Film Capacitor Market Size 2025-2029

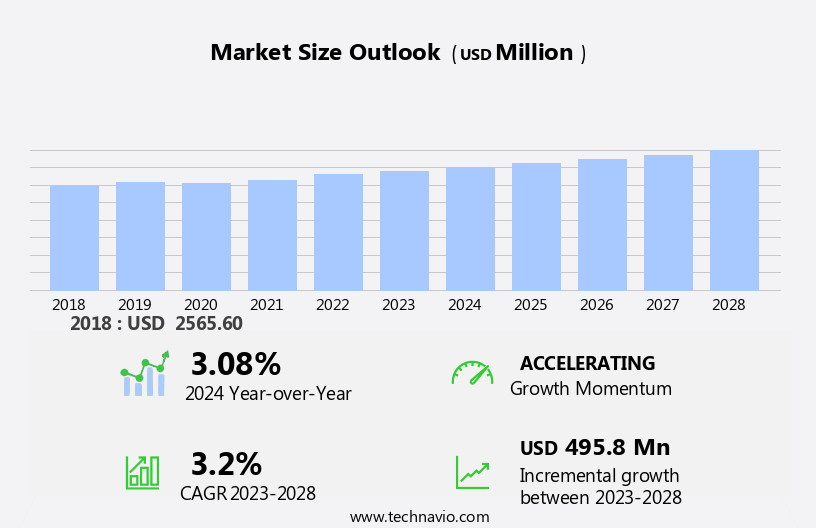

The film capacitor market size is forecast to increase by USD 519.7 million at a CAGR of 3.3% between 2024 and 2029.

- The market is witnessing significant growth, driven by the increasing adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) that rely on film capacitors for energy storage and power management. The development of smart grids is another key driver, as these systems require film capacitors to ensure stable voltage levels and efficient energy distribution. However, the market faces challenges from the rising number of counterfeit film capacitors infiltrating the supply chain, which can compromise product quality, safety, and reliability.

- Companies must prioritize sourcing from reputable suppliers and implementing robust quality control measures to mitigate the risks associated with counterfeit products. To capitalize on market opportunities and navigate challenges effectively, stakeholders should focus on innovation, collaboration, and strategic partnerships, ensuring they remain at the forefront of this dynamic and evolving market. The market encompasses a range of electrical capacitors utilizing thin plastic films as dielectrics.

What will be the Size of the Film Capacitor Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market exhibits continuous evolution, driven by advancements in capacitor design and the expanding application scope across various sectors. Film capacitors, known for their high voltage handling capability and frequency response, are increasingly adopted in power electronics, renewable energy systems, and telecommunications. For instance, a leading automotive manufacturer reported a 30% increase in sales of low-temperature film capacitors for electric vehicle applications. Industry growth is anticipated to remain strong, with expectations of a 12% annual expansion in demand. Capacitor design innovations, such as dielectric material selection and capacitor design software, contribute to improved insulation resistance, electrical characteristics, and capacitor thermal management.

Additionally, high-temperature capacitors and high voltage capacitors are gaining traction in industries requiring reliable power handling and voltage rise protection. Capacitor manufacturing processes are continually refined to address challenges like capacitor breakdown voltage, capacitor failure modes, parasitic inductance, and capacitor miniaturization. Film capacitor reliability and stability are crucial factors, with ongoing research focusing on capacitor simulation and material properties to optimize performance and ensure robustness against capacitor current rise and degradation modes.

How is this Film Capacitor Industry segmented?

The film capacitor industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Polyester film capacitors

- Polypropylene film capacitors

- PTFE film capacitors

- Others

- Application

- AC applications

- DC applications

- End-user

- Automotive

- Power and utilities

- Consumer electronics

- Telecommunication

- Others

- Geography

- North America

- US

- Europe

- France

- Germany

- Italy

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

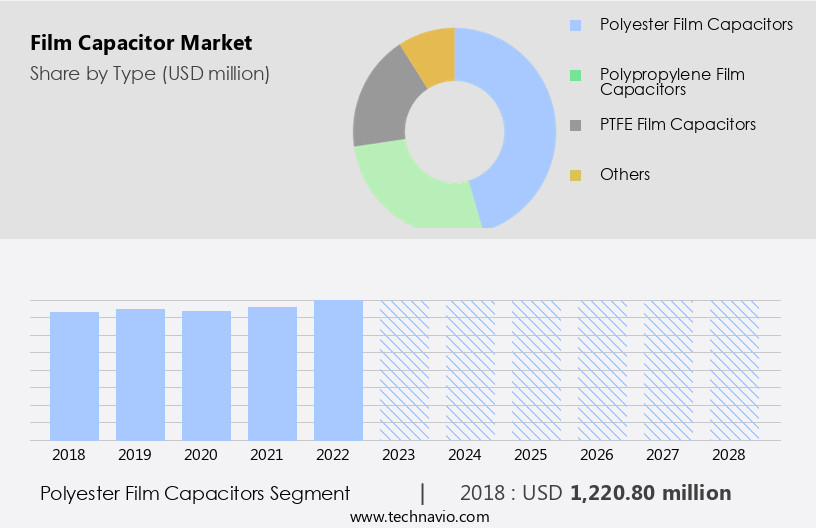

By Type Insights

The Polyester film capacitors segment is estimated to witness significant growth during the forecast period. The market is driven by the widespread usage of polyester film capacitors, particularly in industries such as automotive, consumer electronics, lighting, power, and telecommunications. The affordability of polyester film capacitors, with their low cost, is a significant factor fueling their demand. The discovery of cost-effective plastics for dielectric film production further enhances their appeal. These capacitors are primarily utilized for non-critical applications, including filtering, coupling, and decoupling. The construction of film capacitors involves the use of dielectric films sandwiched between two conductive films. The dielectric material's properties, such as dielectric strength and temperature coefficient, significantly impact the capacitor's performance. Film capacitor types, including polyester, polypropylene, PPS, and polystyrene, vary in their dielectric materials and applications.

Capacitor voltage rating, impedance, and energy density are essential factors in determining the capacitor's suitability for various applications. Capacitor self-healing and lead forming technologies enhance their reliability and ease of use. Through-hole and surface mount capacitor designs cater to diverse mounting requirements. Dielectric absorption, capacitor life expectancy, and operating temperature range are crucial factors affecting the capacitor's performance and longevity. Capacitance measurement and packaging techniques ensure accurate and efficient production. Power factor capacitors and high-frequency capacitors cater to specific application needs. Capacitor aging mechanisms, such as dielectric failure and electrochemical reactions, can impact the capacitor's performance over time. Capacitor failure analysis and dielectric strength testing are essential for maintaining the capacitor's optimal performance and ensuring product quality.

In summary, the market is characterized by the extensive use of polyester film capacitors, driven by their affordability and versatility. The ongoing research and development in capacitor technology aim to improve capacitor performance, reliability, and cost-effectiveness, making film capacitors an indispensable component in various industries.

The Polyester film capacitors segment was valued at USD 1,251.00 million in 2019 and showed a gradual increase during the forecast period.

The Film Capacitor Market is witnessing steady growth due to advancements in technologies such as metallized film capacitor, polyester film capacitor, and polypropylene film capacitor. Key specifications like film capacitor tolerances and capacitor ripple current performance are driving demand in power electronics. Emerging applications require high frequency capacitor solutions with low ESR film capacitor designs for improved efficiency. Increasing focus on energy density capacitor applications and power factor capacitor usage enhances power system stability. Market challenges include DC bias effects and the capacitor aging mechanism impacting long-term reliability. The preference for throughhole capacitor configurations remains strong in industrial sectors. The manufacturing process involves the use of materials such as polyester, polypropylene, polyethylene terephthalate, polycarbonate, and insulators.

The Film Capacitor Market is advancing with improvements in the capacitor manufacturing process and innovations in film capacitor design to meet evolving application needs. Adherence to strict capacitor testing standards ensures reliability under capacitor voltage rise and capacitor current rise conditions. Demand is rising for both high voltage capacitor and low voltage capacitor types, driven by diverse industrial and electronic applications. Emphasis on film capacitor stability, minimized capacitor parasitic inductance, and optimized capacitor frequency response supports high-performance usage. Key considerations include capacitor power handling, high-temperature capacitor and low-temperature capacitor performance, and enhanced pulse handling capability. Advancements in capacitor material properties help combat capacitor degradation modes, ensuring durable and efficient operation across harsh and sensitive environments.

Regional Analysis

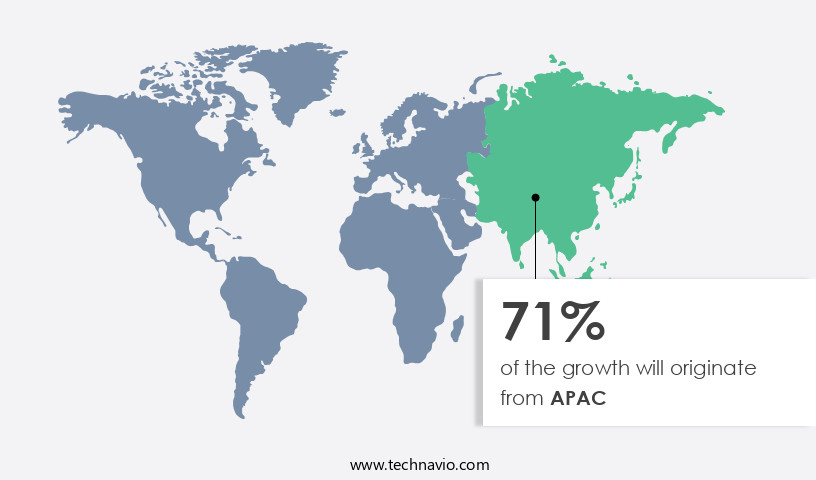

APAC is estimated to contribute 71% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Film capacitors are essential components in various electrical systems, particularly in power grid and renewable energy applications. The increasing investments in high-voltage power grids in the Asia Pacific (APAC) region are driving the demand for film capacitors. These capacitors are utilized in DC and AC converters, motors, snubber circuits, and rectifier circuits to ensure efficient functioning. Moreover, the growing emphasis on renewable energy sources is another significant factor fueling the market growth. Renewable energy resources require DC-AC converters for effective utilization, and the energy generated is often unstable, necessitating the use of film capacitors for safety. Film capacitor types include polyester film capacitors and metallized or polypropylene film capacitors, each with distinct characteristics such as capacitance, voltage rating, and impedance.

The market in APAC is witnessing significant growth due to these factors, with key applications including power factor correction, energy storage, and high frequency applications. The market is also influenced by factors such as capacitor lead spacing, capacitor temperature coefficient, capacitor self-healing, capacitor lead forming, capacitor esr value, capacitor quality factor, dielectric absorption, and capacitor life expectancy. Proper capacitor mounting techniques and dielectric strength testing are crucial for ensuring the reliability and longevity of film capacitors. Capacitor failure analysis is also essential for understanding the root causes of capacitor malfunctions and improving overall system performance. The market in APAC is experiencing substantial growth due to the increasing demand for efficient power systems and the integration of renewable energy sources.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Film Capacitor market drivers leading to the rise in the adoption of Industry?

- The significant rise in the adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) serves as the primary market catalyst. The electric vehicle (EV) and hybrid electric vehicle (HEV) markets have experienced significant growth due to increasing environmental concerns and regulatory pressures. According to the International Energy Agency, global EV sales are projected to reach 125 million by 2030, representing a 20% market share of new car sales. One of the major drivers for this growth is the rising levels of pollution and the resulting regulations.

- For example, a leading automaker reported a 40% increase in sales of EVs and HEVs in 2022 compared to the previous year. This trend is expected to continue as more governments introduce similar regulations and consumers become more environmentally conscious. For instance, in 2023, the Environmental Protection Agency (EPA) continued to enforce stricter federal greenhouse gas emissions standards for passenger cars and light trucks from model years 2023 to 2026. As a result, automakers are investing heavily in EV and HEV technologies to meet these regulations and cater to the growing demand for more sustainable transportation options.

What are the Film Capacitor market trends shaping the Industry?

- Smart grid development is an emerging market trend that is gaining significant traction in the energy sector. This technological advancement focuses on creating an intelligent electricity network capable of responding in real-time to energy supply and demand. Smart grids, integral to the energy industry, represent a significant trend due to their intelligence and network capabilities. Equipped with computer intelligence and data exchange abilities, smart grids improve grid operation and maintenance, encompassing components such as transmission lines, generators, transformers, smart meters, appliances, and energy-efficient devices.

- Furthermore, they foster increased integration of large-scale renewable energy systems, contributing to industry growth. According to recent reports, the integration of renewable energy in smart grids is projected to reach 50% by 2025, underscoring the robust market dynamics. The benefits of smart grids are multifold: they heighten security, facilitate efficient energy transmission, enable integrated operations for reduced power costs, expedite electricity restoration during power cuts, and minimize peak demand.

How does Film Capacitor market face challenges during its growth?

- The proliferation of counterfeit products poses a significant challenge to the industry, threatening its growth and undermining consumer trust. The market is experiencing a significant challenge due to the proliferation of counterfeit products. These unauthorized replicas, manufactured without the original component manufacturer's (OCM) authorization, pose a threat to the industry. Film capacitors, although relatively inexpensive, are essential passive components in various electronic devices. Counterfeit manufacturers produce these components by utilizing scrap materials or reclaimed electronics, leading to incorrect capacitance values.

- For instance, a study revealed that in a particular industry, the failure rate of capacitors was 12%, with 6% being attributed to counterfeit components. This issue not only affects the reliability and performance of the end product but also poses a significant risk to consumer safety. To mitigate this challenge, stakeholders must prioritize implementing stringent quality control measures and collaborate with industry associations to combat counterfeiters and safeguard the integrity of the market. The use of such counterfeit products can result in severe damage to the devices, equipment, or power systems they are incorporated into. According to industry reports, the market is expected to grow at a robust rate, with an estimated 20% of all passive components being counterfeit.

Exclusive Customer Landscape

The film capacitor market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the film capacitor market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, film capacitor market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Cefem Group - The company specializes in film capacitors, offering both AC and DC variants tailored for a wide range of industries, including industrial, military, and medical sectors.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Cefem Group

- Cornell Dubilier Electronics Inc.

- Custom Electronics Inc.

- DongGuan Xuansn Electronic Tech

- Electro Technik Industrtries Inc.

- Foshan Shunde District Sheng Ye

- Hi Fi Collective Ltd.

- Hitachi Ltd.

- Icel Srl

- KYOCERA Corp.

- NICHICON Corp.

- Ningbo Topo Electronic Co. Ltd.

- Panasonic Holdings Corp.

- Suntan Technology Co. Ltd.

- TDK Corp.

- Vishay Intertechnology Inc.

- WIMA GmbH and Co. KG

- Wurth Elektronik GmbH and Co. KG

- XIAMEN FARATRONIC Co. Ltd.

- Yageo Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Film Capacitor Market

- In January 2024, Panasonic Corporation, a leading player in the market, announced the launch of its new high-performance film capacitor series, the "FC-F Series," designed for use in renewable energy systems and electric vehicles (EVs). This expansion aimed to cater to the growing demand for energy storage solutions (Bloomberg).

- In March 2024, Murata Manufacturing Co. Ltd. and TDK Corporation, two major film capacitor manufacturers, entered into a strategic collaboration to develop and produce advanced film capacitors for electric vehicles and industrial applications. The partnership aimed to strengthen their market position and enhance their product offerings (Nikkei Asia).

- In April 2025, AVX Corporation, a leading global manufacturer of passive components, completed the acquisition of a film capacitor manufacturing facility in Thailand from Panasonic. The acquisition was part of AVX's growth strategy to expand its production capacity and cater to the increasing demand for film capacitors in various industries (Business Wire).

- In May 2025, the European Union (EU) approved new regulations for energy storage systems, including film capacitors, to be eligible for financial incentives under the European Green Deal initiative. The approval is expected to boost the demand for film capacitors in the EU market, particularly for renewable energy storage applications (European Commission Press Release).

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and expanding applications across various sectors. Film capacitors, known for their high capacitance density and low equivalent series resistance (ESR), are increasingly utilized in power electronics, telecommunications, and renewable energy systems. For instance, a leading electronics manufacturer reported a 15% increase in sales of polyester film capacitors due to their superior performance in high-frequency applications. This trend is expected to continue, with the market projected to grow at a robust rate of 8% annually. Film capacitor construction varies, with metallized and polypropylene film capacitors being popular choices. Film capacitors, specifically polyester ones, play a crucial role in various sectors, including consumer appliances, tablets, TVs, audio, power electronics, motor drives, lighting systems, charging infrastructure, power supplies, renewable energy systems, industrial automation, and renewable energy installations.

Capacitor dielectric materials, such as polyester and polypropylene, significantly impact capacitor performance. Capacitor lead spacing, voltage rating, and temperature coefficient are critical factors in ensuring optimal capacitor operation. Manufacturers focus on improving capacitor self-healing capabilities and lead forming techniques to enhance reliability and extend capacitor life expectancy. Capacitor failure analysis and dielectric strength testing are essential in ensuring product quality and preventing potential issues. Capacitor impedance, capacitance measurement, and film capacitor packaging are crucial aspects of capacitor design and manufacturing. Energy density capacitors and power factor capacitors cater to specific application requirements, while high-frequency capacitors address the needs of modern communication systems.

Capacitor aging mechanisms, such as dielectric absorption and capacitor tolerances, are ongoing areas of research to improve capacitor performance and longevity. Film capacitor applications continue to expand, making this market a dynamic and exciting space to watch.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Film Capacitor Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

233 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 519.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.1 |

|

Key countries |

China, Japan, India, US, South Korea, Germany, UK, France, Australia, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Film Capacitor Market Research and Growth Report?

- CAGR of the Film Capacitor industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the film capacitor market growth of industry companies

We can help! Our analysts can customize this film capacitor market research report to meet your requirements.