Drugs Of Abuse Testing Market Size 2024-2028

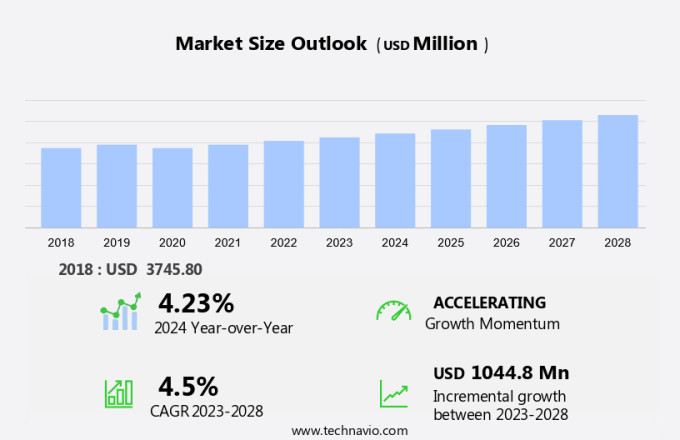

The drugs of abuse testing market size is forecast to increase by USD 1.04 billion at a CAGR of 4.5% between 2023 and 2028. The market is experiencing significant growth, driven by increased strategic developments and the growing adoption of advanced information technology and information management solutions. These advancements in instruments enable efficient and accurate testing, reducing turnaround time and enhancing overall productivity. For instance, mass spectrometer and chromatography systems are extensively employed for the qualitative and quantitative analysis of cannabinoids in cannabis strains. However, high costs associated with the implementation and maintenance of these technologies remain a challenge for market expansion. Additionally, stringent regulations and the need for continuous innovation to keep up with emerging drugs of abuse are other key factors shaping the market landscape. Overall, the DoA testing market is expected to continue its growth trajectory, fueled by the need for workplace safety and substance abuse prevention.

What will be the Size of the Market During the Forecast Period?

The market is driven by the increasing prevalence of prescription drug abuse, psychostimulants, fentanyl, vaping, and illicit drugs, as well as alcohol. Substance use disorders continue to be a significant public health concern in the US. Forensic laboratories and hospitals are major end-users, diagnostics with epidemiologic investigations and addiction treatment centers also contribute. Vulnerable populations such as the elderly, those with chronic pain, LIMS software, and individuals with opioid medications are key focus areas. Drugs like Fentanyl, psychostimulants, and cannabis/marijuana are common targets for testing.

Moreover, fentanyl, a powerful opioid, has emerged as a significant threat in the market. Its illegally manufactured forms are often mixed with other substances, making it difficult to detect and leading to a high number of overdose deaths. The elderly population is another vulnerable group in the market. They are at a higher risk of substance use disorders due to chronic pain and the misuse of prescription medications. Drug use statistics indicate that psychostimulants, such as cocaine and amphetamines, continue to be popular among certain demographics. Vaping, a newer form of drug delivery, has also gained popularity, particularly among the younger population.

Furthermore, real-time surveillance and epidemiologic investigations play a crucial role in identifying drug-related activity and addressing vulnerabilities in the market. Public awareness campaigns and drug testing mandates are essential tools in preventing substance use disorders and promoting addiction treatment. Cannabis, or marijuana, is another substance of interest in the market. While it is legal for medicinal and recreational use in some states, it is still illegal in others, making testing a necessity for employers and law enforcement agencies. The market is expected to grow due to the increasing need for accurate and reliable testing services. This growth is driven by the rising number of overdose deaths, addiction treatment initiatives, and public awareness campaigns.

In conclusion, the market is a critical component in addressing substance use disorders and promoting public health. It encompasses various sectors, including forensic laboratories and hospitals, and offers testing services for a range of substances, including prescription drugs, illicit drugs, and alcohol. The market is driven by various factors, including the increasing prevalence of substance use disorders, the emergence of new drugs and drug delivery methods, and the need for accurate and reliable testing services.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Instruments

- Consumables

- Geography

- North America

- Canada

- US

- Europe

- Denmark

- Asia

- China

- India

- Rest of World (ROW)

- North America

By Product Insights

The instruments segment is estimated to witness significant growth during the forecast period. The market encompasses various systems, analyzers, and devices for detecting and quantifying different drug substances. These tools include breath analyzers, chromatography analyzers, immunoassay analyzers, urine testing devices, and oral fluid testing devices. For example, cannabis testing relies on mass spectrometers and chromatography systems to identify and measure the presence and quantity of cannabinoid compounds. Biotechnology plays a significant role in the market, as the principles of detection and quantification are similar to those used in food testing and other allied fields. Real-time surveillance and epidemiologic investigations are crucial applications for these tests, particularly in the context of opioid dependence and chronic pain management.

Moreover, opioid medications and recreational marijuana are common targets for testing, with cannabinoids being a primary focus for cannabis testing. Forensic drug chemistry also relies on these technologies to identify and quantify drug substances in various contexts. Immunoassays are a popular choice for initial screening due to their speed and cost-effectiveness, while more advanced techniques such as mass spectrometry and chromatography are used for confirmatory testing. The elderly population is an emerging demographic in the market, as they are more likely to be prescribed opioid medications for chronic pain management. Overall, the market is essential for ensuring public safety and effective healthcare management.

Get a glance at the market share of various segments Request Free Sample

The instruments segment was valued at USD 2.05 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

Europe is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American region dominated The market in 2023, with the United States being the primary contributor. The prevalence of drug abuse in the country has been a significant driver of market growth. According to the Centers for Disease Control and Prevention (CDC), drug overdose deaths in the US reached over 96,779 in 2021, a result of illicit drug use or prescription drug misuse. Forensic technologies and hospitals play a crucial role in identifying substance use disorders, including prescription drug abuse and illicit drug use. This figure represented a 29.6% increase from the previous year. In 2022, drug-related deaths in the US reached nearly 108,000, highlighting the urgent need for effective drug-testing solutions. Public awareness campaigns and addiction treatment initiatives have led to an increased demand for drug testing services in North America.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increased strategic development is the key driver of the market. companies in the international the market are pursuing strategic initiatives, including product advancements and innovations, to expand their offerings and cater to the demands of various industries, such as research laboratories and academic institutions. The Recovery Platform is designed to assist primary care physicians in managing the recovery of patients dealing with opioid addiction in a compliant and efficient manner. This collaboration aims to address the significant economic and social burdens caused by narcotic drugs like opiates, amphetamines, methadone, and barbiturates, through rapid testing solutions such as OralTox and multidrug detection methods.

Market Trends

Growing adoption of information management solutions is the upcoming trend in the market. In the United States, drug of abuse testing laboratories play a crucial role in identifying and quantifying various substances, including illicit drugs and prescription medications. These laboratories conduct extensive testing on substances such as opioids, psychostimulants, and vaping products to ensure regulatory compliance and aid in the diagnosis and treatment of substance use disorders. Forensic laboratories, hospitals, and healthcare facilities are significant consumers of drugs of abuse testing services. The testing process involves the application of advanced analytical techniques, including chromatography, mass spectrometry, and immunoassay, to detect and measure the presence and concentration of targeted substances. Maintaining accurate records of testing procedures, techniques, and results is essential for regulatory compliance.

Authorities such as the US Food and Drug Administration (FDA) require detailed documentation for periodic audit checks. Substance abuse mapping and vulnerability assessments help identify trends and patterns in drug abuse, particularly prescription drug abuse and the emergence of new drugs like fentanyl.

Market Challenge

High costs are a key challenge affecting market growth. In the market, stringent regulations necessitate the use of reliable and accurate testing methods. However, these solutions come with a hefty price tag, posing a challenge for medium- and small-scale testing laboratories. Budget constraints often force these labs to allocate most of their resources toward research and development, particularly in the case of cannabis strains, which require the extraction of various cannabinoids. Affordability is also a significant concern in developing regions, where numerous small- and medium-scale laboratories operate under tight budgets. To mitigate costs, these institutions frequently collaborate with other organizations to conduct proteomic research. In summary, while advanced testing solutions are essential for ensuring regulatory compliance, affordability remains a major hurdle for many players in the market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Abbott Laboratories: The company offers iScreen Drugs of Abuse Test Card that rapidly screens for a broad range of illicit and prescription drugs.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bio Rad Laboratories Inc.

- CareHealth America Corp.

- Clinical Reference Laboratory Inc.

- Cordant Health Solutions

- Danaher Corp.

- Dragerwerk AG and Co. KGaA

- F. Hoffmann La Roche Ltd.

- Laboratory Corp. of America Holdings

- Merck KGaA

- Omega Laboratories Inc.

- Precision Diagnostics

- Psychemedics Corp.

- Quest Diagnostics Inc.

- QuidelOrtho Corp.

- Randox Laboratories Ltd.

- Shimadzu Corp.

- Siemens Healthineers AG

- SureHire Inc.

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing prevalence of substance use disorders, prescription drug abuse, and mental health disorders. Fentanyl, psychostimulants, and vaping are among the major drugs of concern in the market. The elderly population and individuals suffering from chronic pain are at higher risk for opioid dependence and misuse of opioid medications. Recreational marijuana use, cannabinoids, and alcohol also contribute to the market growth. Substance abuse disorders, including those related to class A drugs, are a major public health concern. Real-time surveillance, epidemiologic investigations, and public awareness campaigns are essential to mitigate the economic and social burden of drug-related activity.

However, the hospitals and forensic laboratories are key end-users of drug testing services, which include qualitative tests for narcotic drugs, opiates, amphetamines, barbiturates, and multidrug panels. Stringent regulations and the availability of on-the-spot testing kits, such as dip cards, strips, and cassettes, are driving the development of drug testing technologies. Immunoassays and forensic drug chemistry play a crucial role in detecting and identifying illicit drugs and prescription drugs. Rapid testing methods, such as oral fluid testing, are gaining popularity due to their convenience and accuracy. The market is expected to continue growing due to the increasing number of drug testing mandates and the need for addiction treatment.

Moreover, the market growth is influenced by factors like competitive intelligence, prediction, and the increasing prevalence of Mental health disorders and Substance abuse disorders, particularly among the Elderly and those suffering from Chronic pain. Opioid dependence and Class A drugs are significant concerns, leading to the development of On-the-spot testing kits for quick identification. Immunoassays and Forensic drug chemistry play crucial roles in Drugs of Abuse testing. Technological advancements have led to the testing of various substances, including Cannabinoids, Alcohol, and other Illicit drugs. The market is further driven by Addiction treatment, Public awareness campaigns, Drug testing mandates, and the increasing prevalence of Drug-related activity.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market Growth 2024-2028 |

USD 1.04 Billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

Europe at 33% |

|

Key countries |

US, Denmark, China, Canada, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Abbott Laboratories, Bio Rad Laboratories Inc., CareHealth America Corp., Clinical Reference Laboratory Inc., Cordant Health Solutions, Danaher Corp., Dragerwerk AG and Co. KGaA, F. Hoffmann La Roche Ltd., Laboratory Corp. of America Holdings, Merck KGaA, Omega Laboratories Inc., Precision Diagnostics, Psychemedics Corp., Quest Diagnostics Inc., QuidelOrtho Corp., Randox Laboratories Ltd., Shimadzu Corp., Siemens Healthineers AG, SureHire Inc., and Thermo Fisher Scientific Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch