Edge AI Hardware Market Size 2024-2028

The edge ai hardware market size is forecast to increase by USD 7.15 billion, at a CAGR of 17.7% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing adoption of IoT applications across various end-user industries. The proliferation of smart homes and cities is fueling this trend, as edge AI hardware enables real-time processing and decision-making at the source, reducing latency and bandwidth requirements. However, the market faces a notable challenge: the lack of skilled AI professionals. As the demand for edge AI hardware continues to rise, companies must invest in training and recruiting talent to meet this need.

- Additionally, collaboration between hardware manufacturers and software developers will be essential to address the complexities of integrating edge AI hardware into existing systems. Companies seeking to capitalize on market opportunities should focus on developing user-friendly solutions, while those navigating challenges should prioritize talent acquisition and strategic partnerships.

What will be the Size of the Edge AI Hardware Market during the forecast period?

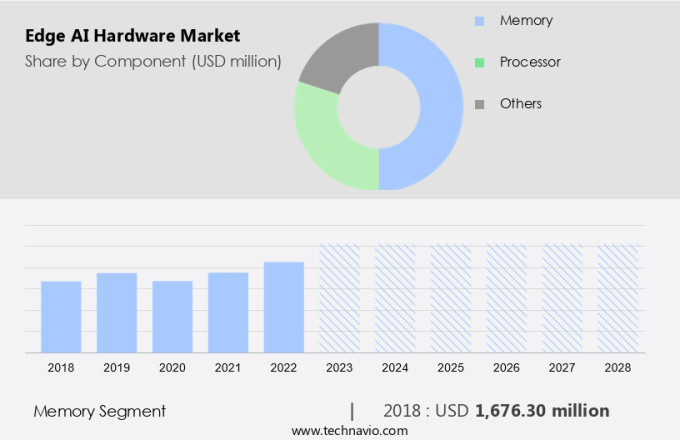

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the increasing demand for real-time data processing and analysis. Neural networks and deep learning models are being integrated into various sectors, including IoT devices, smart home, industrial automation, healthcare applications, and more. On-device inference enables performance optimization and cost savings by reducing the need for constant cloud connectivity. Edge AI processors are being developed with system-on-a-chip (SoC) architectures, sensor fusion, and low-power computing to address power consumption concerns. Model evaluation and deployment are critical aspects of Edge AI implementation. Hardware acceleration and model recall are essential for ensuring efficient and accurate processing.

Thermal management is also a significant consideration for maintaining optimal performance and energy efficiency. Edge AI is finding applications in smart cities, computer vision, autonomous vehicles, and security systems. Data security and privacy concerns are being addressed through secure data preprocessing and cloud integration. Open source platforms and development tools are facilitating the growth of Edge AI infrastructure. Operating systems are being optimized for Edge AI applications, and natural language processing and speech recognition are becoming increasingly important. Anomaly detection and real-time analytics are key benefits of Edge AI, enabling proactive problem-solving and improving overall system performance.

The Edge AI market is continuously unfolding, with new applications and innovations emerging in various sectors.

How is this Edge AI Hardware Industry segmented?

The edge ai hardware industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- Memory

- Processor

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Component Insights

The memory segment is estimated to witness significant growth during the forecast period.

The market is characterized by the integration of advanced technologies such as on-device inference, performance optimization, model evaluation, and cost optimization. These features enable the deployment of AI algorithms on various edge devices, including IoT gadgets, smart home appliances, and industrial equipment. Edge AI processors play a crucial role in this landscape, offering capabilities like image classification, real-time analytics, anomaly detection, and object recognition. Data security and privacy concerns are addressed through robust encryption and access control mechanisms. Smart manufacturing, healthcare applications, and smart cities are significant sectors driving the market's growth. Deep learning models, neural networks, and system-on-a-chip (SoC) solutions are essential components of edge AI infrastructure.

Model training, deployment, and hardware acceleration are critical aspects of edge AI development. Network connectivity and cloud integration facilitate seamless data collection, preprocessing, and post-processing. Natural language processing, speech recognition, and open-source platforms are other essential elements of edge AI ecosystems. Energy efficiency, thermal management, and low-power computing are essential considerations for edge AI hardware design. The market's evolution is shaped by the increasing demand for AI-enabled applications in various industries, such as industrial automation, smart home, and autonomous vehicles.

The Memory segment was valued at USD 1.68 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 45% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth due to the increasing adoption of IoT devices and the need for faster processing at the edge. In North America, this trend is particularly pronounced, with the region holding the largest revenue share. The benefits of edge AI devices, such as performance optimization, cost savings, and real-time analytics, are driving demand. In the manufacturing sector, smart factories are integrating edge AI processors for industrial automation and anomaly detection. In healthcare, edge AI is being used for image classification and object recognition in wearable technology and medical devices. Edge AI is also gaining traction in smart homes and cities for security systems and computer vision applications.

Deep learning models are being deployed at the edge for model training and deployment, requiring low-power computing and hardware acceleration. Data security and privacy concerns are being addressed through advanced encryption and secure cloud integration. Open source platforms and development tools are facilitating the creation and deployment of neural networks and natural language processing models. The market is expected to continue growing as edge AI becomes increasingly integrated into various industries, from smart manufacturing to healthcare and autonomous vehicles. Energy efficiency and thermal management are also critical considerations for edge AI hardware.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Edge AI Hardware Industry?

- The increasing adoption of Internet of Things (IoT) technology across various end-user industries is the primary market driver.

- The market is experiencing significant growth due to the increasing adoption of Internet of Things (IoT) technology across various industries. IoT is revolutionizing business operations by enabling real-time analytics, data collection, and processing at the edge. This is particularly important for sectors such as manufacturing, automotive, and healthcare, where the need for quick decision-making and efficient processes is crucial. Edge AI hardware enables advanced functionalities such as natural language processing, speech recognition, and security systems, which are essential for businesses in today's digital landscape. Cloud integration is another critical factor driving market growth, as it allows for seamless data transfer and storage, as well as access to powerful computing resources.

- Open source platforms and development tools are also playing a significant role in the market's growth, as they provide cost-effective solutions for businesses looking to implement edge AI technology. Operating systems and model precision are essential considerations for businesses when selecting edge AI hardware, as they impact the hardware's ability to process data accurately and efficiently. Security is a major concern for businesses implementing edge AI hardware, and companies are focusing on providing robust solutions to address this issue. Edge computing infrastructure is becoming increasingly important as businesses seek to reduce latency and improve response times.

- In conclusion, the market is poised for growth due to the increasing adoption of IoT technology, the need for real-time analytics and processing, and the demand for advanced functionalities such as natural language processing and speech recognition.

What are the market trends shaping the Edge AI Hardware Industry?

- The demand for smart homes and smart cities is on the rise, representing a significant market trend. This trend reflects the increasing desire for advanced technology solutions that enhance convenience, efficiency, and connectivity in both residential and urban environments.

- The market is experiencing significant growth due to the increasing adoption of neural networks for model recall and deployment in various applications such as computer vision for smart cities and autonomous vehicles. Hardware acceleration is a crucial factor driving this market, enabling faster model execution and improved model accuracy with energy efficiency. Thermal management is another essential aspect, ensuring optimal performance and longevity of the hardware. Advancements in AI technologies, including machine learning and deep learning, are fueling the demand for edge AI hardware. The market is expected to continue its growth trajectory, offering numerous opportunities for businesses and investors.

- Computer vision applications, such as facial recognition and object detection, are leading the way in the adoption of edge AI hardware. Autonomous vehicles are another promising area, requiring real-time processing and decision-making capabilities. In conclusion, the market is an evolving landscape, offering significant potential for businesses and investors seeking to capitalize on the growing demand for intelligent, energy-efficient, and connected devices.

What challenges does the Edge AI Hardware Industry face during its growth?

- The scarcity of proficient AI specialists poses a significant challenge to the expansion and progression of the industry.

- The market is experiencing significant growth as more businesses invest in on-device inference to optimize performance and reduce costs. According to recent research, over 90% of top companies are actively investing in AI, yet a shortage of skilled talent remains a major challenge. This talent gap hinders the implementation of AI strategies, with 91% of businesses acknowledging this as a significant barrier. Performance optimization through edge AI processors is crucial for IoT devices and various industries, including smart home, smart manufacturing, and image classification.

- Data security and privacy concerns are also vital considerations in the market. To address these challenges, organizations are focusing on model evaluation, cost optimization, and data preprocessing to ensure effective implementation of AI initiatives. Despite these hurdles, the market is expected to continue its growth trajectory, driven by the increasing demand for AI capabilities in various industries.

Exclusive Customer Landscape

The edge ai hardware market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the edge ai hardware market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, edge ai hardware market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advanced Micro Devices Inc. - The company showcases AMD's advanced processing solutions, including EPYC and EPYC Embedded processors, as well as Ryzen 3rd Generation models. These offerings boast high core counts and diverse connectivity features, catering to various business requirements. AMD's processors are renowned for their superior performance and versatility, making them an excellent choice for organizations seeking efficient and reliable technology solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Micro Devices Inc.

- Alphabet Inc.

- Apple Inc.

- Applied Brain Research Inc

- Baidu Inc.

- China Cambrian Technology Co. Ltd.

- Graphcore Ltd.

- Horizon Robotics Inc.

- Huawei Technologies Co. Ltd.

- Imagination Technologies Ltd.

- Intel Corp.

- International Business Machines Corp.

- MediaTek Inc.

- Micron Technology Inc.

- Microsoft Corp

- NVIDIA Corp.

- Qualcomm Inc.

- Samsung Electronics Co. Ltd.

- Tenstorrent Inc.

- Texas Instruments Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Edge AI Hardware Market

- In February 2023, Intel introduced its new Neural Compute Stick 2, an edge AI inference device designed for developers and businesses to deploy AI models at the edge. This compact, low-power device is expected to accelerate the adoption of AI applications in various industries (Intel press release, 2023).

- In May 2024, NVIDIA and Microsoft announced a strategic partnership to bring AI capabilities to Microsoft's Azure IoT Edge platform. This collaboration aims to simplify the deployment and management of AI workloads on edge devices, making it easier for businesses to implement AI solutions (NVIDIA press release, 2024).

- In October 2024, Qualcomm completed the acquisition of Cirrus Logic's wireless connectivity and computing business for approximately USD4.5 billion. This acquisition strengthens Qualcomm's position in the market by expanding its portfolio of wireless connectivity solutions and adding expertise in audio and industrial processing (Qualcomm press release, 2024).

- In January 2025, Google unveiled its new Coral Edge TPU (Tensor Processing Unit) development board, designed to enable developers to build and deploy ML/AI models at the edge. The board is based on Google's custom-built TPUs, which offer high-performance and low-power AI inference capabilities (Google blog post, 2025).

Research Analyst Overview

- The market is experiencing significant growth, driven by the increasing demand for real-time data processing and decision making in various industries. Smart Grid applications, for instance, require Edge AI to optimize energy distribution and consumption. Edge AI libraries, such as TensorFlow Lite and PyTorch Mobile, facilitate the development of custom models for specific use cases. Edge AI standards and frameworks, including FPGA-based acceleration and GPU acceleration, ensure interoperability and efficiency. Security protocols are also crucial in Edge AI systems to mitigate potential biases and ethical considerations. Custom ASIC design and Edge AI chipsets are essential for power-efficient and high-performance computing.

- Remote monitoring and diagnostics in precision agriculture and smart retail enable better decision making and productivity. Cloud-Edge collaboration and data aggregation are key trends, allowing for seamless integration of Edge AI with the cloud for advanced analytics and insights. Edge AI ecosystems, including AI-as-a-Service (Aiaas), foster innovation and collaboration among stakeholders. Remote sensor integration and real-time decision making are essential for vertical applications, such as healthcare and manufacturing. Data acquisition and Edge AI regulations are crucial for ensuring data privacy and compliance. In the realm of Edge AI, the future holds exciting possibilities for remote monitoring, real-time decision making, and the integration of various technologies to create smarter, more efficient systems.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Edge AI Hardware Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 17.7% |

|

Market growth 2024-2028 |

USD 7145 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

14.9 |

|

Key countries |

US, China, Germany, UK, Japan, Canada, India, France, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Edge AI Hardware Market Research and Growth Report?

- CAGR of the Edge AI Hardware industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the edge ai hardware market growth of industry companies

We can help! Our analysts can customize this edge ai hardware market research report to meet your requirements.