Graduated Cylinder Market Size 2024-2028

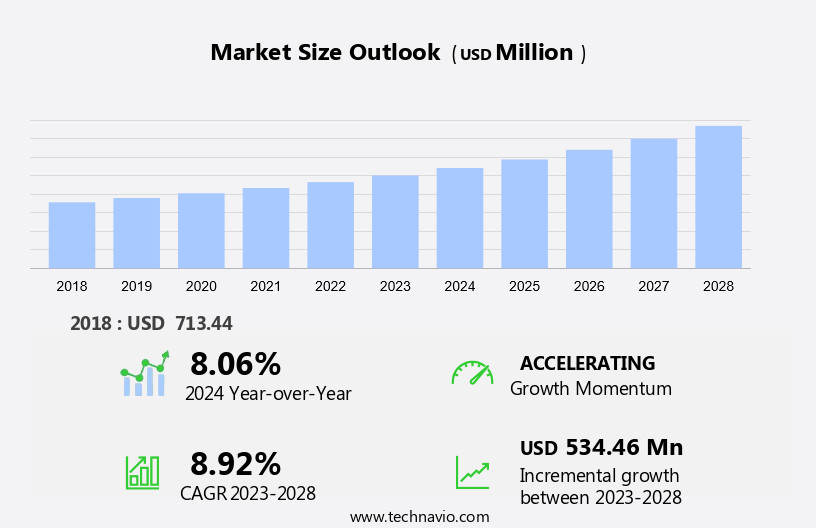

The graduated cylinder market size is forecast to increase by USD 534.46 million, at a CAGR of 8.92% between 2023 and 2028.

- The market is experiencing significant growth due to the expanding healthcare industry and increasing demand from quality testing and research laboratories. The healthcare sector's growth is driven by factors such as an aging population and rising healthcare expenditures, leading to a rise in demand for laboratory equipment like graduated cylinders. In addition, these cylinders are essential tools for precise measurements in various applications, including chemical, pharmaceutical, and educational institutions. However, the market is challenged by the limited application of graduated cylinders in industries where volumetric measurements are not a priority. Despite this, the market's future looks promising, with ongoing research and development efforts aimed at enhancing the functionality and accuracy of graduated cylinders. Overall, the market is expected to witness steady growth In the coming years, driven by the healthcare industry's expansion and the increasing demand for precise measurements in research and quality testing applications.

What will be the Size of the Graduated Cylinder Market During the Forecast Period?

- The market encompasses the production and distribution of various types of cylindrical containers used for measuring and dispensing volumes of liquids in laboratories and scientific applications. These containers, available in both glass and plastic materials, include graduated cylinders, flasks, beakers, and lab decanters. Borosilicate glass graduated cylinders are widely used due to their durability and resistance to thermal shock. Plastic graduated cylinders offer advantages such as lightweight and shatter-resistant properties. The market for graduated cylinders caters to diverse industries, including chemistry, biology, physics, medicine, and education.

- Applications range from chemical research and teaching to hospital and wine industries. These instruments are integral to scientific laboratory settings, enabling precise measurement of volumes in milliliters (ml) and cubic centimeters (cc). Features such as pouring spouts and scale markings facilitate accurate measurement and handling of liquids. The market is expected to grow, driven by increasing research and development activities and the expanding demand for precise measurement solutions in various industries.

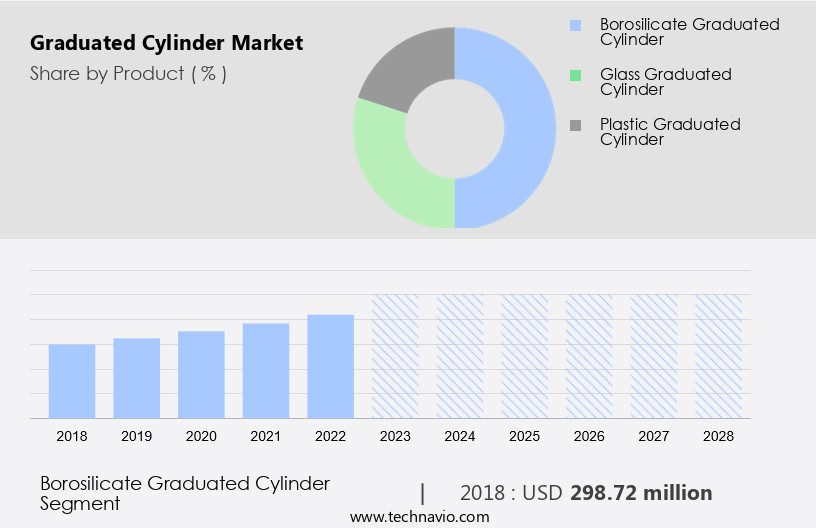

How is this Graduated Cylinder Industry segmented and which is the largest segment?

The graduated cylinder industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Borosilicate graduated cylinder

- Glass graduated cylinder

- Plastic graduated cylinder

- End-user

- Laboratories

- Hospitals and clinics

- Research and development centers

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Product Insights

- The borosilicate graduated cylinder segment is estimated to witness significant growth during the forecast period.

The market is experiencing continuous expansion due to the increasing demand for laboratory equipment in various industries, particularly in pharmaceuticals and food and beverage sectors, for quality testing and research and development purposes. Borosilicate graduated cylinders, known for their temperature resistance, are extensively used in chemical and pharmaceutical processes. Compared to other materials such as plastics, metals, and glass, borosilicate offers several advantages, including a smooth surface that allows for unobstructed viewing and no interaction or catalytic effect with the process medium. Additionally, graduated cylinders are essential laboratory instruments used for measuring the volume of liquids in various scientific disciplines, including chemistry, biology, physics, and medical research.

These cylinders come in various sizes, shapes, and materials, including plastic and glass, and are used in hospitals, laboratories, educational institutions, and commercial settings. The market for graduated cylinders is driven by the need for productivity, precision, and accuracy in scientific studies, automation systems, and robotic applications. The market also caters to safety issues and diagnostic facilities, making it an essential component of STEM-related industries and research organizations.

Get a glance at the Graduated Cylinder Industry report of share of various segments Request Free Sample

The borosilicate graduated cylinder segment was valued at USD 298.72 million in 2018 and showed a gradual increase during the forecast period.

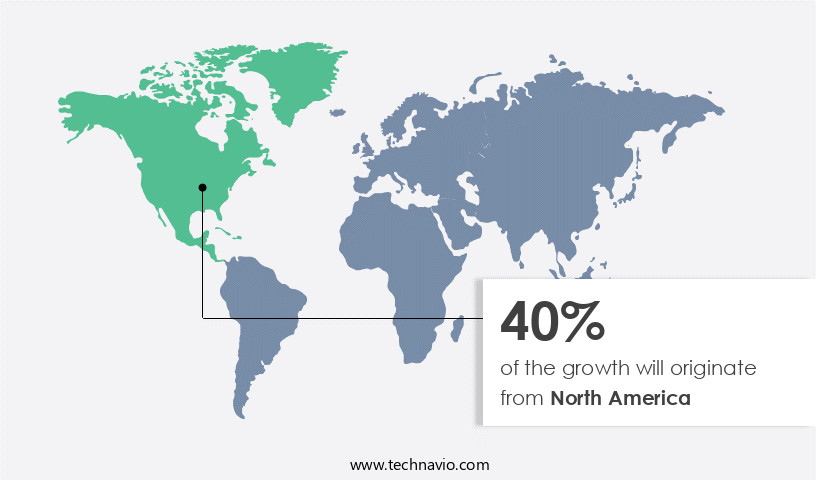

Regional Analysis

- North America is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is a significant segment of the scientific laboratory instrument industry, primarily used for measuring the volume of liquids in various fields such as chemistry, biology, physics, medicine, and commercial applications. In 2021, North America held the largest market share, driven by the well-established pharmaceutical industry In the US, numerous diagnostic centers, and increasing R&D investments. The region's focus on drug development, food safety inspections, and the presence of prominent companies contribute to market growth. Additionally, the market caters to various applications, including chemistry teaching, chemical research, and scientific studies, using glass, plastic, and borosilicate graduated cylinders. These cylinders come in various diameters, with broad bases and narrow necks, enabling dispensing, mixing liquids, and robotic automation. Safety and accuracy are essential considerations, with scale markings in milliliters (mL) and cubic centimeters (cc) for precise measurements. The market also caters to institutions, students, hospitals, and commercial laboratories, ensuring productivity and efficiency in STEM fields.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Graduated Cylinder Industry?

The rising healthcare industry is the key driver of the market.

- Graduated cylinders are essential laboratory instruments used for measuring the volume of liquids in various industries, including healthcare, chemistry, biology, physics, and commercial applications. These scientific laboratory instruments come in various materials, such as glass and plastic, with borosilicate glass being a popular choice due to its durability and resistance to thermal shock. Graduated cylinders are available in different sizes, shapes, and designs, including flasks, beakers, lab decanters, and measuring cylinders. The healthcare industry's growth, driven by the increasing prevalence of diseases and the development of new pharmaceuticals and vaccines, has led to a higher demand for graduated cylinders.

- Pharmaceutical companies are investing more in research and development to meet the growing demand for novel medications and vaccines. Moreover, there is a greater emphasis on ensuring the accuracy and precision of measurements to meet regulatory requirements and address patient expectations. Graduated cylinders are used in various applications, including dispensing, mixing liquids, and robotic automation systems. Plastic graduated cylinders are popular due to their lightweight and affordability, while borosilicate graduated cylinders offer superior durability and resistance to breakage. The graduated valve industry also utilizes graduated cylinders in beverage applications, such as wine, and institutions, including schools and universities, use them for chemistry teaching and scientific studies.

What are the market trends shaping the Graduated Cylinder Industry?

Increasing demand from quality testing and research laboratories is the upcoming market trend.

- The market is experiencing significant growth due to the increasing number of research facilities across various industries, including pharmaceuticals, cosmetics, food and beverages, and hospitals. These laboratories require precise and accurate measurement tools for conducting quality testing tasks, such as microbial growth testing, bacterial load testing, and quantitative testing. Strict regulatory requirements demand the use of advanced laboratory equipment and systems to ensure product safety and purity, leading to a heightened demand for graduated cylinders worldwide. Graduated cylinders, available in plastic, glass, and borosilicate materials, serve essential functions in laboratories, including measuring the volume of liquids, dispensing, mixing, and pouring.

- The market for these scientific laboratory instruments is expected to expand substantially during the forecast period, catering to the needs of institutions, commercial entities, students, and research organizations. The market is driven by the increasing focus on productivity, automation systems, and safety issues in scientific, technology, engineering, and mathematics (STEM) fields, with applications in chemistry, biology, physics, medical, and diagnostic facilities. The market offers a range of products, including plastic graduated cylinders, which are lightweight, affordable, and feature broad bases and narrow necks, making them suitable for various applications.

What challenges does the Graduated Cylinder Industry face during its growth?

Limited application of graduated cylinder is a key challenge affecting the industry growth.

- Graduated cylinders are essential laboratory instruments used in various industries, including hospitals, clinics, pharmaceutical companies, and research organizations, for measuring the volume of liquids, chemicals, or solutions. These cylinders offer greater accuracy compared to laboratory curves and common cups, making them indispensable in daily laboratory work. The market for graduated cylinders primarily caters to the needs of science, technology, engineering, and mathematics (STEM) fields, with applications in chemistry, biology, physics, and medical research. Two common types of graduated cylinders are plastic and borosilicate. Plastic graduated cylinders are lightweight and affordable, while borosilicate graduated cylinders offer durability and resistance to thermal shock.

- Both types come in various diameters, with broad bases and narrow necks, allowing for easy dispensing and mixing liquids. In addition to their use in scientific research applications, graduated cylinders are also employed in commercial settings, such as beverage industries, for measuring and dispensing liquids. Furthermore, they are used in educational institutions for chemistry teaching and diagnostic facilities for precise measurements. Despite their limited application, the market is driven by the need for accuracy and precision in scientific studies. The integration of automation systems, such as robots and software, in laboratories has led to increased productivity and safety issues.

Exclusive Customer Landscape

The graduated cylinder market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the graduated cylinder market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, graduated cylinder market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abdos Labtech Pvt. Ltd.

- Ases Chemical Works

- Avantor Inc.

- Borosil Ltd.

- Cole Parmer

- Controls Spa

- DWK Life Sciences GmbH

- Eisco Scientific LLC

- Gilson Co. Inc.

- Kartell SpA

- Merck KGaA

- Narang Medical Ltd.

- SP Wilmad-LabGlass

- Thermo Fisher Scientific Inc.

- Thomas Scientific LLC

- VITLAB GmbH

- W.W. Grainger Inc.

- Dynalab Corp.

- Paul Marienfeld GmbH and Co. KG

- ProSciTech Pty Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Graduated cylinders are essential laboratory instruments used for measuring and dispensing liquids with accuracy and precision. These scientific tools come in various materials, including glass and plastic, with borosilicate glass being a popular choice due to its durability and resistance to thermal shock. The market caters to a wide range of industries and applications, including laboratories In the fields of chemistry, biology, physics, medicine, and research organizations. The use of graduated cylinders transcends the laboratory setting, extending to commercial applications such as beverage industries and institutions. In the realm of scientific research, these instruments are indispensable for measuring the volume of liquids in various scientific studies.

Also, they are integral components of automation systems and robotic graduated cylinders, which enhance productivity and efficiency in laboratories. Graduated cylinders are available in different sizes, shapes, and materials to cater to diverse applications. Borosilicate graduated cylinders, for instance, offer superior accuracy and precision due to their uniform temperature expansion and excellent resistance to thermal shock. Plastic graduated cylinders, on the other hand, provide an affordable alternative with lightweight and strong designs. The design of graduated cylinders varies, with some featuring broad bases and narrow necks to facilitate easy pouring and mixing of liquids. Others incorporate pouring spouts and scale markings in milliliters (ml) and cubic centimeters (cc) for precise measurements.

In addition, the market caters to specialized applications, such as in diagnostic facilities, where accuracy and precision are paramount. Safety issues are a critical consideration In the use of graduated cylinders. Proper handling and maintenance ensure the longevity and functionality of these instruments. Additionally, the use of safety equipment such as protective goggles and gloves is essential when handling chemicals and other hazardous substances. The market is driven by the growing demand for scientific research and development in various industries. The integration of technology in laboratory instruments, such as software and automation systems, further enhances the functionality and productivity of graduated cylinders.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.92% |

|

Market Growth 2024-2028 |

USD 534.46 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.06 |

|

Key countries |

US, Canada, Germany, UK, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Graduated Cylinder Market Research and Growth Report?

- CAGR of the Graduated Cylinder industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the graduated cylinder market growth of industry companies

We can help! Our analysts can customize this graduated cylinder market research report to meet your requirements.