Europe Commercial Refrigeration Equipment Market Size 2024-2028

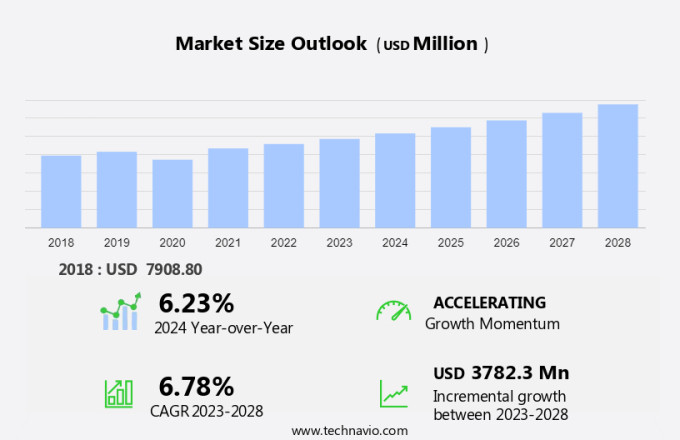

The commercial refrigeration equipment market size in Europe is forecast to increase by USD 3.78 billion at a CAGR of 6.78% between 2023 and 2028. The market is experiencing significant growth, driven by several key trends. The increasing need to extend the shelf life of food products is a major factor fueling market growth. Additionally, there is a growing demand for energy-efficient models of commercial refrigeration equipment as businesses seek to reduce their carbon footprint and save on energy costs. Another trend is the rising preference for pre-used and rented commercial refrigeration equipment, which offers cost savings and flexibility to businesses. These trends are expected to continue shaping the market in the coming years.

The market is witnessing significant growth due to the increasing demand from various end-users such as commercial kitchens in restaurants, hotels, and supermarkets and hypermarkets. Self-contained refrigerators and freezers, as well as remote condensing units, are popular choices for this market. The market is segmented into self-contained and remote condensing equipment. Compressors and condensers are essential components of these systems. Natural refrigerant-based systems are gaining popularity due to their environmental benefits and regulatory pressures to phase out ozone-depleting substances such as hydrofluorocarbons (HFCs) and hydrochlorofluorocarbons (HCFCs). Food processing industries, food and beverage retail stores, and vending machines also contribute to the market's growth.

Moreover, the market includes various types of equipment, such as freezers, refrigerators, ice-making machines, and refrigerated display cases, used in transport refrigeration and for food and beverages, chemicals and pharmaceuticals, and other applications. The primary focus is on maintaining food quality and ensuring food safety while minimizing energy consumption and reducing environmental impact.

Market Segmentation

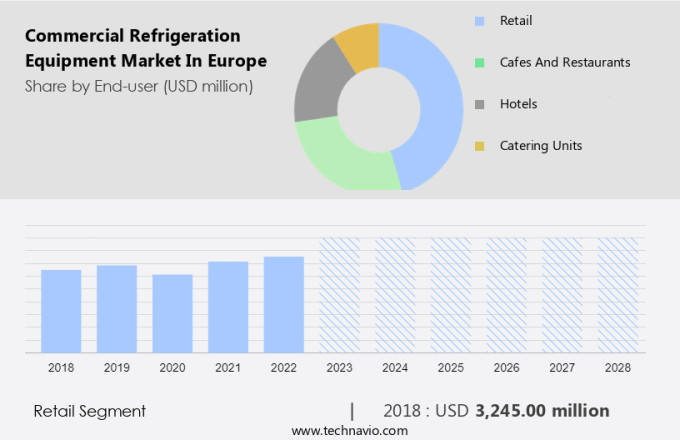

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- End-user

- Retail

- Cafes and restaurants

- Hotels

- Catering units

- Product

- Walk-in coolers

- Display cases

- Refrigerator for drinks

- Ice-making machines

- Others

- Geography

- Europe

- Germany

- UK

- France

- Italy

- Europe

By End-user Insights

The retail segment is estimated to witness significant growth during the forecast period. The market is witnessing significant growth due to the increasing demand from various sectors such as food processing, farming, logistics, and retail. In the food processing sector, the use of refrigeration equipment is essential for preserving and processing perishable items like frozen food products, ice creams, frozen dairy products, processed meat, fish, and seafood. Fluorocarbon refrigerants, including ammonia, CO2, and Carnot Refrigeration, are commonly used due to their high cooling capacity and energy efficiency. Cascade refrigeration systems are gaining popularity due to their ability to use multiple refrigerants with different boiling points. The fluorocarbons segment, which includes chemical compounds such as hydrofluorocarbons (HFCs), hydrochlorofluorocarbons (HCFCs), and hydrofluoroolefins (HFOs), is expected to dominate the market.

Moreover, the transportation refrigeration segment, including freezers, refrigerators, ice-making machines, and refrigerated display cases, is also driving market growth. Additionally, the food and beverage, chemicals and pharmaceuticals, and vending machine industries are significant consumers of commercial refrigeration equipment. The organic food industry is also expected to contribute to market growth due to the increasing demand for fresh and natural produce.

Get a glance at the market share of various segments Request Free Sample

The retail segment was valued at USD 3.25 billion in 2018 and showed a gradual increase during the forecast period.

Our market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Commercial Refrigeration Equipment Market in Europe Driver

Growing need to increase shelf life of food products is the key driver of the market. The European market for commercial refrigeration equipment is driven by the need to maintain optimal storage conditions for perishable food items, particularly in the cold chain process used by supermarkets and hypermarkets. Dairy products and ready-to-eat food are among the most sensitive to temperature fluctuations, making refrigeration an essential component for their preservation. Refrigeration plays a crucial role in extending the shelf life of these products by preventing or limiting microbial growth. For frozen food products, maintaining a sufficiently low temperature is essential to ensure both quality and safety. The nutritional and microbial quality of perishable food products can be preserved through refrigeration, making it an indispensable investment for food service establishments in Europe.

Commercial Refrigeration Equipment Market in Europe Trends

Growing demand for energy-efficient models of commercial refrigeration equipment is the upcoming trend in the market. Commercial refrigeration equipment plays a crucial role in the cold chain process, particularly for supermarkets and hypermarkets that deal with perishable goods such as dairy products and ready-to-eat food. End-users prioritize energy-efficient solutions to minimize operational costs. ENERGY STAR-certified commercial refrigeration equipment offers significant energy savings, consuming an average of 20% less energy than standard models. This energy efficiency is achieved through the use of advanced components like Electronically Commutated Motor (ECM) evaporators and condenser fan motors, hot gas anti-sweat heaters, and high-efficiency compressors. The energy consumption of ENERGY STAR-certified equipment can vary depending on the door type, making it an optimal choice for businesses aiming to reduce utility bills while maintaining optimal temperature conditions for their perishable inventory. Such factors will increase the market trend during tghe forecast period.

Commercial Refrigeration Equipment Market in Europe Challenge

Rising preference for pre-used and rented commercial refrigeration equipment is key challenge affecting the market growth. The European commercial refrigeration equipment market caters to the cold chain process requirements of various industries, including supermarkets and hypermarkets, dairy products, and ready-to-eat food. companies in this market are continually innovating to offer advanced features in their products. However, not all end-users can afford these high-end solutions. Instead, they opt for economical options such as pre-owned commercial refrigeration equipment. These units offer significant cost savings compared to new models. End-users can source pre-owned equipment through various channels, including print media advertisements and online platforms like Gumtree and eBay. Such equipment is particularly beneficial for businesses looking to expand their refrigerated food offerings.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AFE Group Ltd. - The company offers commercial refrigeration equipment such as cabinets, counters, medical racks.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ARNEG SPA

- Carrier Global Corp.

- Daikin Industries Ltd.

- Electrolux group

- ENOFRIGO SPA

- Epta Group

- Frigo DebtCo plc

- Haier Smart Home Co. Ltd.

- HOSHIZAKI Europe BV

- Illinois Tool Works Inc.

- Infrico SL

- Jongor Ltd.

- Liebherr International AG

- Scotsman Ice Srl

- TEFCOLD AS

- True Refrigeration UK Ltd.

- UAB FREOR LT

- Viessmann Climate Solutions SE

- Ziegra Eismaschinen GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand from various end-users such as commercial kitchens in restaurants, hotels, bakeries, and food service industry. Self-contained refrigerators and freezers are popular choices for small and medium-sized businesses, while remote condensing units are preferred for large-scale operations. Refrigerated cases are widely used in supermarkets, hypermarkets, and convenience stores for displaying and preserving packaged food, beverages, and fresh produce like fruits, vegetables, cheese, cream, and plain yogurt. The hospitality sector, including hotels and restaurants, also relies heavily on commercial refrigerators for storing and preserving perishable items. The market is shifting towards natural refrigerant-based systems due to growing concerns over the environmental impact of hydrofluorocarbons (HFCs) and hydrochlorofluorocarbons (HCFCs).

Morerover, the food processing industry also utilizes commercial refrigeration equipment for maintaining food quality and preserving nutritional values. The fast food industry and bakeries have specific requirements for refrigeration equipment, such as maintaining specific temperatures for frozen food and dough. The retail chain and consumer goods sectors also contribute to the growth of the market. Beverages, both alcoholic and non-alcoholic, require specialized refrigeration equipment for storage and preservation. Overall, the market is expected to continue its growth trajectory, driven by the increasing demand from various end-users and the shift towards sustainable refrigeration systems.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 3.78 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.23 |

|

Key companies profiled |

AFE Group Ltd., ARNEG SPA, Carrier Global Corp., Daikin Industries Ltd., Electrolux group, ENOFRIGO SPA, Epta Group, Frigo DebtCo plc, Haier Smart Home Co. Ltd., HOSHIZAKI Europe BV, Illinois Tool Works Inc., Infrico SL, Jongor Ltd., Liebherr International AG, Scotsman Ice Srl, TEFCOLD AS, True Refrigeration UK Ltd., UAB FREOR LT, Viessmann Climate Solutions SE, and Ziegra Eismaschinen GmbH |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles,market forecast , fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Forecast Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch