Drone Payload Market Size 2024-2028

The drone payload market size is forecast to increase by USD 12.89 billion at a CAGR of 16.83% between 2023 and 2028. The market is experiencing significant growth due to the increasing adoption of drones in various industries, including air combat, mining, public sector, private sector, and civil sector. Technological advancements, such as improved navigation systems and satellite communication, are enabling drones to carry heavier payloads and fly longer distances. Aerial refueling is also gaining traction as a solution to extend the operational time of drones. However, challenges persist in ensuring drone safety and security, particularly in areas of warfare techniques. The mining industry is leveraging drones for 3D mapping and surveying, while the public sector uses them for disaster management and search and rescue operations. The private sector is exploring drones for delivery services and agricultural applications. Overall, the market is poised for continued expansion as these technologies become more integrated into everyday operations.

What will be the Size of the Market During the Forecast Period?

The market encompasses the technologies and components that augment the functionality of unmanned aircraft systems (UAS) or unmanned aerial vehicles (UAV) for diverse commercial applications. These payloads are integral to the overall performance and effectiveness of UAS, enabling them to capture high-resolution images, conduct surveillance, and perform covert operations, among other tasks. Commercial businesses increasingly rely on UAS for various purposes, such as photography, inspection, and delivery services. High-resolution cameras are a common payload for UAS used in photography applications, while sensors are essential for tasks like inspection and surveillance.

Moreover, in the realm of security, UAS equipped with sensors play a crucial role in detecting potential threats, including terrorism and other security concerns. UAS can also be used for covert operations, particularly in electronic warfare and missions. These applications require advanced payloads, such as weapon systems and embedded programs, to ensure mission success. However, it is essential to note that the use of UAS for such purposes raises ethical and legal concerns, which are subject to ongoing debate and regulation. Moreover, UAS are increasingly being used for cargo delivery, particularly during night operations. Payloads for these applications include specialized containers and release mechanisms to ensure safe and efficient delivery of goods.

Similarly, the market is a dynamic and evolving sector, with ongoing advancements in sensor technology and other components driving innovation. As UAS continue to gain popularity and acceptance in various industries, the demand for advanced payloads is expected to grow. In conclusion, the market plays a vital role in enhancing the capabilities of UAS for commercial applications. From photography and inspection to security and cargo delivery, payloads are integral to the overall performance and effectiveness of UAS. With ongoing advancements in technology, the market is poised for continued growth and innovation.

Market Segmentation

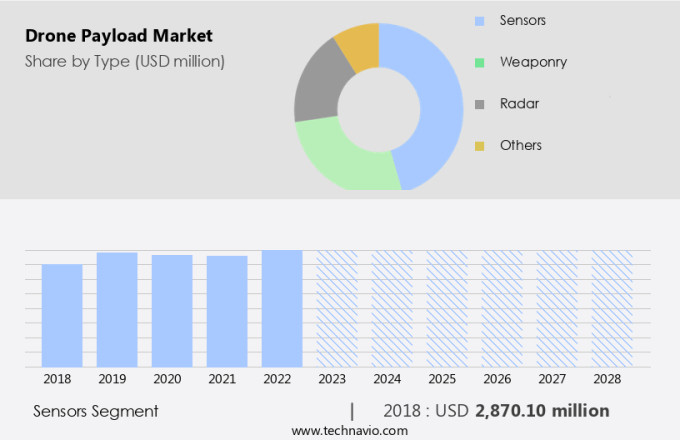

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Sensors

- Weaponry

- Radar

- Others

- End-user

- Defense

- Commercial

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- Middle East and Africa

- South America

- North America

By Type Insights

The sensors segment is estimated to witness significant growth during the forecast period. A sensor is an essential component in drones used for various applications, including night operations and agricultural surveillance. These sensors convert light into electrical signals, which are then processed to provide valuable data. Infrared cameras are commonly used sensors in drones for night operations and weather monitoring. They detect infrared radiation emitted by objects, enabling the identification of temperature differences and the detection of pest infestations or crop health issues.

Further, crop surveillance is another significant application of drone sensors, with sensors used for crop growth and health monitoring. Cattle monitoring is also gaining popularity, with sensors used to track their movement and health status. Drones equipped with these sensors offer accurate and timely data, enabling farmers to make informed decisions to optimize crop yield and reduce losses.

Get a glance at the market share of various segments Request Free Sample

The sensors segment was valued at USD 2.87 billion in 2018 and showed a gradual increase during the forecast period.

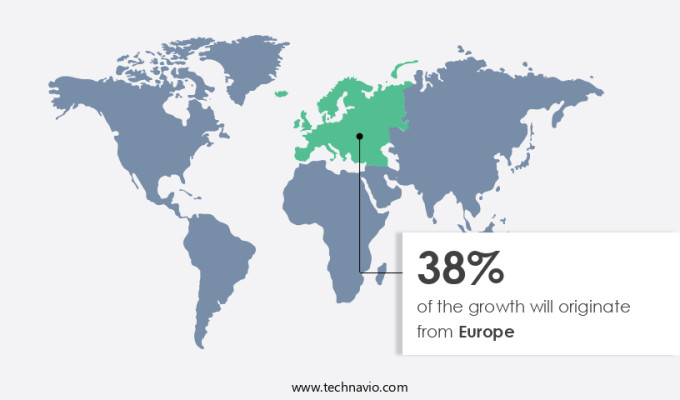

Regional Insights

Europe is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market experienced significant growth in 2023, with the United States leading the charge. The US has shown a strong affinity for adopting advanced technologies, making it an ideal market for drone technology. Commercial applications of drones, such as agriculture, oil and gas pipeline surveys, construction, and logistics, are expected to drive demand for drones across the region during the forecast period. These companies provide advanced drone hardware and software solutions to various industries. In the agriculture sector, drones aid in optimizing the supervision, compliance, and enforcement of new cultivation practices. The use of drones in LiDAR applications, aerial imaging, security and surveillance, cargo management, traffic control, GPS, and mapping services is also increasing. Defense expenditure is another significant contributor to the market's growth in North America.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rising drone applications is the key driver of the market. Drones, once primarily utilized by the defense and military sector, have seen significant expansion in their applications due to technological advancements. Now, industries such as agriculture, construction, mapping, and logistics are integrating drones into their operations. The efficiency of drone delivery is a notable advantage, as they can deliver goods faster than traditional road transport. Traffic congestion is a growing issue, limiting the agility of vehicles for timely delivery. Drone technology, with its capabilities in Geographic Information Systems (GIS) and sensor technology, including shortwave infrared technology, offers a solution to this challenge.

Commercial applications of drones, such as cargo delivery and commercial electronic warfare, are expected to increase in the coming years. This trend is set to continue, making drones an essential tool for various industries.

Market Trends

Technological advancements is the upcoming trend in the market. Drone technology is experiencing significant advancements as manufacturing companies in the United States and beyond continue to innovate and expand the capabilities of these unmanned aerial vehicles. The integration of cutting-edge solutions, sensors, and technologies is leading to a transformation in the size, functionality, and usage of drones. Moreover, companies are incorporating advanced technologies such as artificial intelligence (AI), deep learning (DL), and machine learning (ML) into their offerings to create next-generation drones. These technological advancements enable end-users to gather vast amounts of real-time data through aerial AI, analyze the data for informed decision-making, and optimize asset maintenance. In the Oil and Gas industry, drones equipped with advanced sensors and AI capabilities are revolutionizing operations by providing real-time data on infrastructure inspections, pipeline monitoring, and asset management.

Market Challenge

Issues related to drone safety and security is a key challenge affecting the market growth. Drone payloads utilize advanced technologies for efficient aerial refueling, navigation, and satellite communication during air combat and various warfare techniques. In the public, private, and civil sectors, these technologies play a crucial role in ensuring seamless communication between the UAV and its controller. However, the security of this communication is paramount, as any external interference or unencrypted data transmission can lead to disastrous consequences. For instance, UAVs operating on unsecured Wi-Fi networks are susceptible to data manipulation, which can alter flight parameters such as speed and altitude. Moreover, both the sender and receiver must use the same specific communication channel to maintain effective communication.

In the mining industry, drones with payloads for 3D mapping and surveying provide valuable insights, while in the civil sector, they aid in infrastructure inspections and disaster response.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Advanced Technology Labs AG - The company offers technological solutions such as cameras, sensors, cases, and others for drones, to its associate partners.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aerialtronics DV B.V.

- AeroVironment Inc.

- Autel Robotics Co. Ltd.

- BAE Systems Plc

- Draganfly Inc.

- Elbit Systems Ltd.

- Flyability SA

- Headwall Photonics Inc.

- Imsar LLC

- Israel Aerospace Industries Ltd.

- Lockheed Martin Corp.

- Northrop Grumman Corp.

- Parrot Drones SAS

- Sphere Group

- SZ DJI Technology Co. Ltd.

- Teledyne Technologies Inc.

- Thales Group

- The Boeing Co.

- Yuneec International Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Unmanned aircraft systems (UAS), also known as drones, have gained significant traction in various industries due to their versatility and capabilities. The market caters to the demand for advanced technologies integrated into UAS for commercial businesses. High-resolution cameras and sensors are commonly used in photography, surveillance, and reconnaissance applications. Security concerns, including terrorism and covert operations, drive the adoption of drones for night operations. In agriculture, drones are utilized for crop surveillance, health monitoring, and pest infestation detection using sensors like infrared cameras and LIDAR applications. Weather monitoring and dairy farming are other agricultural applications.

Further, drone sensors play a crucial role in search and rescue missions, signal intelligence, electronics intelligence, and communication intelligence. High resolution cameras, embedded programs, and advanced unmanned aircraft vehicle system, including remotely piloted aircraft system and remotely piloted aerial vehicles (RPAVs), are critical for strike missions and combat search and rescue operations, enhancing the pilot situational awareness.

Moreover, the maritime patrol radar, laser sensors, CBRN sensors, optronics, and geographic information systems (GIS) are essential components of the market for defense applications. Mapping and surveying, monitoring, intelligence, and reconnaissance are integral parts of defense expenditure. The commercial sector leverages drones for delivery goods, traffic control, and cargo management using GPS and smartphone applications. Mining, oil and gas, and 3D mapping are other significant industries that benefit from drone technology. Navigation, satellite communication, and warfare techniques are essential for air combat and aerial refueling. The public, private, and civil sectors all contribute to the growth of the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.83% |

|

Market Growth 2024-2028 |

USD 12.89 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

14.01 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

Europe at 38% |

|

Key countries |

US, China, Germany, France, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Advanced Technology Labs AG, Aerialtronics DV B.V., AeroVironment Inc., Autel Robotics Co. Ltd., BAE Systems Plc, Draganfly Inc., Elbit Systems Ltd., Flyability SA, Headwall Photonics Inc., Imsar LLC, Israel Aerospace Industries Ltd., Lockheed Martin Corp., Northrop Grumman Corp., Parrot Drones SAS, Sphere Group, SZ DJI Technology Co. Ltd., Teledyne Technologies Inc., Thales Group, The Boeing Co., and Yuneec International Co. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch