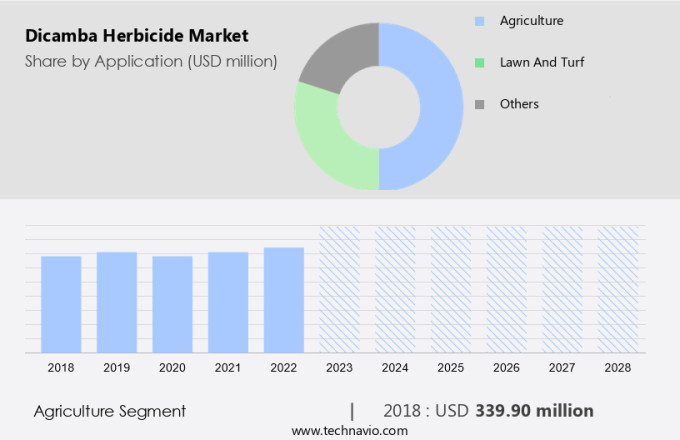

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Agriculture

- Lawn and turf

- Others

- Geography

- Europe

- UK

- APAC

- China

- North America

- US

- South America

- Middle East and Africa

- Europe

By Application Insights

The agriculture segment is estimated to witness significant growth during the forecast period. Dicamba herbicide plays a crucial role in weed management for various herbicide-tolerant crops, including corn, wheat, and soybean. Its growth-regulating properties make it an essential agrochemical for nourishing these crops while inhibiting the growth of broadleaf weeds and woody plants. As a growth regulator herbicide, dicamba mimics the action of auxin (indoleacetic acid), making it an effective solution for weed control in winter wheat fields and other protected agriculture systems. Precision farming practices also contribute to the increasing use of dicamba herbicide due to its targeted application capabilities.

Get a glance at the market share of various segments Request Free Sample

The agriculture segment accounted for USD 339.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

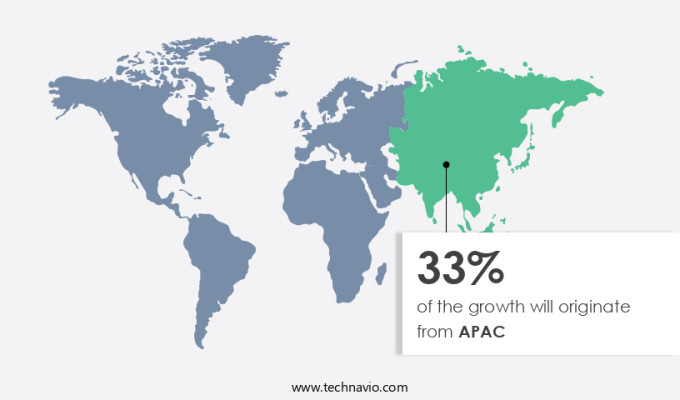

APAC is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Another region offering significant growth opportunities to companies is Europe. The European market is experiencing growth due to the expanding agricultural sector, driven by population growth and the scarcity of arable land. However, the market faces challenges from strict regulations imposed by European governments on dicamba use. The European Union Common Agricultural Policy (CAP), which comprises half of the EU budget, aims to modernize and increase agricultural production. Despite these challenges, the demand for dicamba herbicides remains strong due to the need to control weed-related crop losses.

However, regulatory compliance will continue to be a significant hurdle for market expansion in Europe and other regions. However, the use of dicamba is subject to stringent regulations due to its potential impact on non-target plants and the environment. Therefore, manufacturers and farmers must adhere to these regulations to ensure sustainable and responsible use of dicamba herbicides. In conclusion, the European market is expected to grow due to the increasing demand for food production and the need to control weed-related crop losses.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing use of dicamba to control implications of weed is the key driver of the market. Weeds pose a significant challenge to agricultural productivity, as they compete with crops for essential resources and can lead to various issues. These unwanted plants hinder crop growth by taking up valuable space, light, water, and nutrients, ultimately reducing yields. Furthermore, weeds can obstruct drainage pipes and insulate the soil, increasing the risk of frost damage. Additionally, they can contribute to the spread of diseases and pests. To address this problem, farmers employ various strategies, including minimum tillage, mulching, crop rotation, and intercropping. Herbicides are another effective solution for weed control. However, the use of herbicides, such as Dicamba, comes with challenges, including the risk of herbicide drift under certain climatic conditions.

Moreover, the emergence of weed resistance to herbicides, including Dicamba, is a growing concern. As farmers continue to seek effective crop protection chemicals, the demand for herbicides, including Dicamba, is expected to remain strong. It is crucial for farmers to stay informed about the appropriate application methods and potential risks associated with herbicide use to ensure optimal crop growth and minimize environmental impact.

Market Trends

Incentives and rewards offered to farmers for using dicamba is the upcoming trend in the market. The market has gained significance due to the development of specialized applications for farmers following the ban on its use and the implementation of strict regulations regarding its potential adverse effects on crops. One notable company, Monsanto, offers products such as XtendiMax with VaporGrip, which is approved for use in US soybean farming. Monsanto ensures the safety of XtendiMax when applied correctly, with a cost of approximately USD11 per acre. Farmers can benefit from a cashback offer, reducing their cost to USD11.50 per acre the following year when using XtendiMax in conjunction with other authorized chemicals. Chronic kidney disease is a health concern associated with dicamba herbicide.

Exposure to this herbicide may lead to an increase in uremic toxins in kidney tissue, potentially contributing to kidney damage. Furthermore, dicamba has been identified as a carcinogenic and neurotoxic substance in mouse studies. In the context of the market, it is essential for companies to address the potential health risks associated with the use of their products.

Market Challenge

The imposition of ban on dicamba is a key challenge affecting the market growth. Dicamba herbicide is primarily recommended for use as a pre-plant application with a delayed planting schedule to minimize potential damage to crops.

This herbicide is effective in controlling a wide range of weed species compared to most other auxinic herbicides. In June 2020, the US Court of Appeals for the Ninth Circuit invalidated the US Environmental Protection Agency's (EPA) permit for the sale of dicamba herbicides produced by German agrochemicals group.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Aero Agro Chemical Industries Ltd.: The company offers dicamba herbicide such as 2 4D.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Albaugh LLC

- BASF SE

- Bayer AG

- Drexel Chemical Co.

- DuPont de Nemours Inc.

- Gharda Chemicals Ltd.

- Helena Agri Enterprises LLC

- Marubeni Corp.

- Nufarm Ltd.

- PBI Gordon Co. Inc.

- Shanghai Bosman Industrial Co. Ltd.

- Sharda Cropchem Ltd.

- Sinochem Group Co. Ltd.

- Syngenta Crop Protection AG

- Tagros Chemicals India Pvt. Ltd.

- The Andersons Inc.

- UPL Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for effective weed management solutions in crop protection. Climatic conditions play a crucial role in the efficacy of dicamba herbicides, particularly during the pre-emergence stage. However, the issue of herbicide drift remains a major concern, leading to damage to non-target crops and weeds developing resistance. Crop protection chemicals, including dicamba, are essential for farmers to ensure optimal crop yield. Glyphosate, a widely used herbicide, has carcinogenic characteristics, leading to research into alternative herbicides like dicamba.

Furthermore, the use of dicamba in herbicide-tolerant crops like Xtend soybeans and maize, which have been engineered with specific genes, has become increasingly popular. However, concerns regarding the potential side-effects, including respiratory problems, skin rashes, and dizziness, have arisen. Raw materials used in the production of dicamba, such as vaporization during the manufacturing process, can also pose risks. Precision farming and protected agriculture are driving the adoption of agrochemicals like dicamba. Organic food production and the need for sustainable farming practices have led to increased research into the side-effects and alternatives to traditional herbicides. Despite these concerns, dicamba remains an essential tool in weed management for farmers, particularly in winter wheat fields.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

148 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.83% |

|

Market Growth 2024-2028 |

USD 123.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.36 |

|

Regional analysis |

Europe, APAC, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 33% |

|

Key countries |

US, China, Belgium, UK, and Austria |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aero Agro Chemical Industries Ltd., Albaugh LLC, BASF SE, Bayer AG, Drexel Chemical Co., DuPont de Nemours Inc., Gharda Chemicals Ltd., Helena Agri Enterprises LLC, Marubeni Corp., Nufarm Ltd., PBI Gordon Co. Inc., Shanghai Bosman Industrial Co. Ltd., Sharda Cropchem Ltd., Sinochem Group Co. Ltd., Syngenta Crop Protection AG, Tagros Chemicals India Pvt. Ltd., The Andersons Inc., and UPL Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.