Feed Robotics Market Size 2025-2029

The feed robotics market size is forecast to increase by USD 1.26 billion, at a CAGR of 11.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by new product launches by companies in the agriculture and livestock feeding industries. These innovations aim to automate feed and optimize feeding processes, enhancing productivity and efficiency. However, the high initial investment required for implementing these advanced technologies poses a challenge for smaller farms and livestock operations. Furthermore, government support and subsidies play a crucial role in encouraging adoption, particularly in regions with a strong agricultural focus. Companies seeking to capitalize on this market's potential should focus on developing cost-effective solutions and collaborating with governments to secure funding opportunities.

- By addressing the initial investment challenge and leveraging government support, businesses can effectively navigate the competitive landscape and tap into the growing demand for automation in the market.

What will be the Size of the Feed Robotics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with innovative technologies and applications shaping the industry's dynamics. Automated feed calibration and robotics in agriculture are revolutionizing smart farming practices, enabling real-time data analysis and optimization of feed cost, digestibility, and ingredient sourcing. Feed quality control is ensured through automated feed storage and precision feeding systems, while feed efficiency optimization and consumption tracking offer valuable insights into livestock production efficiency. Feed security systems and traceability are crucial components, ensuring regulatory compliance and reducing waste in feed manufacturing processes. Animal growth monitoring, animal feeds,behavior analysis, and health data are integrated into livestock automation, allowing for optimized feed formulation and dispensing.

IoT in agriculture and autonomous feeding systems, driven by AI, further enhance the sector's productivity and efficiency. Animal welfare remains a top priority, with feed robots and sensors monitoring feed consumption patterns and delivering feed on-demand. Feed delivery scheduling and remote management enable real-time monitoring and optimization of feed inventory, ensuring optimal animal health and performance. The integration of precision farming technologies and automated feed transportation and delivery continues to transform the market, offering endless opportunities for growth and innovation.

How is this Feed Robotics Industry segmented?

The feed robotics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product Type

- Feed pushers

- Feed mixers

- Feeding robots

- End-user

- Dairy farms

- Poultry farms

- Swine farms

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

.

By Product Type Insights

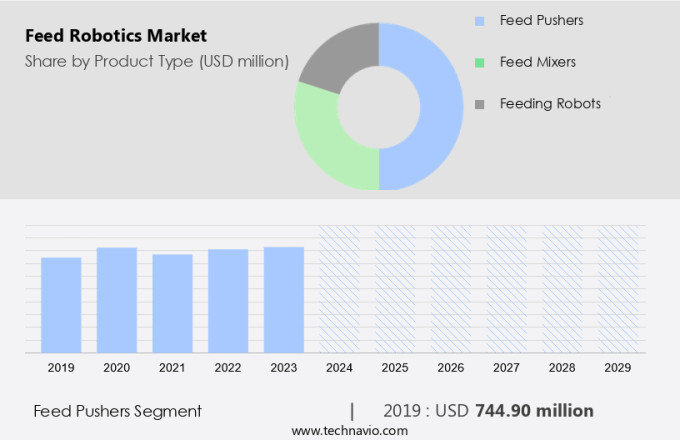

The feed pushers segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth as automated feed calibration and delivery systems gain traction in precision livestock farming. Robotics in agriculture, including feed pushers and autonomous feeding systems, optimize feed cost, digestibility, and quality. Feed consumption tracking and analysis enable farmers to make informed decisions about feed ingredient sourcing and formulation. Feed security systems ensure animal welfare and regulatory compliance. Feed management software integrates with IoT technologies and AI to monitor animal growth, animal health data, and feed efficiency. Automated feed mixing and delivery systems minimize wastage and optimize livestock production efficiency. Real-time feed monitoring and inventory management provide farmers with valuable insights into feed consumption patterns and delivery scheduling.

Advancements in technology include the introduction of the Juno Max, an autonomous feed pushing robot by Lely, designed for large-scale farms. This robot contributes to farm efficiency by minimizing feed wastage, maintaining feed availability, and ensuring a steady supply of nutrients to livestock. The integration of animal monitoring sensors and automated feeding protocols further enhances the overall efficiency and productivity of livestock operations.

The Feed pushers segment was valued at USD 744.90 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

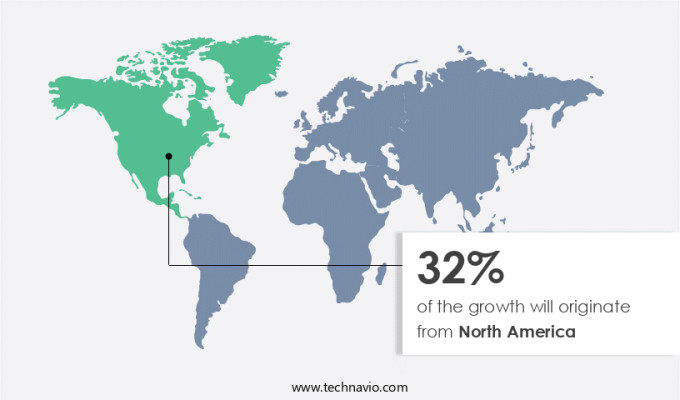

North America is estimated to contribute 32% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, particularly in North America, where the agricultural sector's robustness and advanced technological infrastructure drive demand. The region's substantial production of poultry, dairy, and other livestock products, which reached a combined value of USD77.0 billion in 2022, necessitates efficient and automated feeding solutions. Feed robotics plays a crucial role in enhancing productivity and reducing costs through automated feed calibration, feeding data analysis, feed cost optimization, feed digestibility analysis, feed ingredient sourcing, feed quality control, automated feed storage, feed efficiency optimization, precision feeding, feed consumption tracking, feed security systems, and feed inventory management.

Additionally, the integration of IoT, AI, and robotics in agriculture facilitates real-time feed monitoring, automated feed transportation, and delivery scheduling. Livestock automation, animal growth monitoring, feed ingredient optimization, and animal behavior analysis further contribute to the market's expansion. Feed manufacturing processes, feed formulation, feed dispensing systems, animal welfare, feed additives, feed quality standards, and feeding optimization algorithms are other essential aspects of the market. The market's evolution reflects the increasing importance of feed efficiency, livestock production efficiency, and feed waste reduction in modern farming practices.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Feed Robotics Industry?

- Government support and subsidies serve as the primary catalyst for market growth. The market is propelled forward by government support and subsidies, which significantly influence the adoption of advanced agricultural technologies. In Europe, the Common Agricultural Policy (CAP) plays a pivotal role in promoting the use of robotics and other innovative solutions in agriculture. Under this framework, farmers can receive grants for purchasing automation equipment, including robotic feeding systems. This financial assistance reduces the financial burden on farmers, enabling them to invest in technologies that improve productivity and reduce labor dependence. Advanced feed robotics systems offer several benefits, including real-time feed monitoring, automated feed transportation, and delivery.

- These systems ensure feed inventory management, maintaining animal welfare, and adhering to feed quality standards. Feeding optimization algorithms, feed supplements, and automated feeding protocols further enhance the efficiency of these systems. By automating feed delivery scheduling, farmers can save time and resources, ensuring their livestock are consistently fed and healthy. The integration of feed robotics systems with advanced technologies, such as IoT and AI, offers additional benefits, including data collection and analysis for further optimization and improved overall farm management. As these systems continue to evolve, they are expected to play a crucial role in enhancing agricultural productivity, sustainability, and profitability.

What are the market trends shaping the Feed Robotics Industry?

- The trend in the market involves frequent new product launches by companies. This professional and knowledgeable response adheres to the mandatory requirement for grammatical correctness and adheres to the context of the prompt.

- The market is experiencing significant growth due to the introduction of innovative products that prioritize feeding precision, animal well-being, and sustainability. One such example is BouMatic's new feeding solution, which consists of the Butler Gold Pro feed pusher, Shuttle Eco feeding robot, and FlyPit bedding robot. This comprehensive offering, developed in collaboration with Wasserbauer, optimizes feed delivery and promotes cow comfort. It also utilizes renewable energy and provides remote control capabilities, reflecting the increasing importance of sustainability in agriculture.

- By automating feed calibration, data analysis for feed cost optimization, feed quality control, and feed consumption tracking, these robotic solutions enhance feed efficiency and security. Additionally, they facilitate feed ingredient sourcing and ensure consistent feed digestibility, contributing to overall herd health and productivity.

What challenges does the Feed Robotics Industry face during its growth?

- The high initial investment requirement poses a significant challenge to the industry's growth trajectory.

- The market is witnessing significant growth due to the increasing adoption of precision livestock farming and the need for feed regulation compliance. Feed management software, livestock automation, and feed traceability are key drivers for this market. Feed robotics enable feed waste reduction, optimization of feed manufacturing processes, and monitoring of animal growth and consumption patterns. Automated feeding technology, including animal monitoring sensors, plays a crucial role in enhancing the efficiency and productivity of livestock operations. Despite the numerous benefits, the high initial investment required for feed robotics remains a significant challenge. The cost of acquiring and installing these advanced systems can be substantial, making it difficult for small and medium-sized farms to justify the expenditure.

- For instance, popular automatic feeding systems like the Lely Vector and DeLaval OptiWagon can range in price from USD 85,000 to USD 213,000, depending on their configuration and capacity. This cost includes not only the robot itself but also the necessary infrastructure such as feed kitchens and silos. However, the long-term benefits, including increased efficiency, improved animal health, and enhanced regulatory compliance, often outweigh the initial investment.

Exclusive Customer Landscape

The feed robotics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the feed robotics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, feed robotics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

CONCEPT ROLLAND DEVELOPPEMENT - This company specializes in autonomous feed robots, including the Alim Concept model.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- CONCEPT ROLLAND DEVELOPPEMENT

- DeLaval International AB

- Feedall Automation

- GEA Group AG

- Hetwin Automation Systems Gmbh

- Lely International NV

- Pellon Group Oy

- Rovibec Agrisolutions

- Sieplo BV

- Silofarmer

- Trioliet BV

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Feed Robotics Market

- In February 2023, ABB, a leading technology provider, announced the launch of its new collaborative feed robot, GoFresh, designed specifically for the poultry processing industry. This robot, equipped with advanced AI and machine learning capabilities, aims to increase efficiency and reduce contamination in poultry processing lines (ABB Press Release, 2023).

- In May 2024, Fanuc Corporation, a major robotics company, entered into a strategic partnership with Cargill, a global food company, to develop and deploy feed robots in Cargill's livestock production facilities. This collaboration aims to improve animal welfare and operational efficiency in the livestock sector (Fanuc Press Release, 2024).

- In August 2024, Zodiac Maritime, a leading shipping company, raised a USD 50 million investment round to expand its feed robotics division, focusing on automating livestock feeding systems on ships. This investment will enable Zodiac Maritime to increase its market share and cater to the growing demand for automated livestock feeding solutions at sea (Bloomberg, 2024)

Research Analyst Overview

- In the agricultural robotics market, feed robotics implementation is gaining traction as a key trend in the feed industry. Animal health monitoring and farm security systems are integral components of this technology, enabling data-driven feeding and disease prevention. Feed production costs are a significant concern for farmers, making feed robotics integration an attractive solution for sustainable practices. Predictive feeding models and precision feeding research are driving innovation, while farm management software facilitates data-driven decision making. Animal identification systems, livestock breeding optimization, and automated waste management are additional benefits.

- However, feed robotics adoption faces challenges due to market volatility and the need for robust security measures. Automated cleaning systems and cloud-based farm management further enhance efficiency. Agricultural robotics market growth is fueled by the integration of animal nutrition science and precision livestock management. Despite these advancements, maintenance and remote farm monitoring remain crucial aspects of successful feed robotics implementation.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Feed Robotics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

191 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.5% |

|

Market growth 2025-2029 |

USD 1257.2 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

10.2 |

|

Key countries |

US, China, Canada, UK, Germany, Japan, India, France, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Feed Robotics Market Research and Growth Report?

- CAGR of the Feed Robotics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the feed robotics market growth of industry companies

We can help! Our analysts can customize this feed robotics market research report to meet your requirements.