Docking Station Market Size 2024-2028

The docking station market size is forecast to increase by USD 790.2 million at a CAGR of 2.72% between 2023 and 2028.

What will be the Size of the Docking Station Market During the Forecast Period?

How is this Docking Station Industry segmented and which is the largest segment?

The docking station industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- PCs

- Smartphones and tablets

- End-user

- Enterprise

- Residential

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Product Insights

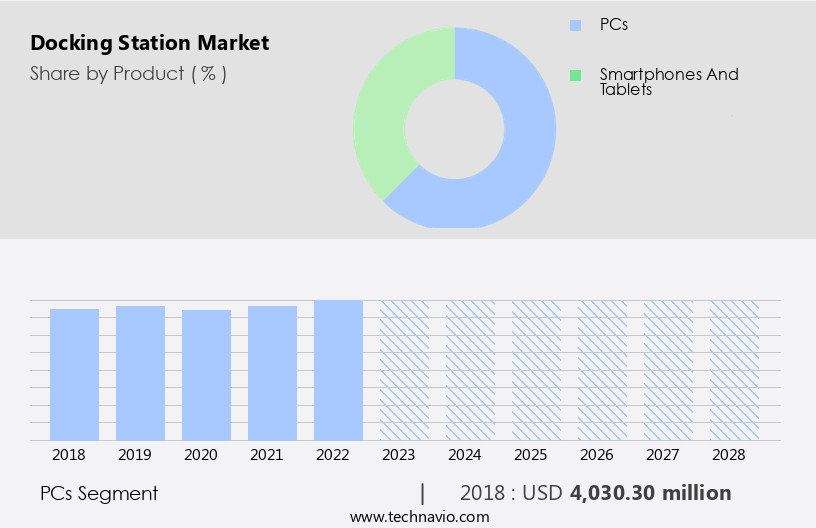

- The pcs segment is estimated to witness significant growth during the forecast period.

Docking stations are essential accessories for enhancing the functionality of PCs, particularly in enterprise settings and among creative professionals. The increasing adoption of hybrid work patterns and portable computing devices necessitates the use of versatile docking solutions for multiple monitors, USB ports, and high-speed connectivity. Market leaders like Targus and Smart-Things offer Thunderbolt 3 Docks, USB-C hubs, and HDMI ports to cater to the demands of gaming consoles, studios, and the Nintendo Switch. With the integration of Bluetooth technology and Wi-Fi, docking stations enable seamless connectivity for tablets, smartphones, and IoT devices. E-commerce platforms, corporate suppliers, and retailers offer a wide range of docking stations, ensuring compatibility with various operating systems and networking protocols.

Energy-efficient components, recycling materials, and sustainability are essential considerations for modern docking stations. In the gaming industry, popular titles such as Call of Duty, PlayerUnknown's Battlegrounds, Fortnite, and Grand Theft Auto require high-resolution graphics and power delivery circuits for optimal performance. In industrial settings, docking stations facilitate the integration of smart factories and connected ecosystems, addressing compatibility concerns and security vulnerabilities.

Get a glance at the Docking Station Industry report of share of various segments Request Free Sample

The PCs segment was valued at USD 4030.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 47% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

In North America, the market for docking stations is experiencing growth due to the expansion of infrastructure in small and medium enterprises (SMEs) and the increasing adoption of desktop computers and laptops. With approximately 30 million SMEs In the US alone, accounting for over 66% of private sector jobs in North America, the growth of these businesses is leading to an increase in demand for PCs. Additionally, large enterprises In the region are also expanding their infrastructure, further fueling the demand for desktop computers and laptops, consequently driving the need for docking stations. These devices offer versatility, enabling users to connect multiple monitors, tablets, and other peripherals for a consistent user experience.

Docking stations support various connectivity options, including USB-C, Thunderbolt 3, HDMI, DisplayPort, Wi-Fi, and Bluetooth, catering to the needs of creative professionals, studios, and gamers. Popular games like Call of Duty, PlayerUnknown's Battlegrounds, Fortnite, and Grand Theft Auto, as well as productivity applications, require high-resolution graphics and fast data transfer, making docking stations an essential accessory. Docking stations are available in both wired and wireless configurations, catering to different user preferences and requirements. The market is also witnessing advancements in energy-efficient components, recycling materials, and connectivity solutions, reflecting the digitization movement and the growing importance of remote work solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Docking Station Industry?

Increasing demand for docking stations for material handling is the key driver of the market.

What are the market trends shaping the Docking Station Industry?

Increasing focus on design enhancement of docking stations is the upcoming market trend.

What challenges does the Docking Station Industry face during its growth?

Slow growth of PC segment is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The docking station market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the docking station market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, docking station market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ACCO Brands Corp. - The market caters to the demand for sports-related merchandise, providing a comprehensive range of products to consumers. This market encompasses a diverse array of offerings, including equipment, apparel, and accessories, ensuring a complete solution for sports enthusiasts. With a focus on quality and innovation, the market serves to enhance the overall sports experience for participants and spectators alike.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACCO Brands Corp.

- Acer Inc.

- Apple Inc.

- Dell Technologies Inc.

- Eltako GmbH

- Fujitsu Ltd.

- Havis Inc.

- Hewlett Packard Enterprise Co.

- Huawei Technologies Co., Ltd.

- Lenovo Group Ltd.

- Microsoft Corp.

- Panasonic Holdings Corp.

- Plugable Technologies

- Samsung Electronics Co. Ltd.

- SilverStone Technology Co. Ltd.

- Sony Group Corp.

- StarTech.com Ltd.

- Targus

- Toshiba Corp.

- VisionTek Products Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of technological solutions designed to enhance the functionality of portable computing devices. These stations offer a centralized hub for connecting various peripherals, enabling users to expand their workstation capabilities and improve productivity. Docking stations cater to diverse industries and applications, from creative professionals in studios to industrial settings and smart factories. They are essential for users seeking to establish a consistent user experience across multiple devices and operating systems. The market is driven by the increasing demand for versatility and connectivity in a rapidly digitizing world. With the rise of remote work and home office setups, the need for reliable and efficient workstations has become more critical than ever.

Smart connectivity is a significant factor influencing the market. Bluetooth and Wi-Fi technologies enable seamless integration of various devices, while Thunderbolt and USB-C ports ensure high-speed data transfer and power delivery. HDMI and DisplayPort ports facilitate the connection of multiple monitors, enhancing productivity and improving the overall user experience. Ergonomic workstations and additional devices, such as keyboards, mice, and speakers, are often integrated into docking stations, providing a more comfortable and efficient work environment. Security and compatibility concerns are essential considerations In the market. As more devices become connected to the internet, the risk of vulnerabilities and data transfer issues increases.

Manufacturers focus on implementing robust security measures and ensuring compatibility with various operating systems and networking protocols. Sustainability is another crucial factor influencing the market. The use of recycling materials and energy-efficient components is becoming increasingly important, as businesses and consumers prioritize eco-friendly solutions. The market is diverse and dynamic, catering to various industries and applications. From gaming consoles and smartphones to laptops and tablets, docking stations offer a versatile and efficient solution for expanding the capabilities of portable computing devices. Insights by Product: The laptop segment is a significant contributor to the market, with the demand driven by the increasing popularity of portable computing devices.

Hybrid work patterns and the need for efficient workstations have led to the growth of this segment. The wired segment dominates the market due to its reliability and stable connections. However, the wireless segment is gaining traction as Bluetooth and Wi-Fi technologies continue to improve. Insights by Connectivity: Trustworthy connections and low latency are essential factors driving the demand for docking stations with high-speed data transmission capabilities. The offline segment also plays a role In the market, catering to industries where internet connectivity is not always available. In conclusion, the market is a dynamic and evolving landscape, driven by the increasing demand for versatility, connectivity, and productivity in a digitizing world.

Manufacturers focus on addressing security concerns, ensuring compatibility, and implementing sustainable solutions to meet the needs of diverse industries and applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.72% |

|

Market growth 2024-2028 |

USD 790.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.62 |

|

Key countries |

US, UK, China, Canada, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Docking Station Market Research and Growth Report?

- CAGR of the Docking Station industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the docking station market growth of industry companies

We can help! Our analysts can customize this docking station market research report to meet your requirements.