Education Personal Computer (PC) And Tablet Market Size 2025-2029

The education personal computer (pc) and tablet market size is forecast to increase by USD 37.4 billion at a CAGR of 13.5% between 2024 and 2029.

- The Education PC and Tablet market is experiencing significant growth due to the robust demand for online education and the shift towards cloud-based solutions. With the COVID-19 pandemic accelerating the adoption of digital learning, educational institutions are increasingly investing in technology to support remote learning. This trend is driving the demand for PCs and tablets, which are essential tools for delivering online education. However, budget constraint issues persist as a major challenge for educational institutes. Despite the benefits of digital learning, many institutions face financial constraints that limit their ability to invest in the necessary technology.

- This obstacle may hinder the growth of the Education PC and Tablet market, particularly in developing regions and lower-income schools. To capitalize on market opportunities and navigate these challenges effectively, companies should explore innovative financing models and partnerships with educational institutions. Additionally, offering affordable pricing structures and financing options may help make technology more accessible to budget-constrained schools. By addressing these challenges and continuing to innovate, companies can help drive the growth of the Education PC and Tablet market and support the ongoing shift towards digital learning.

What will be the Size of the Education Personal Computer (PC) And Tablet Market during the forecast period?

- The education technology market, encompassing personal computers (PCs) and tablets, continues to evolve with dynamic market activities. Machine learning algorithms enhance e-learning platforms, student information systems, and educational software, providing personalized learning experiences. Screen size and processor performance cater to various sectors, from K-12 education to higher education and professional development. Storage space and display resolution ensure seamless delivery of digital textbooks and multimedia content. Student devices, equipped with adaptive learning capabilities, boost student success and engagement. Interactive whiteboards and STEM education tools facilitate immersive, hands-on learning experiences. Security features safeguard sensitive student data. Classroom management software and operating systems streamline faculty adoption, while device management solutions address budget constraints.

- Virtual reality and augmented reality technologies offer innovative educational applications. E-learning platforms and learning management systems enable online courses, while assessment tools and data analytics provide valuable insights for curriculum development. Technical support and educational research ensure continuous improvement and innovation. Battery life, software compatibility, and hardware specifications are crucial considerations for mobile learning. Professional development opportunities and teacher training programs foster effective implementation of education technology. The ongoing unfolding of market activities in this sector reflects the evolving nature of technology's role in education, with applications ranging from coding education to digital literacy. Education technology continues to transform the way we learn and teach, shaping the future of education.

How is this Education Personal Computer (PC) And Tablet Industry segmented?

The education personal computer (pc) and tablet industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- K-12

- Higher education

- Product

- Laptop

- Tablet

- Desktop

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

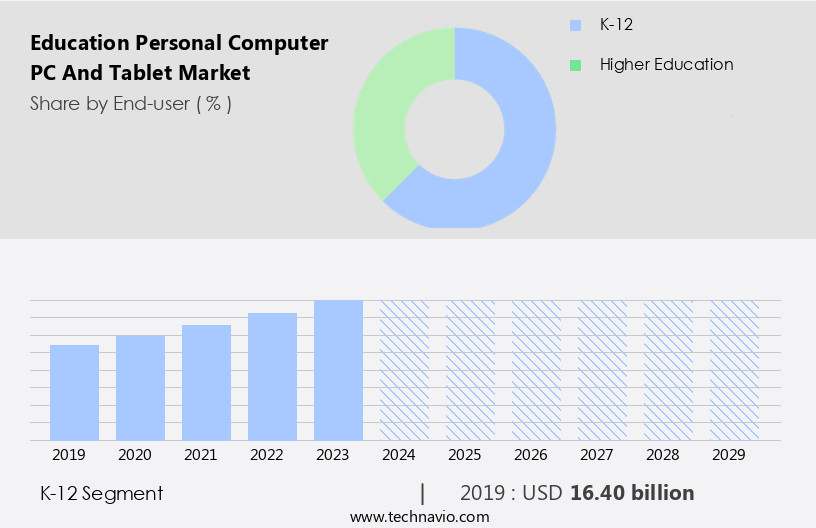

The k-12 segment is estimated to witness significant growth during the forecast period.

The K-12 education market has witnessed significant growth in recent years, fueled by the pursuit of quality education, government mandates, population growth, and increasing parental expectations. Technology integration is a key driver, with e-learning platforms, student information systems, and digital textbooks becoming essential components of modern classrooms. Ram capacity, processor performance, and storage space are crucial hardware specifications for student devices, ensuring seamless access to educational software and applications. Virtual reality, machine learning, and artificial intelligence are transforming computer science education, providing immersive and interactive learning experiences. Security features are paramount to protect student data and ensure privacy.

Student engagement is enhanced through adaptive learning, personalized learning, and mobile learning, catering to diverse learning styles and needs. Faculty adoption of educational technology is crucial for effective classroom management, with software compatibility and data analytics enabling informed decision-making. Cloud computing and learning management systems facilitate online courses and assessment tools, while curriculum development and professional development opportunities cater to budget constraints and teacher training. Interactive whiteboards, stem education, and coding education are essential components of modern classrooms, fostering a holistic learning environment. Battery life, screen size, and display resolution are essential considerations for student devices, ensuring optimal learning experiences.

The integration of educational research, augmented reality, and virtual learning environments further enriches the educational landscape, providing innovative solutions for student success.

The K-12 segment was valued at USD 16.40 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

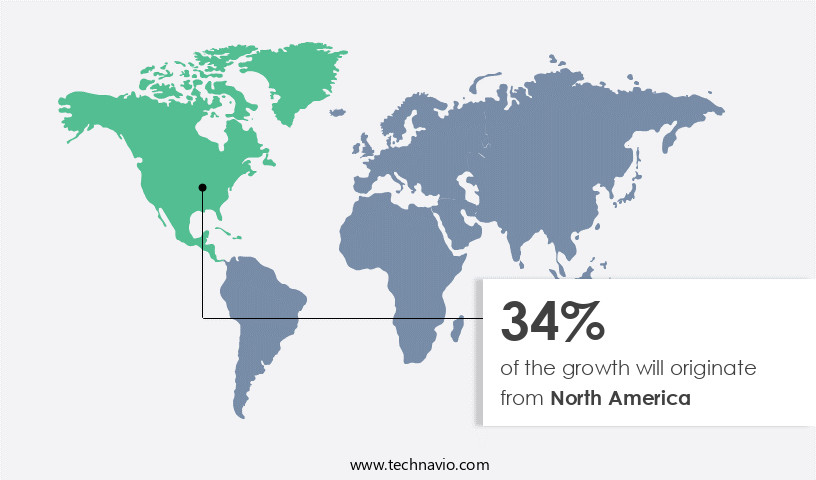

North America is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The education PC and tablet market is witnessing significant growth in North America due to the increasing adoption of digital learning in educational institutions. With a substantial market share in 2024, this region is at the forefront of integrating technology into teaching and learning experiences. The demand for PCs and tablets is escalating as they provide access to digital curriculum, educational apps, online resources, and learning management systems. Many schools have initiated 1:1 device programs, ensuring each student has a dedicated device for their academic needs. These initiatives aim to promote personalized learning and equitable access to technology. Furthermore, the integration of e-learning platforms, student information systems, and digital textbooks enhances the learning experience.

Security features, adaptive learning, and machine learning technologies are prioritized to maintain student engagement and success. Faculty adoption of these devices is also on the rise, as they facilitate virtual learning environments and interactive whiteboards. Cloud computing, software compatibility, and data analytics enable efficient curriculum development and assessment tools. Budget constraints are being addressed through device management and online courses. The integration of coding education, stem education, and artificial intelligence in education technology is further fueling market growth. Professional development for teachers and technical support are essential components to ensure effective implementation and usage of these devices. The market trends include the use of virtual reality, augmented reality, and screen size for enhanced learning experiences.

Processor performance, ram capacity, storage space, and display resolution are critical hardware specifications for optimal device functionality. Battery life is also a crucial factor for mobile learning. The education technology market is evolving, with a focus on personalized learning, classroom management software, and learning management systems.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Education Personal Computer (PC) And Tablet Industry?

- The robust demand for online education serves as the primary market driver, fueling its growth and expansion.

- The education PC and tablet market has experienced significant growth due to the increasing adoption of technology in curriculum development and professional development for teachers. Budget constraints have driven institutions to explore cost-effective solutions, making laptops and tablets attractive options. These devices offer access to online courses, assessment tools, educational apps, and virtual learning environments. Hardware specifications, such as battery life, processing power, and display capabilities, are crucial considerations for educators and students. Long battery life is essential for uninterrupted learning, especially in tablet devices. Professional development programs for teachers often include training on using technology effectively in the classroom.

- Augmented reality technology is transforming education by providing immersive learning experiences. This technology can be integrated into curriculum development to create engaging and interactive learning environments. Virtual and augmented reality tools can help students visualize complex concepts and enhance their understanding. Online courses and assessment tools offer convenience and flexibility for students and teachers. They enable students to learn at their own pace and provide teachers with valuable data for evaluating student progress. The use of technology in education is expected to continue growing, with the integration of artificial intelligence and machine learning offering even more opportunities for personalized learning experiences.

What are the market trends shaping the Education Personal Computer (PC) And Tablet Industry?

- The transition towards cloud-based solutions is an emerging market trend. It is essential for businesses to adopt this approach to remain competitive and efficient in today's digital landscape.

- The education technology market, specifically PCs and tablets, is experiencing significant growth due to the integration of cloud computing in the education sector. Institutions are adopting cloud-based solutions to provide students with easy access to digital textbooks, e-learning platforms, student information systems, and computer science education resources. These tools offer connectivity options that enable seamless collaboration and communication among students and faculty. Moreover, the integration of virtual reality and computer science education is enhancing student engagement and facilitating immersive learning experiences. Security features are also a priority in these solutions to ensure the protection of student data. Cloud-based classroom management software and student information systems are streamlining administrative tasks, allowing faculty to focus on teaching.

- Computer systems with increased RAM capacity are essential for running these advanced educational applications. The operating system of these devices plays a crucial role in their compatibility with various educational software and applications. The market's growth is further driven by faculty adoption of these technologies to deliver more effective and interactive teaching methods. In conclusion, the integration of cloud computing and advanced educational technologies is transforming the education sector, making learning more accessible, engaging, and efficient.

What challenges does the Education Personal Computer (PC) And Tablet Industry face during its growth?

- The growth of the industry is significantly impacted by budget constraint issues faced by educational institutions. This challenge, which is a common theme in the sector, necessitates finding effective solutions to ensure continued expansion and progress.

- In the realm of education technology, schools and institutions grapple with budget constraints when it comes to procuring and maintaining PCs and tablets. These devices, essential for adaptive learning and interactive whiteboards in STEM education, necessitate regular updates, maintenance, and repairs, leading to additional costs. Licensing fees and ongoing subscriptions for software, applications, and digital content further add to the financial burden. The lack of adequate funds for these expenses can hinder schools' ability to invest in new devices, potentially hindering student success and the advancement of educational research. Machine learning and display resolution technologies offer significant benefits in the education sector, enhancing the learning experience.

- However, the costs associated with these advanced features can be prohibitive for schools with limited resources. In conclusion, the global market for educational PCs and tablets faces challenges due to budget constraints and ongoing costs, which may impact its growth during the forecast period. Schools require reliable technical support and cost-effective solutions to optimize their technology investments and prioritize student success.

Exclusive Customer Landscape

The education personal computer (pc) and tablet market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the education personal computer (pc) and tablet market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, education personal computer (pc) and tablet market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acer Inc. - The company specializes in providing a range of education technology solutions, including PCs and tablets such as the Acer Chromebook Tab 10. These devices are designed to enhance learning experiences and facilitate remote education. By offering advanced features and user-friendly designs, our offerings aim to support students and educators in their academic pursuits. Our commitment to innovation and quality ensures that our technology remains at the forefront of the ever-evolving education landscape. With a focus on affordability and accessibility, we strive to make technology an integral part of the educational experience for learners worldwide.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acer Inc.

- Apple Inc.

- ASUSTeK Computer Inc.

- Dell Technologies Inc.

- Dynabook Singapore Pte. Ltd.

- Elitegroup Computer Systems Co. Ltd.

- Google LLC

- HCL Technologies Ltd.

- HP Inc.

- Lava International Ltd.

- Lenovo Group Ltd.

- LG Corp.

- Microsoft Corp.

- NEC Corp.

- Nexstgo Co. Ltd.

- Nokia Corp.

- Panasonic Holdings Corp.

- Samsung Electronics Co. Ltd.

- Sony Group Corp.

- Xiaomi Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Education Personal Computer (PC) And Tablet Market

- In January 2023, Microsoft announced the launch of its new Surface Laptop SE, an affordable and durable laptop designed specifically for the education sector. This device, featuring a starting price of USD249, is aimed at providing students with access to technology that can help them learn effectively (Microsoft, 2023).

- In March 2024, Apple and Google joined forces to collaborate on bringing Google Workspace and Google Classroom to iPads. This strategic partnership aimed to enhance the learning experience for students using iPads, providing them with seamless access to Google's productivity and collaboration tools (Apple, 2024).

- In May 2024, Lenovo secured a significant investment of USD1.2 billion from EDBI, a leading global investor in technology and strategic industries. This funding will support Lenovo's continued growth in the education technology market, enabling the company to expand its product offerings and strengthen its market position (Lenovo, 2024).

- In August 2025, the European Union introduced a new policy initiative, "Digital for Education," which aims to ensure that every student in Europe has access to a digital device for learning by 2030. This initiative, which includes a â¬2.3 billion investment, represents a significant push towards digital transformation in the European education sector (European Commission, 2025).

Research Analyst Overview

The PC and tablet market in education is experiencing significant evolution, with a focus on enhancing student learning experiences through innovative technologies. Digital resources, such as educational games and interactive simulations, are increasingly integrated into student-centered learning environments. Computational thinking and data science education are becoming essential components of the curriculum, enabling students to develop critical skills for the digital age. Student support services are being augmented with technology, including digital assessments, educational dashboards, and personalized learning pathways. Remote and blended learning are gaining popularity, with video conferencing and online collaboration tools facilitating access to quality education regardless of location.

Device lifecycle management and data privacy are critical concerns for educational institutions, necessitating robust technology integration strategies. Pedagogical innovation is at the forefront of educational technology adoption, with digital collaboration tools and accessibility features ensuring inclusive learning environments. Data visualization and student data insights are transforming the way educators assess student progress and inform instruction. Meanwhile, device security and digital content creation tools empower students to become creators and innovators, fostering a culture of creativity and critical thinking.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Education Personal Computer (PC) And Tablet Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

191 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.5% |

|

Market growth 2025-2029 |

USD 37.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.5 |

|

Key countries |

US, France, China, Canada, Japan, Germany, UK, India, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Education Personal Computer (PC) And Tablet Market Research and Growth Report?

- CAGR of the Education Personal Computer (PC) And Tablet industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the education personal computer (pc) and tablet market growth of industry companies

We can help! Our analysts can customize this education personal computer (pc) and tablet market research report to meet your requirements.