US Enterprise Indoor Location-Based Services Market Size 2024-2028

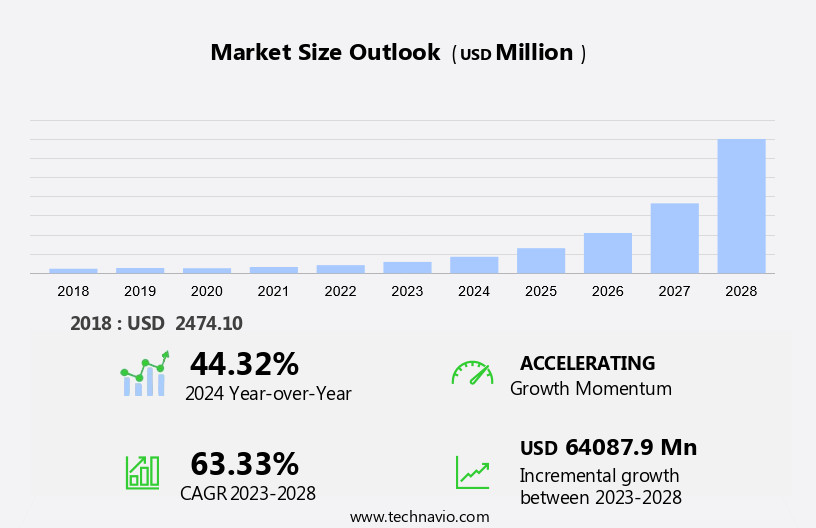

The US enterprise indoor location-based services market size is forecast to increase by USD 64.09 billion billion at a CAGR of 63.33% between 2023 and 2028.

- The Indoor Location-Based Services (LBS) market is experiencing significant growth, driven by several key trends and factors. One of the primary growth drivers is the increasing adoption of proximity marketing, which leverages indoor positioning technology to deliver targeted promotions and offers to consumers. Indoor positioning is achieved using various methods, including light-based technologies such as iBeacons and Wi-Fi triangulation. Despite these growth opportunities, the Indoor LBS market faces challenges, particularly in terms of high costs and capital investment. The deployment and maintenance of indoor positioning systems require significant resources, making it a significant investment for businesses. Trends in this market include the integration of artificial intelligence and machine learning algorithms to improve location accuracy and provide personalized services.

- However, the potential benefits, including enhanced customer engagement and improved operational efficiency, make it a worthwhile investment for many organizations. Hence, the Indoor LBS market is poised for growth, fueled by the trend towards proximity marketing and the increasing demand for more accurate and efficient indoor navigation systems. While high costs and capital investment remain challenges, the potential benefits make it an attractive market for businesses looking to enhance their customer engagement strategies and optimize their operations.

What will be the size of the US Enterprise Indoor Location-Based Services Market during the forecast period?

- The market is experiencing significant growth due to the increasing demand for accurate and efficient indoor navigation systems. This market is driven by the need to enhance customer experience, optimize operational efficiency, and improve safety and security within large facilities such as malls, airports, and hospitals. Indoor location-based services (IBLS) utilize various positioning technologies, including Wi-Fi, Bluetooth Low Energy (BLE), and Ultra-Wideband (UWB), to provide real-time, precise location information. Additionally, the use of beacons and proximity sensors is gaining popularity to deliver targeted marketing and promotions.

- Energy efficiency is also a key consideration, with the adoption of low-power positioning technologies and energy harvesting techniques to minimize battery usage. The market is expected to continue its growth trajectory, driven by the increasing adoption of IoT devices and the need for seamless indoor navigation and location-based services. The integration of renewable energy sources, such as solar and wind power, into indoor location systems is also a growing trend, as organizations seek to reduce their carbon footprint and minimize reliance on traditional power sources.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technology

- RFID

- Bluetooth

- Wi-Fi

- Others

- Component

- Service

- Hardware

- Software

- Geography

- US

By Technology Insights

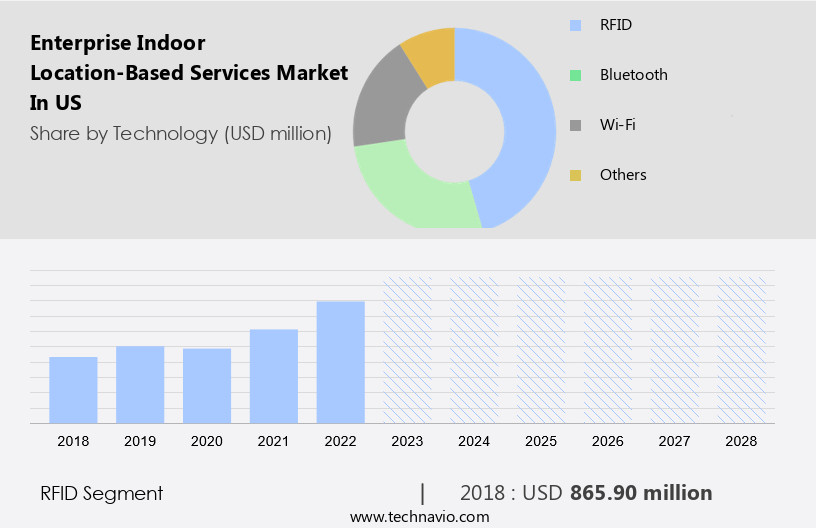

- The RFID segment is estimated to witness significant growth during the forecast period.

RFID (Radio-Frequency Identification) is a wireless technology that utilizes radio waves to transmit data, primarily serial numbers, between tags and readers. RFID systems operate at various frequencies, including 125 kHz, 13.56 MHz, 433 MHz, 900 MHz, 2.4 GHz, and 5 GHz. This technology is gaining traction due to its mobility tracking capabilities for objects or individuals, offering advantages such as high accuracy and low maintenance costs. RFID can be categorized into passive and active systems. In passive RFID, the tag functions as a transponder, storing data on a microchip that is activated and read by an electromagnetic field generated by the reader.

This technology is widely used in various industries, including logistics, healthcare, and retail, for asset tracking and inventory management. RFID's versatility and benefits make it a valuable tool in optimizing business operations and enhancing operational efficiency.

Get a glance at the market share of various segments Request Free Sample

The RFID segment was valued at USD 865.90 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of US Enterprise Indoor Location-Based Services Market?

Proximity marketing is the key driver of the market.

- The market: Enhancing Consumer Engagement and Brand Equity Indoor Location-Based Services (iBeacon and Wi-Fi technologies) are revolutionizing marketing strategies for various enterprises, including retail stores, hotels, entertainment venues, and public places such as airports. These services enable businesses to deliver customized messages to consumers based on their geographic location, user preferences, and prior purchase history. The implementation of indoor location-based services requires a reliable power source, especially for off-grid living and independent power supply systems. Off-grid battery packs, such as lithium-ion batteries and gel underground batteries, are essential for powering DC loads, independent inverters, and solar lithium batteries.

- These batteries come with varying DC voltage levels and energy densities, affecting their self-discharge rate, memory effect, and environmental pollution. Off-grid solar systems, solar battery packs, and solar controllers are essential components of renewable energy storage solutions. Wind power generation and solar power generation are integral parts of new energy development, with renewable energy storage playing a crucial role in system efficiency and electricity demands. Engineers are focusing on circular economy principles to optimize battery systems, including aboveground storage vessels, chemical batteries, and distributed networks. Hardware production lines and local businesses are investing in self-discharge solutions to minimize energy losses and enhance sustainability storage options.

- Solar PV and wind power plants are essential for renewable energy generation, with storage vessels, air pressure, and turbines used to convert energy into usable forms. Energy losses and waste heat are significant challenges, necessitating improvements in electric-to-electric efficiency and natural gas fuel alternatives. Hence, the market is a critical component of marketing strategies for various industries. The integration of renewable energy storage solutions and off-grid power systems is essential for ensuring the reliability and efficiency of these services. Engineers and businesses are focusing on optimizing battery systems, reducing energy losses, and enhancing sustainability storage options to meet the evolving demands of the market.

What are the market trends shaping the US Enterprise Indoor Location-Based Services Market?

Indoor positioning using light is the upcoming trend In the market.

- The market is witnessing significant growth due to the adoption of light-emitting diode (LED) fixtures for indoor positioning. This trend is driven by the cost-effectiveness and privacy benefits of using existing lighting infrastructure, as opposed to installing additional beacons or other hardware. Indoor positioning using LED lights involves the use of chips in overhead lights that communicate with smartphones via Bluetooth Low Energy (BLE) technology and sensors to track consumer movement. This approach offers privacy protection as it does not require the collection or storage of personal data or device identifiers. Moreover, indoor positioning using light is gaining traction in various industries, including airports, museums, and retail shops, to provide directions to services and enhance the customer experience.

- The energy efficiency of LED lights and their long lifespan make them an attractive choice for off-grid living and renewable energy systems. These systems often rely on DC power from batteries, such as lithium-ion, gel underground, or lead-acid, to store energy from solar, wind, or electric generators. The efficiency of battery systems, including energy density, self-discharge rate, and memory effect, is crucial for optimizing system performance and reducing energy losses. Environmental sustainability is a key consideration In the development of new energy storage solutions, as the circular economy gains importance. The comprehensive development of renewable energy sources, such as solar and wind power generation, is driving the demand for energy storage systems to ensure a reliable and independent power supply.

- Hence, the market is experiencing growth due to the adoption of LED lights for indoor positioning, driven by cost-effectiveness and privacy benefits. This trend intersects with the off-grid and renewable energy markets, where energy storage systems play a vital role in ensuring a reliable power supply. The optimization of battery systems and the focus on environmental sustainability are key factors In the market's development.

What challenges does US Enterprise Indoor Location-Based Services Market face during the growth?

High costs and capital investment is a key challenge affecting the market growth.

- The market In the US faces significant challenges due to the high capital investments required. The market's infrastructure needs are substantial, driving up costs for buyers. Enterprise indoor location-based services are complex systems that demand intricate deployment and seamless integration with existing IT infrastructure. These factors contribute to the time-consuming and expensive adoption process. The extensive hardware requirements for enterprise indoor location-based solutions add to the financial burden. Lithium-ion batteries, DC load, independent inverters, solar lithium batteries, and solar controllers are essential components of these systems. Energy density, self-discharge rate, memory effect, and environmental pollution are critical considerations when selecting batteries.

- Lead-acid batteries, gel underground batteries, and lithium batteries are common options, each with unique advantages and challenges. Off-grid living and renewable energy sources like solar and wind power generation play a role In the market. Solar battery packs, off-grid solar systems, and wind energy are essential for powering these systems in off-grid environments. However, energy losses, waste heat, and natural gas fuel are concerns that need addressing to ensure system efficiency. Battery systems, including aboveground storage vessels and chemical batteries, are integral to the market's development. The comprehensive development of the market requires the collaboration of engineers, production lines, local businesses, and distributed networks.

- The circular economy and renewable energy storage are essential aspects of the market's future. However, the challenge of system efficiency and the integration of solar PV and wind power plants remains. The market's growth is influenced by electricity demands, self-discharge, and the environmental impact of energy storage solutions. The market's dynamics are shaped by factors like energy losses, electric-to-electric efficiency, and the role of turbines and generators. The market's success hinges on addressing these challenges and optimizing system performance to meet the demands of enterprise customers.

Exclusive US Enterprise Indoor Location-Based Services Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AiRISTA Flow Inc.

- Aislelabs Inc.

- Alphabet Inc.

- Apple Inc.

- Broadcom Inc.

- Cisco Systems Inc.

- Comtech

- Esri Global Inc.

- HERE Global BV

- Hewlett Packard Enterprise Co.

- HID Global Corp.

- Infillion

- infsoft GmbH

- Juniper Networks Inc.

- Microsoft Corp.

- NextNav Inc.

- Polaris Wireless

- POLE STAR SA

- Qualcomm Inc.

- xAd Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Indoor location-based services (IBLS) have emerged as a significant market In the business world, offering innovative solutions for enhancing operational efficiency, optimizing resource utilization, and improving customer experiences. This market is characterized by the integration of advanced technologies, such as Wi-Fi, Bluetooth Low Energy (BLE), and Ultra-Wideband (UWB), to provide precise indoor positioning and navigation. IBLS caters to various industries, including retail, healthcare, education, and manufacturing, among others. In these sectors, the ability to track and manage the movement of people and assets within large, complex facilities is crucial for streamlining workflows, ensuring safety, and providing enhanced services. The market for indoor location-based services is driven by several factors. One key factor is the increasing demand for real-time data and analytics to optimize business processes. IBLS solutions enable businesses to gather valuable insights into customer behavior, employee productivity, and asset utilization, allowing them to make informed decisions and improve overall performance. Another factor driving the growth of the IBLS market is the proliferation of IoT devices and smart buildings. With the increasing adoption of IoT sensors and connected devices, there is a growing need for accurate indoor positioning and navigation to manage and monitor these devices effectively. Additionally, the trend towards smart buildings, which integrate advanced technologies to optimize energy usage, improve indoor air quality, and enhance safety, is further fueling the demand for IBLS solutions.

The Enterprise Indoor Location-Based Services (IBS) Market is witnessing significant growth, driven by the increasing demand for real-time, accurate indoor positioning systems. Solar energy is playing a crucial role in powering these systems, especially in off-grid and regional applications. Off-grid solar systems, comprising of solar panels, a lithium-ion battery, a solar charge and discharge controller, and an independent inverter, are increasingly being adopted for IBS. These systems provide AC power, ensuring uninterrupted operation of IBS even during power outages. Moreover, the integration of windsolar hybrid power supply systems further enhances the reliability of off-grid IBS. The V off-grid solar system, volts off-grid solar system, and off-grid special inverter are essential components of these systems, optimizing energy usage and ensuring consistent power output.

Lithium-ion batteries, with their high energy density, long cycle life, and fast charging capabilities, are the preferred choice for powering off-grid IBS. The solar energy stored in these batteries is used to power the IBS, making them an eco-friendly and cost-effective solution. The Enterprise Indoor Location-Based Services Market is set to benefit significantly from solar and off-grid power solutions. These systems, utilizing solar panels, lithium-ion batteries, and off-grid inverters, will enable next-generation IBS applications, ensuring uninterrupted and sustainable operation.

Moreover, the market is witnessing significant innovation, with companies developing new technologies and business models to address the unique challenges of indoor location-based services. For instance, some companies are focusing on improving system efficiency by reducing energy consumption and minimizing interference from environmental factors. Others are exploring the use of alternative energy sources, such as solar and wind power, for powering indoor locationing systems. Despite the numerous opportunities, the IBLS market also faces several challenges. One challenge is the need to ensure high system efficiency and accuracy, as indoor environments can be complex and dynamic, with various sources of interference and obstacles that can impact the accuracy of location data. Another challenge is the need to address privacy concerns, as indoor locationing systems can potentially collect sensitive data on individuals' movements and activities. Hence, the indoor location-based services market is a dynamic and innovative space, offering significant opportunities for businesses to optimize their operations, improve customer experiences, and gain valuable insights into their indoor environments. The market is driven by factors such as the demand for real-time data and analytics, the proliferation of IoT devices and smart buildings, and the trend towards sustainability and energy efficiency. However, it also faces challenges related to system efficiency, accuracy, and privacy, which require ongoing innovation and investment to address.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

146 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 63.33% |

|

Market growth 2024-2028 |

USD 64.09 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

44.32 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch