Europe Commercial Real Estate Market Size 2025-2029

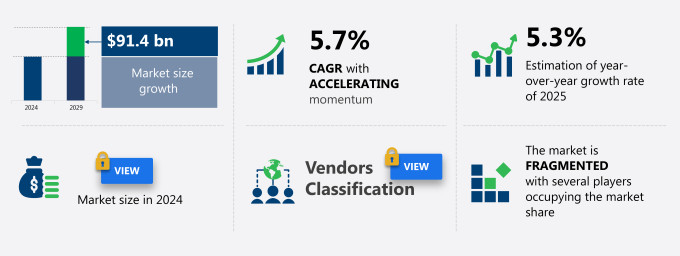

Europe commercial real estate market size is forecast to increase by USD 91.4 billion at a CAGR of 5.7% between 2024 and 2029. European commercial real estate market is experiencing significant growth, with increasing private investment pouring into the sector. The primary catalyst fueling market growth is the increasing aggregate private investment.This trend is driven by a robust economic environment, favorable demographic shifts, and the ongoing recovery from the COVID-19 pandemic.

Market Size & Forecast

- Market Opportunities: USD 31.78 billion

- Future Opportunities: USD 91.4 billion

- CAGR : 5.7%

However, this growth comes with challenges,rising interest rates pose a threat to affordability and profitability, potentially dampening investor enthusiasm and increasing borrowing costs. As a result, companies must navigate this complex landscape by carefully assessing potential investment opportunities, considering alternative financing options, and adapting to changing market conditions. In order to capitalize on the market's potential and mitigate risks, strategic planning and agility will be essential for success.

What will be the size of Europe Commercial Real Estate Market during the forecast period?

- European commercial real estate market continues to evolve, presenting dynamic opportunities across various sectors. Property risk assessment and building inspection reports play crucial roles in mitigating potential hazards, ensuring compliance with safety standards. Property tax appeals and portfolio diversification help investors minimize risk and maximize returns. Facility management services, property valuation techniques, and property value metrics enable effective asset management. Data-driven investment strategies, including transaction closing costs, space planning solutions, and development approval processes, facilitate informed decision-making. Capital expenditure planning, portfolio optimization, operating expense control, lease contract review, energy consumption audits, and commercial lease terms are essential for maintaining profitability.

- For instance, the adoption of energy management systems in commercial buildings has led to a 10% average reduction in energy consumption, contributing to cost savings and environmental sustainability. Commercial real estate market is expected to grow by 3% annually, driven by these evolving trends and the ongoing demand for efficient, sustainable, and compliant properties.

How is this Europe Commercial Real Estate Market segmented?

Europe commercial real estate market market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029,for the following segments.

- Type

- Rental

- Lease

- Sales

- End-user

- Offices

- Retail

- Leisure

- Others

- End-User

- Corporate

- Investment

- Government

- Location

- Urban

- Suburban

- Geography

- Europe

- France

- Germany

- Italy

- UK

- Europe

By Type Insights

The rental segment is estimated to witness significant growth during the forecast period. European commercial real estate market is characterized by dynamic lease renewal negotiations, construction project management, and insurance considerations for green building certification and property refurbishment costs. Zoning regulations compliance and vacancy loss calculations are crucial elements in property acquisition strategy, while property tax optimization and valuation models inform building lifecycle cost analyses. Property management software and tenant occupancy rates are essential for portfolio performance metrics, and market rent surveys guide tenant retention strategies. Portfolio risk management, building code compliance, property data analytics, and rental income projections are integral to asset management strategies. Due diligence processes and capitalization rate analysis are vital during urban planning regulations and space utilization analysis.

In the rental segment, growth is expected to reach over 5% annually, with office rents in the UK, Benelux markets, and peripheral Europe experiencing the highest quarterly growth of 1.8%. However, investment markets remain cautious due to economic uncertainties and rising inflation and finance rates, despite the leasing market's strength and increasing rents. For instance, rental income in the office sector in Paris grew by 3.5% in 2021, reaching €1,122 per square meter per year.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

European commercial real estate market continues to be a significant global investment destination, offering diverse opportunities for both local and international investors. Valuation methodologies are crucial in determining the worth of commercial properties in Europe. These methodologies consider factors such as location, property income, and cost approach. Effective lease negotiation techniques are essential for securing favorable lease terms, ensuring stable rental income. Real estate portfolio performance tracking is vital for investors to monitor the financial health of their investments. Green building certification requirements, such as LEED and BREEAM, are increasingly important for property owners seeking to enhance the value and competitiveness of their assets.

The property tax assessment appeal process can provide opportunities for cost savings, while construction project cost overruns can impact investment returns. A comprehensive real estate investment due diligence checklist is necessary to assess potential risks and opportunities. Commercial property insurance coverage is essential for mitigating risks related to property damage, liability, and business interruption. Smart Building energy efficiency improvements can lead to cost savings and increased tenant satisfaction. Optimal tenant mix strategies can maximize rental income and minimize vacancy rates. Property maintenance cost reduction is another crucial aspect of effective property management. Building lifecycle cost analysis and property acquisition cost analysis are integral parts of a successful commercial real estate investment strategy.

A comprehensive property risk management plan should include rental income forecasting models, property tax optimization strategies, vacancy rate mitigation techniques, space utilization optimization methods, effective tenant retention programs, and building lifecycle cost analysis. By implementing these strategies, investors can minimize risks, maximize returns, and ensure long-term success in European commercial real estate market.

What are Europe Commercial Real Estate Market market drivers leading to the rise in adoption of the Industry?

- The primary catalyst fueling market growth is the increasing aggregate private investment. Commercial real estate investment, comprising land, offices, and other physical structures, represents a significant portion of aggregate private investment in Europe. Businesses and individuals allocate a substantial share of their investment funds towards commercial real estate, with the remaining dedicated to equipment and software. The increasing demand for commercial real estate consulting services is a testament to this trend. These services enable investors to make informed decisions on their property investments, optimize their portfolios, and identify profitable business areas.

- For instance, the demand for office space in major European cities has surged by 3% year-over-year. Furthermore, industry analysts anticipate a 5% growth rate for European commercial real estate market in the next five years.

What are Europe Commercial Real Estate Market market trends shaping the Industry?

- European commercial real estate market is experiencing an increasing trend in investments. This is the upcoming market development.

- European commercial real estate transactions have become more intricate, costlier, and time-consuming, with the average deal duration expanding by 33% in 2022. The industry anticipates robust growth, with nearly one-fifth of German firms planning to reduce their investment activities, a quarter aiming to expand them, and over half intending to maintain the same level of investment. In contrast, the UK market shows strong international expansion intentions, with 82% of investors planning to expand their business abroad.

- Similarly, the majority of French real estate experts (64%) express a desire to increase their international investment. Spanish investors exhibit a more cautious approach, with 46% planning to invest the same amount as previously and 42% aiming to become more active internationally.

How does Europe Commercial Real Estate Market market faces challenges face during its growth?

- The industry's growth is being significantly impacted by the rising interest rates, presenting a major challenge for businesses in this sector.

- European commercial real estate markets are experiencing heightened challenges as tenants face pressure from rising interest rates on loans. Major European lending institutions report an uptick in commercial real estate loan defaults. Although demand for commercial space may decrease in slowing economies, this could lead to softening rents. The recent surge in European interest rates significantly increases the cost of debt servicing for landlords.

- Despite investors' reluctance towards costlier debt financing, higher rates also influence property valuations. For instance, a recent study reveals a 20% increase in commercial property loan defaults in Germany. European real estate industry anticipates growth to remain robust, with expectations of a 3% expansion in 2023.

Exclusive Europe Commercial Real Estate Market Customer Landscape

Europe commercial real estate market market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Atrium European Real Estate - This company specializes in providing comprehensive commercial real estate services for office and retail spaces, offering innovative solutions to help businesses optimize their physical workplaces and retail environments. Through rigorous market analysis and industry expertise, our unbiased research provides valuable insights for informed decision-making.

Europe commercial real estate market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Atrium European Real Estate

- AXA Investment Managers

- BNP Paribas Real Estate

- CBRE Group Inc.

- Colliers International Group Inc.

- Cushman & Wakefield Plc

- Deutsche Immobilien Chancen-Gruppe

- Gecina SA

- Goodman Group

- Grosvenor Group

- Immofinanz AG

- Jones Lang LaSalle Incorporated

- Klepierre SA

- M7 Real Estate

- Merlin Properties Socimi SA

- Prologis Inc.

- Savills Plc

- SEGRO Plc

- Unibail-Rodamco-Westfield

- Vonovia SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Commercial Real Estate Market In Europe

- In January 2024, German real estate investment trust (REIT) Deutsche Wohnen & Co. Announced the acquisition of rival European REIT Vivawest for €6.5 billion, creating the largest listed residential property company in Europe. This merger significantly expanded Deutsche Wohnen's portfolio and market presence (Reuters, 2024).

- In March 2024, tech giant Google and European property firm Brookfield Properties joined forces to develop a new €1 billion data center campus in the Netherlands. This strategic partnership underscores the growing importance of technology in commercial real estate and the demand for data center space (Bloomberg, 2024).

- In May 2024, European Union approved the NextGenerationEU fund, allocating €750 billion for recovery and resilience projects, including investments in sustainable and energy-efficient buildings. This initiative is expected to boost the commercial real estate market, particularly in the green building sector (European Commission, 2020).

- In February 2025, Blackstone, the world's largest real estate investment firm, completed the acquisition of a majority stake in the €14 billion European logistics real estate portfolio managed by TPG Real Estate. This deal marked Blackstone's largest European real estate acquisition to date, underscoring the growing importance of the logistics sector within the commercial real estate market (Blackstone, 2025).

Research Analyst Overview

European commercial real estate market continues to evolve, presenting both opportunities and challenges for investors and property managers. Lease renewal negotiations are a constant factor, with landlords and tenants negotiating terms to secure long-term occupancy and maintain stable cash flows. Construction project management plays a crucial role in ensuring timely and cost-effective delivery of new developments, while commercial property insurance protects against potential risks. Green building certification is gaining traction as investors seek properties with sustainable features, driving up demand for property refurbishment costs to meet these standards. Zoning regulations compliance and vacancy loss calculations are essential components of a successful property acquisition strategy, with portfolio performance metrics and property tax optimization key to maximizing returns.

Property valuation models and building lifecycle costs are essential tools for asset management, while property management software and tenant occupancy rate analysis help optimize operations. Market rent surveys and tenant retention strategies are critical for setting competitive rents and minimizing turnover. Industry growth is expected to reach double-digit percentages, driven by increasing demand for commercial space and a shift towards flexible workspaces. For instance, a recent study showed a 15% increase in flexible workspace take-up in major European cities. Property data analytics, rental income projections, and portfolio risk management are essential for navigating this dynamic market.

Environmental impact assessments and property tax assessments are becoming increasingly important, with building energy efficiency and building code compliance key considerations for property owners. Lease agreement terms and lease negotiation strategies are crucial in securing favorable deals, while due diligence processes and capitalization rate analysis help ensure sound investment decisions. Urban planning regulations and space utilization analysis are essential for developers and investors, with property appraisal methods providing accurate valuations and asset management strategies ensuring optimal returns. Building lifecycle costs, property tax optimization, and property valuation models are all interconnected aspects of managing a successful commercial real estate portfolio.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Commercial Real Estate Market in Europe insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2024 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.7% |

|

Market growth 2025-2029 |

USD 91.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.3 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch