Hard Seltzer Market Size 2024-2028

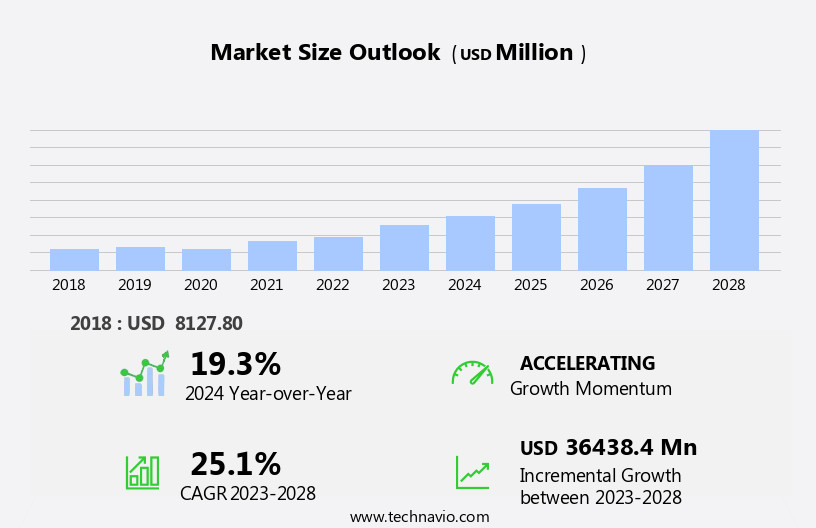

The hard seltzer market size is forecast to increase by USD 36.44 billion, at a CAGR of 25.1% between 2023 and 2028.

- The global hard seltzer market is growing steadily, driven by increasing consumer demand for low-calorie, refreshing alcoholic beverages and advancements in flavor innovation. Key factors include a shift in consumer preferences toward healthier drinking options from alcoholic beverages, particularly among millennials and Gen Z, and the convenience of ready-to-drink formats, which have fueled widespread adoption through e-commerce and retail channels.

- This report provides a comprehensive analysis for businesses, detailing market size, growth projections through 2028, and key segments, which leads due to its balance of flavor and moderate alcohol content. It highlights trends such as the rise of exotic fruit flavors like mango and passionfruit, reflecting consumer interest in variety, and addresses challenges like intense competition from new entrants, which pressures pricing and brand differentiation. The data is tailored for strategic planning, product development, and market positioning.

- For companies aiming to compete in the global hard seltzer market, this report offers practical insights into leveraging health-conscious trends and navigating competitive dynamics, ensuring they can adapt and thrive in a rapidly evolving beverage landscape.

What will be the Size of the Market During the Forecast Period?

The market is experiencing a significant rise in demand from health-conscious consumers, particularly millennials. These individuals are seeking out low-calorie, low-sugar, and gluten-free alcoholic beverages, making it an attractive choice. Hard seltzers, which contain lower alcohol content than traditional alcoholic beverages, are often sugar-free and carbohydrate-conscious, aligning with the current health trends. Established brands have entered the market with their Hard Seltzer offerings, while emerging brands continue to introduce new flavors in ready-to-drink cans. The variety of options available caters to the diverse preferences of consumers. Hard seltzers are made from raw materials such as fruit, water, and alcohol, with some brands offering keto-friendly and lower calorie options.

The alcohol content in hard seltzers is typically lower than that of beer, making them a healthier alcohol choice for many. The market for gluten-free beverages, including hard seltzers, is expected to grow as more and more people become health-conscious and seek out alternatives to traditional alcoholic beverages. The increasing popularity of hard seltzers is a testament to the evolving preferences of consumers and the industry's ability to adapt to these changing trends.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Distribution Channel

- Off-trade

- On-trade

- ABV Content

- 1.0% to 4.9%

- 5.0% to 6.9%

- Others

- Packaging Type

- Glass Bottles

- Metal Cans

- Flavor

- Classic or unflavored

- Flavored

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- Japan

- South Korea

- South America

- Brazil

- Middle East and Africa

- North America

By Distribution Channel Insights

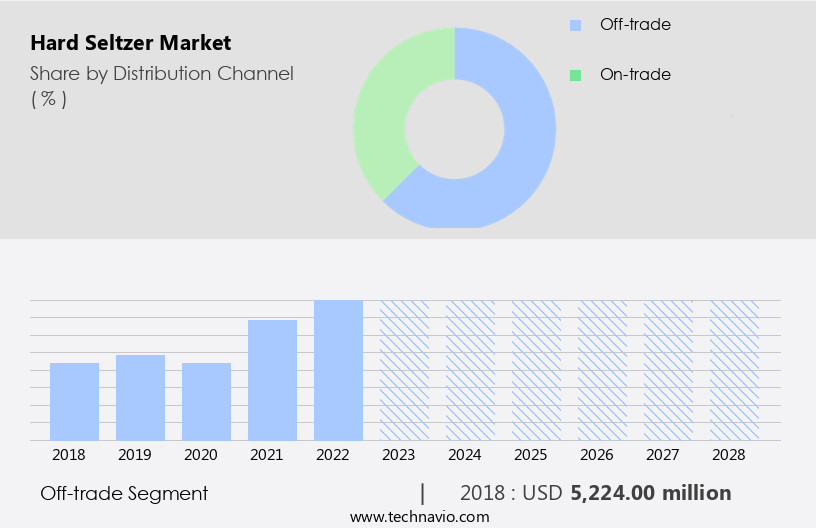

The off-trade segment is estimated to witness significant growth during the forecast period. Hard Seltzer, a popular beverage among health-conscious individuals and those seeking lower-calorie and low-sugar alternatives to traditional alcoholic beverages is widely available through various off-trade distribution channels. These channels include individual retailers, supermarkets, hypermarkets, and online platforms. The taste and sweetness of hard seltzers, often described as fruity and bubbly, attract a broad consumer base.

Get a glance at the share of various segments. Download the PDF Sample

The off-trade segment was valued at USD 5.22 billion in 2018. The variety of flavors, including raspberry, blackberry, tropical fruits like mango and passionfruit, and others, offer customization options for consumers. Established brands and emerging players in the market compete for consumer preferences, with fruit flavors being a popular turnoff for some. Local regulations and cultural factors influence product formulations and labeling requirements. Alcohol consumption and macroeconomic factors, such as disposable income and consumer confidence, also impact the affordability and innovation and expansion strategies of companies in the market. Hard seltzers, available in ready-to-drink cans, are gluten-free options that cater to specific consumer needs. The buzzed sensation they provide, combined with the wide range of flavors, makes them a popular choice for many. Consumer preferences for low-calorie and low-sugar alternatives to traditional alcoholic beverages, such as wine, continue to drive the growth of the market.

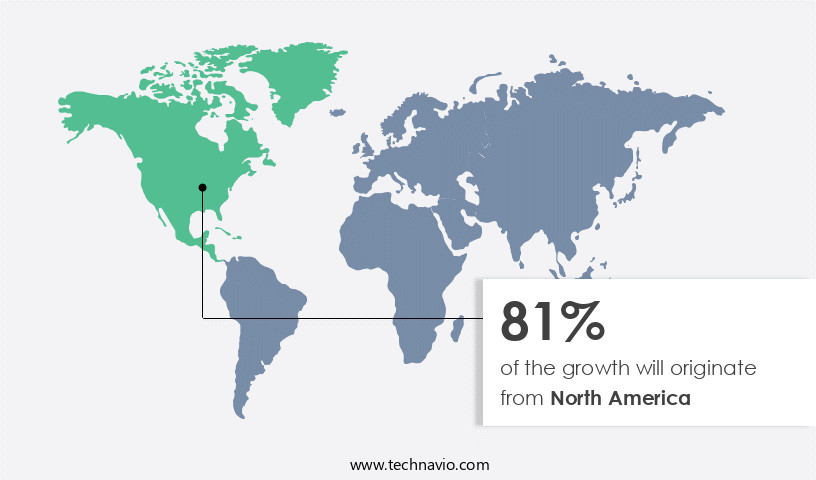

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

North America is estimated to contribute 81% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. Millennials and Gen Z, two demographic groups with a strong preference for health-conscious choices, are driving the growth of the market in North America. This segment of the alcoholic beverages sector is gaining popularity due to the availability of low-calorie, low-sugar, sugar-free, gluten-free, and keto-friendly options. Alcohol delivery applications, such as direct-to-consumer channels, have made it easier for health-conscious consumers to access these beverages. Hard seltzer, which comes in flavored and classic varieties, is often marketed as a lower-calorie alternative to beer. With increasing health awareness, consumers are seeking out alcoholic beverages with lower carbohydrate content.

Major brewers have entered the market, making product availability more convenient through metal cans and glass bottles. Branding and strategic acquisitions have played a significant role in increasing the visibility of hard seltzer in the market. On-trade sales, such as those in cafes/bars and restaurants, are also growing in popularity. The market is expected to continue its rising demand due to its appeal to health-conscious consumers. Carbonation, a key ingredient in hard seltzer, can sometimes lead to bloating and gas, but advancements in raw materials and alcohol volume are addressing these concerns in the alcohol sector.

Market Dynamics

The hard seltzer market is rapidly growing as consumers seek refreshing, low-calorie drink options with a hint of alcohol. Sparkling alcoholic drinks, such as flavored carbonated beverages and crisp seltzer blends, are at the forefront of this trend, offering light booze options that appeal to those looking for a lower-calorie refreshment. Natural fruit infusions and subtle flavor mixes bring a fresh twist to the market, while low-sugar fizz and gluten-free alcohol make hard seltzers accessible to a wide range of consumers.

Ready-to-drink cans and portable seltzer packs make these drinks perfect for on-the-go or chilled party drinks, providing convenient and casual sipping drinks. Low-ABV refreshment options are increasingly popular, as they offer a more moderate alcohol choice without compromising on flavor. Effervescent light beers and bubbly cocktail alternatives cater to those who enjoy the fizz but prefer a cleaner, lighter option.

Festive bubbly drinks and summer drink options are perfect for social occasions, while minimalist booze cans and clear spirit bases appeal to those seeking simplicity in their beverages. The market also sees growing demand for seltzer variety packs and fresh fizz recipes, further enhancing the versatility and appeal of hard seltzers as the go-to hydrating alcohol choice.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Hard Seltzer Market Driver

Growing demand from millennials is notably driving market growth. Hard Seltzers have emerged as a popular choice among consumers, particularly among the millennial demographic, who constitute a significant portion of the global population. The preference for hard seltzers can be attributed to their unique taste profile, which offers a balanced blend of sweetness and a subtle buzz. Price is also a crucial factor, as many millennials seek affordable yet authentic beverage options. Health-conscious individuals are drawn to Hard Seltzers due to their lower calorie and sugar content compared to traditional alcoholic beverages like wine. Customization is another key consumer preference, with both established and emerging brands offering a variety of flavors such as berry, tropical fruits, and mango. Business objectives for both large and small companies in the market include meeting the evolving consumer preferences for healthier beverage options and low-calorie alternatives. Product formulations and labeling requirements are essential considerations to cater to these demands.

Local regulations and cultural factors play a role in the market's growth, with some regions favoring specific flavor profiles or labeling requirements. Alcohol consumption trends and macroeconomic factors, including disposable income and consumer confidence, also impact the market's expansion. Innovation and expansion are critical for companies to stay competitive in the consolidated market. Consumer preferences for gluten-free options and ready-to-drink cans further add to the market's complexity. Overall, the market presents significant opportunities for growth and development in the alcoholic beverage industry. Thus, such factors are driving the growth of the market during the forecast period.

Hard Seltzer Market Trends

The increasing prevalence of online sales is the key trend in the market. Hard Seltzer, a refreshing and carbonated alcoholic beverage, has gained significant traction in the global market due to its unique taste and customization options. The sweetness and buzzed sensation it offers make it an attractive choice for health-conscious individuals seeking low-calorie and low-sugar alternatives to traditional alcoholic beverages like wine. The market is consolidated, with both large and small companies vying for consumer preferences. Business objectives include innovation and expansion, driven by the growing demand for gluten-free options and ready-to-drink cans in various fruit flavors such as raspberry, blackberry, and tropical options like mango and passionfruit. Despite the buzz, the market is subject to local regulations and cultural factors. Established brands and emerging players must adhere to labeling requirements and alcohol consumption guidelines. Macroeconomic factors like disposable income and consumer confidence also impact affordability and overall market growth.

The price point of Hard Seltzers, which often falls between that of beer and wine, adds to its appeal as a versatile beverage option for various occasions. Product formulations and labeling requirements are essential considerations for companies in the market. Ensuring compliance with country-specific regulations and consumer preferences for specific flavors and calorie counts is crucial for business success. The market is expected to continue growing, driven by the increasing trend toward healthier beverage options and the convenience of ready-to-drink cans. Thus, such trends will shape the growth of the market during the forecast period.

Hard Seltzer Market Challenge

Campaigns against alcohol consumption is the major challenge that affects the growth of the market. Hard Seltzers have gained significant attention in the global beverage market due to their unique taste and sweetness, offering a buzzed sensation without the high calorie and sugar content typically associated with traditional alcoholic beverages like wine. The price point and low-calorie, low-sugar alternatives have attracted health-conscious individuals and those seeking gluten-free options. However, the adoption of Hard Seltzers is influenced by various factors, including local regulations and cultural preferences. Business objectives of both large and small companies in the market aim to cater to consumer preferences for customization and variety. The market is consolidated with established brands, but emerging brands continue to introduce innovative and expansion strategies through a wide range of fruit flavors such as raspberry, blackberry, and tropical options like mango and passionfruit. Despite the appeal, the market faces challenges from stringent regulations and macroeconomic factors like disposable income and consumer confidence.

Affordability remains a crucial factor, as some consumers may view the price as a turnoff. Product formulations and labeling requirements must adhere to health and safety concerns, as well as cultural norms and alcohol consumption guidelines. Governments and health organizations continue to promote awareness campaigns, such as the "Live Better, Drink Less" initiative by the Pan-American Health Organization, to educate the public about the potential health risks associated with alcohol consumption. These efforts may impact consumer preferences and the overall growth of the market. Hence, the above factors will impede the growth of the market during the forecast period.

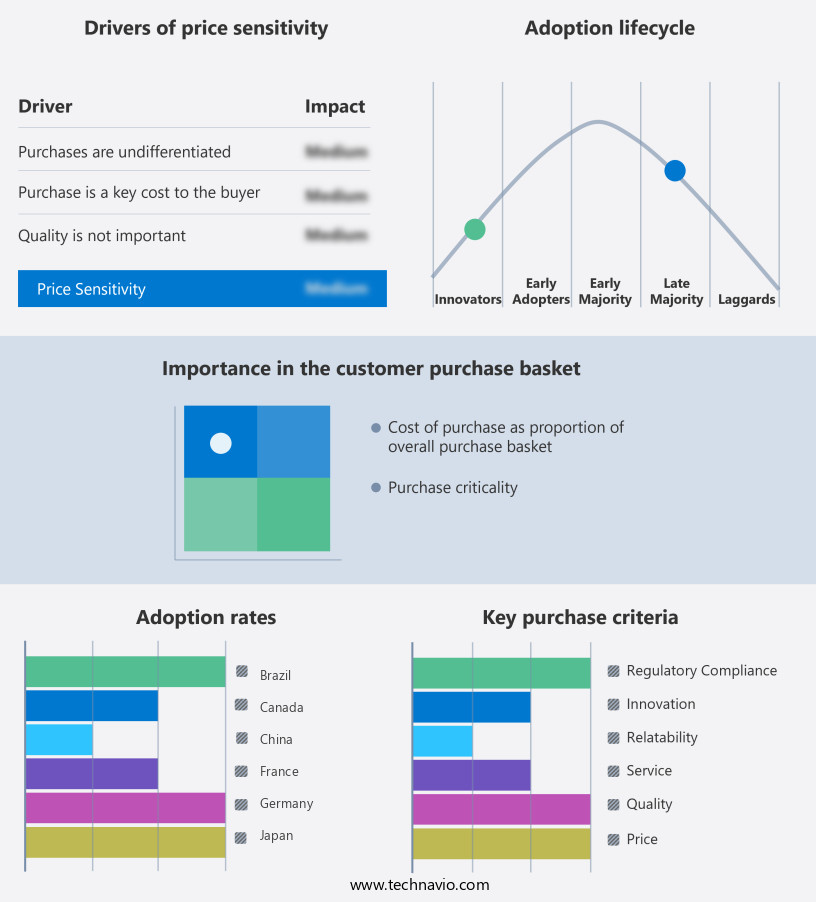

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Constellation Brands Inc. - The company offers hard seltzer such as Corona Hard Seltzer, which combines the refreshing taste of Corona with a range of tropical flavors, designed to evoke a beachside experience.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anheuser Busch InBev SA NV

- Diageo PLC

- E. and J. Gallo Winery

- Future Proof Brands LLC

- Hard Seltzer Beverage Co. LLC

- Heineken NV

- Kona Gold Beverage Inc.

- Kopparberg Cider of Sweden Ltd.

- Lift Bridge Brewing Co.

- Mark Anthony Brands International Unlimited Co.

- Molson Coors Beverage Co.

- Nude Beverages

- Retail Services and Systems Inc.

- San Juan Seltzer Inc.

- The Boston Beer Co. Inc.

- The Coca Cola Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Analyst Overview

The market is experiencing significant growth due to the increasing consumer preference for low-alcohol and sugar-free beverages. Alcoholic beverages, delivery, and consumer trends are key factors driving the market. The sector consists of alcoholic beverages made through the fermentation of sugars from fruits and vegetables, or malt, with added flavors and carbonation. The low-calorie and gluten-free nature of hard seltzers appeals to health-conscious consumers. Companies are focusing on innovative flavors and packaging to cater to diverse consumer preferences. The sector is competitive, with various players vying for market share. Consumers are looking for unique and authentic experiences, leading to the importance of branding and marketing strategies. The sector is expected to continue its growth trajectory in the coming years.

The hard seltzer market has experienced explosive growth in recent years, with flavored varieties leading the charge. Social media has played a significant role in this trend, with influencers and consumers alike promoting the light and refreshing taste of these lower calorie, low alcohol content beverages. Off-trade sales, including convenience stores, micromarkets, wine and spirit shops, have seen a surge in demand for both classic and flavored hard seltzers. With calories typically ranging from 100-150 per can and carbohydrates often under 5g, these beverages appeal to health-conscious consumers. Hotels, catering services, and other commercial establishments have also taken notice, incorporating hard seltzer into their offerings. Localized offerings have emerged, with breweries and distilleries creating unique flavors to differentiate themselves. Retail selling prices vary, but the convenience and portability of hard seltzer make it a popular choice for consumers looking for a delicious and refreshing beverage option.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 25.1% |

|

Market Growth 2024-2028 |

USD 36.44 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

19.3 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 81% |

|

Key countries |

US, China, Canada, Germany, UK, Mexico, France, Japan, South Korea, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Anheuser Busch InBev SA NV, Constellation Brands Inc., Diageo PLC, E. and J. Gallo Winery, Future Proof Brands LLC, Hard Seltzer Beverage Co. LLC, Heineken NV, Kona Gold Beverage Inc., Kopparberg Cider of Sweden Ltd., Lift Bridge Brewing Co., Mark Anthony Brands International Unlimited Co., Molson Coors Beverage Co., Nude Beverages, Retail Services and Systems Inc., San Juan Seltzer Inc., The Boston Beer Co. Inc., and The Coca Cola Co. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the market forecast period. |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.